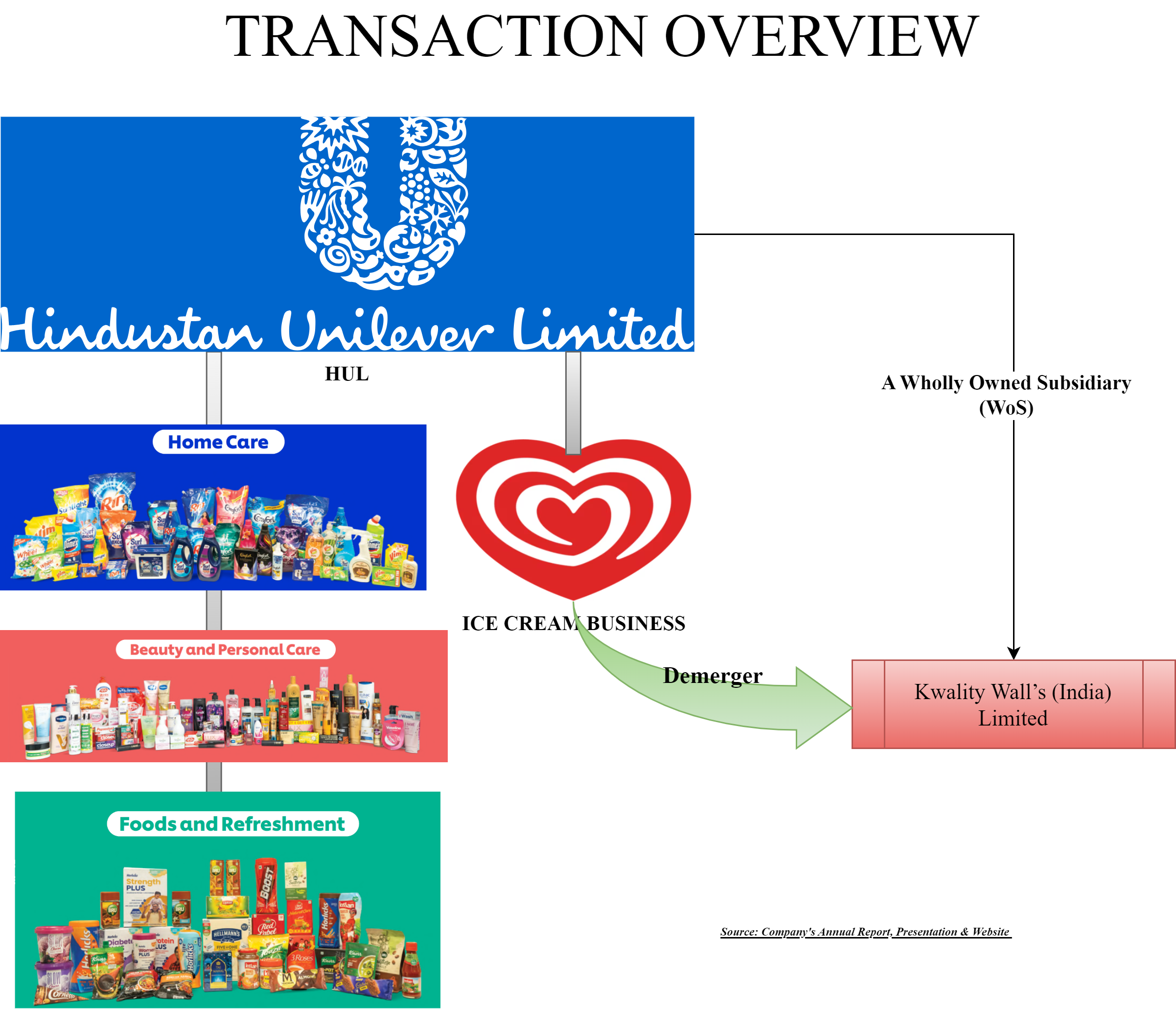

To accelerate its growth, Unilever announced the separation of its “Ice Cream Business” from other businesses. The move was announced mainly as the Ice Cream business has a different operating model which will serve best as a standalone entity. Following the global announcement, Hindustan Unilever Limited (Indian arm of Unilever Plc) announced the demerger of the “Ice Cream Business” undertaking into a separate company which shall later be listed on nationwide bourses.

Hindustan Unilever Limited (“HUL” or “Demerged Company”) is one of India’s leading private sector companies and is engaged in the business of manufacturing, marketing, distribution, and sale of fast-moving consumer goods (FMCG). Currently, HUL has four key business segments:

- Home Care

- Beauty & Wellbeing

- Personal Care

- Food (including ice cream)

The equity shares of HUL are listed on nationwide bourses.

Kwality Wall’s (India) Limited (“KWIL” or “Resulting Company”) is recently incorporated to facilitate the demerger of the “Ice Cream business.” Currently, KWIL is a wholly owned subsidiary of HUL.

