……Mastek to demerge its Insurance Business

Demergers are gaining momentum in the Indian Market again. There has been a spate of demerger announcements in the past months by Indian Companies. Crompton Greaves, Polaris, India Cements all appear to be in spin-off mode. Crompton Greaves, a part of the Avantha Group, announced demerger of its consumer products business this July, while Polaris Financial Technologies hived off its products business into a separate entity, called Intellect Design Arena. Divided we rise seems to be these companies’ Mantra. Joining this spin-off bandwagon is IT Company Mastek Limited, a BSE-NSE Listed Company, which has announced to demerge its insurance products and service business into a separate Listed Company. In this article, we have tried to analyse the Mastek demerger and what it means for the Company and its Investor moving forward.

THE DEAL

Mastek is an IT solutions player with global operations providing new technology and intellectual property led enterprise solutions to insurance, government, and financial services organizations worldwide. Mastek Limited has two distinct business verticals:

- Insurance Products and Services Business — This business vertical is Intellectual Property-centric, domain intensive and largely caters to the US insurance market, with some customers in other jurisdictions like Canada, Malaysia, Thailand, and UK. It constitutes nearly 55% of its business.

- Vertical Solutions Business — This business vertical delivers large unique complex programs, leveraging information technology service capabilities. This business largely caters to the UK markets, serving the government, financial service, and retail customers.

Mastek Limited has a Global presence with operations in 7 countries and 8 global delivery centers. The US Subsidiary of Mastek Limited is known as MajescoMastek. Mastek has a talent pool of approx. 3,000 professionals.

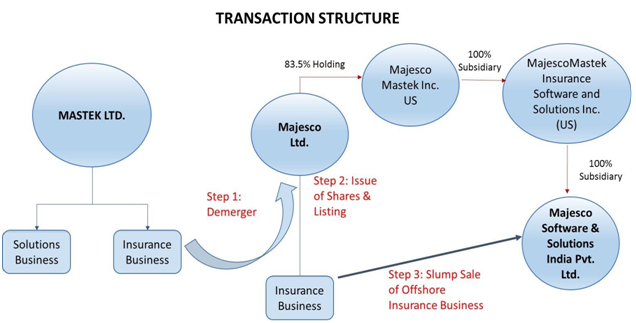

Step1: Mastek Limited by way of Scheme of Arrangement will demerge its Insurance business into Minefields Computers Private Limited (to be renamed as Majesco Limited) with effect from the Appointed Date 1st April 2014. by a Court approved Scheme of Arrangement under the provisions of Section 391 to Section 394 of the Companies Act, 1956. Consequent upon the demerger, Mastek will remain with Solutions businesses and will continue to run the same.

Step2: As a consideration for the demerger, Majesco will issue its shares to the existing shareholders of Mastek in the ratio of 1:1. The existing shares of Majesco held by Mastek will be canceled. Consequently, the shareholding pattern of Majesco would be a mirror image of the shareholding pattern of Mastek. The shares so issued by Majesco to the shareholders of Mastek would be listed on the Stock Exchange.

Step3: Upon the demerger becoming effective, Majesco will transfer its Offshore Insurance Operations by way of Slump Sale to its step down subsidiary Majesco Software and Solutions India Pvt. Ltd. (MSS India), a wholly owned subsidiary of MajescoMastek Insurance Software and Solutions Inc. from the Appointed Date 1st November 2014. The consideration for the transfer of the Offshore Insurance Operations would be equal to Rs. 22 Crores to be discharged in Cash.

There will be a separate board for the two companies and the two entities will be sister concern companies. In Majesco, it will make sense to have a more insurance-specialist board, while Mastek shall have Solutions–specialist Board. The Scheme is subject to the approval of Hon’ble High Courts of Bombay and Gujarat, shareholders and creditors of Mastek, SEBI and Stock Exchanges and expected to be fully operationalized in the second quarter of 2015.

COMPANY STRUCTURE

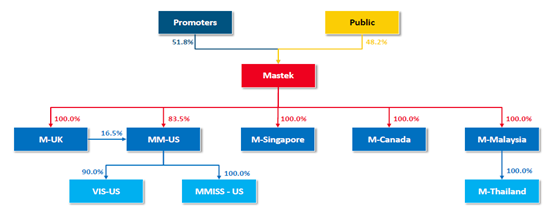

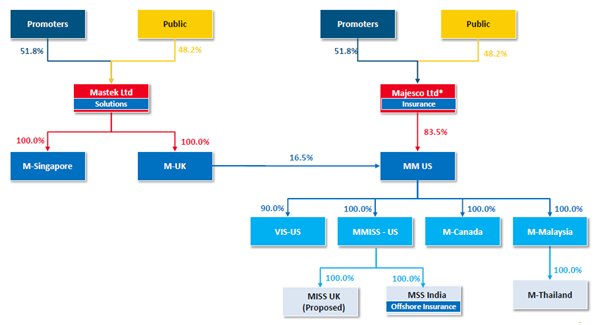

The current structure of Mastek has the promoters owning about 51.8% and the public with large institutions holding about 48.2%. Also, the company operates in different countries through the subsidiary model. In the new structure, the whole intent will be to move these subsidiaries so that all the Solutions businesses come under Mastek. Majesco will be the listed entity in India as far as Insurance business goes. The Indian part of the operations will operate directly under Majesco, while all global operations will operate through the MajescoMastek US wing.

CURRENT STRUCTURE

NEW STRUCTURE

Source: Mastek Investor Presentation

WHY to SPLIT?

