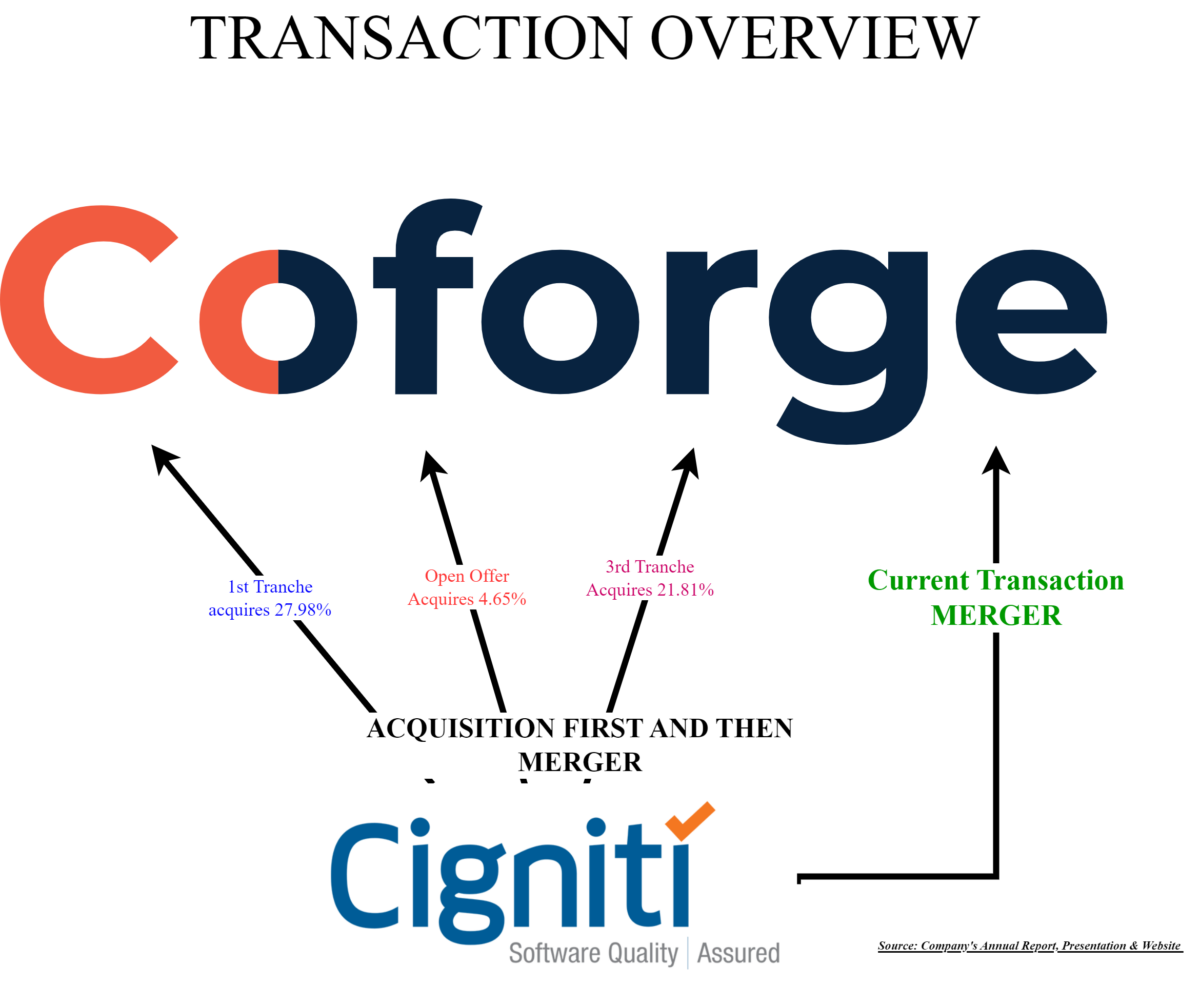

Coforge Limited in 2024 acquired a controlling stake in Cigniti Limited to quicken its journey to become a USD 2 billion company, after acquiring the controlling stake, Coforge has now announced a merger of Cigniti Limited with itself.

Cigniti Technologies Limited (“Cigniti” or “Transferor Company”) is engaged in the business of providing digital assurance and engineering (software testing) services across the world helping in predicting and preventing unanticipated failures, leveraging AI-driven, proprietary Continuous Testing & Test Automation solutions, which are platform and tool agnostic, thereby optimizing engagement for customer experience. The equity shares of Cigniti are listed on nationwide bourses. Coforge Limited holds circa 54% paid-up capital of Cigniti.