The Proposed Transaction:

Following the announcement by HUL’s parent entity, Unilever PLC, of its intention to separate its ice cream business globally, the Board of Directors of HUL had undertaken a comprehensive review and decided to separate the Ice Cream Business Undertaking through “demerger” given its different operating model, including differentiated infrastructure for supply and distribution, capital allocation needs, distinct channel landscape and go-to-market strategy.

The Ice Cream business of HUL in India, as a part of its Foods & Refreshment segment, is engaged in the manufacturing and marketing of ice cream and frozen desserts on a pan-India basis. The business, operating for about three decades, is one of the leading players in India. The ice cream and frozen desserts are marketed under various well-known brands such as Kwality Wall’s, Cornetto, and Magnum.

The “Appointed Date” for the demerger will be the Effective Date or such other date that may be mutually agreed to by the Boards of the Demerged Company and the Resulting Company and approved by the NCLT. Thus, effectively all profits/losses pertaining to the ice cream business till the completion of the demerger shall be with HUL.

As HUL club the Ice Cream business under “Food” segment, no separate financials pertaining to the demerged undertaking are available in the public domain. However, as per the press release by HUL, the turnover of the ice cream business for FY 2024 was circa ₹ 1595 crore constituting 2.7% of the total standalone turnover of HUL. As of now, no details of profitability or assets and liabilities are disclosed for the Indian business.

For Unilever PLC, Ice Cream business contributes circa 14% of the total revenue amounting to yearly revenue (CY 2024) of circa ₹ 75,000 crore with low double-digit operating margins. Over the last couple of years, the business has remained flat.

The consideration for the demerger shall be for every 1 (one) equity share of face value of Re. 1/- fully paid upheld in the Demerged Company, the Resulting company shall issue 1 (one) equity share of the face value of Re. 1/. Post demerger, the shareholding pattern of the resulting company shall be a mirror image of the shareholding pattern of HUL. The existing paid-up share capital of HUL is circa ₹ 235 crore. One may ponder whether the Ice Cream business, which is only 2.7% of the total standalone turnover of HUL, requires a similar share capital as that of HUL. Please note that the per share revenue of KWIL will be circa ₹ 7 only. The Resulting Company must service such large share capital. In addition to this, KWIL must spend circa ₹ 3 crores to increase share capital & stamp duty on the same.

The issued equity shares of the resulting company will be listed on nationwide bourses, which shall pave the way for a separate listing of the ice cream business.

Accounting Treatment

The Demerged & Resulting Company shall account for the Scheme in their respective books of account in accordance with Ind AS and other generally accepted accounting principles in India. The Resulting Company shall record the shares issued as a consideration at fair value and the difference between par value & fair value shall get credited to the “Securities Premium Account.”

Further, the resulting company shall account for the difference between the fair value of the equity shares issued by the Resulting Company to the shareholders of the Demerged Company as consideration and the book value of the assets and liabilities of the Ice Cream Business Undertaking received from the Demerged Company will be debited or credited, as the case may be, to equity and classified as “Capital Reserve” under the head “Other Equity”. In the most likely scenario, this shall usher in a debit balance in capital reserve.

To avoid debit capital reserve, the scheme provides for a reduction in securities premium account of the resulting company post giving effect to the demerger. Pursuant to this, the debit balance of the capital reserve shall get adjusted against the credit balance of the securities premium account.

To illustrate the above, let us assume that the assets & liabilities pertaining to “Ice Cream Business” are 1000 & 400 respectively and fair value per equity share of KWIL will be ₹ 10 each.

Pursuant to the set-off provisions of the securities premium account against the debit balance of the capital reserve, the balance in the securities premium account will be 365.

Now, if KWIL had decided to issue shares at face value only (no securities premium) which is done by most of the companies, the capital reserve would have been 365.

Thus, essentially by issuing shares at a fair value & adjusting the capital reserve against securities premium account, KWIL will show securities premium of 365 as against the capital reserve of the same amount (365).

Other Arrangements

Currently, there must be several assets/resources which are shared by the ice cream business with other businesses of HUL. To facilitate a smooth transition & support ice cream business, the scheme provides for having an option with the demerged & resulting company to enter certain arrangements to use the common assets, R&D, for such time and terms as may be mutually decided by the companies. It also provides that the demerged company may provide short term loan support to the resulting company if required. Not only that if some assets or liabilities are wrongly considered as assets or liabilities of Ice cream undertaking, then the same should be transferred back and vice versa.

Conclusion

HUL, domestically and globally expanded its brand portfolio via mergers and acquisitions, Recently, it has completed the divestment of the PUREIT brand and initiated the acquisition of the Minimalist Brand.

The current arrangement is in line with the strategy of the holding company. One needs to see how an independent entity will turn around the stagnated Ice cream business and create value for minority shareholders, especially with the size of paid-up capital post demerger.