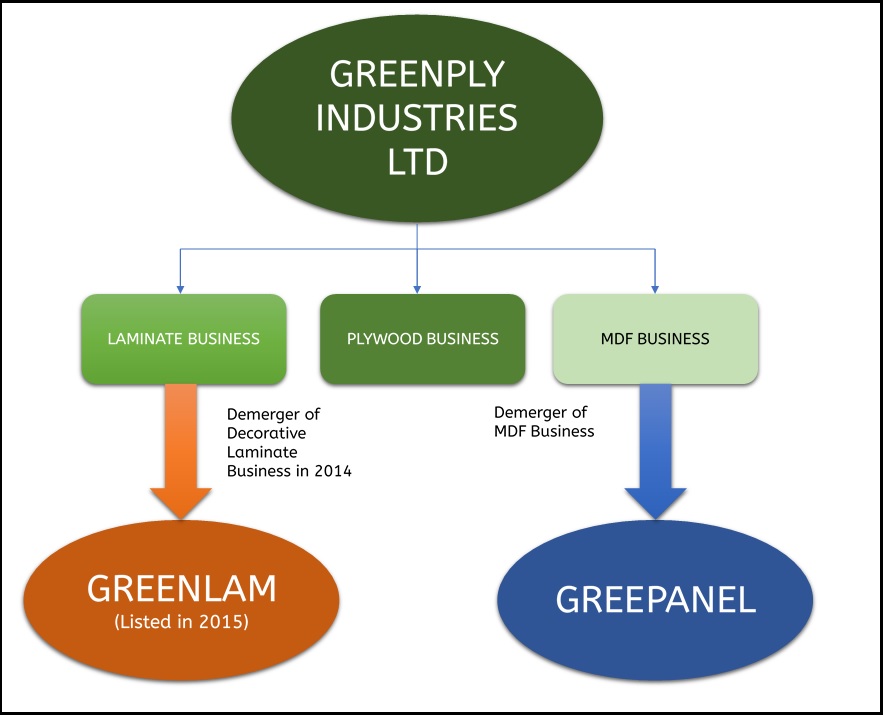

In May 2018, Greenply Industries Limited decided to demerge its Medium Density Fibre Boards (MDF) business, and now, the company will be left with only plywood business. What really is happening is that the two products both with almost similar raw material requirements and customer base, can do better as part of the same structure and organisation are getting separated. It will be interesting to see how the demerger will create value for all the stakeholders in the future without creating issues in overlapping in operations and transfer pricing. Through earlier demerger in 2013, Greenply demerged its Decorative Business (comprising of Laminates and Allied Products) into Greenlam Industries Limited.

The Earlier Transaction

To climb to the next level, Greenply demerged its decorative business into a separate entity called Greelam Industries.

Table 1: Greenlam Financial Post Demerger of Decorative Business (INR Crores)

| Particulars | FY 18 | FY 14 |

| Revenue | 1,155 | 769 |

| EBIT % | 10.0% | 9.6% |

| PAT | 65 | NA |

| Capital Employed | 627 | 456 |

| RoCE | 18.3% | 16.2% |

The equity shares of Greenlam got listed on stock exchanges in March 2015. From the date of the listing, the market capitalisation of the company has got doubled.

The Current Transaction

- Board of directors of Greenply approved the demerger of MDF division of Greenply to its wholly owned subsidiary Greenpanel Industries Ltd.

- The Resulting Company (Greenpanel) shall issue 1 (one) fully paid-up equity share of Re 1 (Rupee One) each for every 1 (one) fully paid-up equity share of Re 1 (Rupee one) each of the Demerged Company.

- The equity shares of Greenpanel issued to the shareholders of Greenpanel Industries will be listed on BSE and NSE.

Division-wise details

MDF Division

- Business comprising of manufacturing, marketing and trading of Medium Density Fibre Boards (MDF), Pre-Laminated MDF, Wood Floors, Plywood, Decorative Veneers, Doors and allied products. Presently, this business consists of the MDF manufacturing unit situated at, Chittoor (AP) and unit located in a common plot at Pantnagar (Uttarakhand).

- The company is setting up a new plant in Andhra Pradesh with a capacity of 360,000 cubic meters is expected to commence in H1FY19. This will increase the MDF capacity by 200%. The expansion is funded through, internal accruals, debt and equity infusion.

- Current debt attributable to MDF division is INR 20 crore. By the time of completion, Debt expected from new plant is to be around INR 470 crore.

- Major Capital Expenditure of the company is happening for its MDF division.

Plywood segment

- Over the last few years, the company’s plywood business has shown single-digit growth. To counter this, the company has entered the lower segment of plywood through the outsourcing route. It is planning to increase its outsourcing proportion from up to 30% from 22% presently over the next 3 years.

- The plywood business has a debt of around INR 200 crore.

Financials

Table 2: MDF Business Post Demerger (INR Crores)

| Particulars | FY 18 | FY 14 |

| Revenue | 499 | 353 |

| EBIT % | 23.0% | 17.8% |

| Segment Net Assets | 531 | 343 |

Table 3: Plywood Business Post Demerger

| Particulars | FY 18 | FY 14 |

| Revenue | 1,205 | 1,037 |

| EBIT % | 9.3% | 9.1% |

| Segment Net Assets | 329 | 425 |

Recent transactions in the Industry

- In December 17, Uniply Industries Limited merged its wholly owned subsidiary Vector Projects with itself, which was engaged in the business of architects, designers, builders and interior designers to strengthen its position.

- In May-18, Archidply Industries Ltd announced demerger of its Chintamani unit (manufacture Prelaminated Particle Board & Decorative Veneer) into Archidply Décor Ltd.

Our View

In India, the large market is shifting from plywood to MDF. Since last couple of years, plywood business has seen a stagnant growth while MDF has erroneously growing. All the major capital expenditure of the Greenply is for increasing its capacity MDF business. It will be interesting to see how Greenply will grow in the future without having any of the growing business (Decorative & MDF) in its portfolio. Further, after demerger, Greenpanel will be highly leveraged entity. In such scenario, it is difficult to say that the re-structuring will create any value for the stakeholders as it created last time.

Most likely reason for the demerger could be the separation of businesses within promoters as Rajesh Mittal & his son will look after the Greenply while S.P. Mittal & Shobhan Mittal will look after Greenpanel.