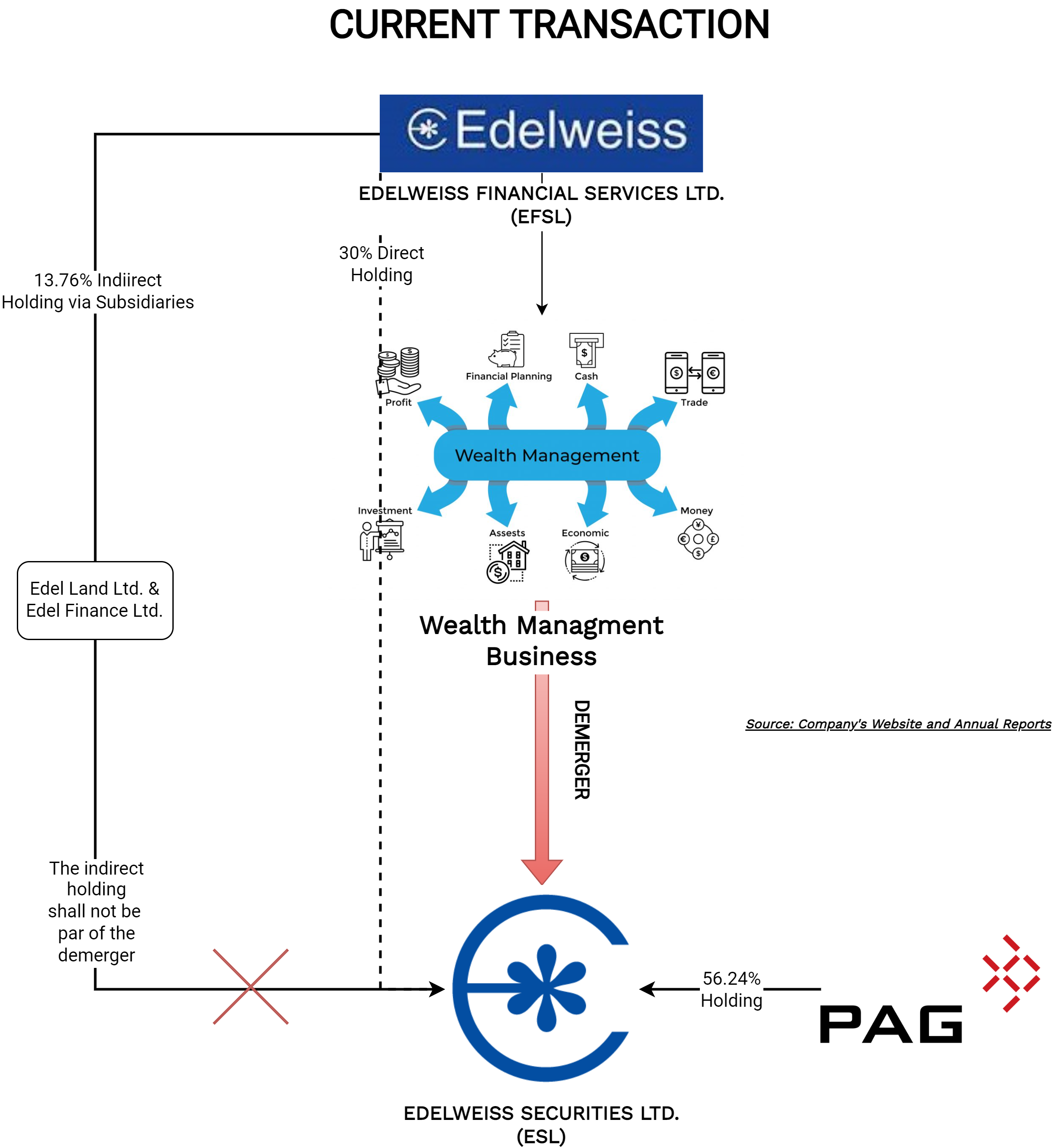

In 2020, Edelweiss Group announced the selling of controlling stake in its Wealth Management Business to PAG, one of the world’s largest Asia-focused investment groups. The move was aligned towards Edelweiss’s vision to become debt free. It seems in pursuant to Shareholder’s Agreement with PAG, Edelweiss Group announced demerger & listing of wealth management business with complete management control including classification as Promoter of PAG group.

