India Glycols Limited (“Demerged Company” or “Transferee Company/IGL”) is in the business of manufacturing and marketing of

- Bio-based Specialities & Performance Chemicals such as Bio-Polymers, Green Solvents, Specialty Derivatives, Industrial Gases

- Biopharma

- Biofuels and

- Spirits

The equity shares of IGL are listed on the BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”).

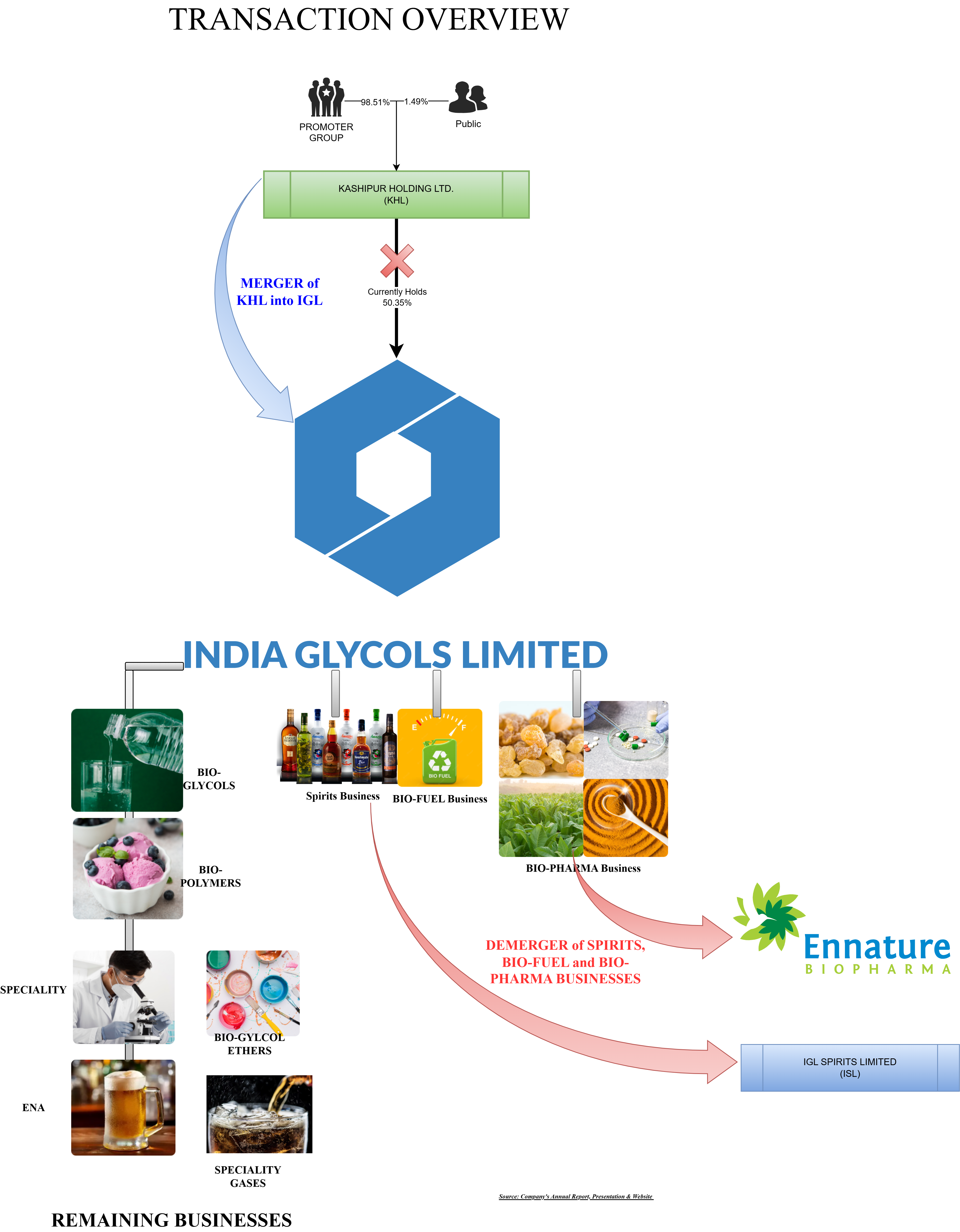

Kashipur Holdings Limited (“Transferor Company/KHL”) is owned by the promoter group of IGL. As on date, KHL holds 50.35% of paid-up equity of IGL. Apart from investments in IGL, KHL only asset is liquid cash which shall be used to discharge the transaction cost including stamp duty.

Ennature Bio Pharma Limited (the “Resulting Company 1/EBL”) engaged in the business of producing nutraceuticals, phytochemicals, and natural plant-based active pharmaceutical ingredients. However, EBL has not generated any revenue since its incorporation. The Resulting Company 1 is a wholly owned Company of the Demerged Company.

