CESC Ltd. is India’s first fully integrated electrical utility company engaged in the generation and distribution of electricity. The company’s operation is spanning the entire value chain: right from mining coal generating power distribution of power. They serve 2.4 million customers which include domestic, industrial and commercial users within 567 square kilometres of Kolkata and Howrah delivering safe cost-effective and reliable energy to their consumers. CESC Ltd enjoys a market cap of Rs 11,976.36.

Division of Business segments

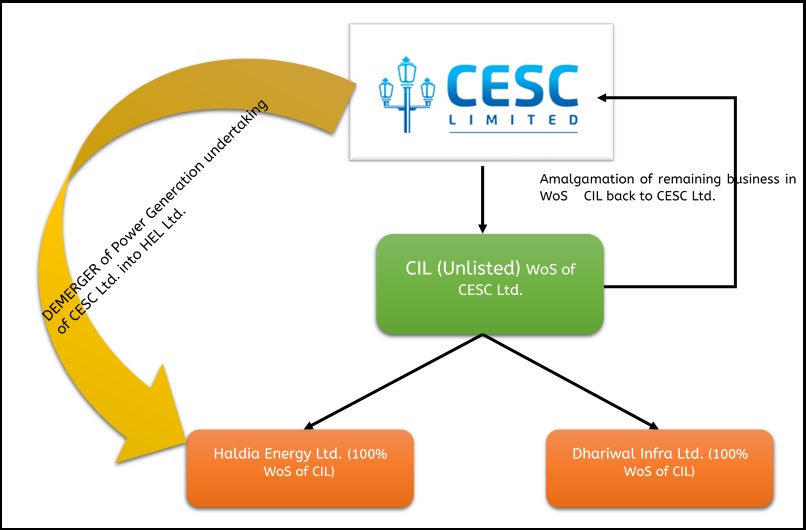

Business Segment 1: Power Generation

CESC Generation Ltd. will house all power generation projects being 2550 MW company. So, post-merger following will be the scenario for Generations business:

Haldia Energy Limited’s name will change to CESC Generation Ltd, followed by its listing on stock exchange and it will solely focus on Generation business, Dhariwal Infrastructure Ltd and Crescent Power Ltd will come under generations business, plus three generations stations such as:

- Budge Budge Generating Station (BBGS) (750 MW)

- Southern Generating Station (SGS) (135 MW)

- Titagarh Generating Station (240 MW).

From these three generating stations, CESC accomplishes 88% of their customer’s electricity requirement and remaining 12% is achieved by purchase of electricity from third parties. More than 50% of coal is sourced from captive mines for generation of electricity in their generating stations. In order to meet the requirement of their electricity CESC have installed two thermal power plants which are: 600 MW Haldia TPP; 600 MW Chandrapur TPP; and others such as 40 MW rejects based power plant; around 190 MW renewable energy portfolio.

Business Segment 2: Power Distribution

CESC Ltd. will house all the power distributions business and it will have under its banner, Noida Power Company Limited; Bikaner Electricity Supply Limited; Bharatpur Electricity Services Ltd; Kota Electricity Distribution Limited. They also own & operate the Transmission & Distribution System through which they supply electricity to consumers. This system comprises of 474 km circuit of transmission lines linking the company’s generating & receiving stations with 105 distribution stations, 8,211 circuit km of HT lines further linking distribution stations with LT substations, large industrial consumers and 12,269 circuit km of LT lines connecting the LT substations to LT consumers.

Business Segment 3: Retail

Retail business which is engaged in organized retailing and new company Spencer’s Retail will house all the business related to retail. Hence post-merger the scenario will be as RP-SG Retail Ltd’s name will change to Spencer’s Retail and it will be listed on stock exchange post-merger. This will solely focus on retail business. There will be online companies under Spencer’s Retail. Key features will be PAN India Organized Retail player with 1 mn+ sqft area and 124 stores spread over 35+ cities.