Both business verticals are significantly different in terms of their business models, growth opportunities, investment requirements and staff profile. On one hand, the Insurance Products and Services Business offers tremendous growth potential but also has large investment requirements in terms of Research and Development, brand building and sales. On the other hand, the Vertical Solutions Business offers steady growth, is profitable, but has lesser investment requirements. Also, the current business structure of Mastek limits the ability of the Insurance Products and Services Business to fund its organic and inorganic growth independently. This becomes a key challenge for the growth of this vertical.

Operating the two business verticals under one umbrella of Mastek has made it difficult for each of the businesses to perform to full potential. Further, the differing risk-reward profile of the two businesses has led to the overall performance of Mastek being sub-optimal. The diverse trajectory of the Insurance Products and Services Business and the Vertical Solutions Business also leads to disparate risk-reward profile for the stakeholders.

In order to mitigate the aforementioned challenges splitting the two business verticals is a good decision. The move will not only help in unlocking the value for existing shareholders but will also help in realizing the full potential of the individual verticals.

RESTRUCTURING OBJECTIVE

The key objectives for this restructuring, which is primarily focused towards maximizing shareholder value, are:

- It will give shareholders the opportunity to participate in the business of their choice, based on their risk-reward profile;

- It will facilitate each business to independently pursue their growth plans through organic /inorganic means;

- It offers a dedicated management team focused on a single business vertical; and

- It will create a platform to enhance financial flexibility to pursue next stage of growth.

- It will leverage cross-border synergies between insurance clients across geographies and provide a wider spectrum of intellectual property offerings to global customers and market needs.

FINANCIALLY SPEAKING

As on March 31, 2014, Mastek’s consolidated operating revenue stood at ₨. 923.02 crores as compared to ₨. 683.4 Crore in FY 13 reflecting annualized increase of 1.3% in rupee terms and 6.6%in constant currency dollar terms; with the Insurance business contributing ₨. 507 crore (55%) and Solutions churning ₨.416 crore (45%).

The Consolidated net worth of the company stood at Rs. 560.19 Crores.

The Net Profit stood at ₨.51.8 crore as against Rs.34.3 crore in nine month period ended March 2013.In 2013-14, Mastek spent Rs 57.5 crore on R&D while its net profit was Rs 51.8 crore. Due to higher R&D spending, the insurance division has a lower operating profitability of 6% than 14% for the other division. This has impacted the company’s overall valuation. Due to higher capital investment in the insurance vertical, the overall valuation is much lower at present.

Mastek’s cash on books was ₨. 171 crore, of which around ₨.42 crore would be given to the solution entity, with the balance going towards the insurance business. Thus Mastek is driving the bulk of its cash reserves towards the Insurance business as it requires larger investment as compared to the Solutions Business. Along with the cash and equivalents, Majesco will gain two existing development centers while Mastek will retain cash of Rs. 40 crore along with an advance tax benefit of Rs. 31 crore and six centers.

Post announcement of the demerger, the stock price of Mastek have seen an upward trend.

Comparable financials as on 31st March 2014:

(Rs. In crores)

| Particulars | Solutions Business | Insurance Business |

| Networth | 206.4 | 353.8 |

| Fixed Assets | 55.8 | 205.4 |

| Cash & Cash Equivalents | 42 | 129 |

| Revenues | 416 | 507 |

| EBITDA | 599 | 301 |

| EBITDA Margin | 14.4% | 5.9% |

| Adjusted EBITDA (without considering product development expenses) | – | 875 |

| Adjusted EBITDA Margin | – | 17.3% |

The company’s trailing 12-month (TTM) EPS was at Rs. 23.13 per share as per the quarter ended September 2014. The stock’s price-to-earnings (P/E) ratio was 11.50; which is lower than the other similar sized IT Players.

GOING FORWARD

In the Insurance vertical; Mastek does 85% of its business in the US. They have invested substantially in IP in terms of acquiring companies as well as building their IP over $90 million in the last five to six years. They also have a good client track with almost 80 customers in Insurance in the North American market. 7 out of the top 25 P&C players are their customers. The clear opportunity is that Majesco, already owns the IP for Insurance, especially the P&C business; it uses India as a delivery center on a cost plus model. If they can build the balance sheet, if they can increase the financial margin around the US operation and MajescoMastek US, then they have an opportunity to raise capital, use that entity with its balance sheet strength to acquire companies to raise further capital and make the necessary investments and grow this business, which they were finding difficult to do earlier.

The Solution Business is predominantly centered around the UK with almost 95% of the revenues being earned from the UK. Although solutions is a higher margin business compared to insurance where fixed costs are huge, the company size may become a challenge going ahead. One of the challenges they may face is that they are not a large company, though they are specialised and have a niche. So from a customer’s and employee’s perspective, the size could be a challenge. However, the reputation and track record that Mastek have should help them overcome this hurdle. Being small, they are also agile. That is also one way which can help penetrate markets deeper.

CONCLUSION

The biggest problem for Mastek was that it had two dissimilar businesses under the same umbrella and that led to cross-funding and actually disproportionate investments in the Insurance business as compared to the Solutions business. As a result, it created more suboptimal results rather than actually leveraging any potential synergy benefits. Thus, the move was taken by the management to demerge the Insurance Business appears to be in the right direction. This is in line with similar restructuring adopted by other IT majors. Mastek demerger is similar to the Polaris demerger in terms of its structure and benefits to the stakeholders. With both the demergers both Mastek and Polaris were able to focus on the individual businesses, serve their customers better, be able to access capital, and give shareholders an opportunity to invest in the area of business which suited their risk profile.