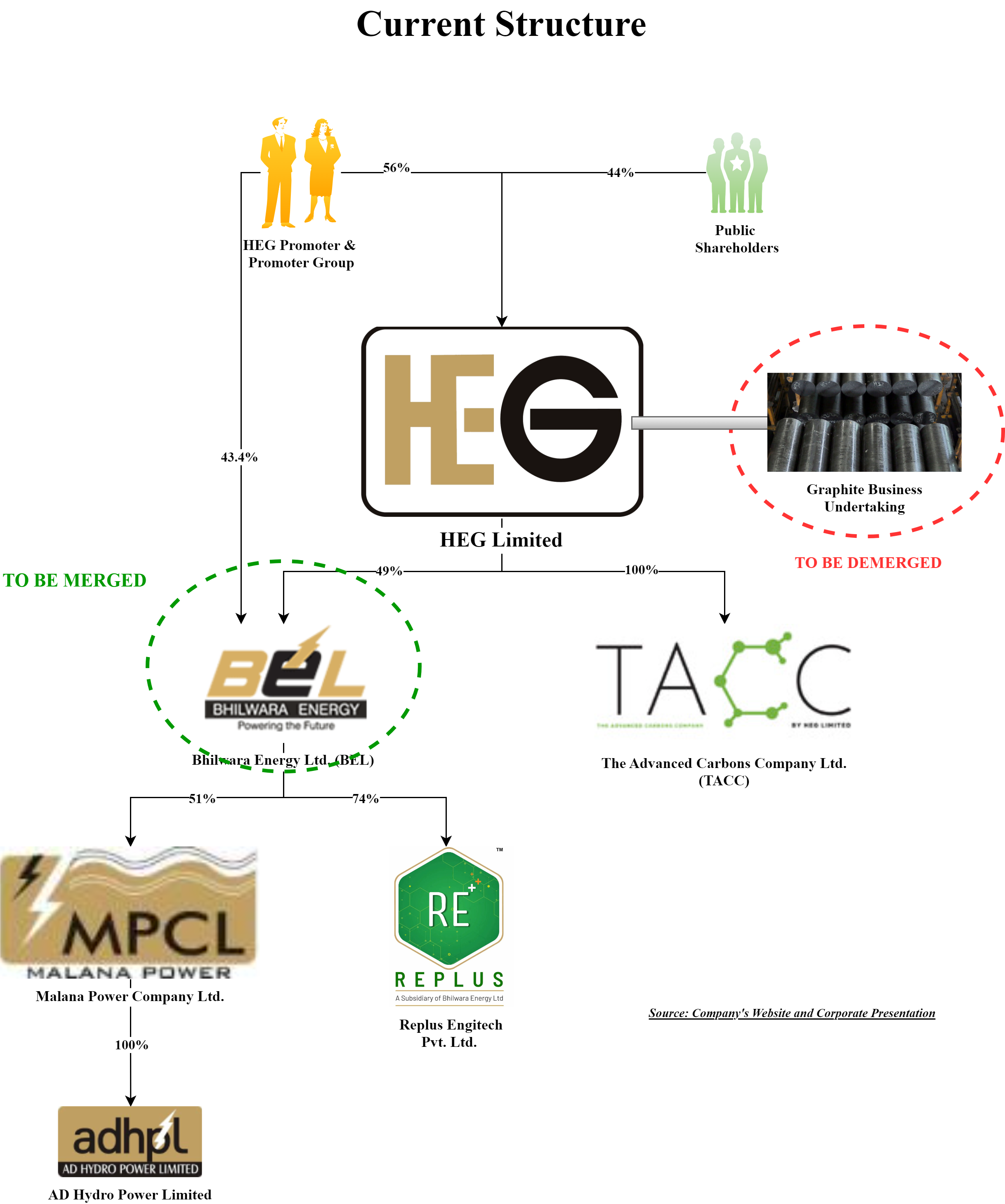

HEG Limited (“Demerged Company” or “HEG”) is, inter alia, engaged in the business of manufacturing and exporting graphite electrodes and operates the world’s largest single-site integrated graphite electrodes plant. HEG also operates three power generation facilities with a total capacity of about 76.5 MW which are captively used by Graphite business. Apart from the above, HEG also holds 49% equity shares of Bhilwara Energy Limited which is engaged in power generation. HEG also owns 100% equity shares of TACC which is setting factory for graphite anode for lithium cells. The equity shares of HEG are listed on the Stock Exchanges.

HEG Graphite Limited (“Resulting Company”) is a company incorporated to facilitate the demerger of Graphite Business of HEG. The Resulting Company is a wholly owned subsidiary of the demerged Company.

