Consolidation is picking in the radio industry. In a move to take on other radio giants, the two separately listed entities HT Media Limited and Next Mediaworks Limited has decided to consolidate their operation.

HT Media Limited (HTML) is a media conglomerate with interests in the newspaper, radio, digital media and education businesses. The Company is involved in printing and publishing of English newspaper ‘Hindustan Times’, Hindi newspaper ‘Hindustan’ and Business newspaper ‘Mint’.

HT Music & Entertainment Company Limited (HTMEL) is a wholly owned subsidiary of HTML which is operating the FM Radio station in Chennai.

Next Mediaworks Limited (NML) is a listed holding company of Next Radio Limited (NRL) which operates FM radio stations under the brand “Radio One” in Delhi, Mumbai, Chennai, Kolkata, Bengaluru, Pune and Ahmedabad.

Radio Business of HTML

The company operates a radio stations under the brand names of ‘Fever’ and ‘Nasha’. Fever FM operates radio station in Delhi, Mumbai and Bengaluru (non-Kannada); while Radio Nasha, the premier retro-music focused station in Delhi and Mumbai.

TRANSACTION

Board of Directors of the Company, at their meeting held on 8‘” August 2018, have considered and approved the draft of the composite scheme of arrangement and amalgamation amongst HTML, NRL, NML and HTMEL.

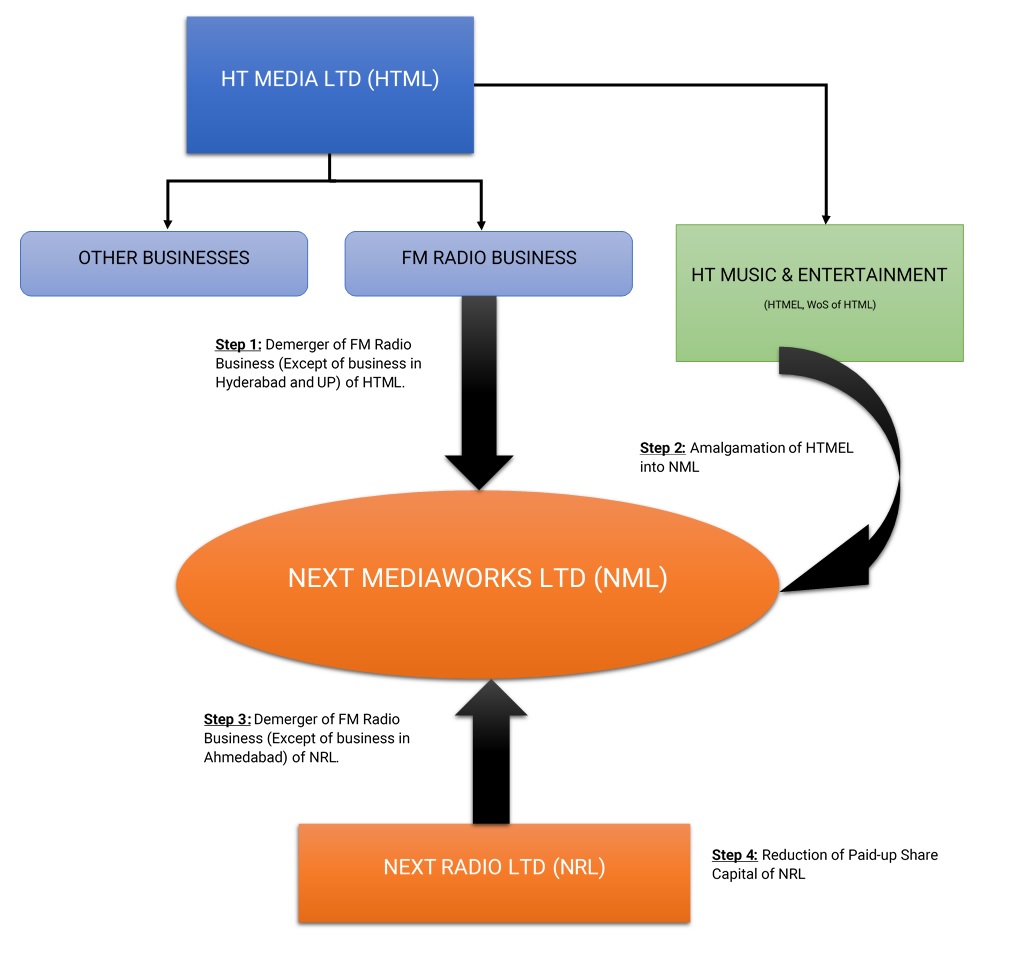

Steps of the transaction

Step 1: Demerger of the FM radio business of HTML (except the FM radio business operated by HTML in Hyderabad and Uttar Pradesh) to NML.