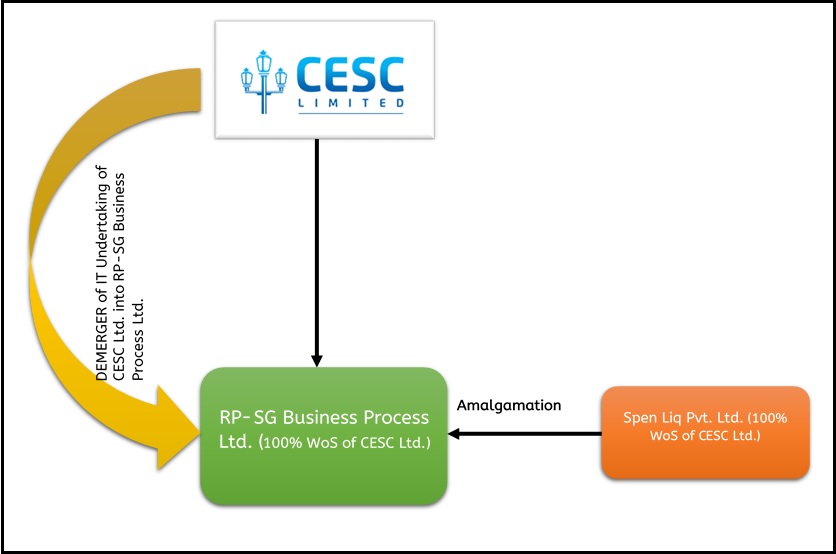

Business Segment 4: BPO

This segment comprises of Property, IT undertaking, FMCG business, and this will be housed by new company CESC Ventures. Post-merger the name ‘RP-SG Business Process Sources Ltd’ will change to CESC Ventures and it will be listed on stock exchange post-merger. It will focus on BPM (Business Process Management) and Other Businesses. It will comprise of Firstsource Solutions which is already a listed company with a market cap of Rs 2,335 Crores and currently trading at Rs 35.10. It is a Business Process Management (BPM) company in India. Quest Properties, its key feature includes “Quest” shopping Mall in Kolkata with 4,15,000 sq.ft. retail area. Guiltfree Indus. Ltd and Others. FMCG Business and all the businesses not related to power and retail.

TRANSACTION OVERVIEW

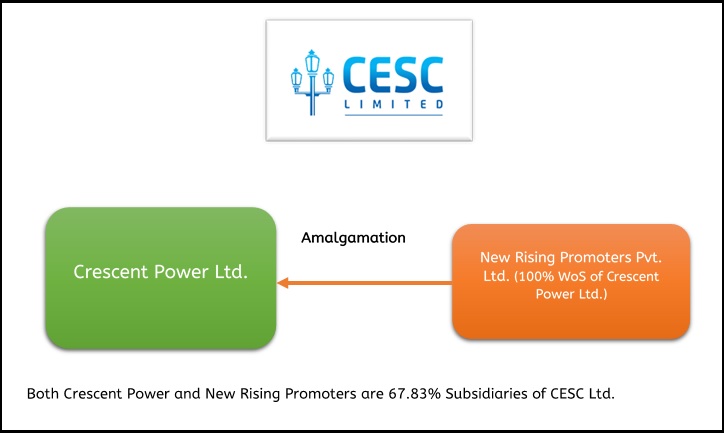

Note: Appointed date 1 and 2 is 1st October 2017. Since wholly owned subsidiaries are getting amalgamated, there is no consideration involved.

Share Swap Ratio

Table 1: Share Swap Ratio (All Companies)

| CESC Ltd (Distribution) | CESC Generation Ltd | Spencer’s Retail | CESC Ventures Ltd | Total ratio |

| 5 Shares | 5 Shares | 6 Shares | 2 shares | 5:5:6:2 |

| Share capital reduced from FV 10/- to FV 5/- and consolidated again to FV 10/- | For every 10 shares held in CESC Ltd, 5 shares of FV 10/- | For every 10 shares held in CESC Ltd, 6 shares of FV 5/- | For every 10 shares held in CESC Ltd, 2 shares of FV 10/- |

The current share capital of CESC is Rs 132 Crores, post-merger it will be increased to Rs 198 Crores which breaks into the following: – Distribution: 66 Crores, Generation: 66 Crores, Spencer’s Retail: 39.6 Crores, Ventures: 26.5 Crores. Promoters will continue to hold 49.92% stake in all the companies.

Financials

Table 2: Financials of CESC & Its Holding Companies as of 31.03.2017 (All Fig. in Rs. Crores)

| Particulars | Total Assets | Networth | Turnover | PAT | Cash Balance |

| CESC Infrastructure Ltd | 3,820.58 | 2,902.63 | 7.84 | 7.25 | 46.51 |

| Spencer’s Retail Ltd | 583.05 | -1,696.00 | 2,021.27 | -107.58 | 7.44 |

| Music World Retail Ltd | 0.00 | -21.04 | Nil | 0.00 | 0.00 |

| Spen Liq Pvt Ltd | 472.16 | 472.11 | Nil | -0.02 | 0.47 |

| New Rising Promoters Pvt Ltd | 49.25 | -64.29 | 51.13 | -61.34 | 37.32 |

| CESC Ltd | 26,254.64 | 13,323.75 | 7,220.07 | 862.86 | 682.81 |

| Haldia Energy Ltd | 5,964.24 | 1,642.52 | 2,032.47 | 296.51 | 188.43 |

| *RP-SG Retail Ltd | Nil | Nil | Nil | Nil | Nil |

| *Rp-SG Business Process Services Ltd | Nil | Nil | Nil | Nil | Nil |

| Crescent Power Ltd | 437.71 | 256.97 | 167.12 | 47.608 | 43.07 |

Please note: *These two companies were incorporated in 2017, and currently there are no activities commenced yet.