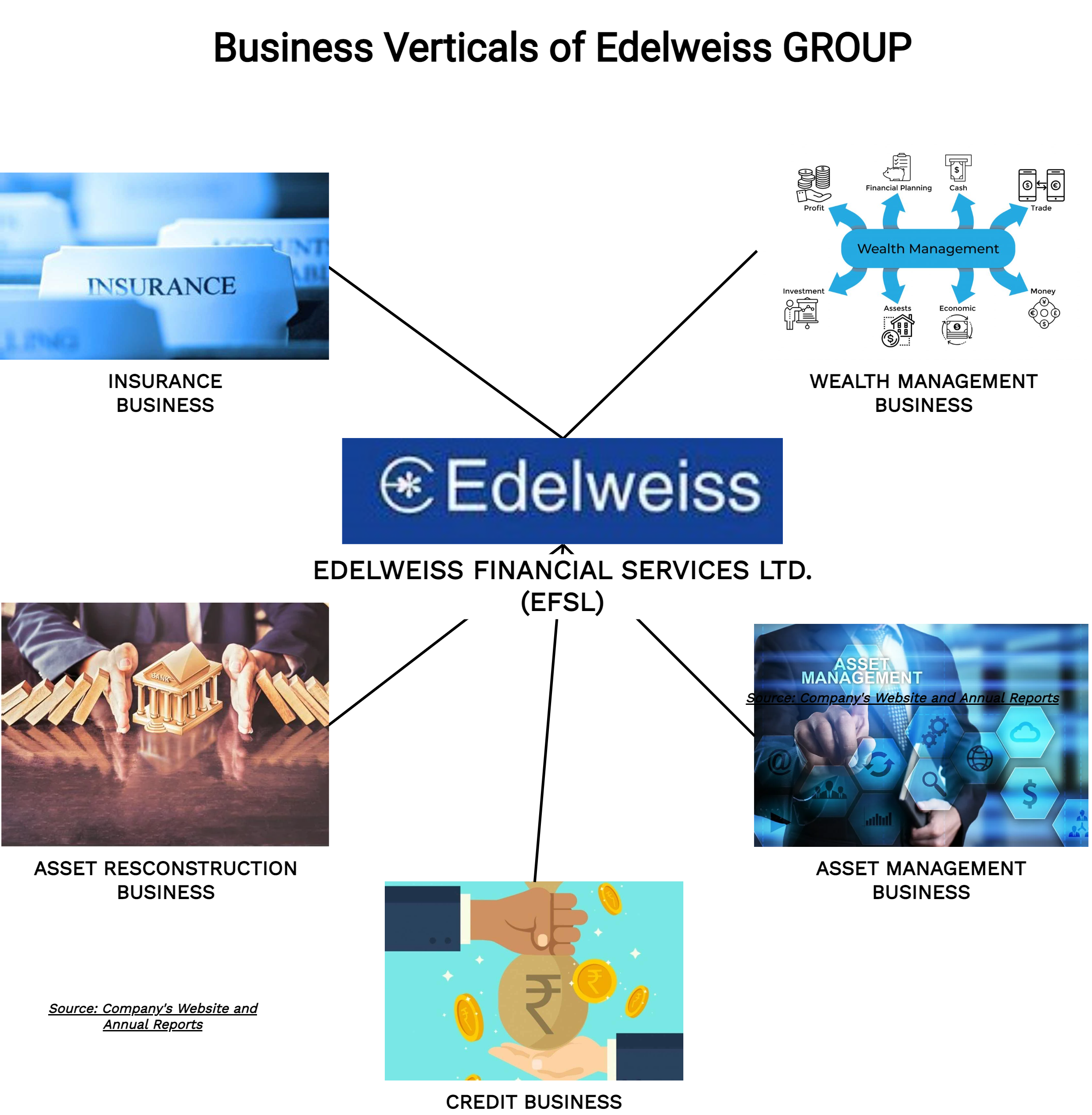

Edelweiss Financial Services Limited (“Demerged Company” or “EFSL”), is the holding company of Edelweiss Group. At present, the Group is engaged in wholesale and retail financing, distressed assets resolution, corporate debt syndication and debt restructuring, institutional and retail equity broking, corporate finance advisory, wealth advisory and asset management, housing finance and insurance business through various subsidiaries of EFSL.

The equity shares of EFSL are listed on nationwide bourses.

