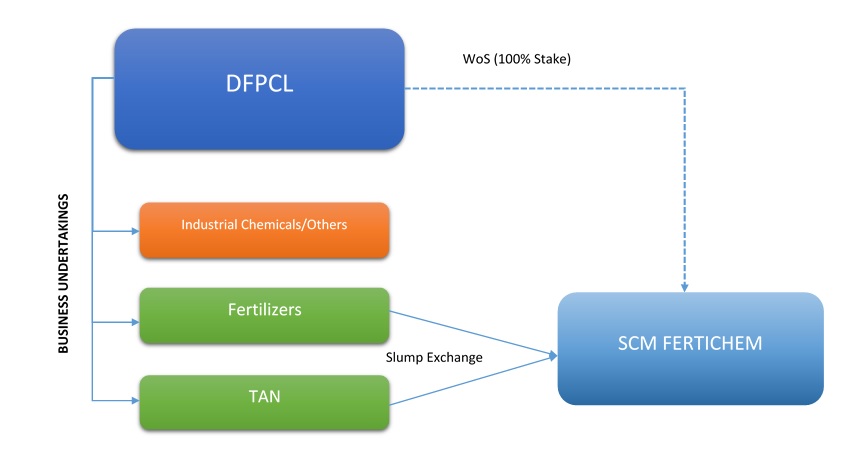

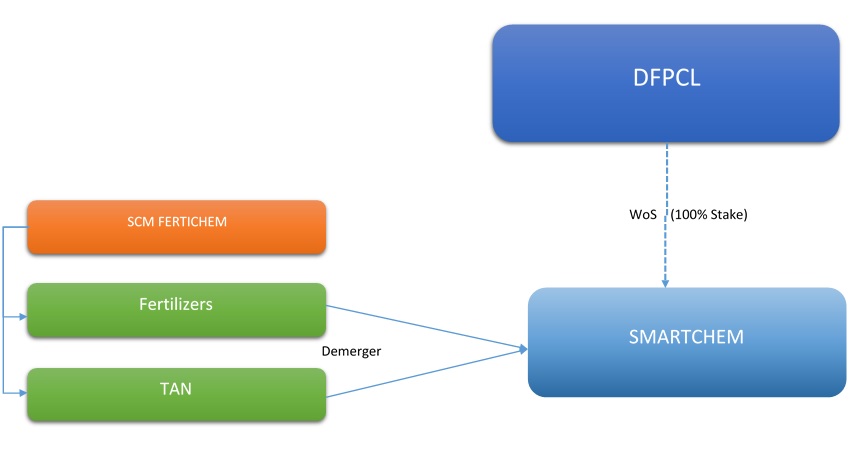

A scheme of Arrangement was proposed amongst Deepak Fertilisers And Petrochemicals Corporation Limited (“DFPCL”), SCM Fertichem Limited (“SCM Fertichem”) and Smartchem Technologies Limited (“Smartchem”) and their respective shareholders and creditors. The transaction is going to be in 2 steps as shown in fig. 1 and fig. 2

Figure 1: (a) Slump Sale of TAN & Fertilizer

The transaction is carried in two steps:

- Transfer of Technical Ammonia Nitrate (TAN) undertaking & Fertilizer undertaking of DFPCL together on a going concern basis through slump exchange

- Thereafter, subsequent Demerger of Demerged undertakings (TAN & Fertilizer undertaking) and vesting of the same from SCM Fertichem in Smartchem Technologies Limited) in accordance with Section 2(19AA) of the Income Tax Act, 1961

Figure 2:(b) Demerger of TAN & Fertiliser Business

DFPCL shall continue to retain control of TAN & Fertilizer businesses through the present structuring.

The scheme is expected to enable better realization of the potential of the business and yield beneficial results and enhanced value creation for the companies, their respective shareholders, lenders & employees.

The board of directors of DFPCL approved the scheme on 29th March 2016. Post the restructuring, there will not be any change in the shareholding patterns of the companies and DFPCL will continue to hold 100% shares of Smartchem and SCM Fertichem. The appointment date under the scheme is 1st January 2015.

DFPCL (Transferor Company):

Listed Diversified Company primarily engaged in the business of manufacturing & selling of Technical Ammonia Nitrate (TAN), Fertilizers, Bulk Chemicals, Mining chemicals, Power generation & distribution & Real estate. DFPCL along with its nominees hold 100% equity share capital of SCM Fertichem and Smartchem.

SCM Fertichem (Transferee Company):

Unlisted Wholly owned subsidiary of Deepak Fertilizer. & is engaged in the business of manufacturing & trading of Fertilizers, Petrochemicals & their by-products.

