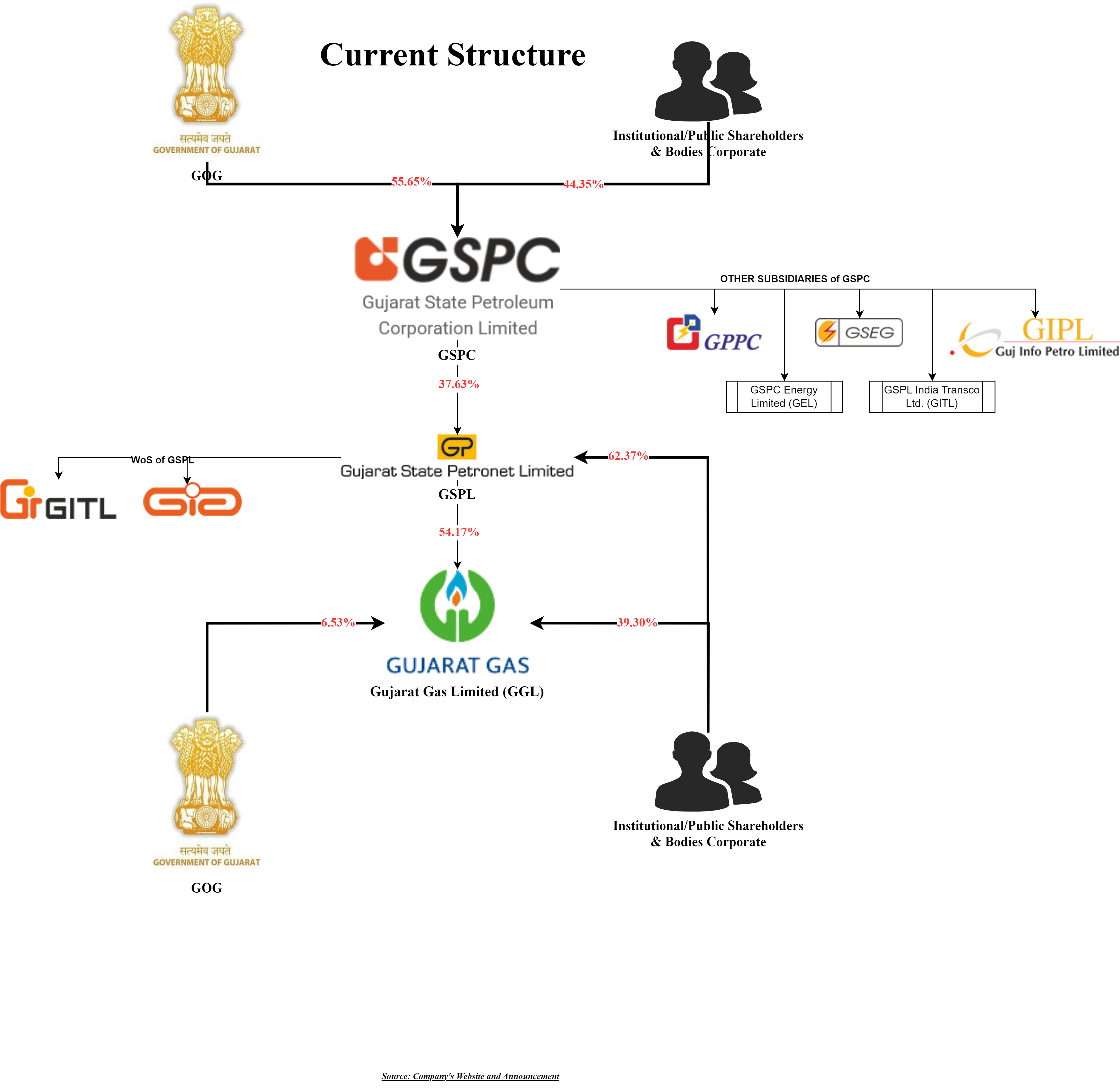

Gujarat is one of the states which has a large portfolio of state-owned companies including some of the listed companies. In line with the vision of the Central Government, Gujarat is also trying to monetise its stake in various entities

To start with, Gujarat government has started planning to streamline the ownership of the various companies & businesses which will facilitate ease of transfer, direct transfer of consideration in the hands of the government and give control to the acquirer. The first one to enter this queue is Gujarat State Petroleum Corporation group.

