In November 2015 Indorama Ventures Public Company Limited (IVL) acquired Micro Polypet Pvt. Ltd. (MPPL) the sole manufacturer of PET Ruin in North India and now equal joint venture with Dhunseri Petrochem Limited sole manufacturer of PET Ruin in East India. This deal will place this Join Venture at the second place with 38% market share, after Reliance Industries, which has 51% market share in India

OPPORTUNITIES

Petroleum Ether (PET) usage per head is just 0.6 kg per annum in India compared to 2.6 kg per annum in China and 10.9 kg per annum in the USA.

DEAL

Dhunseri Petrochem Limited (DPL) and Indorama Ventures Public Company Limited (IVL) have announced on 29th February 2016 that they have agreed to enter into an equal joint venture to manufacture and sell PET resins for Indian domestic market and for the exports. However, the point to take note of is that the Egypt plant of DPL (around 50% of total capacity of Dhunseri) is not included in this deal.

STRUCTURE

DPL will transfer its Haldia Manufacturing plant to its WoS Dhuseri Set global limited (DPGL) a newly incorporated for the purpose of this joint venture and a consideration of Rs 284.75 crore in the form of optionally convertible debenture will be allotted to DPL as a part of a scheme of arrangement.

Thereafter with an infusion of new equity in DPL by Indorama Venture Public Company Limited will get 50% stake for a consideration of Rs 418.76 crore.

Whereas IVL will transfer current 50% stake in Micro Polypet Pvt Ltd to DPL for consideration of Rs 110 crore.

DHUNSERI

- The Group commenced its business in tea in 1956 and has diversified into petrochemicals and infrastructure (SEZ).

- Earlier to this Transaction:

- The tea business of the erstwhile Dhunseri Petrochem & Tea Limited (DPTL) was demerged to Dhunseri Tea & Industries Limited with the appointed date 1st April 2014 into Dhunseri Tea & Industries Limited which is separately listed.

- In the same Scheme of Arrangement, it also transferred the IT SEZ Division to the WoS i.e. Dhunseri Infrastructure Limited (DIL) for total consideration of Rs. 46.18 crore. The Consideration is discharged by DIL as follows:

- The issue of Equity to DPL of Rs 5 crore.

- Balance i.e. 41.18 crores to be paid in cash within a period of five years from 1st September 2014.

With this restructuring exercise Dhunseri Petrochem Limited (DPL) formerly known Dhunseri Petrochem & Tea Limited is in the business of manufacturing of PET at Egypt and India and also IT SEZ as a WoS- Dhunseri Infrastructure Limited “DIL”.

- It is among the top ten in the world with manufacturing at Ain El-Sokahan, Egypt and Haldia West Bengal, India with a capacity of 4,20,000 tonnes per annum and 4,80,000 tonnes per annum respectively.

- It’s Egypt business is into loss-making, therefore it has waived off its royalty for the FY 2015 amounting to Rs 9 crore.

- It is the second largest producer of PET (Polyethylene Terephthalate) resin in India with Market of 26% after Reliance. It is the sole producer of PET Resin in East India. It has a marketing presence in the 50 countries.

- It is listed on Bombay Stock Exchange and National Stock Exchange.

- It invested in cutting edge German technology to manufacture PET resin under brand “The Aspect”. The brand is marketed in the continents of Africa, Asia, Europe, North America and South America.

- The net turnover of the PET resin business of DPL is FY 2014-15 is Rs 2,717.88 crore

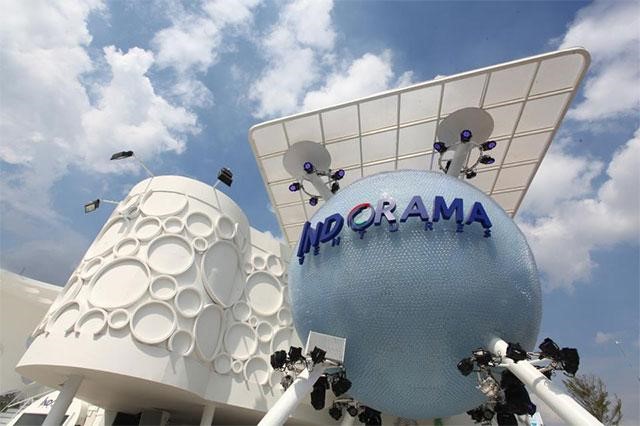

INDORAMA

- Indorama Ventures Public Limited (listed in Thailand) is one of the world’s leading producers, a global manufacturing footprint with 59 sites in 20 countries across Africa, Asia, Europe and North America.