Bhilwara Energy Limited (“Transferor Company” or “BEL”) is, inter alia, engaged in the business of establishment, operation and maintenance of power generating stations and tie-lines, sub-stations and main transmission lines connected therewith. Currently, the Transferor Company is engaged in the generation of wind power through 14 MW wind power project situated in Maharashtra.

- 51% stake in Malana Power Company Limited in a joint venture with StatKraft, Norway which owns 86 MW hydroelectric project in Himachal Pradesh;

- Malana Power Company Limited has further investment in wholly owned subsidiary AD Hydro Power Limited, which owns 192 MW hydroelectric project in Himachal Pradesh; and

- 74% in Replus Engitech Private Limited which is into the business of battery energy storage solutions. Remaining stake is own by HEG promoters.

49% stake of BEL is owned by HEG while the remaining stake is owned by the promoters of HEG directly. The equity shares of BEL are not listed.

The Proposed Transaction

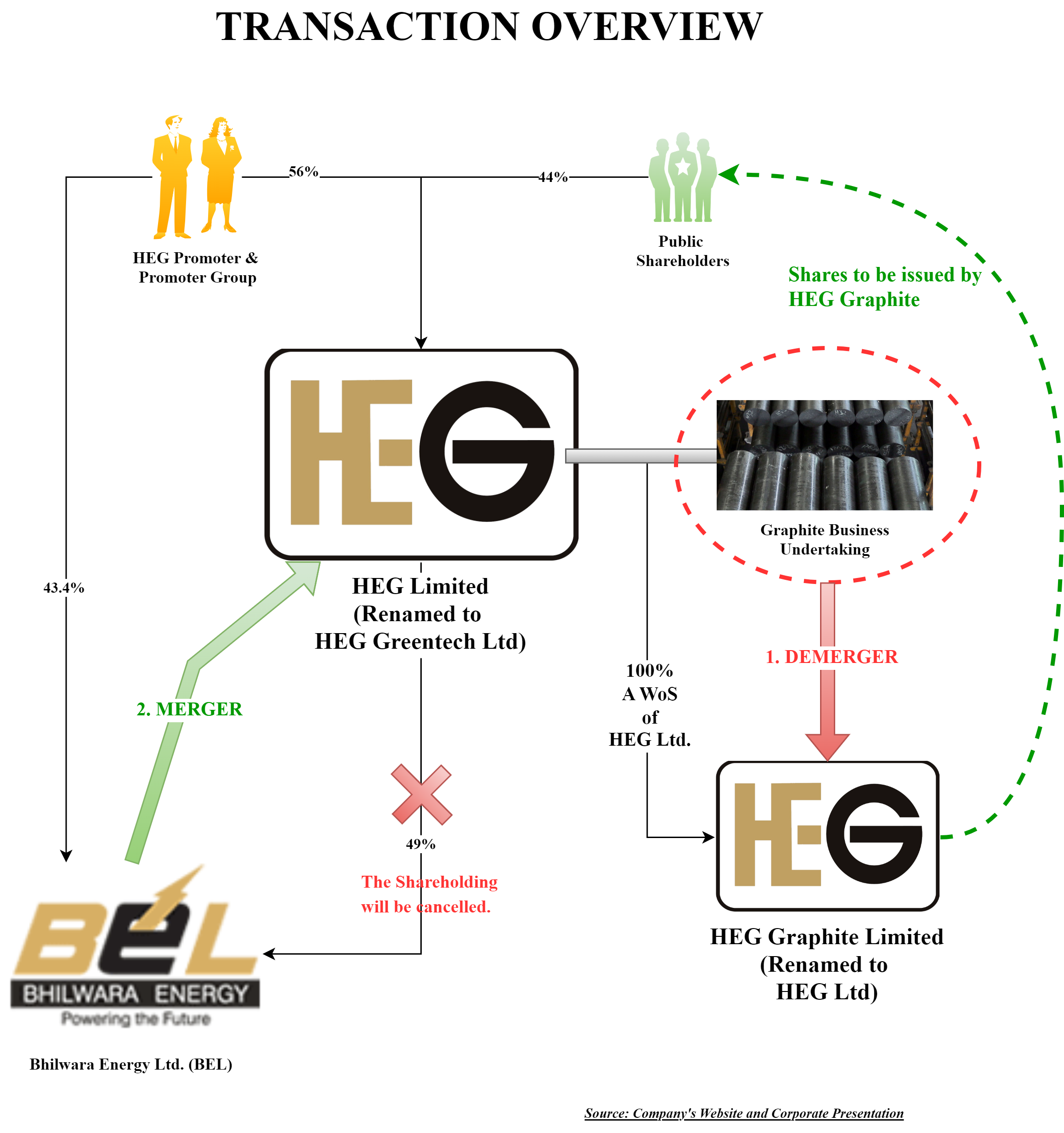

All the companies at their respective Board of Directors’s meetings approved a composite scheme of arrangement (“Scheme”) which provides for:

- The demerger, transfer and vesting of the Graphite Business Undertaking from the HEG into the Resulting Company on a going concern basis, and issue of equity shares by the Resulting Company to the shareholders of HEG, in consideration thereof;

- the merger of with HEG and issue of equity shares by HEG to the shareholders of BEL (except HEG itself), in consideration thereof.