Edelweiss Securities Limited (“Resulting Company” or “ESL”) is primarily engaged in Wealth Management activities. The company is also registered as a trading and clearing member with Stock Exchange and acts as a ‘Sponsor’ to AIFs. The entire Wealth Management Business of Edelweiss Group is carried through ESL. As on date, EFSL holds circa 43.76% stake in ECL while the remaining stake is held by PAG.

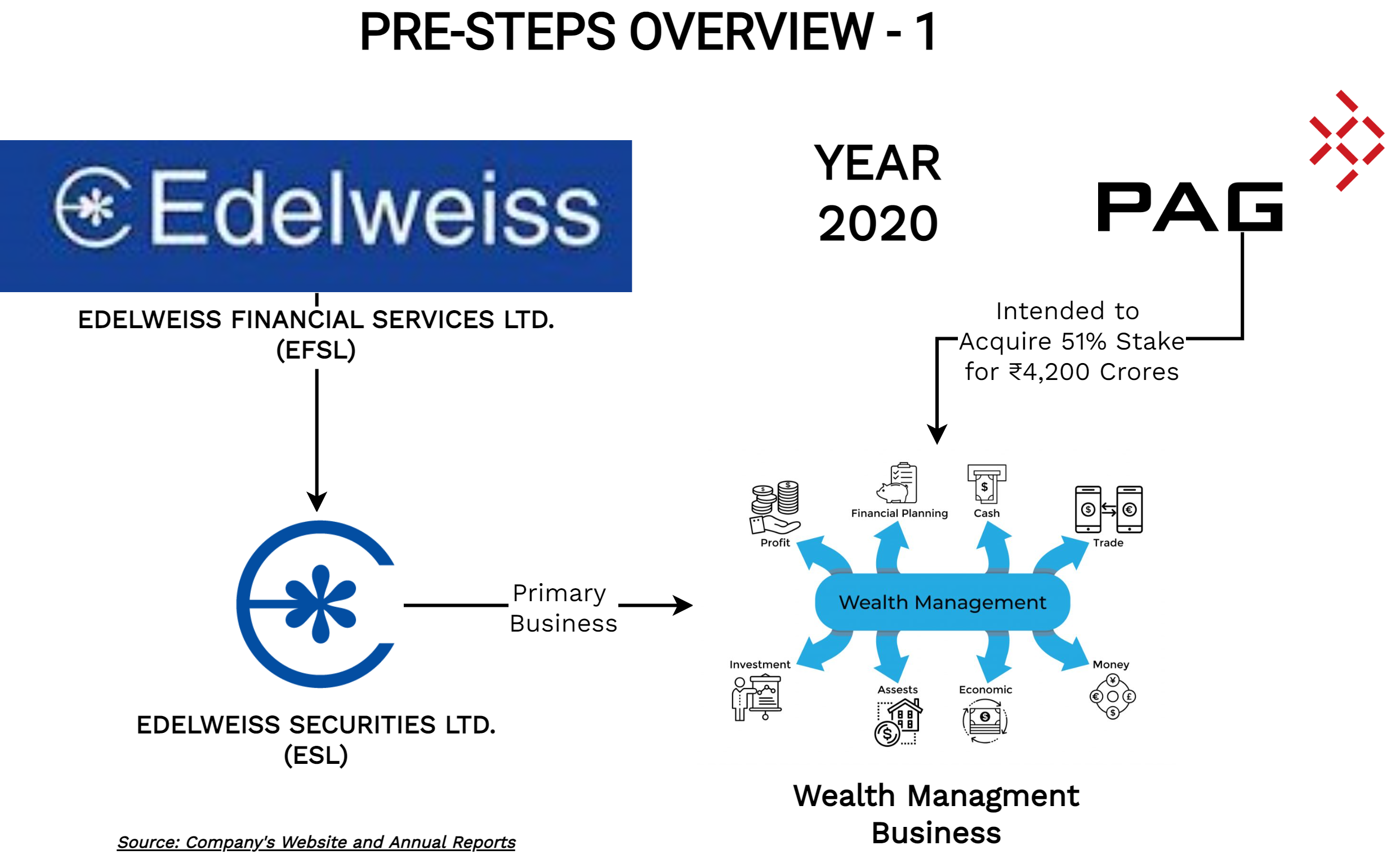

Pre-Steps Taken by Edelweiss Group in last 2 years

In August 2020, Edelweiss Group announced that PAG will acquire 51% stake in Edelweiss Wealth Management (EWM) at a post-money valuation of INR 4400 crore. Later, while closing the transaction in March 2021, PAG ended with a stake of circa 61.5%. PAG had made an investment of INR 2,366 crore in EWM, including primary and secondary investment, taking its stake to ~61.5%. Edelweiss group’s ownership in EWM fall to ~38.5%, with the option to increase it further to up to ~44%.