Smartchem (Transferee Company):

Unlisted wholly owned subsidiary of DFPCL engaged in the trading of Ammonium Nitrate & weak Nitric Acid

RATIONALE OF THE SCHEME

- TAN & Fertilizer business verticals have interlinkages in the form of common raw materials & similarity of select manufacturing process, while the Industrial Chemicals business is relatively independent of process commonalities

- Complementary seasonality of TAN & Fertilizer business helps in maintaining steady level of operations

- Facilitate strategic investment in demerged undertaking

- Each business vertical to get dedicated management focus

- Consolidation of TAN & Fertilizer businesses will provide synergistic integrations to Smartchem’s operations resulting in increased operational efficiency & optimum utilization of resources

- Greater economies of scale and & provide a larger and stronger base for potential future growth

CONSIDERATION & SHARE EXCHANGE RATIO

The valuation report dated March 29th 2016 is issued by/s Sharp & Tannan, Independent CA firm prescribing the share entitlement ratio & Fairness opinion dated March 29th 2016 is given by JM Financial (SEBI registered Merchant Banker.

- Slump exchange – SCM Fertilizer shall discharge the entire consideration of Rs 743 Crores payable by it to the company by the issue of 1, 60, 00,000 equity shares of the face value of. Share Rs 10 Share premium Rs 727 Cr (Rs 454 per share). SCM Fertichem will remain unlisted wholly owned subsidiary of DFPCL

- Demerger – Smartchem shall issue its equity shares to the shareholders of SCM Fertichem (i.e DFPCL) with a share exchange ratio of 1:1. DFPCL will receive 1 fully paid equity share of Smartchem for every one share held in SCM Fertichem.

Demerger consideration:

Share issued by Smartchem to DFPCL – 16050000

SHARE CAPITAL & SHAREHOLDING

Table 1: Share Capital of all Companies as of 31.03.2016 (Source: Annual reports)

| Particulars | DFPCL | SCM Fertichem | Smartchem |

| Authorized share Capital | |||

| Equity value | 125,00,00,000 | 5,00,000 | 7,00,00,000 |

| Cumulative Redeemable Preference Shares | 10,00,00,000 | Nil | 18,00,00,000 |

| Issued,& Fully Paid Up Share Capital | 88,20,49,430 | 5,00,000 | 1,00,00,000 |

| Shares outstanding | 88,20,4943 | 50,000 | 10,00,000 |

| Face Value of shares | 10 | 10 | 10 |

DEMERGED UNDERTAKING – BREAK UP

Table 2: Financials of TAN & Fertilizers Businesses

| Particulars | TAN Undertaking (INR Crores) | Fertilizer Undertaking (INR Crores) | % of Total Turnover / Networth of the company |

| Total Turnover for FY12 | 807.13 | 1039.91 | 49.76% |

| Net worth as on March 2015 | 483.24 | 224.67 | 46.42% |

| Net worth as on Dec 2014 | 522.18 | 220.78 |

INCREASE IN AUTHORIZED SHARE CAPITAL

- SLUMP EXCHANGE

For the purpose of issuance of equity shares to DFPCL, it is proposed that the authorised share capital of SCM Fertichem be further increased by 16,20,00,000 to an aggregate Rs 16,25,00,000 divided into 1,62,50,000 equity shares of Rs 10 Each. - DEMERGER

For the purpose of issuance of equity shares to shareholders of SCM Fertichem, it is proposed that the authorised share capital of Smartchem be further increased by 10,50,00,000 to an aggregate Rs 17,50,00,000 divided into 1,75,00,000 equity shares of Rs 10 Each.

ACCOUNTING TREATMENT ON SLUMP EXCHANGE & DEMERGER

- SLUMP EXCHANGE

Accounting treatment in the books of SCM Fertichem- Upon the scheme becoming effective, from the Appointment date, SCM Fertichem shall record all assets and liabilities of demerged undertakings as appearing in DFPCL as vested in it pursuant to slump exchange in accordance with the allocation report to be prepared as per Accounting Standard 10 notified under the Companies Act 1956 read with general circular 15/2013 of Ministry of Corporate Affairs in respect of section 133 of 2013 act. Accounting treatment in the books of DFPCL:

- Accounts representing assets & liabilities of demerged undertakings will be removed from Demerged company.

- Any difference between consideration received & net assets of Transferred Undertakings shall be adjusted in the P&L account of DFPCL

- DEMERGER

Accounting treatment in the books of SCM Fertichem- Upon the scheme becoming effective, the BV of assets and liabilities of the demerged undertakings as appearing in the books of SCM Fertichem and transferred to Smartchem shall be reduced from the book value of assets & Liabilities of SCM Fertichem

- The net assets transferred will be adjusted against securities premium Account to the tune of Rs 727 Crores ad Share capital to the tune of 16 CroresAccounting treatment in the books of Smartchem

- All the assets & Liabilities of the Demerged undertaking will be recorded in the books of Smartchem at their respective book values

- The Intangible Assets (not recorded in the books) shall be recorded in the books of smartchem, subject to fulfillment of criteria mentioned in AS 26, by smartchem at a value determined by an independent valuer

- The excess of Fair value of shares issued as consideration over the net assets of the demerged undertaking will be recorded as Goodwill. In the event the result is negative, it shall be credited to capital reserve.