The Board of Directors of Gujarat Gas Limited, Gujarat State Petroleum Corporation Limited, Gujarat State Petronet Limited and GSPC Energy Limited approved a composite scheme of arrangement which will effectively pave the way for direct ownership in city gas distribution & transmission company.

Over the past four decades since its formation, Gujarat State Petroleum Corporation group (comprising GSPC, GSPL and GGL) has experienced remarkable growth and operational success. The group is having a firm presence across the natural gas value chain over the years. Each of the companies enjoys a leadership market position in their respective domain and inherent synergies are present amongst each of the group companies.

Gujarat Gas Limited (“GGL” or “Transferee Company” or “Demerged Company”) is a Gujarat government company and is a preliminary City Gas Distribution company engaged in Natural Gas Business in India. Natural gas business involves the distribution of gas from sources of supply to centres of demand and to the end customers. The equity shares of GGL are listed on the stock exchanges in India.

Gujarat State Petroleum Corporation Limited (“GSPC” or “Transferor Company 1”) is a Gujarat government company and is primarily engaged in the trading of natural gas, oil and gas activities comprising oil & gas exploration, development, and production. As on date, GSPC holds a 37.63% stake in GSPL.

GSPC is ‘India’s 2nd largest Natural Gas Trading Company’ and a key player in developing Gujarat as a gas-based economy.

In 2019, GSPL executed a turnaround plan to improve the financial and operating performance of the company by:

- Issuing Convertible debentures to financial institutions

- Selling 28.40% stake in GGL to GSPL for INR 3253 crore

- Assigning its non-convertible debentures worth INR 6000 crore to Gujarat State Investment Limited (through a scheme of arrangement) by issuing its equity shares

Post turnaround, GSPC has started generating cash flow & currently has surplus cash in its books.

Gujarat State Petro Net Limited (“GSPL” or “Transferor Company 2”) is primarily engaged in the transmission of natural gas through pipelines on an open access basis from supply points to demand centres. As on date, GSPL holds a 54.17% stake in GGL. The equity shares of GSPL are listed on the stock exchanges in India.

GSPC Energy Limited (“GEL” or “Transferor Company 3”) is primarily engaged in the business of trading of natural gas. As on date, GSPC is a wholly owned subsidiary of GSPC.

Gujarat Transmission Limited (“GTL” or “Resulting Company”) is proposed to be engaged in the business of transmission of natural gas through pipeline on an open access basis from supply points to demand centres. The company is incorporated to facilitate the proposed demerger of the “Transmission business.”