Currently, Cigniti is in the process of shifting its registered office from the state of Telangana to Haryana.

Coforge Limited (“Coforge” or “Transferee Company”) is engaged in delivering services around the world directly and through its network of subsidiaries and overseas branches. The company is engaged in application development & maintenance, managed services, cloud computing and business process outsourcing to organizations in a number of sectors viz. financial services, insurance, travel, transportation and logistics, manufacturing & distribution and government.

Coforge Limited was earlier NIIT Technologies Limited witnessed promoter change in 2019 when Baring Private Equity bought a controlling stake of 70.10%. Soon after the acquisition, Baring started selling its stake in tranches and took a complete exit in 2023. Thereafter, the company is being managed professionally.

Currently, Coforge is in the process of shifting the registered office from NCR, Delhi to Haryana. The equity shares of Coforge are listed on nationwide bourses.

Acquisition of Controlling Stake

In May 2024, Coforge announced the acquisition of a controlling stake in Cigniti Limited. In the first tranche, Coforge acquired circa 28% stake (through a mix of promoters and public shareholders). Pursuant to the acquisition of more than 26% stake, Coforge gave an open offer as per the SEBI takeover code through which it acquired an additional circa 4% stake from public shareholders. Post completion of the open offer, Coforge acquired almost entire remaining stake from erstwhile promoters of Cigniti making its total stake in Cigniti as 54%.

Coforge funded the acquisition mainly through availing the bridge loan.

Rationale for Acquisition

- The acquisition will create three new scaled up verticals – Retail, Technology and Healthcare.

- Help Coforge realize its objective of scaling up its presence across South-West, Mid-West and Western US markets.

- Help Coforge address the significant opportunities that the proliferation of AI is creating for specialized Assurance Services

The Proposed Transaction

The Board of Directors of Coforge Limited announced their intention to finally merge Cigniti with Coforge at the time of acquisition only. Following its end intention, the board announced a scheme of amalgamation which provides inter-alia for the merger of Cigniti with Coforge.

The “Appointed Date” for the proposed merger shall be 1st April 2025 or such other date as maybe approved by NCLT.

Consideration & Share Capital

Coforge shall issue 1 equity share of INR 10 each for every 5 shares of INR 10 each held by the shareholders in Cigniti. Coforge shareholding in Cigniti shall get cancelled and no shares shall be issued for this.

Share Capital Structure

Acquisition followed by Merger

We see that the initial acquisition of a controlling stake followed by the merger is becoming a standard practice by companies. Sometimes the structuring provides comfort to a buyer and gives time to identify with all the potential risks & returns possibilities of a target company. Additionally, there could be other commercial reasons including:

- Immediate cash flow in the hands of target company shareholders

- Effective utilization of cash sitting with the acquirer

- Reduce equity dilution for acquirer shareholders

Financials

Coforge is much bigger than Cigniti. However, in terms of margins, both operate at similar levels. Further, Cigniti has significant surplus assets available while Coforge still has borrowing in its book. Going ahead, borrowed funds can be repaid through available cash & internal accruals of Cigniti.

Valuation

Assigned valuation for the swap ratio

| Particulars | Coforge | Cigniti |

| No. of Shares (including ESOP) | 6,87,02,304 | 2,75,46,959 |

| Assigned value per share (₹) | 9837 | 1970 |

| Valuation (₹ crores) | 67,580 | 5426 |

Valuation of Cigniti is considered at ~40% premium to the acquisition price Coforge paid while acquiring controlling stake in Cigniti. No doubt price of Coforge is also more than 50% higher than prevailing at the time of the Cigniti Acquisition.

Conclusion

Coforge Limited continues to acquire and have strategic tie-ups. Most of those acquisitions are bolt-on acquisitions. It recently entered into a new agreement with Sabre Corporation, that will strengthen their long-standing partnership to supercharge Sabre’s product roadmap a leading global travel technology company. Apart from that, it also announced a couple of acquisitions to strengthen its product portfolio/clients.

In line to achieve its target revenue, Coforge continues to grow with multiple acquisitions mostly through internal accruals or temporary borrowings to minimise dilution. It also tries to optimise its transaction cost by acquiring shares of a target company and then merge. At the same time, transaction is structured to further optimise taxes like shifting of the registered office etc.