ANALYSIS OF CURRENT STRUCTURE – TAX PERSPECTIVE

The present structuring has been planned to ensure that control & ownership of subsidiaries lies in the hands of DFPCL and at the same time it is tax efficient and also it helps to minimise tax liability subsequently when DEEPAK decides to completely exit the business

- Slump exchange – Between DFPCL & SCM Fertichem

- Slump exchange will not be taxable as slump sale under section 50B. Further, capital gain tax is exempt under section 47(iv) which deals with transfer of capital assets to WOS & as such no tax implication on transfer of capital assets to SCM fertichem from DFPCL

- Demerger – Between SCM Fertichem & Smartchem

- Demerger is Tax neutral. No capital gain tax on transfer of capital assets.

Further, if direct slump exchange would have been considered i.e demerging the undertakings from DFPCL into Smartchem, then provisions of section 47A would have got applied & it would have been difficult for Smartchem to attract any strategic investment before lapse of 8Yrs (section 47A) and any change in shareholding of Smartchem would have resulted in withdrawal of capital gain tax exemptions claimed under section 47(iv). To avoid this complication, the demerged undertakings were first transferred on slump exchange basis to SCM Fertichem & then subsequently were transferred to Smartchem I.e from one WOS to another WOS. The shares allotted to DFPCL in the process of slump exchange will be recorded at the fair value including securities premium i.e. 743 crores, which is like to be considered as s cost of acquisition for capital gain on sale of such shares.

Scheme of Amalgamation of a different WoS

In another scheme of Amalgamation, SCM Soilfert Limited (SSL), a wholly owned subsidiary of DFPCL merged with the DFPCL. SSL is engaged in manufacturing & trading of fertilizers, petroleum and their by-products. Amalgamation of SSL with DFPCL is with effect from April 01, 2015.

Merger to result in cancellation of investment in equity share capital of SSL held by DFPCL. Upon the scheme being effective, the authorized share capital of DFPCL shall stand enhanced by Rs 5, 00,000 and entire authorized share capital of SSL so transferred shall be classified as equity share capital of DFPCL. The board approved the scheme on November 05, 2015.

The merger to result in reducing managerial, compliance & administrative costs & will enable effective management & unified control of operations.

RECENT NEWS – Deepak Fertilisers to invest Rs 550 crore in new Dahej plant (5.08.2016)

Deepak Fertilisers and Petrochemicals Corporation plans to set up 1.48 lakh tonnes per annum nitric acid manufacturing facility at Dahej in Gujarat with an investment of Rs 550 crore. The project is scheduled to be completed by the second half of 2018. Currently, the company has a manufacturing facility at Taloja in Maharashtra to produce 8.40 lakh tonnes per annum of nitric acid. However, most of acid produced is used for captive purpose with only 1.60 lakh tonnes per annum made available for merchant sale.

The new facility would be the first step to develop a mega multi products site at Dahej which will cater to the growing demand of intermediates and specialty chemical manufacturers in India.

The company caters to dyes, defence, agrochemicals, nitro-aromatics and pharma sectors.

With most of Deepak Fertilizers manufacturing facilities including chemicals, TAN (Technical Ammonium Nitrate) and fertilizers are based in Maharashtra, this will be its maiden foray into Gujarat.

CONCLUSION

Deepak Fertilizers has faced a challenging environment over the last few years and were left battling multiple challenges mainly across Fertilizer & TAN business in last 2-3 years. The major challenges include discriminatory cut in 33 years of Gas supplies leading to total absence of manufacturing fertilizers, extreme volatility in global commodity prices, restriction in coal mining leading to stagnation in TAN industry & see change in Ammonia Nitrate (AN) prices – key raw material for TAN has added to the woes. Moreover, the company’s working capital position has weakened over the last one year due to holding up of subsidy payments by Department of Finance (DoF) pending recovery of unintended benefits, resulting in significant build-up of short term debt. Due to the ongoing litigation with the Government of India, the company’s subsidy receivables remain stuck and at elevated levels (Rs. 795 Cr. as on March 31, 2016), which has led to sharp increase in its borrowing levels and consequently high interest costs leading to stagnant growth as production suffered & margins were impacted. If DoF releases outstanding subsidy arrears, this should improve the overall liquidity position of the company.

Demerger option was not chosen as DFPCL wanted to keep the control & ownership of the subsidiaries in their hands which would not have been possible as consideration would have been required to be paid to all shareholders of DFPCL including public Given the macro challenges, the restructuring undertaken by DFPCL shall enable new credible investors to invest in the demerged undertakings & facilitate growth. Also unlike other businesses of DFPCL, both TAN & Fertilizer business have reached stability of size & presence in the market & focussed management attention shall result in improving their operational efficiency.