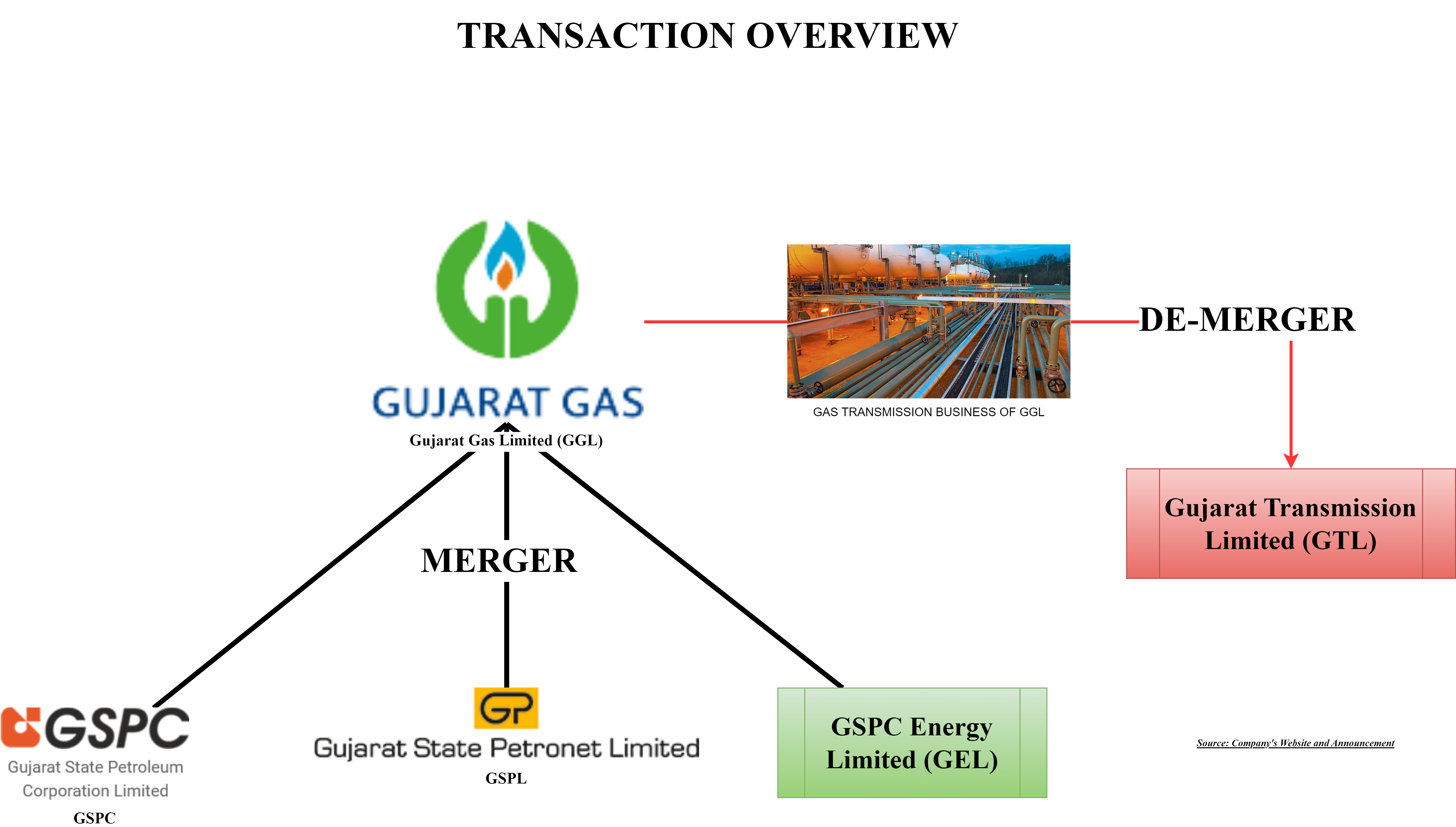

The Proposed Transaction:

The Scheme of Arrangement inter alia provides for the following transactions in chronological order:

- Reduction & Reclassification of reserves of GSPC (mentioned below in detail);

- Merger of GSPC with GGL;

- Merger of GSPL with GGL;

- Merger of GEL with GGL;