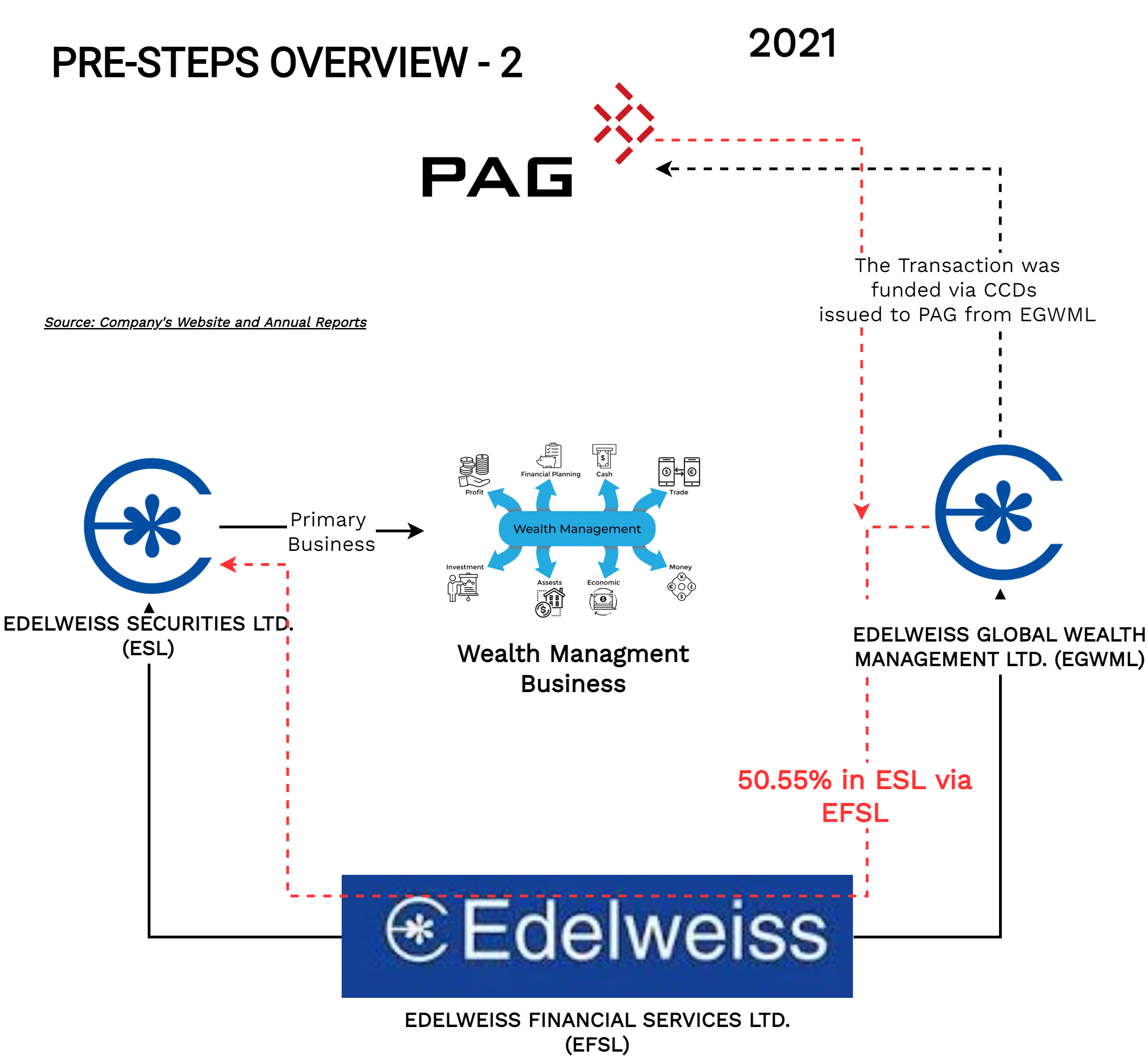

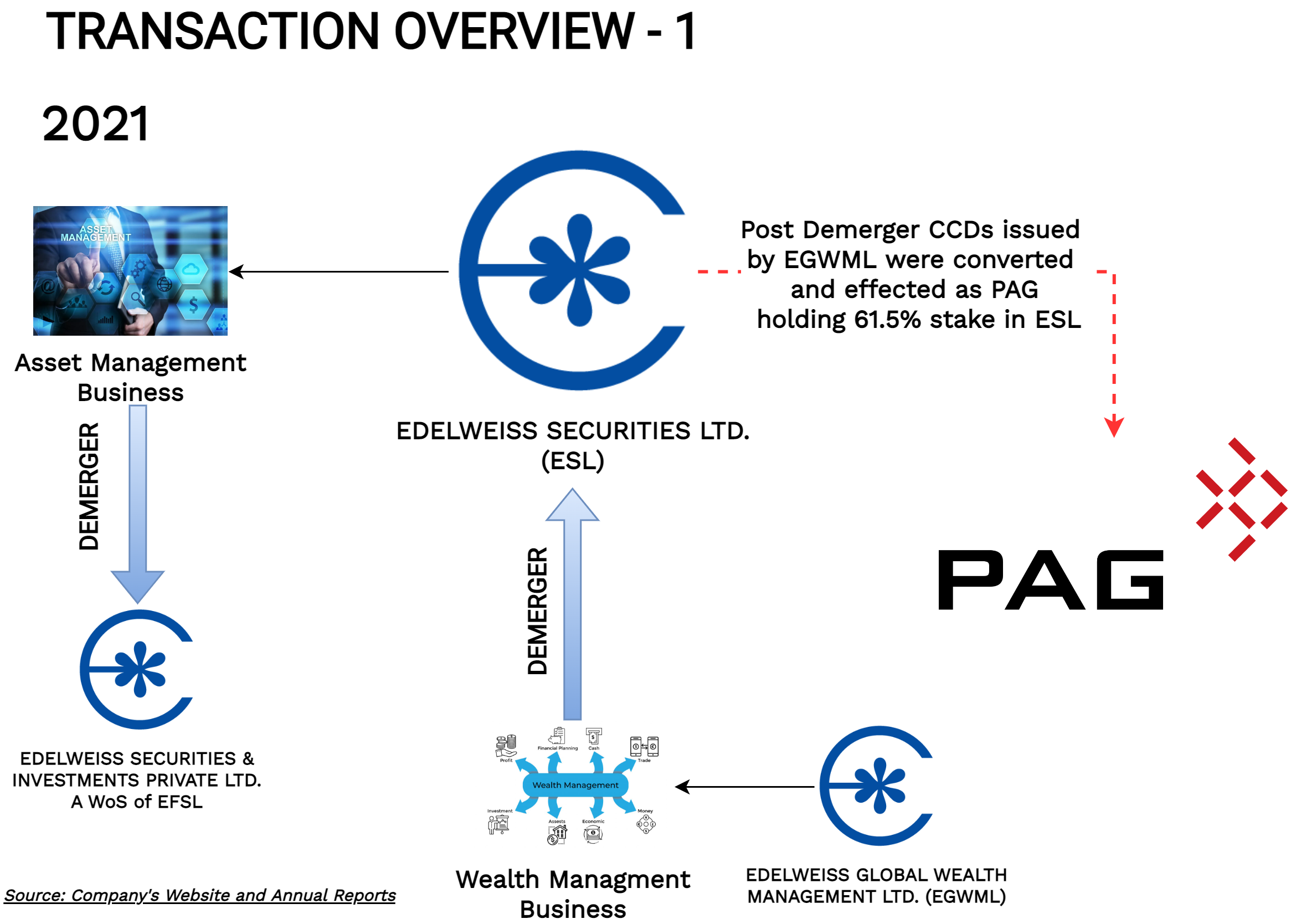

Pursuant to the investment of PAG, there were couple of re-arrangement group carried as to bring entire wealth management business under ESL.

