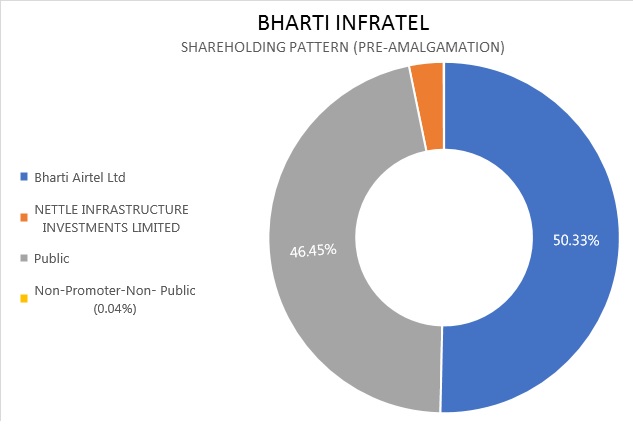

Bharti Infratel, incorporated on November 30, 2006, is India’s leading provider of tower and related infrastructure and it deploys, owns and manages telecom towers and communication structures for various mobile operators. The company has a consolidated portfolio of over 91,000 telecom towers which includes over 39,000 of its own towers and the balance from its 42% equity stake in Indus Towers. The three leading wireless telecommunications service providers in India by revenue — Bharti Airtel Vodafone and Idea Cellular — are the largest customers of Bharti Infratel. The company has market share of 9.8% and in terms of company Co locations 11.6%.

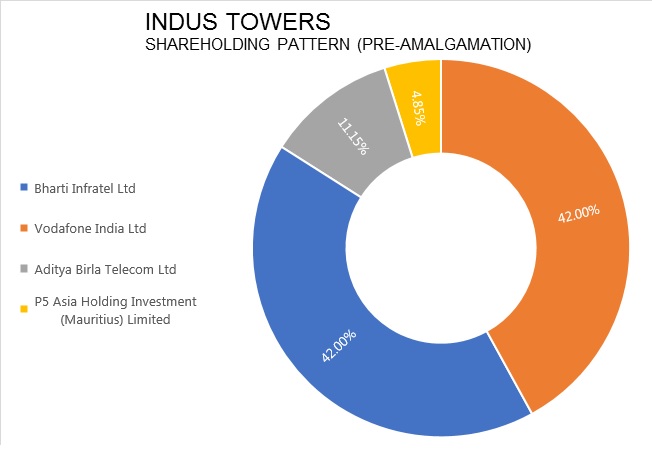

Indus Towers is an independently managed company offering passive infrastructure services to all telecom operators and other wireless services providers such as broadband service providers. Incorporated in November 2007, Indus Towers Limited has been promoted under a joint venture between entities of Bharti Infratel Limited Vodafone India and Aditya Birla Telecom (to render passive infrastructure services to telecom service providers. The company has market share of 31% and in terms of Co locations 37.1%.

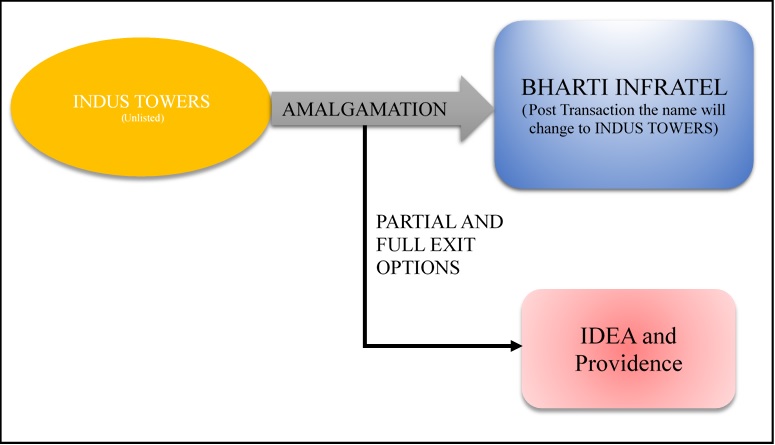

Transaction Structure

As per the implementation agreement, Idea and Providence shareholders of Indus Towers have been given an option to exit. Idea have full exit option and whereas Providence for partial stake of 3.35%. Bharti Infratel will fund the same through debt or either through internal accrual. Fund receivable by Idea and Providence is Rs 7,202.17 crore and Rs 2,163.93 crore. The transaction is expected to be complete before the end of the financial year ending March 31, 2019.

Shareholding Pattern

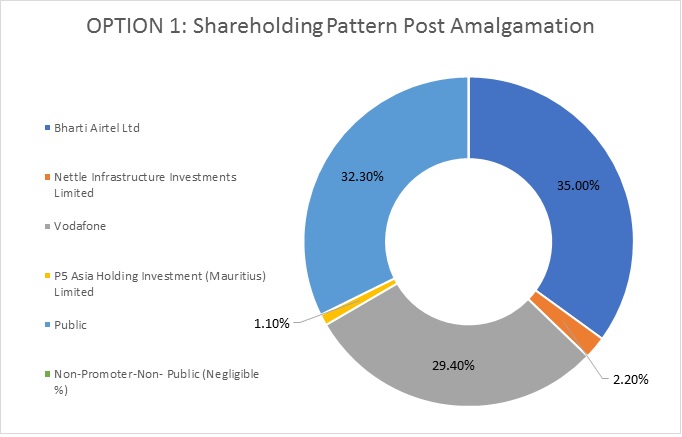

Option 1: 100% exit option to Idea and Partial exit option to Providence.