- Demerger of Gas Transmission Business from GGL to GTL

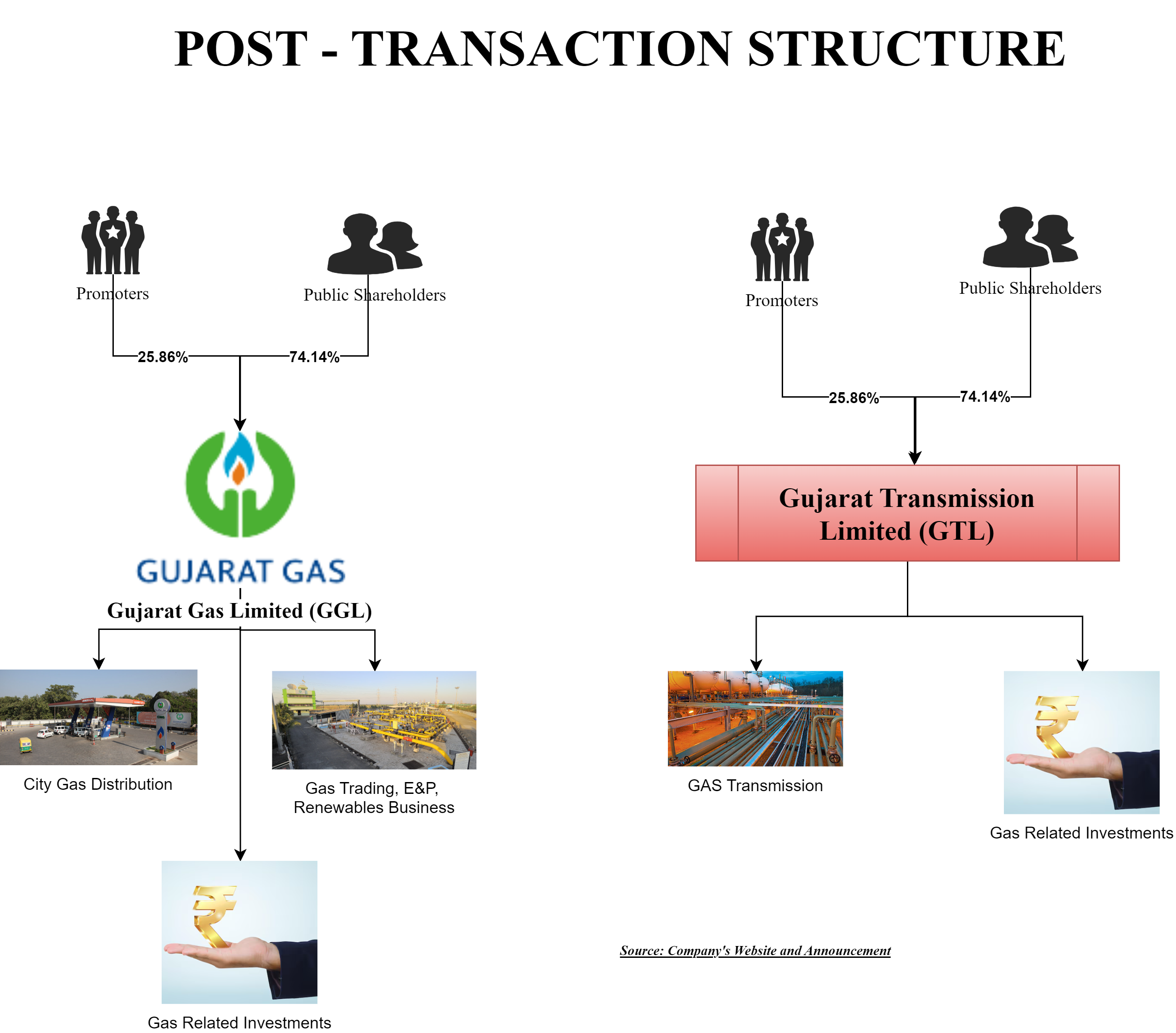

After execution of the transaction:

- All GSPL group entities will get consolidated which will simplify shareholding by giving direct ownership to the Gujarat government

- After the merger, the transmission & gas distribution business (along with gas trading business) shall get separated and will be ready for divestments.

The “Gas Transmission business” as defined under the scheme means undertaking of the GGL as on the Appointed Date pertaining to the gas transmission business which consists of laying, building, owning, expanding and operating natural gas pipelines which was carried by GSPL as on date and shall also include Hazira-Ankleshwar pipeline owned & operated by GGL. Thus effectively, the undertaking shall consist of business carried by GSPL which shall be demerged post-merger of GSPL.

Effectively after execution of the entire transaction, the inter-stakes between companies will get cancelled which will facilitate a clean ownership structure.

Key rationale as proposed in the scheme:

- Achieving better business synergies and growth

- Simplification of group holding structure

- Unlocking shareholders valuer

- Improved efficiencies and enhanced scale of operations

- Optimum utilization of resources

The appointed date for all mergers will be 1st April 2024 & for the demerger will be 1st April 2025. The management have kept a 1-year buffer for the demerger of the transmission business after its consolidation with GGL. One-year profitability for the transmission business will be merged with GGL. We believe the buffer will also help GGL to:

- Clear bifurcation of assets & liabilities getting transferred through demerger

- Flexibility to park cash in demerged & resulting company as may be necessary

Share Capital & Swap Ratio

Currently, the major ownership of all companies is with the Government of Gujarat.