New investment made /bought under ESL:

| Particulars | Value (INR in Crore) |

| Edelweiss Broking Limited | 365 |

| Edelweiss Alternative Assets Advisors Pte. Ltd | 53 |

| Edelweiss Securities (IFSC) Limited | 18 |

Further, the shareholding pattern of ESL also got changed. Edelweiss Global Wealth Management Limited, a wholly-owned subsidiary of EFSL bought circa 50.55% equity interest of ESL through primary & secondary transactions (from EFSL). This acquisition was funded by PAG which subscribed to the compulsorily convertible debentures of Edelweiss Global Wealth Management Limited. As a result, EFSL ceased to be holding company of Edelweiss Global Wealth Management Limited and PAG became the holding company.

Immediately after investment, in April 2021, ESL, Edelweiss Global Wealth Management Limited and Edelweiss Securities and Investments Private Limited (WoS of EFSL) announced a composite scheme of arrangement which inter alia includes:

- Demerger of Asset Management Business of ESL into Edelweiss Securities and Investments Private Limited and

- Demerger of Wealth Management Business of Edelweiss Global Wealth Management Limited into ESL.

The Scheme became effective from March 2022. Further, as a result of this scheme, PAG directly got ownership of ESL. On 31st March 2022, Edelweiss Global Wealth Management Limited again became a wholly-owned subsidiary of EFSL.

In quarter 3 of FY 2022, Edelweiss Group exercised its option to increase stake to 44%. Interestingly, it looks this right was exercised through subsidiary of EFSL and not by EFSL. Further, currently, to retain some stake in ESL, EFSL is transferring 8.53% stake to its another subsidiary.

| Particulars | Description | Circa Valuation |

| Announcement of the Deal | In August 2020, EFSL announced partnership with PAG whereby PAG will invest 51% in ESL through Primary & Secondary Purchase | INR 4200 crore |

| Closure of the Deal | In March 2021, EFSL announced closure of the deal & PAG ended with circa 61% stake in ESL | INR 3878 crore |

| Purchase of Stake from PAG | In Dec 2021, EFSL through its WoS bought back 5.23% stake in ESL from PAG | Not available |

| Transfer of Stake | EFSL is in the process of transferring 8.53% stake in ESL to Edel Lands Limited. | Not Available |

Current Transaction:

The Board of Directors of EFSL in their meeting held on 13th May 2022 approved a “Scheme of Arrangement” between EFSL & ESL which inter alia provides for demerger of “Wealth Management Business” of EFSL into ESL.

Wealth Management Business (“Demerged Undertaking”) is preliminary consist of 30% equity stake (out of total stake of 43.76% held by the EFSL & its subsidiaries) in ESL held by EFSL.

Further, as mentioned in the Scheme, the demerged undertaking shall also consist of merchant banking, securities broking, investment advisory and research analysis services provided to clients however, the quantum of these activities in demerged undertaking looks to be miniscule and it is not clear whether the entire merchant banking, securities broking, investment advisory and research analysis services carried on by EFSL including through subsidiaries will get transferred or not.

The Appointed Date for the demerger is Effective Date. Further, post demerger, the equity shares of ESL will get listed on nationwide bourses.

