Indo Amines Limited (IAL), incorporated as a public limited company in 1994 in the State of Maharashtra, is a significant worldwide manufacturer, developer and supplier of speciality chemicals and active pharmaceuticals ingredients. The products manufactured find application in various industries like Pharmaceuticals, Agrochemicals, Fertilizers, Petrochemicals, Road Construction, Pesticides, Perfumery Chemicals, Dyes, and Intermediates, etc.

The company has four manufacturing sites: They are located at Baroda (Gujarat), Dombivli, Rabale (Navi Mumbai) and Dhule. IAL is one of the largest manufacturing company in South Asia.

Transaction

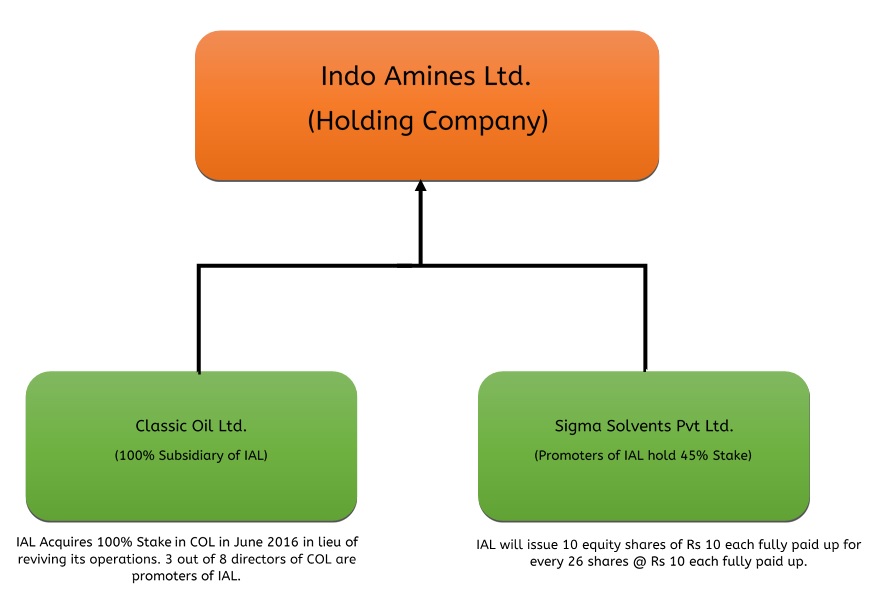

The scheme of amalgamation between Classic Oil Limited, wholly owned subsidiary of the company (Transferor Company 1) and Sigma Solvents Private Limited (Transferor Company 2) with Indo Amines Limited (Transferee Company) and their respective shareholders and creditors.

Consideration

- There is no obligation to carry out valuation of Classic Oil Limited (COL) as there is an amalgamation of Wholly Owned Subsidiary with its Parent Company i.e. IAL.

- The Share Exchange Ratio of the Equity Shares for Amalgamation of Sigma Solvents Private Limited (SSPL) into Indo Amines Limited at 10 (Ten) equity shares of IAL of Rs 10 (Rupees Ten Only) each fully paid up for every 26 (Twenty-Six) equity shares of Rs 10 (Rupees Ten Only) each fully paid up.

Basis for Amalgamation: The value per equity share of SSPL and IAL is arrived at by using the Future Earnings Capitalisation Method and Market Price Method respectively.

Transaction Overview

Business of Three Companies

| IAL | COL | SSPL |

| This is a listed company. It is engaged in the business of Basic Chemical Manufacturing.

Its main products include Organic Chemicals, Bulk Drugs, Fine Chemicals, Compounds, Speciality Chemicals, Short Chain Amines, Residue, Fatty Amines, chemical intermediaries for pharmaceuticals. |

No Business activity.

And financials of COL are not available. |

Sigma Solvents Private Limited is an SME operating in niche markets.

SSPL manufactures selected chemicals for identified end users in-

|

Financials

Table 1: Financial Position (All Figures in Rs Lakh and as on 31.12.2016)

| Particulars | Indo Amines Ltd | Classic Oil Limited | Sigma Solvents Private Limited |

| Net worth | 5871.24 | -31.35 | -537.28 |

| EPS | 3.06 | -2.63 | -51.99 |

| Book Value | 17.84 | – | – |

| Sales | 19897 | 0 | 850.30 |

| PAT | 1007 | -19.47 | -632.46 |

Table 2: Finacial Performance of IOL (All Figures in Rs Crores)