Please note that GSPC & GSPL are classified as promoters wherever they are shareholders. Directly & indirectly, Gujarat Government (through promoter & public shareholding) holds 92.26%, 49.05% and 74.68% equity stakes in GSPC, GSPL & GGL respectively.

Swap Ratio:

| For merger of GSPC with GGL | 10 shares of GGL for every 305 equity shares of GSPC |

| For merger of GSPL with GGL | 10 shares of GGL for every 13 equity shares of GSPL |

| For merger of GEL with GGL | No issuance as it would become a wholly owned subsidiary post-merger of GSPC |

| For demerger of Gas Transmission Business from GGL to GTL | 1 equity share of GTL for every 3 equity shares of GGL |

As envisaged by the management, all the shareholders of the merged entity would also become the shareholders of GTL, and their shareholding in GTL would mirror their shareholding in the merged entity. Thus, the swap ratio has been designed as per management intended capital for the transmission business.

Please note that pursuant to the merger of GSPC & GSPL with GGL, the share capital owned by GSPC & GSPL in GGL & GGL holding in GSPC & GSPL (post-merger of GSPC with GGL) will be cancelled and no shares will be issued to that extent. GGL will issue shares to other shareholders only.

Post Shareholding Capital & Pattern:

Accounting Treatment:

As provided in the scheme, GGL shall account for all mergers in accordance with the 'Pooling of Interest Method' of accounting as laid down in Appendix: C of Indian Accounting Standard (Ind AS) 103- "Business Combinations of entities under common control" notified under Section 133 of the Companies Act, 2013, under the Companies (Indian Accounting Standard) Rules, 2015.

However, Clauses 17 & 18 of the proposed scheme provide for the reduction of securities premium account & reclassification of general reserves of GSPC into retained earnings.

As on 1st April 2024, the reserves of GSPC are:

INR in Crore

| Retained Earnings (negative) | (8668.15) |

| Securities Premium Account | 9471.78 |

| General Reserve | 3245.14 |

Pursuant to the reduction & reclassification, the retained earnings which shall be transferred to GGL will be positive INR 3245.14 crore. Effectively, it will be free reserves in the books of GGL. The balance Securities Premium Account of INR 803.63 crore shall be transferred to GGL. As per the effectiveness of the scheme in sequence, it is clearly mentioned that the reduction & reclassification of reserves of GSPC will be given effect first then the merger of GSPC will happen with GGL.

Sequence of giving effect to the scheme in a chronological manner:

- Reduction of Securities Premium Account to extent of negative retained earnings & Reclassification of the general reserve to retained earnings of GSPC which is internal restructuring before its merger with GGL

- Merger of GSPC with GGL

- Merger of GSPL & GEL with GGL

- Demerger of Gas Transmission business from GGL to GTL

Financials:

GSPC has recorded a cumulative revenue of more than Rs.1 lakh crore and a PAT of more than Rs. 6,500 crore in the past five years. As per management, close to 45% to 50% of the total operations of GSPC is with GGL Tax loss of GSPC which will be carried forward to GGL which will be added savings for GGL in future.

Valuation

GSPC is valued close to ~INR 21,000 crores. And of that, close to 35% is with respect to the gas trading business. It also has cash to the extent of INR 2,300 crores. Other businesses, that is, GSPL and other investments are close to INR 10,600 crores. Of which GSPL is close to 89% of the total valuation of other investments.

Similarly, with GSPL, it has been valued considering the market capitalization & discounted cash flow method, which shall also account for the value of investment in GGL.

Considering the price assigned per share to GGL, post consolidation the equity valuation of GGL is likely to be circa INR 56,000 crore.

Currently, the cumulative value of stake held by the Government of Gujarat (Directly or indirectly) amounts to Circa INR 28,300 crore in the GSPC group. Post consolidation & demerger, the government will have the flexibility to sell any of the businesses or monetize some stake.

Conclusion

The government of Gujarat is one of the proactive state governments which has created enormous value by setting up some large state companies. Linking its vision with central government, the state is preparing for divestments. The mega scheme is the first step taken to achieve that. Simplification will also provide opportunities for other Gujarat government companies and financial institutions to monetize their stake at good valuations and invite strategic partners for both businesses. We may see similar schemes for different state-owned companies soon.