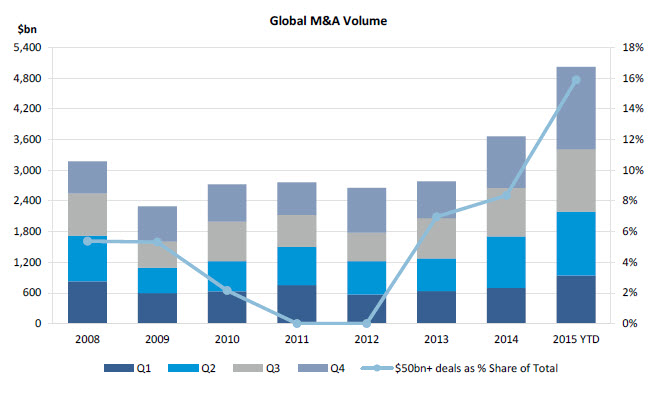

The year 2015 created a record in terms of global mergers and acquisitions (M&As). The total value touched $5.03 trillion, a massive rise of 37% ($3.67 trillion) from 2014, according to data from Dealogic. In fact, the total value of deals in 2015 was more than double of 2009, the year following the outbreak of the global financial crisis. M&As took place across industries ranging from healthcare, energy, power to technology in the US, Europe, and Asia Pacific.

Most notably, the year 2015 also recorded higher returns for acquirers as year-end results from Wills Towers Watson’s Quarterly Deal Performance Monitor show that acquirers closing deals in 2015 outperformed their index by 10.1 percentage points during the year. According to the research, in 2015 the outperformance of cross-sector deals was more than double that of the previous year.

Sector-wise, pharmaceuticals saw the biggest value in deals followed by the technology sector. The healthcare sector chalked up deals worth $724billion, up 66% on $436.4 billion in 2014 and the highest annual level on record. It was followed by technology at $713 billion and real estate at $458 billion. The year’s top two deals are among only eight mergers in history topping $100 billion. There were 69 deals in 2015 exceeding $10 billion, more than double than last year’s level and also a new record. Also, mega deals of $50 billion or more accounted for nearly one in six of all the year’s deals—a share for heavyweights never seen ever. Goldman Sachs was the world’s leading advisor for M&A followed by Morgan Stanley and JP Morgan.

The biggest deal in the pharma space was that of Pfizer Inc acquiring anti-wrinkle Botox maker Allergan for $160 billion. The combined entity will become the world’s largest drug-maker and it expects operating cash flow of over $25 billion beginning 2018. With the merger, Pfizer will have greater financial flexibility which will enable the company to move ahead in discovery and development of new innovative medicines and direct return of capital to shareholders. The merger will broaden the innovative pipeline with more than 100 combined mid-to-late stage programs in development.

Region-wise, every place saw record M&A deals in 2015. The United States and Asia Pacific accounted for 74% of the total deals. European M&A total $907.5 billion, an 8% increase compared to a year ago and the strongest period for M&A in Europe since 2008. Japan and Africa/Middle East accounted for 4% of worldwide deals.

Why M&As touched record high in 2015?

The record mega M&A deals changed the competitive landscape for many global industries and left boardrooms and deal makers to look back at the drivers of the past two years and look ahead to a new year. The weak economic condition has signed companies across the world and many of them are consolidating or merging to stay in the business. All over the world, big corporations are looking for cost-cutting measures to improve their bottom lines. After the 2008 global economic crisis, there has been lackluster revenue growth across many industries and it led to slow economic growth rate, low inflation, weak wage growth rate, under utilization of resources and lack of pricing power. Companies increased scale by consolidation, removing excess capacity and reduced costs. Pharma companies are increasingly externalizing research and development work as new drug development is very expensive and technology firms are purchasing smaller firms to provide add-on services to their existing portfolio.

Another reason for higher M&As in 2015 was because firms had purchased a business that gave access to emerging markets where the growth is still stronger compared to developed countries. For instance, in Japan, demographic factors influence cross-border acquisitions among banks and insurance companies in emerging countries. Low-interest rates and quantitative easing of the US Fed Reserve had lowered the equity risk premiums, which in turn drove stock prices higher. This increased the share prices and technology and healthcare companies used their own stock as currency for purchasing businesses at elevated valuations.

Pharma sector scores the record in M&A

At the end of 2014, many industry experts were of the opinion that M&A in pharma and biotech industry had reached a high plateau. But it proved wrong as the industry recorded the maximum value in deals in 2015. In fact, the year 2014 too witnessed an intense phase of M&A in the pharma industry. While the number of transactions was comparable to 2013, the accumulated total transaction volumes more than doubled due to the larger number of multi-billion dollar deals.

Many of the prior concerns such as patent expiration, implementation of Affordable Care Act in the US and higher R&D costs appear to have been offset by the current strategy of companies for focused growth and increased M&A. Specialty pharma transactions saw a significant increase in debt/equity financing ratios and very positive post-transaction guidance by a management of the companies had resulted in higher valuations and stock prices. With ObamaCare (Affordable Care Act) bringing in more business for health insurance companies and forcing them to cut costs, many companies are now engaged in merger talks. For example, Aetna’s proposed acquisition of rival insurer Humana for $37 billion, which is still awaiting regulatory approval, is one such deal.

Despite facing significant challenges, including rising customer expectation, the generic market has experienced substantial growth in the last decade. It remains a volume business, even though intensely competitive and highly consolidated with many companies looking to improve margins either by optimizing their operations or by diversification into products with higher margins. As a result, the trend of consolidation through M&As will continue. Moreover, it has become increasingly expensive to develop drugs, which in turn has led to a lot of deals to offset the R&D costs. A report by BGI Research underlines that pharma deals can offset $2.5 billion of costs of developing novel drugs in 2016. The feverish M&A activities globally have been led by drug makers seeking new treatments that can replace the billions of dollars in sales they will lose when their existing patents expire.

