Greenply Industries Ltd’s demerger of laminate business was approved by the Gauhati High Court on October 31, 2014, under Sections 100 to 104 and 391 to 394 of the Companies Act, 1956 between Greenply Industries Limited (Greenply) and Greenlam Industries Limited (Greenlam), a wholly owned subsidiary of Greenply, and their respective shareholders and creditors, for demerger of the Decorative Business (comprising of Laminates and Allied Products) of Greenply with all its assets and liabilities, into Greenlam with effect from April 01, 2013 (Appointed Date). Record Date to give effect to the scheme was November 27, 2014.

The Demerged Company was originally incorporated as Mittal Laminates Private Limited on 28.11.1990. It was thereafter converted into a public limited company and the name of the company was changed to Mittal Laminates Limited. Further, the name was changed to Greenply Industries Limited The Demerged Company was listed on BSE Limited on 19.04.1995 and on National Stock Exchange of India Limited on 06.03.1996.

CONSIDERATION

The ratio of one fully paid up equity share of face value Rs. 5 of resulting company has been recommended for every one existing fully paid equity share of demerged company.

GREENPLY

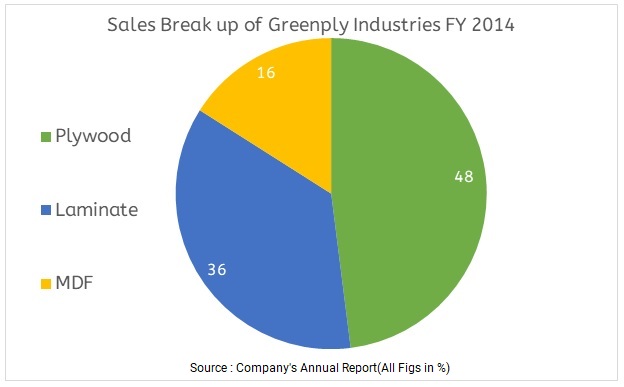

- 32% organised plywood market

- 28% organised laminate market

- 30% MDF market

DEMERGED UNIT

Greenply Industries is the largest producer of decorative laminates in Asia and ranks 3rdin the world. It offers customers products like decorative laminates, decorative veneers and Exterior clads in addition to this new company will offer products like Digital & customs laminate, Lab guardian, Engineering wood flooring and Melamine faced chipboard(MFC). It is the first Non-American brand to award with Green Guard Certification. The laminate market has grown moderately by 2%per annum and is expected to continue at a similar pace but the company is growing at a much faster pace at 47% business contribution of laminates comes from the international market, making Greenply the largest exporter of decorative laminates from India for last four consecutive years.

WHY DEMERGER

There is a visible shift from unorganised to organised, unbranded to branded sector. Organised players have grown at 15-20% over the five years from FY 2009 to FY 2014. Demerger will help both businesses to address separate segments. The decorative business will focus on global market while wood business will focus on domestic market. Each of these growing businesses warrants a dedicated management focus and resource allocation in line with respective market trends. Demerger will enable each business to gravitate toward its optimal discounting on the secondary capital market.

GROWTH DRIVERS

No doubt all the businesses are growing but growth and ROCE are different in different businesses. In this case, one is India focused wanting to capture local consumption and the other is the export focus. Demerged business of decorative lamination requires considerable innovation in product development, marketing etc while wood business is more like commodity business through branding can definitely add to contribution.

Following Factors are leading for increase of decorative business in India

- India has a young population with an average age of 24 years, leading to higher disposable incomes in the hands of those with aspiration for lifestyle and stylish interior.

- Highest urban population rate of change among BRICS nations.

- By 2030 India is likely to emerge as world’s largest middle-class consumer market with aggregate consumer spending of nearly USD 13 trillion.

- Raising nucleus families in India is driving the need for quality housing.

FINANCIALS

Table 1: Green Ply Financials (Segment-Wise)

| Particulars | FY14 | FY13 | % Change |

| NET SALES (INR Crores) | |||

| Plywood | 1037 | 940 | 10 |

| Laminates | 768 | 683 | 13 |

| MDF | 353 | 374 | 21 |

| EBITDA (%) | |||

| Plywood | 10.31 | 10.56 | (25bps) |

| Laminates | 12.05 | 11.90 | 15bps |

| MDF | 21.65 | 21.61 | 4bps |

Q4 was bad in terms of sales for MDF and with below average annual growth rate for plywood and laminates. In terms of EBITDA, laminates business shows good growth for FY 2014 and also for Q4. Demerger of Decorative segment will help Greenply to separate its raising business (both in terms of sales and EBITDA) from other two businesses.

