Ind Swift Limited (hereinafter also referred to as ‘ISL’ or ‘Transferor Company’) is engaged in the business of manufacturing Pharmaceutical Products. ISL is a leading pharmaceutical manufacturer of Finished Dosages Form (FDF) with national and international presence based in Chandigarh. Its strength lies in innovative pharmaceutical products. The Transferor Company is listed on BSE Limited and the National Stock Exchange of India Limited.

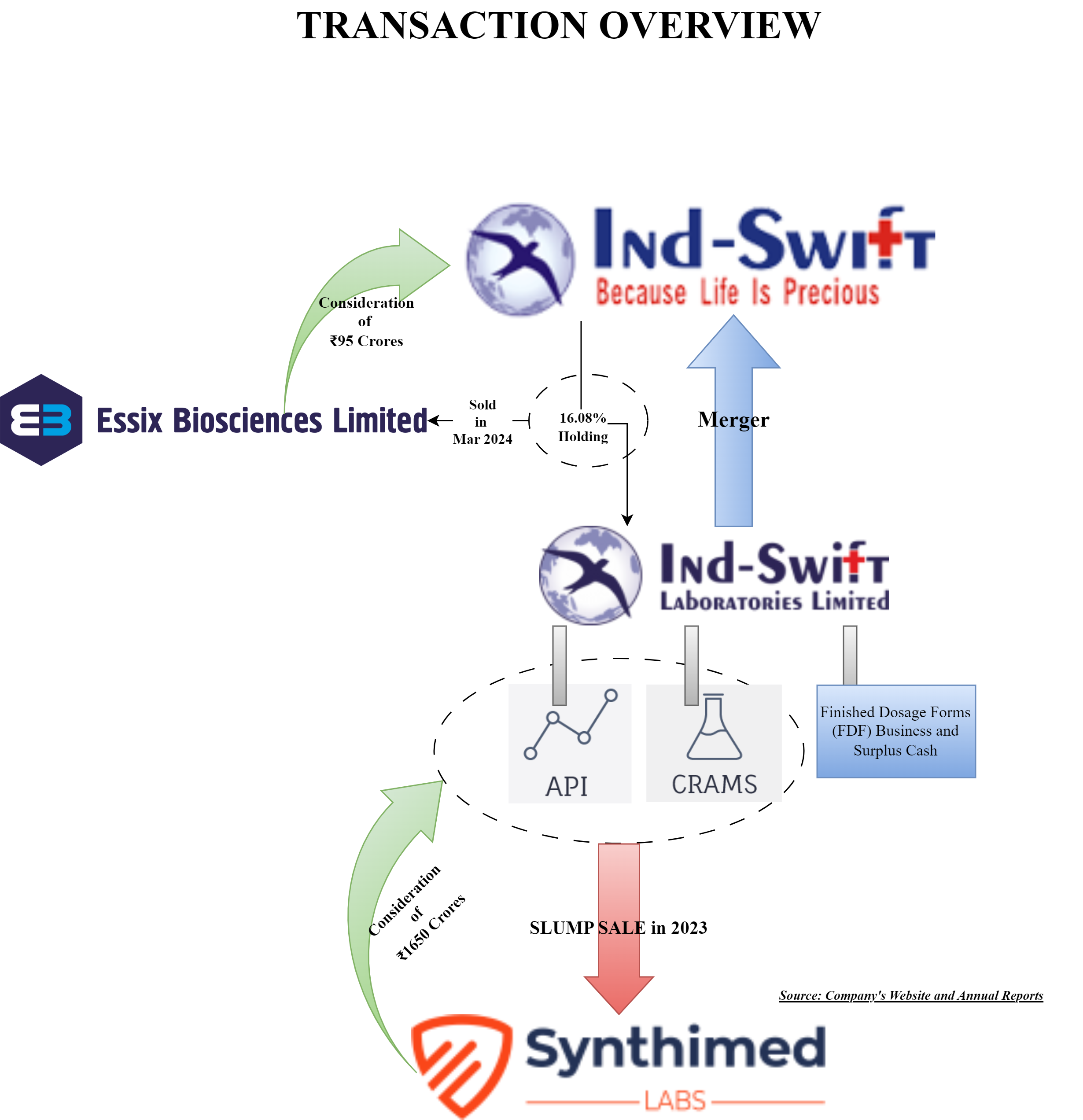

Ind Swift Laboratories Limited (hereinafter also referred to as ‘ISLL’ or ‘Transferee Company’) is primarily engaged in inter alia in the business of manufacturing and marketing of Active Pharmaceutical Ingredients (APIs), Intermediates and Finished Dosages through recently set up joint ventures. Recently, ISLL completed the transfer of its core API & intermediates business through a slump sale transaction. The Transferee Company is also listed on BSE Limited and the National Stock Exchange of India Limited. Currently, ISLL has recently started a Finished Dosage Business through joint ventures and surplus cash received through a slump sale. Earlier, ISL was holding 16.08% of the equity capital of ISLL which was transferred to other promoter company Essix Biosciences Limited in March 2024 for a consideration of INR 95 crore.

