The long time discussed subject of credibility of the resolution process under the Insolvency and Bankruptcy Code,2016, which is dependent on the sustainability of the Resolution Plan and credibility of the Resolution Applicant, is now settled by the Insolvency and Bankruptcy Board of India(IBBI) by introducing amendment regulations to the Corporate Insolvency Resolution process on 7 November 2017 and subsequent Ordinance passed by the Central Government on 23 November 2017 on the subject.

A key objective of the Insolvency and Bankruptcy Code, 2016 is insolvency resolution of corporate persons in a time bound manner for maximization of value of their assets. This objective would be achieved only if a resolution process ends up with a credible resolution plan that maximizes the value of assets of the corporate debtor, that is, the plan has been drawn up realistically and would be implemented successfully. Though there is no restriction on as to who can submit a resolution plan, it should come from any person, who can really rescue the insolvent business and the Committee of Creditors is expected to approve the best of them.

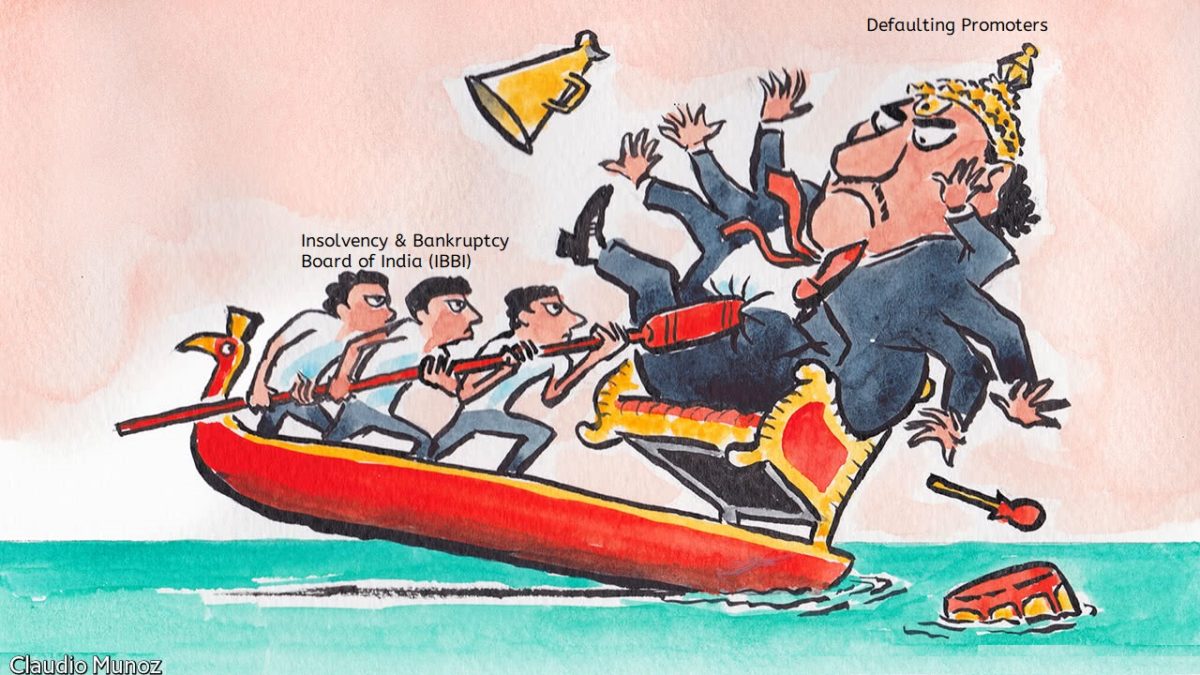

However, it was observed that the persons who themselves were responsible for the current debt owed situation of a corporate leading to insolvency proceedings, were submitting their resolution plans to the Insolvency Professional which if approved, may lead to shift the control of the Company again in the hands of those people who dragged the Company in such a situation.

Here from, the question raised about the creditworthiness of the promoters/persons who are submitting the resolution plan to the Insolvency Professional and credibility of their resolution plan.