Healthcare companies are facing a lot of headwinds due to rising R&D expenditure, patent expiration, depleted pipelines, tighter FDA regulations and slowing global economy. So, to overcome all these challenges, companies are looking at various kinds of deals like mergers, asset transactions, licensing agreements and partnership to boost revenues. Deal-making also provides smaller companies the opportunity to leverage the strengths of larger industry leaders. Specifically, oncology and infectious diseases have been key therapy areas of focus for deal-making over the past five years.

For a recap of 2014, the benefits of a lower tax rate were a major deal driver, but the strategic rationales of the largest transactions in 2014 were gaining scale such as Actavis, which is now a true big company. Another example of refocusing a business was Novartis. In April 2014, the giant initiated a series of transactions to dispose of business where it was in a sub-critical position. So, Novartis and GSK engineered an innovative deal in which they swapped businesses and achieved their goal in one stroke. GSK and Novartis now co-own one of the global leaders in OTC and Novartis increased its oncology footprint by acquiring GSK’s business and pipeline and GSK increased its position in vaccines by acquiring Novartis’ non-influenza vaccine assets. Similarly, announced in February 2014, Actavis’ $25 billion deal for Forest Laboratories is one of the several transactions the company has taken advantage of in recent years to move away from its generic roots and into higher margin branded drugs. The acquisition provides Actavis with additional branded product depth by the antidepressant Viibryd and the blood pressure treatment Bystolic, while Forest teamed up with a deep-pocketed industry powerhouse.

A major pruning of product and business portfolio will be seen in the next few years particularly by the companies who went through acquisition sprees such as Actavis, Perrigo or Mylan. For these companies, the critical question will be how they can combine OTC, generics and originator businesses with their totally different constraints and challenges, or whether they have to spin off assets which do not fit their core competencies. The M&A activities in pharma sector will continue in 2016 as an aging population, new technological treatment discoveries, and continued corporate cost consolidation will spur further deals.

Another important trend for acquisitions in pharma space has been the rise of tax inversions in the US. Transactions by US companies leading to tax inversions have been performed since a long time, but in recent years, their frequency increased dramatically. Between 1984 and 2004, there were 28 transactions which involved a tax inversion. According to data from IMAP, since 2004, there have been 47 inversions and 28 between 2012 and 2015. In fact, the biggest pharma M&A deal in 2015 between Pfizer Inc and Allergan is the biggest-ever instance of a US company re-incorporating overseas to lower its taxes. In fact, the US Treasury is really concerned about such tax inversion deals – in which a company redomiciles in a country with lower taxes — and is taking steps to limit losing billions in tax revenue. US President Barack Obama has called inversions unpatriotic and has tried to crack down on the practice.

So, why are transactions involving inversions growing and why are they so attractive for US pharma companies? Actually, it is all because of the high tax rate in the US. The combined corporate income tax rate (combined federal rate and the average rate of US states) of US-domiciled companies has stayed between 39 and 40% since 1993. On the other hand, the comparable tax rate of all OECD countries declined steadily over the years. The US corporate tax rate is the highest among all OECD countries. Thus it has become more and more alluring for US companies to move their tax domicile abroad. Moreover, the US taxes foreign incomes of US-domiciled companies as soon as these earnings are repatriated applying the incremental rate between the US and foreign tax rate.

IT stands second in global M&A by value

Mergers and acquisitions in the technology sector boomed in 2015. From a flurry of IPOs to surprisingly high valuations for dotcom businesses, many analysts within the space in 2014 began to talk of a bubble forming around IT and the wider tech sector. But they were again proved wrong as in 2015, the technology sector was one of the main drivers of the resurgence in global M&A activity. The increasing importance of mobile technology, the emergence of cloud computing and companies’ ever-increasing reliance on data analytic spurred many companies to dip into the deal market. In addition to cloud computing, the increasing availability, and popularity of wearable and eventually the so-called ‘internet of things’ will drive M&A transactions.

The Dell-EMC merger marks the biggest tech takeover deal ever struck. Dell agreed to acquire EMC, with a market capitalization of $52 billion – making it one of the largest tech mergers of all time. EMC, a company which existed for over three decades, makes data, and storage products for the enterprise, has a market value of about $50 billion. Texas-based Dell, which rose to prominence in the 1990s ruled the PC market for the last two decades, went private in 2013 for $24.4 billion. The deal would undoubtedly cement Dell’s transition from a consumer-facing company to one focused on technology for the enterprise.

Intel’s $16.7 billion acquisition of Altera can be a significant investment for the world’s largest chip company and much was made over the consolidation in the semiconductor industry. As Intel continues to reduce the size of its chips, its ability to use the full benefit of those chips is limited. Altera’s integrated circuits, which use a technology called field-programmable gate array, provide a way for Intel to improve the performance of its chips at a slightly higher cost. Similarly, NXP has completed its nearly $12 billion deal to buy Freescale, doubling the proportion of auto-related revenue to 40 percent to create the world’s top maker of automotive electronics.

M&A outlook for 2016

Following a record year of deals, more companies are already eyeing mergers to jump-start growth. Global and regional political instability will provide a catalyst for more M&As this year. A number of events could combine to have global significance such as further US Fed rate hike, the US election, European political uncertainty and slowing of Chinese economy. As commodity prices remain weak, the extraction and oil sectors will be looking to create new income streams. Globally, pharma companies are likely to continue to drive mega-deals because strong category leadership positions might prove to be a successful strategy for pharma companies to counter the global pressure.