Recently, the Board Of Directors of Pfizer Ltd. (“Pfizer India”) and Wyeth Ltd. (“Wyeth India”) had approved the long-awaited merger of Wyeth India into Pfizer India, which will create a single Pfizer brand in India. In 2009, Pfizer Inc, USA (“Pfizer”) acquired Wyeth, USA (Wyeth) for $68 billion. Subsequently, Wyeth was merged with Wagner Acquisition Corp., a direct wholly-owned subsidiary of Pfizer and as a result of which Pfizer is now the parent company of Wyeth and hence the ultimate parent of the Wyeth India. In view of this, the merger of Pfizer India and Wyeth India was anticipated since long. Despite global merger which was completed by the end of 2009, Pfizer India and Wyeth India remained separate listed entities in India till date, although management and operational integration between the two entities were undertaken. It is understood that the valuation of equity swap and regulatory hurdles for the merger of two listed entities were the main reason for the delayed decision for the consolidation of these companies in India. In addition to the long-awaited merger proposal, the Board of Directors of the Pfizer India and Wyeth India has also proposed interim dividends of Rs 360 and Rs 145 per share, respectively. In this article, we have attempted to summarize and give some insight on the proposed merger and the proposal of dividend payout.

Pfizer-Wyeth merger along with dividend bonanza!

Pfizer India – Brief Background:

Incorporated in 1913, Pfizer India is the Indian unit of US leading drug maker Pfizer Inc, currently the world’s biggest pharmaceutical company in terms of revenues. However, Pfizer’s annual revenues from India accounts for less than 1% of its global revenues, which indicates tough competition from generic manufacturers in India.

The shares of Pfizer India are listed on BSE Ltd and the National Stock Exchange of India Limited. Currently, the Promoter’s stake in Pfizer India is around 70.8%.

Pfizer India is engaged in manufacturing, marketing, trading and export of pharmaceutical products. The manufacturing facility of the company is at Thane and various independent third party manufacturers are based across the country. Pfizer sells its products through independent distributors in India.

The parent company, Pfizer Inc., was founded by Charles Pfizer and Charles Erhart in 1849. Pfizer Inc, a research-oriented pharmaceutical company, is in Fortune 500 list. Pfizer has produced innovative breakthroughs in a wide range of research areas such as depression, erectile dysfunction, high cholesterol, HIV infection, hypertension, bacterial infections and systemic fungal infections. In 2000, Pfizer increased its global presence through the acquisition of Warner-Lambert and Pharmacia. Through strategic partnerships and acquisitions of diversified businesses, such as Wyeth in 2009, Pfizer solidified its place as one of the most diversified companies in the global healthcare industry.

Pfizer India divested its animal health business in 2012 and subsequently sold it to wholly owned subsidiary of parent company, Pfizer Inc. Pfizer India is one of the major players in Indian pharmaceutical industry. In terms of domestic sales, Pfizer India is ranked 18th in the Indian pharmaceutical industry with market shares of around 1.9%. Pfizer India has vast product range such as anti-infectives, antifungal, anti-TB, cardiovascular, dermatology, gastrointestinal etc. The popular brands of Pfizer in India are COREX syrup, BECOSULES Capsules, and Gelusil.

In FY 2013, Pfizer India reported total revenue of Rs 11,553 million and Net Profit (after tax) of around Rs 5,032 million (which includes gain from the sale of animal health business). The quantum of gain from the sale of animal health business was around Rs 4,141 (before tax).

Wyeth India – Brief Background:

Established in 1947, Wyeth Limited (Wyeth India) is the Indian subsidiary of US-based Pharma Company Wyeth, a global leader in pharmaceutical, consumer healthcare, and animal health products. In 2009, Pfizer acquired Wyeth for $68 billion in order to diversify its product portfolio, which includes Wyeth’s major biotech drugs and vaccines. The Shares of Wyeth India are listed on BSE Ltd and the National Stock Exchange of India Limited. Currently, the Promoter’s stake in Wyeth India is around 51.1%.

Wyeth Ltd. is a market leader in vaccines and women’s health. Wyeth has pioneered the introduction of several new therapies in India and was the first to launch hormone replacement therapy and conjugated pneumococcal vaccines for infants and adults. The company has an award-winning manufacturing facility in Goa. The pharmaceuticals business of the company comprises bulk drugs and formulations, such as oral contraceptives, hormone replacement therapy, antibiotics, vaccines, steroids and other prescription medicines. The company also manufactures OTC pharmaceuticals, cosmetics, toiletries and other allied consumer products.

In FY 2013, Wyeth India reported total revenue of Rs 7,136 million and Net Profit (after tax) of around Rs 1,301 million.

Transaction – Proposed Merger:

Wyeth India is proposed to be merged into Pfizer India in terms of a Scheme of Amalgamation (“Scheme”) under the provisions of Sections 391 to 394 and other applicable provisions of the Companies Act, 1956. The Appointed Date of the Scheme would be April 01, 2013.

In consideration of the amalgamation, Pfizer India will issue it’s 7 (seven) equity shares each to the shareholders of the Wyeth India for every 10 (ten) equity shares held by them of Wyeth India. The swap ratio is based on the valuation carried out by independent accounting firms, after taking into account the payment of the interim dividend as set out above, and is on a post dividend basis. Based on the proposed merger swap ratio, Pfizer India will issue approximately 15.9 million new equity shares to the shareholders of Wyeth India, resulting in dilution of around 35% in Pfizer India.