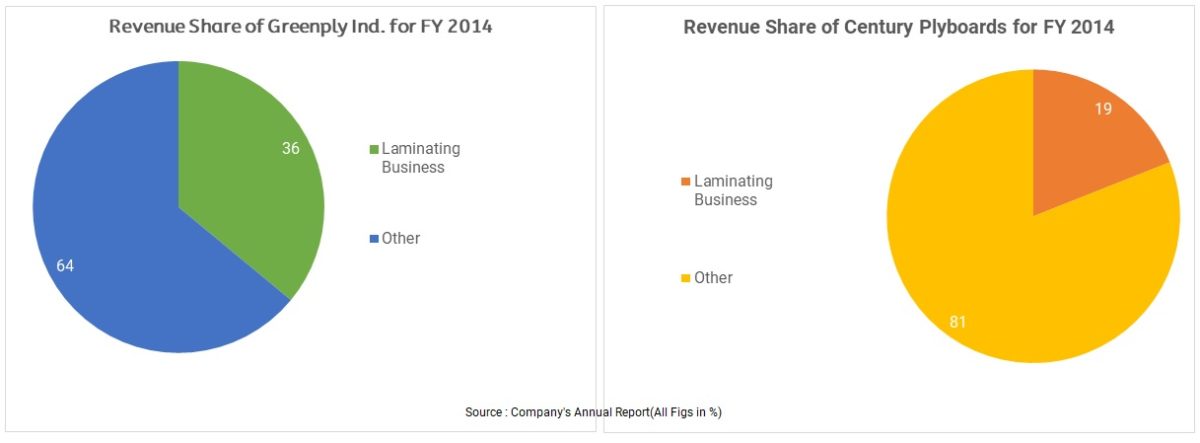

Now to have peer comparison with Century Ply, laminate business of Greenply is three times larger.

Market Cap of Century Ply is around INR 3740 Crs which is almost double of Greenply Industries market cap INR 1960 crs. Enterprise value of Greenply Industries is INR 2200 crs and Century Ply is INR 3836 Crs.EBITDA for FY2014 of Greenply Industries was INR 26,524 lakhs and that of Century Ply was INR 15,767 lakhs. So it seems that Century ply enjoys much better discounting as compared to Greenply for no apparent reasons.

It shows Greenply Industries are more concentrated towards laminating segment than Century Plyboard. The overall revenue share of laminating business in Greenply Industries is around 36% and that of laminating segments share in Century Plyboards amounts to 19% for FY 2014.

If we compare Greenlam Industries (Laminating Segment) with Century Plyboard’s Laminating segment, Sales of Greenlam for FY2014 was 76908 lakhs against Century Plyboards laminating segment’s 23669 lakhs and EBIT was 7474(9.72%) and 808(3.41%) respectively. However for Quarter ended on 30.09.14 EBIT margin of Greelam Industries was 8.44% against Century Ply’s 9.79%. This shows Century Ply’s laminating business is growing by much faster speed.

Table 2: Peer Comparison (All Figs in INR Crores)

| Particulars | GREENLAM | Century Ply (Laminating ) | ||

| FY 2014 | FY 2014 | |||

| Sales | 769.08 | 236.69 | ||

| EBIT | 74.74 | 8.08 | ||

| Half Year Ended on | ||||

| 30.09.14 | 30.09.13 | 30.09.14 | 30.09.13 | |

| Sales | 398.91 | 379.73 | 141.51 | 122.51 |

| EBIT | 36.18 | 34.34 | 11.40 | 4 |

| Quarter Ended | ||||

| 30.09.14 | 30.09.13 | 30.09.14 | 30.09.13 | |

| Sales | 212.90 | 204.62 | 78.78 | 64.19 |

| EBIT | 17.97 | 19.02 | 7.71 | 3.98 |

| Capital Employed | 509.50 | 455.89 | 180.18 | 160.76 |

Sales of laminating business of Greenply for half year ended on 30 September 2014 grew by 5% against Century Ply’s Laminating segments 15%. Greelam’s EBIT for the same period grew by only 6% against Century Ply’s 185%. EBIT of Century Ply’s laminating business for quarter ended on 30 September 2014is almost equal to EBIT for FY 2014.Huge growth in EBIT of Century Ply(Laminating Business) shows that Laminating business of Century Ply is performing extremely well as against laminating business of Greenply Industry.

EBITDA of Greenlam Industries( Laminating segment) for the same period was around INR 9700 lakhs & Century Ply’s laminating segment was around INR 1550 lakhs while that is for half year ended on 30 september 2014 for Greenlam Industries was INR 5087 lakhs and Century Ply’s laminating segment was around INR1610Lakhs. EBITDA of Century Ply’s laminating business for half year ended on 30 September 14 is more than EBITDA of Century Ply’s same segment for FY2014.

Total net income from operation( EBIT) of laminated and allied product segment of Greenply Industries for half year ended on 30 September 2014 is more than 2.5 times that of the Century Playboards laminating segment’s income, though in terms of EBITDA Century ply has performed exceedingly well in current year.

CONCLUSION

- The nature of technology, risk, competition in each of the undertaking of Greenply is distinct from each other hence it is considered desirable to demerge its laminating business to Greenlam Industries.

- The demerger will seek to create a new platform for independent growth of a decorative business, while Greenply to concentrate its growth efforts in plywood and MDF businesses in more focused manner.

- The dedicated focus will enable diversification expansion into newer product portfolios for faster growth.

- Demerger will give the cutting edge to the company in laminating business in future.

- It will strengthen the prospects in each of businesses towards mobilising funds to service their respective growth plans.