- The company’s portfolio comprises high value-added (HVA) category of polymers, fibers, and packaging, selectively integrated with self-manufactured ethylene oxide/glycols and PTA where economical.

- This company has 14,000 employees worldwide and consolidated revenue of US$ 7 billion is 2015.

- It has a market share of 12% In India with a presence at Panipat Haryana which has a manufacturing capacity of 2,16,000 tonnes per annum. It is the sole producer of PET Resin in North India.

- In last 14 months, it has done eight Merger and Acquisition worldwide. Six M&A deals added 1.6 MMt capacity. And On December 23, 2015, it has acquired Micro Polypet Private Limited, which was a joint venture of Action Group and RLG Group and its two subsidiaries Sanchit Polymers Private Ltd and Eternity Infrabuild Private Ltd in India for an undisclosed consideration. The plant of MPPL has commenced its operation in March 2014 only thereafter recording revenue of Rs 0.23 crore and Rs 155.93 crore in FY14 and FY15, respectively

- MicroPet is a Polyethylene Terephthalate (PET) manufacturer with a production capacity of 216,000 tonnes which accounts for about 12% of India’s total production capacity. MicroPet has virtual integration with the Indian Oil Corp (IOCL) for its two major feedstocks purified terephthalic acid (PTA) and mono-ethylene glycol (MEG).

- It utilises melt-to-resin technology that Indorama Ventures has experience with at its AlphaPet plant in Alabama, USA.

- Indorama Ventures Global Services Limited, a 100% subsidiary of IVL, has established a new subsidiary company in India to pursue packaging opportunities.

SYNERGY BENEFITS JOINT VENTURE

- The significant synergy benefits being the sole producer of PET resin in North and East India and with both sites being effectively integrated with third party Purified Terephthalic Acid (PTA) suppliers, which will bring savings in Selling General & Administrative (SG&A) and procurement.

- Indorama Ventures’ global market reach and high utilisation rates are expected to supplement Haldia’s location benefit at Eastern India’s largest port while MicroPet enjoys a strong location advantage in the high-demand territory of North India

- The combined capacity of 700,000 tonne/annum in the strongest growth market having a population in excess of a billion people, as well as having favourable trade agreements with logistically advantaged countries in the region.

WHAT IS IN DEAL FOR IVL

- Joint venture with an already established player in the east and market share of 26% in the huge potential market. Easy expansion in India and market share increased to 38% after the joint venture.

- Profit making unit only as Egypt kept out of the deal.

WHAT IS IN DEAL FOR DHUNSERI

- This joint venture will allow them to gain the highest benefits by covering a larger geographical area of the fast-growing India market with a complementary and experienced partner.

- IVL’s global presence and technological leadership.

- Using profit making unit (Haldia plant) to fund the loss-making a unit (Egypt Plant) i.e. the surplus funds received by DPL will be used to fund the Egypt plant as per VC Circle. As a part of demerger process, Dhunseri Petrochem Limited will also transfer its liabilities of more than Rs 550 crore to the Dhunseri Petglobal Limited. Dhunseri Petrochem to get Rs 285 crore while, Rs 130 crore will be retained by new company Dhunseri Pet Global.

- It will bring scale benefits to all stakeholders.

TAXATION

Since to form a joint venture DPL is transferring its Haldia Plant to its WoS DPGL through a scheme of arrangement, and consideration is issued to DPL instead of Shareholders of DPL and that too optionally convertible debenture, so if it’s done through demerger process it will not be Tax neutral Demerger under Income Tax Act 1961.

VALUATION

The Halida plant of Dhunseri is valued at Rs 837.52 crore and that of Micro Polypet of Indorama is valued at Rs. 220 crore for the capacity installed of 4.8 lakh tonnes and 2.1 lakh tonnes respectively, the premium to Haldia plant is for profit making unit, established network with market share of 26% and easy excess to the Eastern India largest port.

But to note is that

- Optionally convertible Debenture is issued by DPGL to the DPL while demerged process

- Consideration paid by Indorama will be introduced in the company i.e. DPGL as against the full consideration without any additional allotment of equity in Micro Polypet will be paid by Dhunseri Petrochem Limited to Indorama and to Micro Polypet.

SOME QUESTIONS, GOING FORWARD

Currently, it is not clear, but going forward the following needs a thought

- Whether there is a need for two separate entities where they own 50% equally in both the entities?

- How will each other not compete as both the group has a separate entity to produce and distribute worldwide?

- Whether the optionally convertible debenture issued by DPGL as part of demerger process will be redeemed out of the funds received from Indorama for 50% equity stake in DPGL?

- How Egypt plant will be funded as Dhunseri Petrochem limited will remain with the investment so no major cash inflow?