According to the amendments, especially newly inserted Sec. 29A in the Code vide Insolvency and Bankruptcy Code (Amendment) Ordinance, 2017, a person (including promoter) cannot submit Resolution Plan if such person or any other person acting jointly with such person is:

- Adjudged Insolvent

- Willful Defaulter as per RBI Guidelines

- Having NPA Account with one year or more

- Convicted for offence with imprisonment for 2 years or more

- Disqualified to act as Director pursuant to the Companies Act, 2013

- Prohibited by SEBI from trading /accessing Securities Market

- Indulged in a Preferential /Extortionate Credit / Undervalued/ Fraudulent Transaction in respect of which Adjudicating Authority has made an Order under the Code

- Executed enforceable guarantee in favour of a creditor of the Company.

- Subject to any disability corresponding to above clauses (a) to (h), under any foreign law.

To effectuate the spirit of Sec. 29A, it has now been mandated for a person submitting the Resolution Plan to include all the above details/declarations in the resolution plan itself along with his identity so that the Committee of Creditors can carry out due diligence of every resolution plan to satisfy itself that (a) the plan is viable, and (b) the persons who have submitted the plan and who would implement the plan are credible, to avoid the plans which may lead to liquidation, post resolution, and to select the most suitable plan under the circumstances.

In view of substituted subsection 4 of Section 30 of the Code by virtue of the amendment Ordinance, duty has been cast on the Committee of Creditors to ascertain feasibility and viability of the Resolution Plan before approving the same. Further, in the context of this subsection, the Ordinance applies with retrospective effect which means, all the pending cases of disqualified persons where their resolution plan/s have been filed but not approved by the Committee of Creditors would be subject to rejection if not fitted within the above mentioned specified criteria enlisted for the resolution applicant and the contents of the Resolution Plan. Accordingly, in all the pending cases, the resolution professional shall have to call for new resolution plans if there are no other eligible plans.

Accordingly, Committee of Creditors will have to look at how realistically the plan has been drawn up, is it actually grounded, does it actually take into account aspects like market situation, technological situation as well as the capability of the promoters who is the resolution applicant. Creditors should take into consideration that the promoters who have to implement these, if are not credible, then how can they entrust the company to the promoters. If the company has to continue to exist, it must be in the hands of desirable persons.

Since Committee of Creditors has to ascertain the credibility of the Resolution Plan and creditworthiness of the resolution applicants, it is surely going to be a subjective test for them to accept a resolution plan where they have to consider the various aspects like credit rating of the Applicant and not to accept a resolution plan simply because the applicant is offering lowest haircut.

Accordingly, Resolution Professional has also been obligated to submit before the Committee of Creditors all the eligible Resolution Plans only, after scrutinizing them within the bracket of requirements under the aforementioned amended regulations and the Ordinance.

Conclusion

IBBI has tightened conditions by introduction the said Section 29A and also putting additional responsibilities on Committee of Creditors and Resolution professional before going ahead with the resolution process. In fact, it should have been there from the day one, hence as a result, these changes are now applicable to all the pending cases as well. This is based on the present trend of promotors’ bidding to take back the insolvent companies, allaying fears of lenders that such entities might go back to the very people who were responsible for the current mess, at lower prices.

There may be possibility of the disqualified directors becoming employee of the Company and submitting resolution plan under the identity of ‘employee’, which is not yet directly prohibited. Hence, it is the need of the hour to curb such kind of practices adopted by the disqualified directors/promoters.

As insolvency cases keep mounting in the NCLT, the IBBI is keen to ensure that resolution professionals facilitate a proper shift in ownership in the case of acquisition of an insolvent company by another entity. Henceforth, if a promoter has to put forth his resolution plan, it is incumbent upon him to put forward a vastly superior plan to stack up with other applicants. As per the language of the new Section 29A, the defaulting promoters cannot put forth their resolution plan even indirectly through any other connected persons like their associate or subsidiary company or any relatives.

However, nobody should consider these initiatives as disadvantageous to the promoters as these amendments are not against promoters, this is for everyone whosoever is putting forth his resolution plan, as the objective of the Code is insolvency resolution in a time bound manner for maximization of value of the assets of the Corporates.