Anil Ambani‐led Reliance MediaWorks Ltd. (RMW) and Carnival Cinemas announced the signing of definitive agreements for the sale of the former’s multiplexes business to Carnival Cinemas Ltd in the largest‐ever deal in the sector in India till date.

The transaction will help Reliance Capital, the parent firm of Reliance MediaWorks Limited to reduce its leverage by around Rs 700 crore, through a combination of transfer of debt of Reliance MediaWorks and infusion of cash proceeds. The transaction will catapult to the ranks of the top three multiplex operators in the country, with over 300 screens.

The Deal

Carnival said that it will acquire Big Cinemas for an enterprise valuation of a little over Rs 700 crore inclusive of its debt. This deal excludes IMAX Wadala multiplex’s real estate assets in Mumbai and some other properties that the group plans to sell separately for about Rs 200 crore. Carnival is planning to part fund the acquisition through internal accruals of the group while the rest will be brought in by Mr.Shrikant Bhasi as part of promoter funding. Additional debt may be raised in future for refurbishments and brand expansion.

The initial cash outgo will be quite small. Of the Rs 710 crore enterprise value, close to Rs 450 crore will be the debt of Big Cinemas and remain INR 260 Crores is the equity value.

If we assume so, the cost paid by Carnival for acquiring single screen will go around close to the unit value of Rs 3 crore, which is much cheaper than the cost paid by Cinepolis to acquire 83 screens of Fun Cinemas earlier this month. Cinepolis paid approximately Rs 5.80 crore to acquire single screen of Fun Cinemas.

The proposed transaction is subject to statutory and other approvals and is expected to be closed within the current financial year.

About Reliance MediaWorks

Reliance MediaWorks Limited (RMW), a part of Reliance Group, is one of India’s leading Media & Entertainment Companies, with a presence across several businesses including Film and Media services, Theatrical exhibition of films & Television content production and distribution called ‘Big Synergy Media’.

Reliance MediaWorks operates one of India’s largest cinema chains, under the brand ‘BIG CINEMAS’ with over 250 screens Pan India.

Equity shares of RMW were earlier listed under National Stock Exchange and BSE Limited. However, the company has been delisted with effect from May 6, 2014.

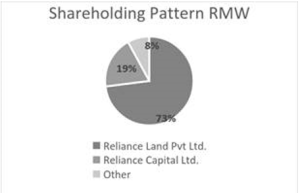

Shareholding Pattern of Reliance MediaWorks as on 31 March 2015

BIG CINEMAS

Big Cinemas offer a unique experience with formats like Cine Diner‐ Asia’s first cinema‐ dining concept, 180 degrees recliner seats, Ebony Lounges, Pause Lounge & Mischief‐ Kid Zone.

Big Cinema’s had an average ticket price of INR 141 & average spend on food & beverages per head of INR 34 for a period of eighteen months ended March 14.

Big Cinemas served 43 million customers for eighteen months period ended March 14 against market leader PVR who entertained around 76 million customers for the same period. This shows PVR served 44% more customers than Big Cinemas.

Standalone revenue of RMW from the sale of tickets for a period of 18 months ended March 2014 was INR 3753 Million compared to 3893 Million for eighteen months ended September 2012 while PVR recorded revenue of INR 7,725 million in FY14, as against INR 3,941 million in FY13. PVR’s sale of tickets saw an increased leap of 96% in twelve months while that of Big Cinemas saw a decline of 4% in eighteen months.

Market Cap of Reliance MediaWorks is little over INR 1150 crore while that of its competitor INOX is around INR 1,700 crore & PVR is around INR 2,900 crore.

About Reliance Capital

Reliance Capital is one of India’s private sector financial services company. Reliance Capital has presence in Asset Management and Mutual Funds, Life and General Insurance, Stock Broking and other activities in financial services.

Reliance Capital had recently announced plans to focus on core business and is in the process of en‐ cashing its minority investments.

The proposed transaction is aligned with Reliance Capital’s stated objective of focusing purely on its core financial services businesses, significantly reducing exposure to non‐core investments in the media and entertainment sector, and reducing overall debt.

RCL’s debt equity ratio as on 31st March 14 stood at 2:1. Its finance cost for the FY 14 was up by 11%to INR 1,850 crore from Rs,1661 crore a year ago.

The transaction will help RCL to reduce its long-term borrowings of INR 12,801 crore (As on 30 September 14) by approximately INR 700 crore.

RCL has recently exited from day to day operations of its global film and media services business, by merging its global film and media services business with Prime Focus.

Reliance Capital is also in talks with 2‐3 international investors to sell its 16 per cent stake in leading travel portal Yatra.com for an estimated INR 500 crore.

