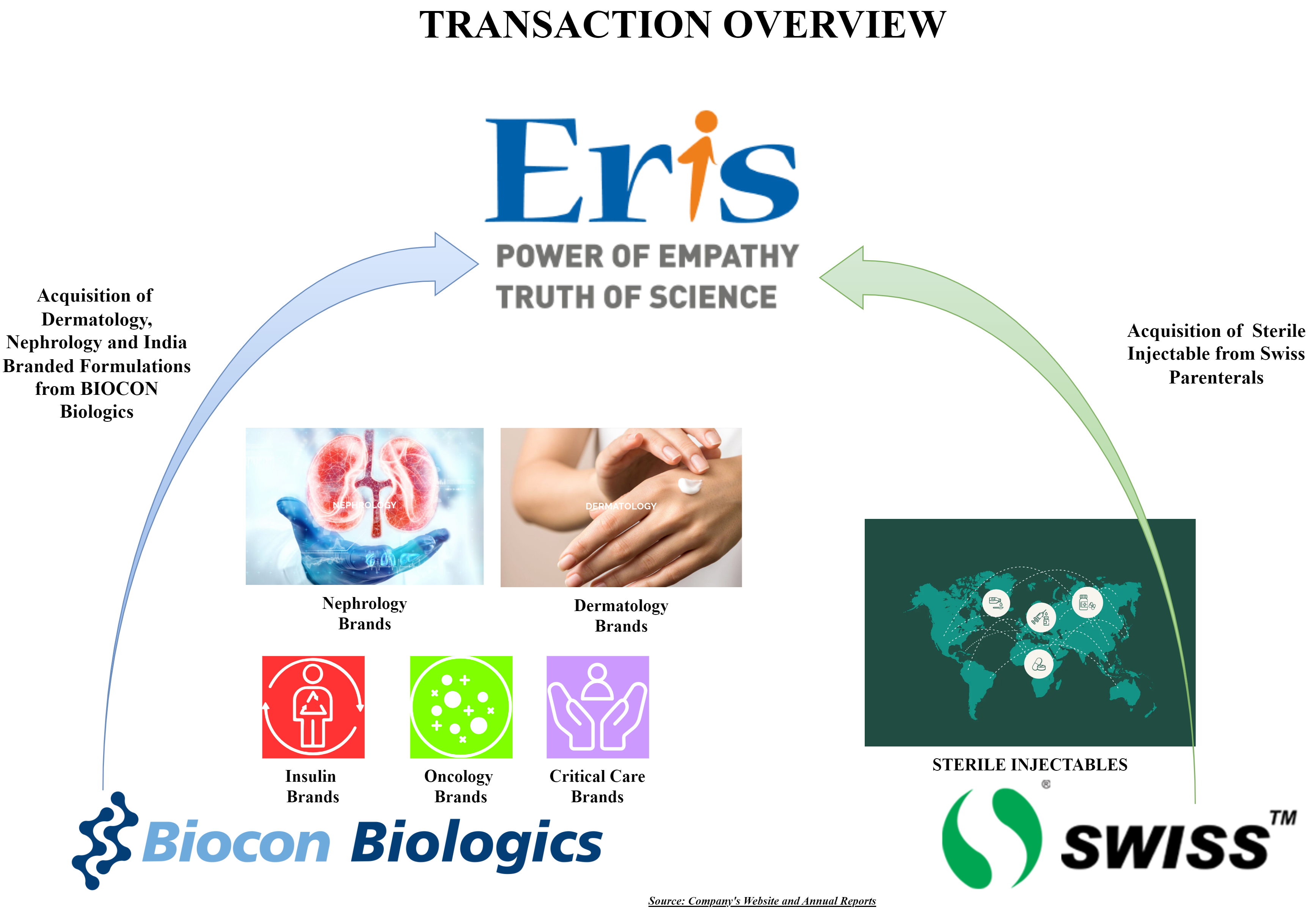

Recently, Eris Lifesciences Limited announced the acquisition of the ‘branded Formulation Business’ of Biocon Biologics Limited pertaining to the Indian territory through slump sale. In addition, ELL also announced a foreign acquisition.