Table 3: Turnover or different Business Undertakings

| Particulars | Amount(Rs in Crores) | % to total turnover of the Company as on 31st March 2017 |

| Generation Undertaking | 2,034.23 | 28.17% |

| IT Undertaking | 64.00 | 0.89% |

| Retail Undertaking 1 | 11.39 | 0.16% |

| Distribution Undertaking | 5,110.45 | 70.78% |

| CESC Ltd.’s total turnover | 7,220.07 |

Please note: Spencer Retail Ltd (SRL) which is WOS of CESC Ltd, has a turnover of Rs 1988.66 Crores just from retail which is 98% of SRL’s total turnover.

Whether there arises any Tax liability?

The demerger of Generation Undertaking, Retail Undertakings and IT Undertakings is carried out in compliance to Section 2(19AA) and the said transactions are covered under Section 47(vib) of the Income Tax Act 1961, hence no tax liability will arise in this case.

All the amalgamations in this scheme are carried out as per Sec 2(1B) and the said transactions are covered under Section 47(vi), hence thereunder no tax liability will arise.

Accounting Treatment for CESC Generation Ltd, Spencer’s Retail (new), CESC Ventures Ltd

- Resulting company shall record the assets and liabilities pertaining to the Generation Undertaking/Retail undertaking/IT undertaking, transferred to and vested in it pursuant to this scheme at their respective book values as appearing in the books of the demerged company.

- Loans and advances, receivables, payables and other dues outstanding between demerged company and the resulting company relating to Generation undertaking/Retail undertaking/IT undertaking will stand cancelled and there shall be no further obligation/ outstanding in that behalf.

- Resulting company shall credit to its share capital in its books of account, the aggregate face value of the equity shares issued by it to its members of the demerged company pursuant to the demerger.

- The difference between carrying value of assets and liabilities i.e. Net Assets, transferred from demerged company as reduced by share capital shall be adjusted to the Capital Reserve of the resulting company.

Expansion in FCMG Business

Benefits to all stakeholders

- CESC Ltd. will create one of India’s largest and profitable private sector Power Distribution company.

- CESC Generation Ltd. will create a pure play Power Generation company with a portfolio of Thermal, Wind and Solar Assets.

- Spencer’s Retail (new) will emerge as a Debt free company poised to capture the growth in (food first) organised retail business with significant focus on newly launched apparel brand (2Bme).

- CESC Ventures (new) will emerge as a separate entity to own BPM business, shopping Mall and FMCG businesses.

Comparable

Table 4: Transmission Business Comparison (All Fig. in Rs. Crores)

| Particulars | CESC Ltd (Transmission business) | Adani Transmission Ltd |

| Market Price per share on 8th August, 2017 | 958.60 | 126.15 |

| Market Cap | 11,976.36 | 13,874.10 |

| Revenue | 5,110.45 | 2,879.45 |

| EBITDA | 1,385.80 | -941.33 |

| Depreciation | 289.37 | -569.25 |

| EBIT | 1,096.42 | -372.08 |

| Interest | 316.96 | -904.01 |

| EBT | 779.46 | 531.93 |

| PAT | 610.74 | 416.43 |

| Borrowings (Secured+Unsecured) | 5,618.96 | 7,729.08 |

Please note: It is assumed that 71% of the total cost consists of distribution business and worked accordingly.

Conclusion

The complete overhaul of the businesses of CESC Ltd appears to be a valuable move, as the resultant outcome will be focused management on defined businesses. The company will also transfer the risk and return related to its various business to its companies which are proposed to be listed and thereby putting each egg in different baskets. Like Tata Power in west, CESC is the oldest player in East. Historically it started all businesses in one company for various reasons including regulatory and licence raj. It has multiple business each having different risk and return profile and requirements of capital. To do justice and focus to each of the business, this move is in the right direction. In past, the similar business rejigs had done by Adani Power and Sterlite Company which unlocked the value for shareholders Hence on the same lines CESC Ltd will also create value for shareholders.