Based on the assumption that Idea group sells it’s 11.15% shares for cash and Providence elects to receive cash for its 3.35% shareholding in Indus Towers. The final number of shares issued will be subject to closing adjustments, including movements in net debt and working capital for Bharti Infratel and Indus Towers.

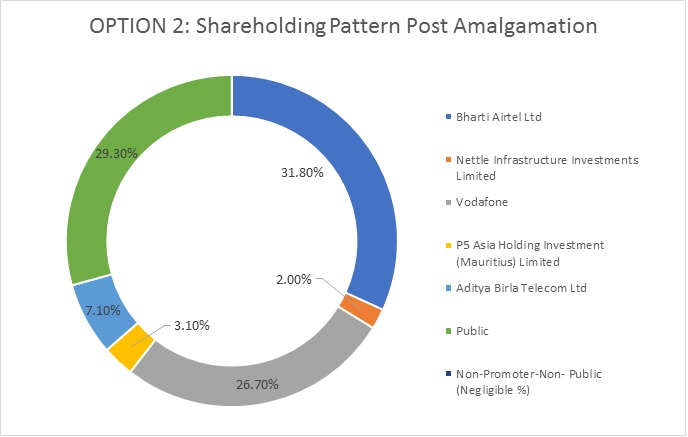

Option 2: Idea and Providence take stake in merged entity.

Based on the assumption that Idea group and Providence elect to receive shares for their 11.15% and 4.85% shareholding in Indus Towers. The final number of shares issued will be subject to closing adjustments, including movements in net debt and working capital for Bharti Infratel and Indus Towers.

Please note: In both the options, the promoters will be Bharti Airtel Ltd and Vodafone only

Synergy benefits post scheme

Commercial Synergy

- Creating a listed pan-India tower company which will be the largest tower company in the world outside China with over 163,000 towers

- Highly complementary footprints to continue to support the delivery of the Government of India’s vision of ‘Digital India’.

- Continue to offer high quality passive infrastructure services to all telecom operators on a non-discriminatory basis

Key Highlights of the scheme

- Bharti Airtel and Vodafone will have equal management rights and board seats in the combined company.

- The board of the combined company will comprise of 11 directors, of whom three will be appointed by each of Bharti Airtel and Vodafone, one will be appointed by KKR/Canada Pension Plan Investment Board and four (including the Chairman) will be independent.

- None of Bharti Airtel, Vodafone or Idea Group (if it elects to receive shares), will be subject to a lock-in on their shareholdings in the combined company.

- The combined company is expected to distribute any excess cash flow to its shareholders through dividends or share buybacks, without exceeding a maximum leverage ratio of 3.0x LTM EBITDA.

- It is intended that any cash consideration paid to Idea Group and/or Providence will be financed through new debt facilities and the existing cash resources of Bharti Infratel. On the basis that Idea Group and Providence elect to receive the maximum possible cash consideration, the pro forma net debt of the combined company would have been Rs 5,600 crore as on March 31, 2018.

Taxation

Merger will be tax compliance under the Income Tax Act.

Valuation

Appointed date means the effective date. Bharti Infratel has been valued based on Market Price method approach Rs 67,048 crore and whereas Indus Tower has been valued at Rs 64,595 crore average of Income and Comparable Multiple Method Approach. The Valuation is subject to change for Net Debt and Working Capital.

Exit price to Idea and Providence will be determined Bharti Infratel VWAP for the 60-trading day period prior to the completion of the Merger i.e. Effective Date.

The merger ratio as at the date of Implementation Agreement (Dated April 25, 2018) is 1,565 shares in Infratel for everyone Indus share.

Table 1: Key financials Standalone & Consolidated as on March 31, 2018

| Standalone Figures | Bharti Infratel | Indus Towers | Combined Company |

| Towers in Nos | 39,523 | 1,23,639 | 1,63,162 |

| Tenancies in Nos | 88,665 | 2,78,408 | 3,67,073 |

| Tenancy Ratio in Nos | 2.24x | 2.25x | 2.25x |

| Revenue (INR Crores) | 6,618 | 18,742 | 25,360 |

| EBITDA Margin | 48% | 41% | 43% |

| Net debt / (net cash) | 6,816 | 3,918 | 5,559 |

| EV/ EBITDA | 9.63 | 9.27 |

Considering the EV/LTM EBITDA of both the companies, it can be seen that the valuation is done at par.

Conclusion

The Industry as whole has been in the phase of consolidation with the entry of Reliance JIO. This consolidation will create much bigger player with approx. 41% market share and exit to the small shareholders. The exit price will be determined based at final stage of implementation. Idea most likely will exit considering its cash crunch. The Bharti and Vodafone will have equal rights, however, Bharti’s shareholding in the consolidated company will be 7.8% higher than Vodafone, which in due course will be mostly liquidated.