Eris Lifesciences Limited (“ELL” or “Eris”) is a publicly listed Indian pharma company and is a leading player in the domestic branded formulations market. Established in 2007, ELL has been focusing on chronic and sub chronic lifestyle related therapies. ELL is a fully integrated business with manufacturing facilities in Guwahati and Gujarat.

As part of its adding strategic growth engine strategy, ELL entered the Indian insulin market in 2022 with joint venture (70% with ELL) with MJ Biopharm. The JV commenced two products and INR 18 crore revenue in first year of operations and currently having monthly run rate of circa INR 5 crore. To achieve annual revenues of INR 1000 crore in near future from the Diabetes care portfolio, ELL announced two major back-to-back acquisitions which shall facilitate exports & domestic growth.

Eris has historically leveraged acquisitions to enter new therapies; it entered Neuropsychiatry in 2017 through the acquisition of Strides Shasun’s domestic business and entered Dermatology in 2022 through the acquisition of Oaknet Healthcare, followed by brand portfolios from Glenmark and Dr. Reddy’s in early 2023.

Acquisition of Nephrology and Dermatology branded formulation business:

In November 2023, Eris & Biocon Biologics Limited announced strategic partnership to evaluate ways to strengthen Nephrology and Dermatology business owned by Biocon Biologics using strong footholds of Eris in particular area. As a part of this, ELL acquired Biocon Biologics Branded Formulations’ India (BFI) business units of Nephrology and Dermatology on a slump sale basis.

The business includes over 20 mother brands with FY23 Revenue of INR 90 cr and current revenue run-rate of INR 100 cr. The deal consideration is INR 366 crore inclusive of working capital conveyed as part of the deal.

Post deal Eris will become the 2nd largest player in Psoriasis with a market share of 11%. The transaction was partly funded through debt & internal accruals.

Acquisition of ‘Branded Formulation business’:

ELL announced the acquisition of Biocon Biologics Limited’s India branded formulation business for a consideration of INR 1,242 crore thereby jumpstarting its entry into the INR 30,000+ crore injectables market in India and becoming a leading player in the Insulins segment.

The branded formulation business mainly includes:

- Biocon’s insulin portfolio

- Biocon’s critical care portfolio

- Biocon’s oncology portfolio

The acquisition brings two major insulin brands – Basalog and Insugen – into the Eris fold. These are the largest Indian brands in their respective segments with market shares of over 10%. The combined revenue of these two brands is in the vicinity of Rs. 200 crores per annum

This acquisition will also mark Eris’ entry into Oncology and Critical Care. Biocon’s Critical care portfolio has a revenue base of around Rs. 80 crores per annum with leading brands in important segments like Immunoglobulins, Human Albumin, Enoxaparin, Heparin, and several Intensive Care Units (ICU) Antibiotics.

The Oncology portfolio of Biocon brings us three significant Monoclonal Antibodies (MAB) with an aggregate revenue of Rs. 80 crores per annum. The first of these Biomab is a product called Nimotuzumab, which is India’s first novel MAB for head and neck cancer.

To ensure the supply of raw materials (Active Pharma Ingredient), Eris has signed a 10-year supply agreement with Biocon Biologics Ltd. as part of this deal. Under this agreement, the Biocon product range will continue to be manufactured and supplied to Eris for commercialization in India. In short, Eris will do marketing & distribution while manufacturing will still be done at Biocon’s facility. Another reason for the agreement could be as the existing facilities of Biocon are already approved by all concerned regulators, this will ensure smooth continuity in the business for Eris.

Pursuant to the transaction, over 435 employees including 325 representatives will join Eris.

Acquisition of controlling interest in Swiss Parenterals Limited

Eris also announced the acquisition of controlling interest in Swiss Parenteral Limited, an Ahmedabad-based pharma company from its existing promoters. Swiss Parenterals is a dossier-driven Sterile Injectable business in the Rest of World (“RoW”) markets, an impressive product range with more than 190 unique existing molecules and a pipeline of more than 40 new molecules.