“Graphite Business” means the entire business of manufacturing graphite electrodes and speciality graphite products together with all associated activities, assets and liabilities including 76.5MW captive power generating capacity (comprising of two thermal power plants and a hydroelectric power facility owned by HEG directly). The turnover of the Graphite business of the Company for FY 2024 accounts for 100% of the operational turnover of HEG.

Appointed Date for both demerger & merger is an opening business hour of 1 April 2024 or such other date as may be mutually agreed by the respective Board of the Parties. Though the appointed date for both merger & demerger transactions is same, the effect will be given in the following order:

- Demerger transaction will be given effect first and

- Immediately upon effectiveness of the demerger; BEL merger will be given effect.

We can notice that if the merger transaction was carried out earlier, the promoter and promoter group would have increased their stake in both the resultant and demerged company. But promoter and promoter group have carefully selected the sequence of transactions and swap ratio to increase their stake significantly only in the demerged company.

Key rationale as envisaged by the management for the proposed restructuring:

- Creation of a structure amenable for future growth keeping in view different growth trajectory for each business segment

- Unlocking the value of each of the businesses for the shareholders

- Independent identity and focused management

- Efficiency in operations, processes

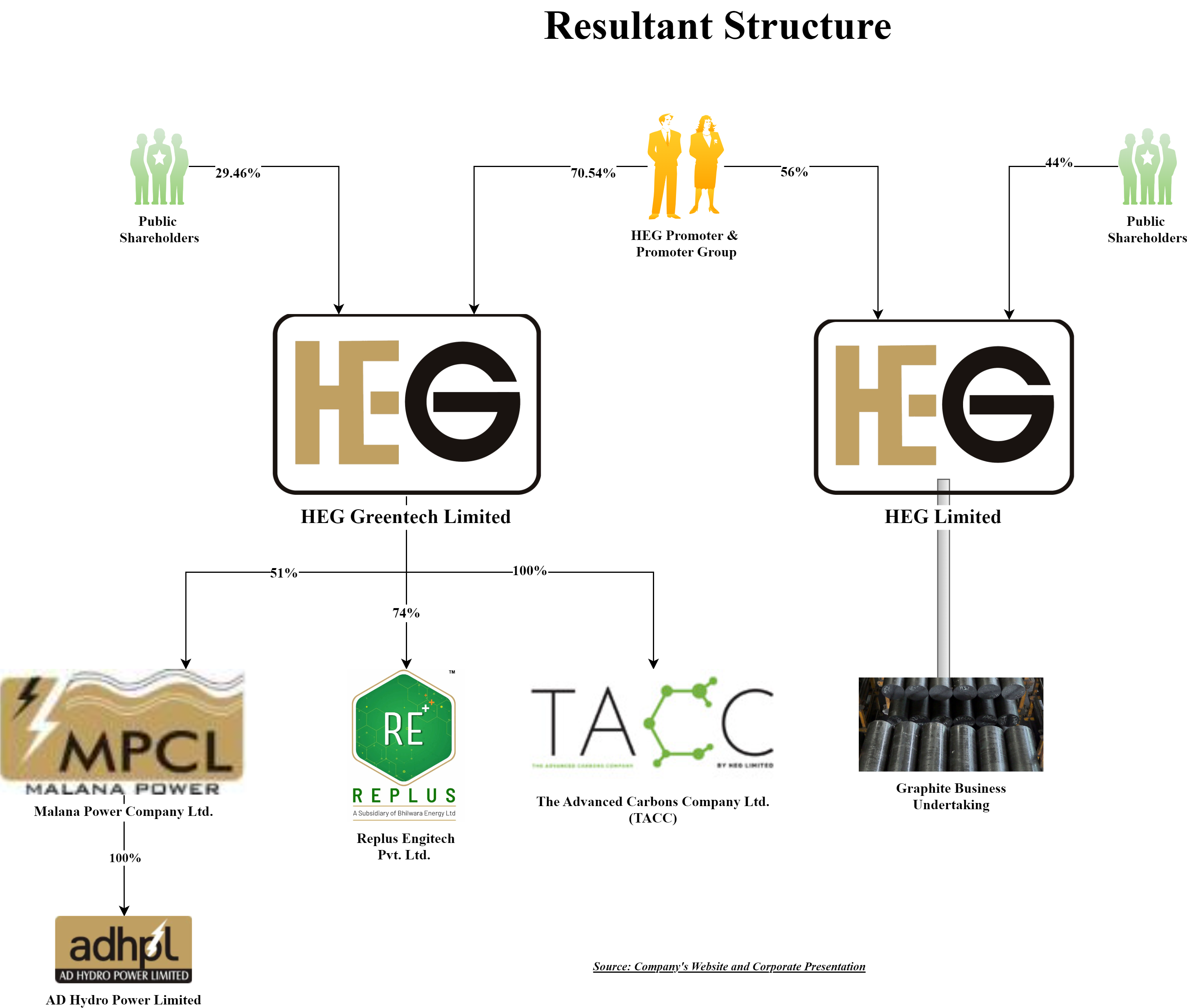

Resultant Structure:

Remaining HEG will house:

- 14 MW wind power project situated in Maharashtra.

- 100% stake in TACC which is setting up manufacturing of graphite anode for lithium cells

- 51% stake in Malana Power Company Limited in joint venture with StatKraft, Norway which owns 86 MW hydroelectric project in Himachal Pradesh;

- Malana Power Company Limited has further investment in wholly owned subsidiary AD Hydro Power Limited, which owns 192 MW hydroelectric project in Himachal Pradesh; and

- 74% in Replus Engitech Private Limited which is into the business of battery energy storage solutions. Remaining stake is owned by HEG promoters.

Share Capital & Swap Ratio

For Demerger:

1 fully paid-up equity share of INR 10 each of the Resulting Company will be issued to the shareholders of HEG for every 1 equity share of INR 10 each of the Demerged Company.

For Merger:

8 fully paid-up equity shares of INR 10 will be issued by HEG to the shareholders of BEL for every 35 equity shares of INR 10 held by them in BEL. The equity shares held by HEG in BEL will be cancelled and no shares will be issued for it.

| Particulars | HEG-Pre | HEG-Post (merger) | Resulting Company (post) |

| No. of Paid-up equity shares of INR 10 each | 3,85,95,506 | 5,79,24,918 | 3,85,95,506 |

| Promoter’s Stake | 55.78% | 70.54% | 55.78% |