About Carnival Group

Carnival Group is a Mumbai based corporate with diversified business in Hospitality, Media, Real Estate, and Entertainment& Multiplexes. Carnival has already established its brand in movie production, exhibition & distribution along with Food Court, Events, IT Parks, etc.

Carnival Films Pvt. Ltd., operates cinema chains under the brand ‘Carnival Cinemas’ with over 50 operational screens while 75 screens are to come on stream in the next 2 months taking the total portfolio to 125 screens. Carnival Cinemas is currently present in Kerala, Karnataka, Tamil Nadu, Maharashtra, Madhya Pradesh, Uttar Pradesh and West Bengal.

Carnival Group is targeting to achieve 1000 screens by the year 2017.

.Carnival has involved in in movie production down south. The group entered the movie business five years ago as financiers for Bollywood films. Finding Bollywood projects expensive, Carnival shifted its focus to South India where it financed, produced and distributed Malayalam movies.

While doing business in the south, the company realised the biggest lacunae is in the exhibition space. So they started with Multiplex chain from the south and now aiming to have an all‐India footprint.

In July, Carnival had acquired HDIL’s multiplex chain Broadway Cinemas for around INR 110 crores.

The Overall Industry

The movie exhibition sector in India had been represented solely by single‐screen cinemas, until the late 1990s. The Multiplex sector in India has seen phenomenal growth over the last few years. The industry had seen a phase of consolidation with PVR acquiring Cinemax a couple of years ago. Earlier this year Inox Leisure had acquired Satyam Cineplexes. This deal is the fourth transaction in the movie exhibition business in last six months.

As per FICCI‐ KPMG Indian Media and Entertainment Report, 2014 multiplexes as of today account for approximately 25 percent of the total number of screens in the country with a low screen density of 8 screens per million in comparison with 117 per million in the US. Given the low screen penetration, India has the potential to significantly increase the number of existing multiplex screens in the country over the next decade without causing an oversupply.

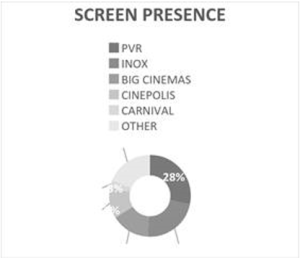

India currently has approximately 1700 multiplex screens with PVR in pole position with 454 screens, followed by INOX at 361 screens. From a small 40 screen player just a year back, Carnival straight away breaks into the 3rd spot and through organic and inorganic growth, they are looking at close to 450 screens soon which will make them in the second spot.

High entertainment tax is a major impediment to exhibition industry’s growth. The overall tax implication is as high as 40‐50% in states like Maharashtra, Uttar Pradesh, etc. However, post‐GST, the peak rate is likely to be 16%, leading to significant cost reduction. Also, input tax credit will be available for set off against the output tax liability (service tax paid presently on rent, electricity, security, housekeeping etc. is not available for set off against output liability of entertainment tax or VAT). GST implementation is likely to result in 200bp margin expansion.

What does Carnival get?

● The deal will make Carnival the third largest multiplex operator with nationwide presence and over 300 screens.

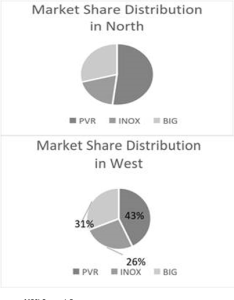

● This is a landmark deal for consolidation in the exhibition sector which is now a 3‐4 player game, on a pan-India business. Since Big Cinema was very strong in the North and West it gives Carnival, which is already strong in the South, an all India presence.

● Carnival Cinemas will not only make its presence in Tier I but would lay emphasis for strong presence across Tier II & III cities.

● The transaction will help Carnival which is already having presence in movie production & exhibition to foray its presence in distribution segment.

What’s in it for Reliance Group?

● The sale of Big Cinemas will help Reliance group to deleverage RCL balance sheet by Rs 700 crore.

● RMW will continue to retain 4 properties worth INR 200 Crores to monetise separately for higher value.

● Reliance Capital will have the option to acquire a pre-IPO minority stake in Carnival Cinemas at an appropriate discount, upon an eventual listing of Carnival Films.

Conclusion

● With the addition of more than 250 screens, the transaction will catapult Carnival to be amongst the top 3 film exhibition companies with over 300 screens nationwide thereby increasing its bargaining power with film producers and distributors for a larger share of the box office receipts.

● Northern and Western region have the higher share in all India ticket collections. Hence, enhancing its presence in these regions will work well for Carnival in the coming years.

● Sale of Multiplex Business will strengthen the financial business of Reliance Group and is expected to give the cutting edge to the company in their core business future.