IGL Spirits Limited (the “Resulting Company 2/ISL”) is incorporated to facilitate the proposed demerger of “Spirit & Bio-fuel business of IGL” with an object clause of engaging in the business of manufacturing and production of alcoholic & non-alcoholic beverages and ethanol & alcohol and related products. The Resulting Company 2 is a wholly owned Company of the Demerged Company

The Proposed Transaction

The Board of Directors of the Company (“Board”) at their respective board meetings approved the Composite Scheme of Arrangement involving Kashipur Holdings Limited (the “Transferor Company” or “KHL”), India Glycols Limited (the “Transferee Company” or “Demerged Company” or “IGL”), Ennature Bio Pharma Limited (the “Resulting Company 1” or “EBL”) and IGL Spirits Limited (the “Resulting Company 2” or “ISL”) and their respective shareholders (“Scheme”) under the provisions of Sections 230 to 232 read with other applicable sections/ provisions, if any, of the Companies Act, 2013. The Scheme, inter alia, provides for:

1. Amalgamation of KHL into IGL; and

2. Demerger of Bio Pharma Undertaking into a separate undertaking, namely, EBL;

3. Demerger of Spirits and Biofuel Undertaking into a separate undertaking, namely, ISL.

Biopharma Undertaking – Production of nutraceuticals, phytochemicals, and natural plant-based active pharmaceutical ingredients along with the Bio Polymers business.

Spirits and Biofuel Undertaking – Manufacturing and production of alcoholic & non-alcoholic beverages, ethanol & alcohol and other related products.

Remaining Business: IGL shall continue Glycols, Bio Glycols, New Specialty Products along with Industrial Gases business.

Snapshot of revenue generated by the demerged undertaking for IGL as provided in the scheme announcement:

| Particulars | IGL | Biopharma Undertaking | Spirits & Biofuel Undertaking |

| Revenue FY 23-24 in crore* | 7918 | 250 | 6188 |

| % of total | 100% | 3.16% | 78.15% |

*: including excise duty of ₹ 4627 crore.Please note that the Biopharma undertaking also contains the bio-polymers business, which was classified under “Bio-based Specialities & Performance Chemicals” segment in IGL’s Annual report for FY 2023-24.The appointed date for all 3 transactions will be 1st April 2026. However, to give the transaction effect in the chronological order as mentioned above, the proposed scheme provides for 2 different effective dates.

- Effective Date 1 for the purpose of giving effect to the amalgamation which shall fall within 10 business days from completion of various conditions (approval from NCLT)

- Effective Date 2 for the purpose of giving effect to both demergers is 48 hours later than Effective Date 1.

The scheme also provides for 2 different record dates for the issue of shares pursuant to the amalgamations & demergers. The purpose of the same is to execute the amalgamation transaction first followed by the demerger transaction. Effectively, all the shareholders of KHL shall receive the shares of resulting companies as well.

Rationale

- The proposed scheme will simplify the promoter holding structure by enabling promoters to directly hold shares of Transferee Company

- The demerger will enable independent growth for each business

- Each business will have a clear focus, leading to improved management and resource allocation for growth

- Each business will adhere to regulations that are specific to its industry

- Will create a potential to unlock value for stakeholders by drawing focused investors

- Separating the businesses will reduce the risk of one business affecting the others

- Each business will manage its capital, investments, and resources based on its specific needs, ensuring more efficient capital use

Swap Ratio & Shareholding Pattern

For amalgamation, IGL shall issue 1 (One) Equity Share having a face value of INR 10 (Indian Rupees Ten) each, for every 1(one) equity share held by KHL in IGL, to shareholders of KHL in proportion to their shareholding in KHL.

For demerger of Bio-pharma undertaking, EBL shall issue 1 (One) Equity Share having face value INR 10 (Indian Ten) each, to the shareholders of IGL holding 3 (Three) shares of INR 10 (Indian Rupees Ten) each.

For demerger spirits and bio-fuel undertaking, ISL shall issue 1 (One) Equity Share having face value INR 10 (Indian Ten) each, to the shareholders of IGL holding 1 (One) share of INR 10 (Indian Rupees Ten) each.

The management has decided the swap ratio for both demergers’ basis the capital requirement commensurate with the size of the resulting companies.

Change of Shareholding in IGL

| Particulars | Pre-Amalgamation | Post-Amalgamation |

| Promoters | 1,88,91,032 | 1,86,59,236 |

| % | 61.01% | 60.27% |

| Public | 1,20,70,468 | 1,23,02,264 |

| % | 38.99% | 39.73% |

Currently, the entire stake i.e. 50.35% held by KHL in IGL is classified as “Promoter”. However, Promoters own 98.51% of equity shareholding of KHL while the remaining 1.49% is owned by public shareholders who will also get shares of IGL directly. Pursuant to this, promoters’ stake in IGL will reduce from 61.01% to 60.27%. Upon demerger, Post amalgamation stake will get mirror-imaged in both resulting companies with different numbers of paid-up shares for EBL while ISL will remain exactly same.

Financials

Conclusion

The Composite transaction includes splitting IGL into three different listed companies and providing direct ownership in each of the three listed companies to promoters which is achieved through the merger of the holding company with IGL. The proposed scheme can be due to each of the businesses having different scalable opportunities and strategic tie-ups like the recent announcement of IGL for doing a partnership with Amrut Distilleries.