Upon the Scheme coming into effect, Wyeth India will be dissolved without being wound up. The merger process would require several approvals and hence expected to take approximately another nine months for completion.

The management of the companies also indicated that post merger the combined entity will operate under a single brand, Pfizer.

Resultant Structure (post merger):

Impact of the proposed merger:

- Pfizer India to get access to various therapeutic classes that will improve its portfolio mix

The merged entity will have greater therapeutic diversification, with vaccines and women’s healthcare products becoming the new growth drivers for Pfizer India. It will also cover products across nine out of the top 10 largest therapeutic areas (in value terms) in the domestic pharma market.

Pfizer India generates the large part of its revenues (approximately 35-40%) from 4 brands viz., Corex (respiratory), Becosules (Vitamins), Gelusil (Gastrointestinal (GI)) and Minipress (CNS). In recent times, these brands had been witnessing growth pressures, especially Corex, which is the company’s No 1 selling the product. As Pfizer India had a higher dependence on 4 drugs, diversification of its portfolio became quite necessary. Thus, the addition of Wyeth’s portfolio will not only allow Pfizer enter into newer therapies but will also help in boosting its market share in existing therapies. This will help Pfizer de-risk its product portfolio and business profile.

- Consolidation to strengthen overall company’s standing

The Indian pharma industry was always extremely competitive with the top player having a total market share of approx 7%. Before the merger, both the players figured nowhere in the list of top 10 pharma companies in India. Post-merger, the combined entity will be ranked 9th largest pharma companies in India in terms of domestic sales. Earlier, while Pfizer was ranked 18th, Wyeth was in the 28th slot. The market share of the companies together will increase to 2.9%. Further, the merger would also strengthen the competitive position of Pfizer in India with Wyeth strengthening its brand image and market presence.

- Greater financial strength

Notes:

- EBITDA is calculated as Sales less cost of materials consumed, purchases of stock-in-trade, changes in inventories of finished goods, work-in-progress and stock-in-trade, employee benefits and other expenses

- Cash is not adjusted for payout of dividend

- Financials for Pfizer India exclude Animal Health business but not adjusted for intercompany eliminations.

Combined entity will have a stronger balance sheet and enhanced debt raising capability. Post dividend payout, Return of Equity would improve significantly.

- Cost synergies – No major upside expected

Though Pfizer India and Wyeth India remained separate, they functioned in the marketplace as one by integrating marketing, information technology (IT) and finance. For example, Pfizer India had provided its sales force to market Wyeth’s drugs before the merger. Post merger too, the sales force and the structure for both the companies will remain the same.

Hence, the proposed merger will not yield the kind of synergy one normally associates with these transactions. The savings will mainly be on time and money spent on statutory compliances.

On the margins front, Wyeth India has the better portfolio and thus better margins. However, one should note that Wyeth India’s imports from its parent company stand at 36% of its sales, while Pfizer India this stands at just 5% of sales. A large part of Wyeth’s imports are related to the vaccine Prevenar 13 and post-merger too, this product will continue to get sourced from the parent company owing to manufacturing complications involved. Hence, the depreciating rupee will impact the margins of the company. From the table below it can be seen that margins were the most impacted during 1HFY14 when the rupee had depreciated the most.

Wyeth’s gross margins*

| Particulars | FY12 | FY13 | 1HFY14 |

| (Rs in Millions) | |||

| Net Sales | 5,840 | 6,612 | 3,306 |

| Cost of Raw Materials | 2,113 | 2,725 | 1,571 |

| Gross Profit | 3,727 | 3,887 | 1,736 |

| % Gross margins | 64% | 59% | 52% |

* Please note the impact on gross margins is because of depreciating rupee and other factors too.

Impact of the proposed dividend payout:

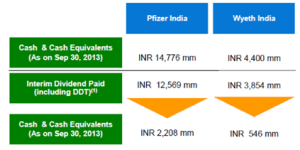

The Board of Directors of the Pfizer India and Wyeth India has proposed interim dividends of Rs 360 and Rs 145 per share, respectively.

- Proposed dividend payout would leave the Pfizer-Wyeth combined entity holding little cash, as it is paying out Rs 16,423 million (including dividend distribution tax) or approx 86% of its Rs 19176 million cash pile. This move indicates that Pfizer does not see any attractive acquisition opportunities in the domestic market in near future. It is, however, to be noted that, the combined entity does have the headroom to borrow funds and also raise capital from the parent company, as Pfizer Inc. has enough headroom before its stake hits the 75% cap.

- Due to dividend payout, the contribution of other income to profits will decline in future years. In FY 2012-13, the interest income on bank deposit accounted for around 25% of the profit (before tax and extraordinary items) of the Combined Entity.

- Dividend payout will improve the return on capital employed, as cash balances typically earn less than the capital that is employed in the business.

Conclusion:

Though delayed, the proposal to merge Wyeth India with Pfizer India is a welcome move. In highly fragmented and competitive Indian pharma industry, this long-awaited merger would be a win-win for everyone in the long run, although no immediate merger-related financial synergies are expected out of this merger. The merger’s valuation process appears to be considering that Wyeth may be an undervalued stock compared to Pfizer. The merger swap ratio or dividend payout does not appear to confer any undue benefit for the global parent. In the absence of any identified opportunity for utilization of the surplus cash proceeds, the decision of returning the profits to the shareholders appears to be correct move by the management of both companies.