| Particulars | 2016(9months) | 2016(31st March 2016) | 2015 | 2014 |

| Net Sales | 198.97 | 242.73 | 215.47 | 217.28 |

| Operating Profit | 26.45 | 29.61 | 22.4 | 18.93 |

| Operating profit percentage % | 13.29% | 12.20% | 10.40% | 8.71% |

| Profit After Tax | 10.07 | 8.59 | 4.62 | 5.88 |

| Capital Employed (Net worth + Long term borrowings) | 68.81 | 62.2 | 52.48 | 47.25 |

| ROCE | 26.04% | 28.57% | 23.48% | 27.70% |

| P/E Ratio (as on 31st March) | 25.70 | 14.71 | 14.68 | 5.20 |

| Market Cap (as on 31st March) | 258.89 | 126.40 | 67.64 | 30.59 |

Table 3: Financial Performance of COL (All Figures in Rs. Lakhs)

| Particulars | Period ending 31st December 2016 | Period ending 31st March 2016 |

| Reserves and Surplus | -105.34 | -85.86 |

| Profit After Tax | -19.47 | -14.32 |

Classic Oil Limited has no revenue from operations, and it holds fixed assets such as Leasehold Land, Factory Building and Motor Vehicle, which will be transferred to Indo Amines Limited after amalgamation.

Total other expenses for the period ending on December 2016 is Rs 19,02,341. This includes major expenses for the period ending on 31st December 2016, relating to auditors’ remuneration Rs 3.5 lakh, repairs and maintenance to machinery Rs 2.61 lakh and legal and professional charges Rs 8.07 lakh.

Table 4: Financial Performance of SSPL (All Figures in Rs. Lakhs)

| Particulars | Period ending 31st December 2016 | Period ending 31st March 2016 |

| Reserves and Surplus | -657.78 | -33.42 |

| Profit After Tax | -632.46 | 5.11 |

Table 5: SSPL Income & Expenses Details (All Figures in Rs. Lakh)

| Particulars | 9 months | Equivalent 12 months | 31st March 2016 | % change | Remarks | |

| Sales | 850.30 | 1133.74 | 1388.83 | -18.37% | Decrease | |

| other expenses | 261.58 | 348.77 | 260.54 | 33.87% | Increase | |

| Salaries and Wages | 125.89 | 167.86 | 67.49 | 148.71 | Increase | |

| Staff welfare expenses | 12.41 | 16.54 | 5.66 | 192.37 | Increase | |

| Bad debts | 111.61 | NA | NA | |||

| Advances to supplier w/off (prior period expenses) | 144.86 | NA | NA | |||

Merger of loss-making company majority hold by promoters

Table 6: Financial Position of IOL Post Amalgamation (All Figures in Rs. Lakh as on 31st Dec 2016)

| Particulars | Pre-amalgamation | Post-amalgamation |

| Equity Share Capital (A) | 3291.68 | 3337.83 |

| Reserves and Surplus | ||

| Capital Reserves | 19.77 | 20.58 |

| Capital Redemption Reserve | – | 5.00 |

| Securities Premium Reserves | 222.25 | 222.25 |

| General Reserves | – | 10.26 |

| Surplus in the Statement of Profit and Loss | 2337.54 | 1558.84 |

| Total Reserves and Surplus (B) | 2579.56 | 1816.93 |

| Net Worth (A+B) | 5871.24 | 5154.76 |

Decrease in market capitalisation of the company shows that stakeholders are not favourable to the merger.

Key Highlights of this Amalgamation

Benefits

- IAL will use the fixed assets of COL such as leasehold land, factory building for the erection of its new plant after amalgamation. Thereby achieving a leverage of combined assets and building a stronger sustainable business.

- There will be stability of the operations, cost savings and higher profitability levels for amalgamated company post-merger.

- Greater integration, financial strength, and flexibility for the amalgamated company, which would result in improved overall shareholder value.

- Benefit of operational synergies to the combined entity in areas such as raw material sourcing, product placement, marketing, and sales promotion initiatives, which can be put to the best advantage of stakeholders.

However, after going through financials, the actual picture of the amalgamation has the following areas of concern which needs clarity:

- How much is the capex for the erection of new plant? What are the measures for revival taken by IAL?

- As per the above financial analysis, there is a decrease in market capitalization of transferee company post-amalgamation, hence there will not be any real improvement in the shareholders’ value. So why does the company want to amalgamate?

- There will be no revenue synergy benefit to IAL post-merger with SSPL because the sales of SSPL are decreasing and therefore there will no actual market share for IAL due to amalgamation with SSPL.

Conclusion

This amalgamation will pose no benefit to stakeholders in the real sense.