On account of the merger of BEL, promoter’s stake in HEG will get increase significantly. The shares issued by the resulting company will be listed on stock exchanges.

Change of Name:

Existing HEG shall change its name to HEG Greentech Limited or such other name which is available and approved by the Registrar of Companies (RoC) while the Resulting Company name shall stand changed to ‘HEGLimited’ or such other name which is available and approved by the (RoC).

Shifting of Registered Office

Existing registered office of BEL is in New Delhi while other entities is located in the state of Madhya Pradesh. To optimise the regulatory process and stamp duty, the BEL is in the process of shifting its registered office from Delhi to Madhya Pradesh.

Internal restructuring by BEL

BEL was having couple of other subsidiaries and partners in subsidiaries. During FY 2023 & 2024, it streamlined the subsidiaries by divesting loss-making/non-operational companies and also provided exit to other shareholders in some of its subsidiaries.

Financials

BEL on its own and through subsidiary is engaged in the power generation business. As stated by the management, going ahead BEL will receive circa ₹100-150 crores annual dividend from its subsidiary. Further, Replus will also start generating incoming in the immediate future.

TACC Limited which will remain with HEG, will require investment of circa INR 1600-1800 crore in the coming future to build manufacturing unit. For this purpose, management will leave cash & cash equivalent of circa INR 750 crore with the demerged company. Remaining investment will be funded through internal accruals (dividend from subsidiary) and debt.

The resulting company which will house graphite business does not require significant funds and generates substantial free cash flow.

Valuation

Valuation of arrived by the appointed valuer.

| Particulars | Graphite Business | Remaining HEG | BEL |

| Value assigned (INR in Crore) | 7650 | 2172* | 2100 |

*: Including 49% stake in BEL & 100% stake of TACC.As guided by the management, overall valuation of the hydro business is valued at INR3,000 crore, of which BEL holds 51%. So, the valuation of BEL’s 51% in the hydro company stands at around INR1,500 crores. The remaining valuation pertains to 74% stake in Replus and other surplus assets.

Conclusion

The demerger will facilitate creation of an independent listed company focusing on green energy/technology while other entity will be focusing on core “Graphite Business”. Interestingly, the structure of the transaction is designed in such a way that promoters will be able to increase their stake substantially in green energy business.

Further, cash requirement for future expansion has been taken care by keeping the cash generated by the Graphite business in past with green energy business. Time will tell how accretive the demerger proves for all stakeholders, especially minority shareholders.