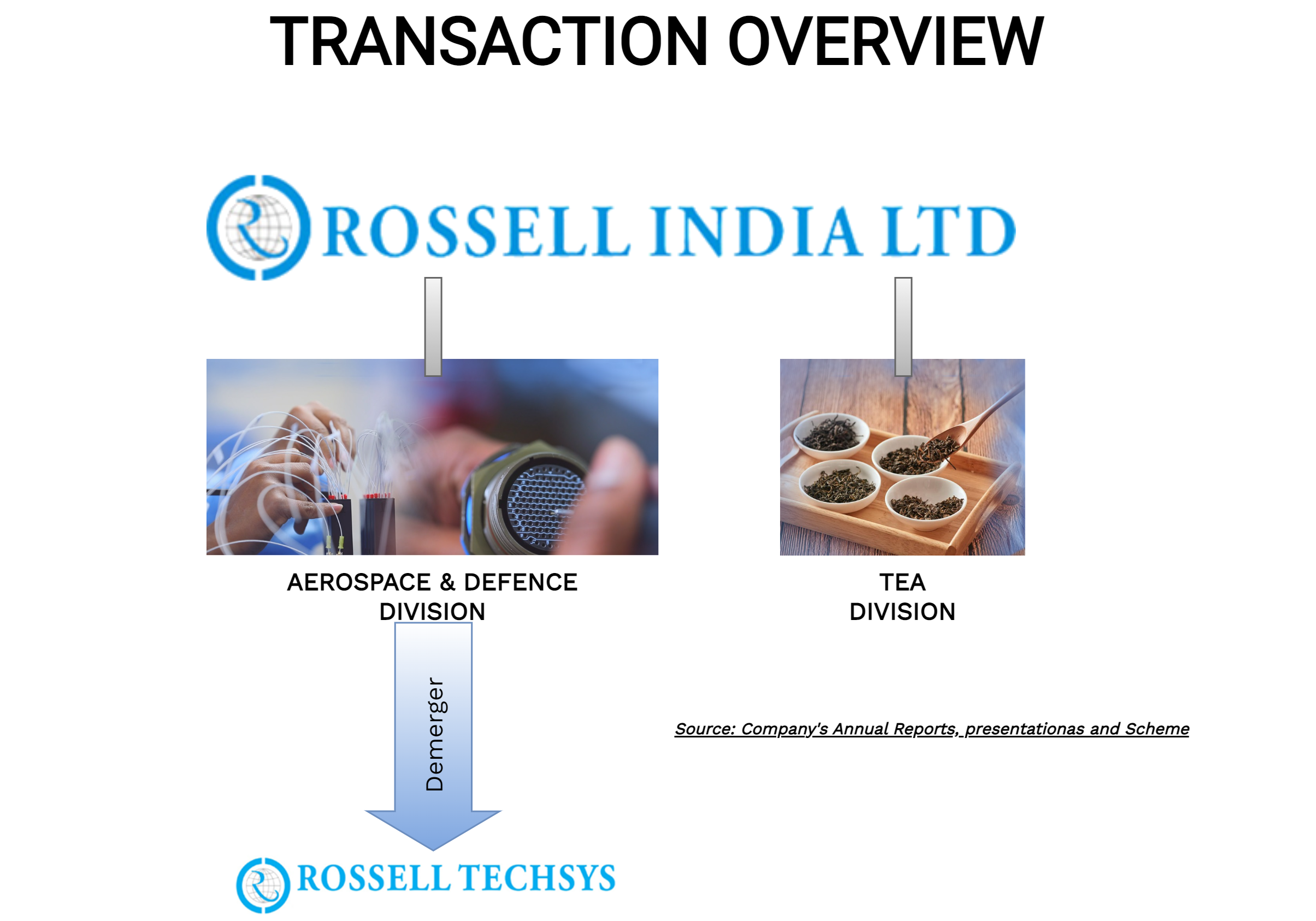

In December 2022, the Board of Directors of Rossell India Limited announced demerger of identified undertaking into its wholly-owned subsidiary Rossell Techsys Limited which on completion of the demerger, will be listed separately.

Rossell India Limited (“RIL” or “Demerged Company”), established in 1994, is engaged in two different set of activities:

- Tea business and

- Aerospace & Defence

Its Tea business includes the cultivation manufacture and selling of Bulk Tea known as ‘Rossell Tea’. RIL owns Tea Estates in Assam. Rossell’s Techsys division is engaged in the business of providing interconnect solutions and electrical panel assemblies, Test Solutions and aftermarket services in Aerospace and Defence sector.

The equity shares of RIL are listed on nationwide bourses.

Rossell Techsys Limited (‘RTL’ or ‘Resulting Company’) is recently incorporated to facilitate the demerger. Currently, entire share capital of RTL is owned by RIL.

Earlier Scheme:

In May 2022, to streamline the promoter holdings in RIL, the Board of Directors approved a scheme of amalgamation which inter-alia provides for the merger of RIL’ promoter-owned holding company BMG Enterprises Limited (‘BMG’) into RIL. BMG holds 2,47,31,795 Equity Shares representing about 65.61% of the total paid-up Equity Share Capital of RIL.

Pursuant to the amalgamation, promoters streamlined their holding in RIL (instead of holding through a company i.e., BMG, they will directly own shares in RIL). Further, equivalent shares (as held by BMG in RIL) will get issued pursuant to the amalgamation, there will not be any change in the shareholding pattern of RIL. The Appointed Date for the amalgamation is 1st July 2022 which is prior to the appointed date for demerger.

The Transaction:

[rml_read_more]

The Board of Directors of RIL has approved a Scheme of Arrangement which inter-alia provides for the demerger of the Aerospace & Defence business into RTL.

The Appointed Date for the demerger will be 1st April 2023. Further, as a consideration, RTL shall issue 1 fully paid-up equity share of INR 2 each for every 1 fully paid-up equity share of INR 2 each of RIL. The existing shares held by RIL of RTL will get cancelled and thus effectively RTL will have mirror shareholding.

Change in Paid-up Capital:

| Particulars | RIL | RTL-Post Demerger |

| Paid-up Number of Equity Shares of INR 2 each | 3,76,96,475 | 3,76,96,475 |

| Paid-up Capital | 7,53,92,950 | 7,53,92,950 |

The overall restructuring is divided in 2 stages. One to streamline the promoter holding in RIL & second to separate its growing Techsys Business. The Appointed Date for both transactions has been kept in such a way that promoters holding in the Resulting Company will also be streamlined pursuant to the earlier announced merger. Further, the management has taken due care to execute the two transactions separately so that any delay/rejection won’t affect the other transaction.

Financials

In October 2008, RIL established a new division namely Vankesh Avionics Technologies to design, development and manufacture of various types of test rigs, aircraft looming and PCB assembly etc which in May 2011 was renamed as ‘Rossell Techsys’.

INR in Crore

The other business of RIL i.e., Tea business is highly cyclical. Over the years, RIL expanded its Techsys division. Its contribution in overall revenue increased from 11.9% in 2011 to over 50% in 2022. Meanwhile, Techsys divisions added few marquee clients and RIL also realigned its other businesses & investments in last decade. In 2019, it also closed its hospitality division.

Conclusion:

Over a last decade, RIL tried to diversify its business. From cyclical tea manufacturer, it successfully grew into Aerospace & Defence space. As Techsys Division achieved size & has significant growth opportunities in future, the management has decided to list it separately. After demerger, the management may bring some strategic investor/s in either of the businesses. Meanwhile, they also trying to streamline promoters holding through the merger.