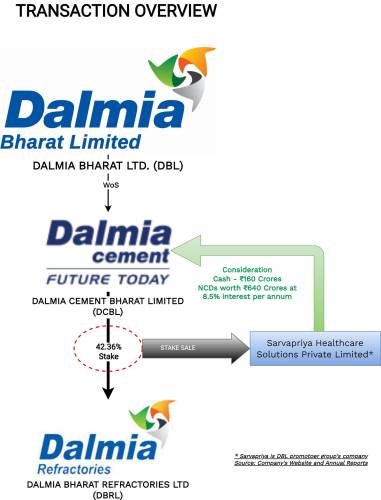

Dalmia Bharat Limited (“DBL”) has created a Vision 2031 for capacity creation plan of 110 –130 million tons from the existing capacity of 40 million tons of cement manufacturing. In a move to fund its ambitious plan, DBL started to hive-off their non-core assets. In pursuant to the same, DBL announced divestment of its entire 42.36% equity interest in Dalmia Bharat Refractories Limited (“DBRL”) held through it WoS Dalmia Cement (Bharat) Limited (DCBL).

Dalmia Bharat Limited (“DBL”) is the fourth-largest cement manufacturing company in India by installed capacity. Spread across 10 states and 14 manufacturing units, DBL is a category leader in super-specialty cement used for oil well, railway sleepers and airstrips and is the country’s largest producer of Portland Slag Cement (PSC). The equity shares of DBL are listed on nationwide bourses.

Dalmia Cement (Bharat) Limited, a wholly owned subsidiary of DBL inter-alia was holding 42.36% stake in Dalmia Bharat Refractories Limited (“DBRL”).

Dalmia Bharat Refractories Limited (“DBRL”) was engaged in providing a complete line of services including refractory design and layout for greenfield projects, refractory application and maintenance. In January 2023, DRBL sold its entire India Refractory Business to RHI Magnesita India Limited against 2,70,00,000 equity shares of RHI Magnesita India Limited representing circa 13.25% Stake valued at circa INR 1800 crore. The Equity shares of DBRL are listed on Metropolitan Stock Exchange & Calcutta Stock Exchange.

At the time of this transaction, DBRL shareholding pattern was 42.36% by DCL (through DCBL), 32.63% by Dalmia family in their personal capacity (total promoter holding being 74.99%) while remaining 25.01% is owned by public shareholders.

The Transaction

DCBL has subsequently entered into a binding agreement to sell its 42.36% stake in DBRL to a promoter group company called Sarvapriya Healthcare Solutions Private Limited at a consideration of ₹800 crores. The payment consideration for the same will come in as follows:

- 20% of the transaction value that is INR 160 crores will be realized by DCBL within April 2023,

- The balance consideration of 80% that is INR 640 crores will be converted into NCDs, which will carry an interest rate of 8.5% per annum. These debentures will be redeemable in two tranches. The first one will be redeemed in December ’23 and the remaining 40% will be redeemed in September ’24.

The assets held by DBRL on the date of this transaction:

- Small and subscale refractories businesses in Germany and China [DBRL sold its German business to RHI Magnesita Deutschland AG on 28th March 2023 for consideration not less than INR 100 cr].

- 2,70,00,000 equity shares of RHI Magnesita India Limited representing circa 13.25% Stake in RHI Magnesita India Limited valued at circa INR 1800 crore;

- 0.37% equity stake in DBL valued at circa INR 130 crore;

- Other investments to the tune of INR 500 crore.

On liability side, tax liability to be payable on the Slump Sale of circa 400 crore and indemnity given to RHI.

Exists from Non-Core Assets taken by DBL so far

DBL chalked out its vision to grow beyond 100 million tons capacity by 2031. To align the vision with capital requirements, DBL started its plan to hive-off certain non-core assets.

Last year, they sold 5% out of its total 20% equity stake in a listed entity Indian Energy Exchange Limited for circa INR 600 crores. Remaining investment will be sold in the coming period. Further, they also divested Hippo Stores in December 2021 through Slump Sale to other promoter entity for consideration of INR 155 crore. Before selling refractory business, DBL combined DCBL’s refractory business, which they had received along with the acquisition of OCL, with a group entity called Dalmia Refractories Limited and created a pure-play refractory company in financial year ’22, called Dalmia Bharat Refractories Limited, (DBRL).

DCBL also won the bid for insolvent Murli industries and eventually merged the same last year to consolidate its cement assets.

These was done to create value by creating a pure-play company and building scale.

Other details of Transaction

This translates the total valuation of DBRL to INR 1876 crore. Issuing debentures for 80% part of consideration will provide time for Sarvapriya to discharge the valuation which is being fixed today. No doubt, debentures will carry interest rate of circa 8.5% per annum which may be claimed as deduction for direct tax purposes by Sarvapriya. It is not clear how Sarvapriya will arrange the funding to discharge the consideration.

DBRL-Post stake transfer

On 10th March 2023, DRBL announced the acquisition of 100% equity shares of Dalmia Mining and Services Private Limited, a company with nil turnover for FY 2021-22 for circa INR 2.25 lacs. The company is engaged in Contract Mining and Mine Developer cum Operator.

DBRL after the transfer of 42.35% stake by DBL to Sarvapriya, conducted Extra Ordinary General meeting on 20th April 2023 to consider & approve the following items:

- Disposal of the whole investment/shareholding of DBRL in the equity shares of Dalmia GSB Refractories GmbH (Germany Refractory business) to RHI Magnesita Deutschland AG.

- Changes in Object clause.

- Investment in the equity share capital of Dalmia Bharat Limited of amount not exceeding INR 1000 crore.

- Investment in the equity share capital of Hippo Stores Technology Private Limited for an amount not exceeding INR 500 crore.

- Increasing borrowing power to amount not exceeding INR 2000 crore.

Conclusion

DBL systematically executed the entire plan for divestment of its refractory business. First, it consolidated its own & OCL’s refractory business under DBRL. Post that it hived-off domestic & German operations to RHI group followed by transfer of stake in DBRL to a group company. The various divestments will pave the way for DCL to focus on its core cement business. At a same time, the consideration in the form of debentures which will give some time for discharging the consideration. DBRL will most likely to sell the equity shares of RHI Magnesita India Limited received as part of consideration for slump sale in coming period.

This particular transaction looks as merely internal restructuring as the stake shall remain with Dalmia promoter group, though it is most likely towards taking it private after giving delisting offer.