Step 2: Amalgamation of HTMEL with NML.

Step 3: Demerger of the FM radio broadcasting business of NRL (except the FM radio business in Ahmedabad) to NML.

Step 4: Reduction of paid-up share capital of NRL by cancellation and extinguishment of the entire shares held by the Company in NRL, which shall be regarded as reduction of share capital of NRL.

The appointed date of the transaction is effective date.

Swap Ratio

- HTML Demerger: NML shall issue 784 equity shares for every 1000 equity shares held in HTML.

- HTMEL Amalgamation: NML shall issue 125 equity shares for every 2228 equity shares held in HTMEL.

- NRL Demerger: NML shall issue 1713 equity shares for every 1000 equity shares held in NRL.

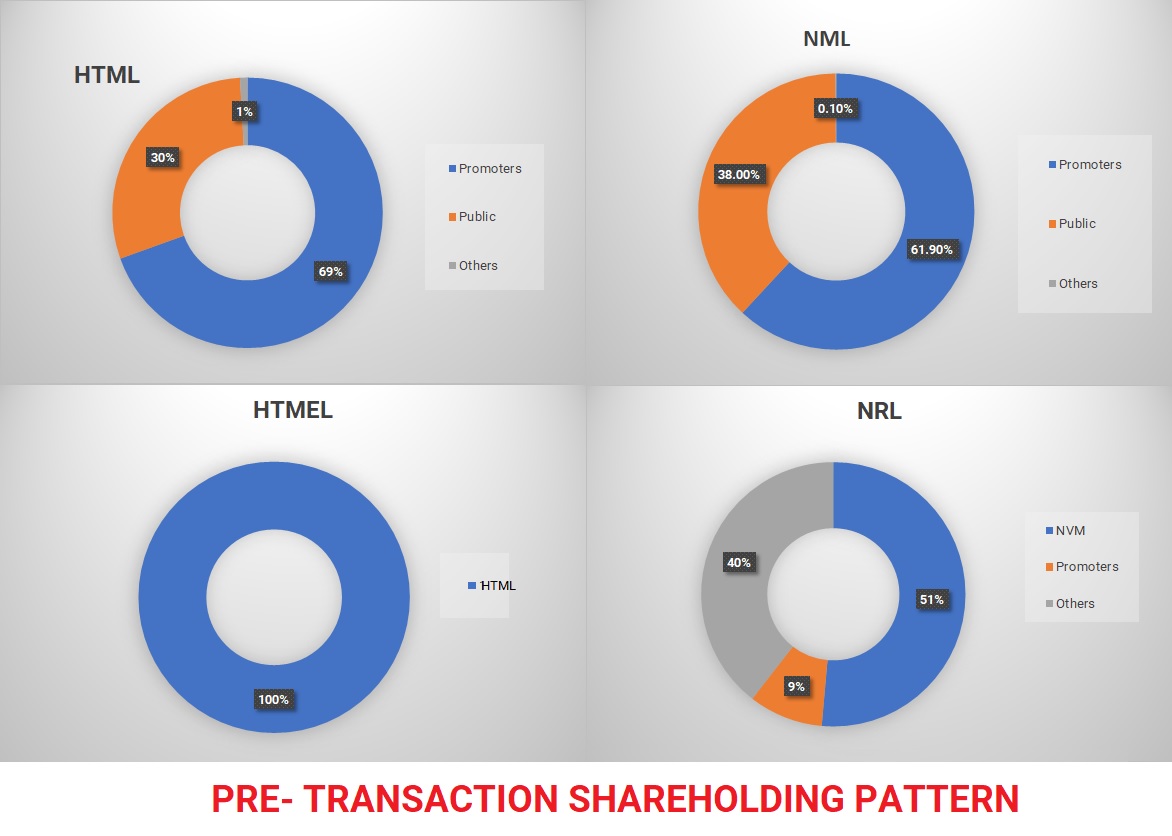

Shareholding Pattern

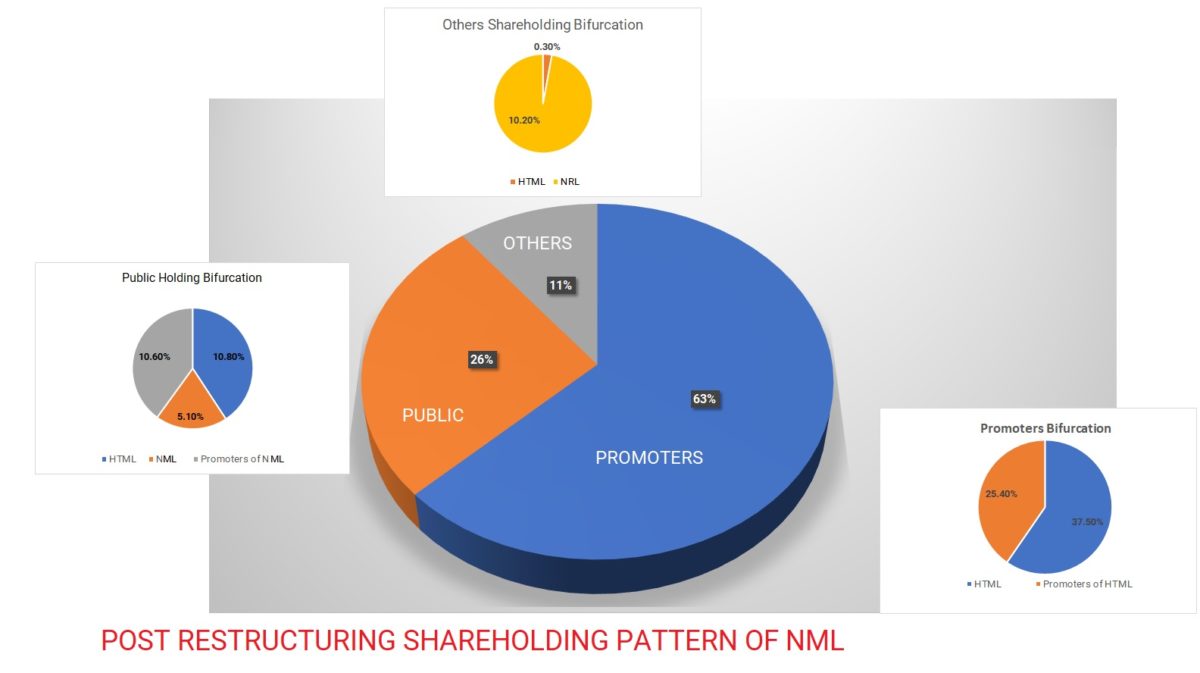

Post-transaction, the existing promoters of NML will be reclassified as a public and HTML will become the promoters of NML with the stake of ~63% in the company. Further, post-transaction, the share capital will shoot up from INR 67 crore to INR 500 crore.

The shares held by NML in NRL will get cancelled and NRL will pay INR 0.32 per equity share to NML.

Financials

Table 1: Financials of all Companies (All Figs in INR Crores)

| Particulars | HTMEL | NRL | HTML* | NWL |

| Total Assets | 20 | 184 | NA | 45 |

| Turnover | 5 | 80 | 152 | 2 |

| PAT | -3 | -5 | NA | -1 |

| Networth | 16 | 67 | NA | 29 |

| Loans | 0 | 61 | NA | 123 |

| Carry forward losses | 18 | 9 | NA | 124 |

Table 2: HTML’s FY 18 Radio & Broadcasting Segment details

| Particulars | Amount |

| Revenue | 176 |

| EBIT % | 20.5% |

| Assets | 558 |

| Liabilities | 30 |

| Capital Employed | 528 |

| RoCE | 6.8% |

Taxation