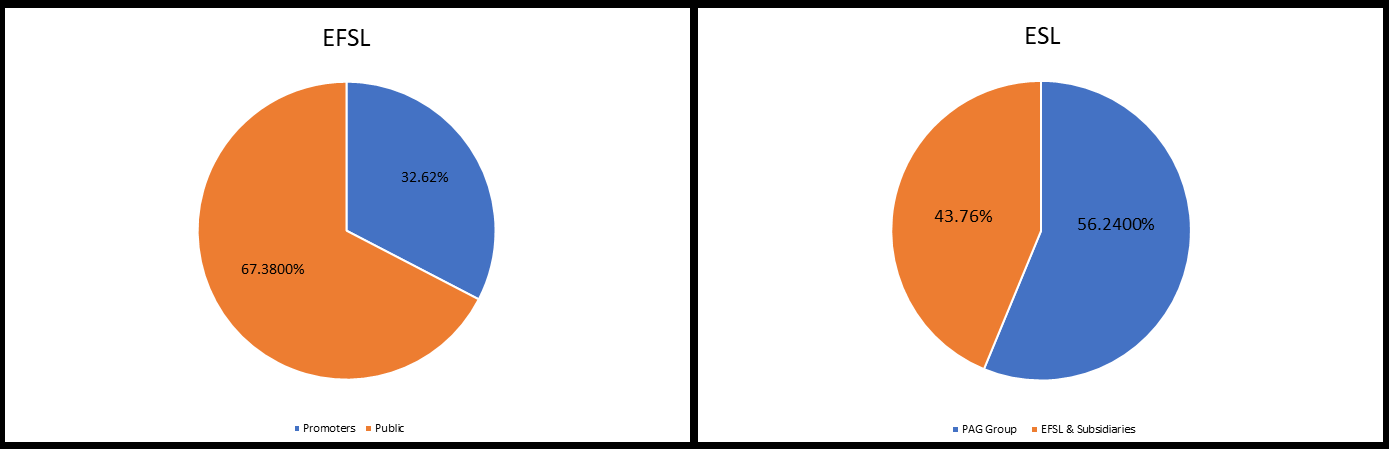

Shareholding Pattern of the Company:

EFSL directly holds 30% stake in ESL. The remaining stake of 13.76% is held through Edel Land Limited & Edel Finance Company Limited, both wholly-owned subsidiaries of EFSL. The stake of 13.76% held through subsidiaries will not form part of the demerged undertaking and will be continued with EFSL indirectly (through subsidiaries).

As a part of the demerger, ESL will issue total 1,05,28,748 equity shares of INR 10 each to the shareholders of EFSL in proportionate to their holding in EFSL.

Share-capital of the Companies:

Shareholding Pattern of ESL Post Demerger:

PAG along with Asia Pragati Strategic Investment Funds are shown as Promoters while EFSL & its subsidiaries are shown as public shareholders in ECL. Further, Clause 7.12 of the Scheme provides that PAG along with its affiliates will be classified as Promoters while all other (including promoters of EFSL & EFSL) shall be classified as public shareholders.

Capital Reduction of Resulting Company

Clause 8 of the Scheme provides for setting of debit balance in retained earning against capital reserve and balance if any against the securities premium account. However, as per the balance sheet of ESL as on 31st March 2021, the retained earnings of ESL were positive. It looks ESL’s retained earning adjusted on account of effect of earlier demerger scheme.

Accounting Treatment

AS ESL is controlled by PAG, the demerger will be accounted as per the “Acquisition Method” prescribed under Ind As 103: Business Combinations in the books of ESL, while EFSL will account in accordance with Appendix A of Indian Accounting Standard (“Ind AS”) 10 'Distribution of Non-Cash Assets to Owners’.

ESL Shall record the difference between aggregate of the consideration transferred over the value of Net Assets of the Demerged Undertaking shall be treated as goodwill in the books of the Resulting Company. Similarly, the Demerged entity after shall give effects as prescribed under clause 10.1 of the Scheme & difference shall be adjusted in profit & loss account.

Undertaking & Valuation Assigned to Wealth management Business

As per the valuation report submitted along with the scheme, ESL per equity share has been valued as INR 1243.32 per share which translates to equity valuation of circa INR 4350 crore. Further, total 1,05,28,764 equity shares will be issued as consideration for demerger.

Thus, a major part of the undertaking (99.84%) constitutes EFSL 30% investment in ESL.

Compare with IIFL Wealth & Anand Rathi

Few years before, through a composite scheme of arrangement, IIFL group separated & listed its wealth management business (IIFL Wealth management Limited) on nationwide bourses. Recently, Anand Rathi group has also done initial public offering of its wealth business (Anand Rathi Wealth Limited).

Let us compare both with Edelweiss Wealth Management Business:

Financials for FY 2022

INR in crore

Assuming ESL will get same PE Multiple as of IIFL Wealth & Anand Rathi, ESL is likely to fetch an equity valuation of circa INR 4400 crore which is in line with value assigned for demerger.

Conclusion

Though apparently, it looks a simple demerger of Wealth Management Business, the execution of the transaction is complex. Beginning from the investment by PAG till proposed demerger, EFSL & ESL gone through multiple complex internal restructurings. In fact, it looks to be a desperate exit of EFSL from Wealth Management Business to facilitate deleveraging its balance sheet. The transaction marks foray of PAG into India’s wealth management business.

Post-demerger, EFSL will continue with circa 13.76% indirect holding in ESL as public shareholders. Last few years, despite excellent growth in all financial products offered by EFSL, it is not getting reflected in bottom line and value creation for stakeholders. Only time will tell whether this complex re-structuring by which EFSL would exit the high growth potential business will reverse the value erosion for stakeholders, especially minority shareholders.