Swiss, currently derives 100% of its business from the export of Sterile Injectable products to more than 80 RoW markets in Africa, Asia Pacific, Middle East, and Latin America.

Earlier Eris announced the acquisition of 51% of the equity shares of Swiss Parenterals Limited while an additional 19% will be acquired by the promoters of ELL directly. The transaction has been closed with the mentioned shareholding, however within a month of execution, considering the oppose from public shareholders, Eris announced the purchase of additional 19% equity interest in Swiss Parenterals Limited of Eris promoters at the same consideration. Now, Eris owns 70% of the equity interest in Swiss Parenterals Limited while the remaining 30% is held by Naishadh Shah, Director of Swiss Parenterals, who will be a long-term equity partner in the business and in charge of day-to-day operations and growth. Swiss Parental has been valued at INR 1250 crore & Eris has paid INR 875 crore for the purchase of 70% equity stake in Swiss Parenterals.

Swiss has a strong set of financials, with the Financial Year 23 revenue of Rs. 280 crores, a 37% EBITDA margin and a 25% Profit after tax margin. The business model of Swiss is debt-free and cash-accretive.

Deal Synergies

ERIS

Eris has articulated its vision for 2029 whereby the revenue for Eris in Fy 2029 to be in tune of INR 5000 crore from FY 2023 revenue of circa INR 1600 crore. This will be achieved through organic & non-organic growth. As part of its acquisition strategy, Eris went ahead and executed 3 major acquisitions in the last 6 months for cumulative consideration of more than INR 2000 crore. Clearly, ELL is chasing growth, growth and growth………

Both the acquisition of branded formulation business & controlling stake in Swiss Parenterals can be seen as one basket. According to ELL, both deals are complementary and provide great synergies for ELL and its respective businesses.

Biocon:

Acquisition of the branded formulation business of Biocon provides great platform to jumpstart India’s branded Sterile Injectables business for ELL. It gives ELL an entry into Critical care and Oncology. Secondly, it gives ELL leadership in Insulin and an Anti-Diabetes franchise of nearly Rs. 1,000 crores in size.

This will leapfrog the Eris Insulin franchise to a leadership position with the addition of two power brands and create the fifth largest Diabetes care portfolio in India with a revenue base approaching Rs. 1,000 crores per annum. Existing brands of Eris in insulin market will be continued along with newly acquired brands.

Swiss Parenterals:

Swiss manufactures the widest range of SVPs in its two manufacturing units in Gujarat. It also brings an impressive collection of intellectual property, with a product portfolio is an IP driven with more than 1,000 active dossiers across nearly 200 unique molecules in 80+ countries and a pipeline compassing another 1,000 dossiers across existing and 40+ new molecules.

Swiss has an R&D team with significant sterile development capability, including complex technologies such as liposomal, microsphere, oil-based and depot injections.

The Swiss Parenterals platform gives ELL a direct entry into the Small Volume Parenterals (SVP) market in India. It will leverage the Eris platform and Swiss product range to establish an SVP Branded Formulations business in India. This is an additional addressable market for ELL of more than USD 3.5 billion per annum.

The channel presence and the distribution reach of Swiss in the RoW markets gives ELL the opportunity to build an oral solid dosage business in the RoW markets. They will leverage the Eris oral solid manufacturing capability, Swiss’ RoW channels and distribution presence and the marketing expertise of Eris Lifesciences.

With both acquisitions put together; as per ELL, there is an immediate opportunity to start cross selling the Swiss Parenterals’ product portfolio through Biocon’s channel, including niche inhalation anaesthetics Sevoflurane and Isoflurane. It will also come with margin expansion opportunity by leveraging the Swiss Parenterals’ manufacturing footprint for in-sourcing and technology transfer.