The Transferor Company and Transferee Company belong to the same group i.e., the Ind-Swift Group.

Slump Sale by ISLL

In 2023, ISLL announced the slump sale of its API and CRAMS Business to Synthimed Labs Private Limited for an enterprise valuation of INR 1650 crores while the equity value was circa INR 850 crores. The proceeds of the said sale shall be used primarily to repay its debt and to discharge other financial obligations. Post the completion of this transaction, the Transferee Company will be left with Surplus Cash along with some residual business i.e., Finished Dosages Forms (FDF) Business.

After the deal, ISSL invested in Synthimed Labs Private Limited amounting to 8.42% of the equity capital (for INR 32 crore) and non-convertible debentures of INR 48 crores.

Turnover/revenue of the API Business was INR 1151.95 Crores (for the year ending March 31, 2023, which constitutes ~96% of the Company’s consolidated turnover/revenue for the year ending March 31, 2023.

The Proposed Transaction

The Board of Directors of ISL & ISLL at their respective board meetings approved a Scheme of Amalgamation which inter -alia provides for the merger of ISL with ISLL.

Some of the key rationale as envisaged by Companies:

- Expansion into formulation business

- Discharge of debt of the Transferor Company using cash available with the Transferee Company

- Simplification of group structure

- Operational synergies etc.

The Appointed Date for the proposed merger will be 31st March 2024 or some other date as may be approved by the Hon’ble National Company Law Tribunal. Thus effectively, the closing balance sheet of the Transferee Company as on 31st March 2024 will be of the merged businesses.

Capital Structure of the Companies

As a consideration for the merger, the Transferee Company shall issue and allot 15 equity shares of INR 10 each for every 100 equity shares of the Transferor Company.

For every 1 preference share of INR 100 each of the Transferor Company, the Transferee Company shall issue 1 preference share of INR 100 each. The terms of the preference shares shall remain identical.

| Particulars | ISL | ISLL | ISSL-Post |

| No. of paid-up equity shares | 5,41,64,653 | 59,086,860 | 67,211,558 |

| Face Value | No. of paid-up cumulative redeemable preference shares of INR 100 each | 10 | 10 |

| No. of paid-up cumulative redeemable preference shares of INR 100 each | 14,20,000 | – | 14,20,000 |

| Promoters Holding | 55.58% | 42% | 43.64% |

Please note that the preference shares are issued to the public shareholders.The Financial Turbulence at ISL

ISL is in deep financial trouble. Even one of the rationales for the proposed consolidation of ISL with ISSL as mentioned in the scheme is survival of ISL. ISL is facing challenges in servicing its debt due in March 2024. There is a significant risk of the company being pushed for the IBC process.

ISL financials position as on 31st March 2024

| Particulars | Amount in crore |

| Net Worth | -691 |

| Borrowings | 1014 |

During the quarter ended on March 24, a loan amounting to INR 815 crore due to Edelweiss Asset Reconstruction Company Limited have been taken over by ISLL and restructured the loan with the sustainable part being INR 352 crore payable in 9 years with 10% interest & remaining being an unsustainable part as zero-coupon debt. Post-merger, effectively the inter-company loan will be knocked off. The Appointed Date has been chosen as the immediate next date of signing of this assignment of the loan. Further, to safeguard interest payment till approval by NCLT, 15 months moratorium have been provided for principle & interest payment.

The proposed merger is a part of the extension of the slump sale done by ISLL effectively to revive ISL.

Conclusion

Both companies are based in Chandigarh, listed on the bourses, and have a strong focus on research and development to bring innovative pharmaceutical products to the market. The borrowings of ISL which has ballooned over time is a risk where the company can be dragged to NCLT under the Insolvency and Bankruptcy Code, 2016 if they default of the payments.

The scheme is a desperate attempt by the promotors to not lose their control of the companies. No doubt in the process, there is the possibility for all the stakeholders to salvage some value even if minuscule.