The whole transaction will be compliant transaction as per Income Tax act 1961. However, the reason for reverse consolidation radio business into NML instead of HTMEL could be the huge carry forward losses in NML. During FY 2015-16, NML had recognised a loss of INR 117 crore on account of diminution in the value of its investments in NRL as a result of the Scheme of Capital Reduction of NRL. These losses could have foregone if NML would have merged into HTMEL or any other HT Media group company. It seems the structure of the scheme is so designed to enable the NML to carry forward its capital losses, facilitate listing even though net worth is not as per the criteria for listing and fewer compliances required for listing as compared to direct consolidation.

Valuation

| Particulars | Amount |

| HTMEL | 314 |

| HTML* | 305 |

| NRL* | 217 |

| NML | 112 |

| Total | 947 |

In Q1FY19, HTML has made an investment of INR 302 crore by subscribing to the equity shares of HTMEL. It looks the move of infusing INR 302 crore was keeping in the view to arriving at such valuation so that major stake in the consolidated entity will be held by HTML.

Conclusion

NML despite having a good network of radio channels, it is not yet profitable. HTML in the future can leverage the network of NML and its own funds to scale up the radio operations. The merger seems to be the move to consolidate the network of one with funds of other. The transaction is designed in such a way that HTML will become the largest shareholder and the control will be with the HT Media group in the merged entity.

The reason behind keeping a few stations separate could be regulatory hurdles or strategic move. In the process, the current promoters of NML i.e. Ansari family can take the exit from the radio business without following much of the SEBI regulations i.e. Open offer.