Biocon’s branded formulation business can serve as an ideal launch platform for ELL to address the India Injectables market. ELL has a plan to scale up this business with new product launches from the Swiss Parenterals’ current and pipeline basket of more than 230 molecules.

In all, ELL sees many opportunities by combining Swiss Parenterals’, Biocon branded formulation business with its existing business.

Strategy for Eris, Biocon & Swiss Parenterals Limited

Biocon Biologics’ strategy to unlock value from its legacy business of branded formulations built over the past two decades and extends its existing partnership with Eris for Biocon’s Nephrology and Dermatology business announced in Dec 2023.

As a part of this collaboration, Biocon Biologics will continue to leverage Eris’ strong commercial footprint to significantly expand patient access to its world class biosimilars in India. Biocon will use the net proceeds for developing its core business.

For Swiss Parenterals Limited, the strategy seems to be clear. Considering the revenues for last three years, growth seems to be matured/flattish for the existing portfolio (or for management). Eris can provide much needed growth for the business. At the same time, the promoter is retaining 30% with the role of in charge for day-to-day operations. This provides upside for existing promoter whereby after efficiently integrating the business with Eris, he may get higher valuation/Eris shares for 30% stake in Swiss Parenterals. For Eris, this will ensure the smooth continuity of the acquired business.

Funding

Most of the part of all three deals will be funded through an additional debt. The deal will be funded through debt financing. It looks tentatively around INR 2000 odd crore debt will be added in ELL’s balance sheet. As per management, the cost of debt will be around 9%.

The existing structure of ELL

As on 30th September 2023

INR in Crore

| Particulars | Amount |

| Net worth | 2427 |

| Borrowings | 785 |

| Cash & Cash Equivalent | 189 |

With an additional debt, debt : equity ratio will likely exceed 11 and there will be roughly INR 200 crore annual interest payment for ELL. It will be interesting to see if ELL is able to pay interest outflow & service the debt from the cashflows generated from the acquired businesses. The acquired businesses will have circa INR 160 crore operating profit along with ELL’s operating profit circa 536 crore for FY 2023 (without any synergies if so achieved). With total debt of around 2800 crore, this will take near about 4-5 years for repayment.

Financials & Valuations

Brief Snapshots of ELL & Acquired Businesses for FY 2023:

INR in Crore

| Particulars | ELL-Consolidated | Biocon-Nephrology & Dermatology Business | Swiss Parenterals | Biocon-Branded Formulation Business |

| Yearly Revenue | 1685 | 90 | 280 | 360 |

| EBITDA % | 31.8% | 17.7% | 37% | 19% |

| PAT % | 22% | NA | 25% | NA |

Compared to the existing business of ELL, Swiss Parenterals business is more margin accretive, however, flattish for the last three years. Acquired business from Biocon fetches significantly lower margins.

Tentative Valuations & Multiples:

INR in crore

| Particulars | Eris | Biocon-Nephrology & Dermatology Business | Swiss pare | Biocon-Branded Formulation Business |

| Revenue for FY 2023 | 1685 | 90 | 280 | 360 |

| Consideration / Value assigned | 11,500 | 366 | 1250 | 1242 |

| Revenue Multiple | 6.82 | 4 | 4.46 | 3.45 |

| EBITDA Multiple | 21.4 | 22 | 12 | 18 |

On a valuation front, the acquisitions are a bargain compared to the valuation fetched by ELL.

Conclusion:

ELL is on acquisition spree and has spent more than INR 2300 crore in the last 6 months to acquire various businesses. The set vision for ELL of achieving INR 5000 crore turnover in the next 5 years seems to be fulfilled majorly through incremental revenue through acquisitions. Though management is claiming a lot of inter-se synergies between various acquired businesses and with ELL’s existing portfolio. To achieve desired growth, the key challenge will be successful integration.

Almost the entire consideration will be funded through debt. This raises the significant challenge of additional interest payments and repayment of loans from the present cash flow of around Rs 200 crores. This should trigger some consolidation of ELL’s associates and JV companies to make additional cash flow available for the interest and loan servicing.