The UK-based promoter of specialty chemicals company Ineos Styrolution rejected the discovered price of Rs 1,100 for its delisting and did not even provide a counteroffer to the shareholders. Accordingly, the delisting offer failed in terms of the delisting regulations. The regulations allow a promoter to walk away if the price discovered through the Reverse Book Build process is higher than the promoter’s expectations.

This one is the first Delisting offer in Indian Market after provisions of the counteroffer as per new regulations 16 (1A) of SEBI delisting regulations — notified in November 2018 by Promoter of Ineos Styrolution India Limited (the Company) under the Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009.

Proposal of the Promoter and its objective:

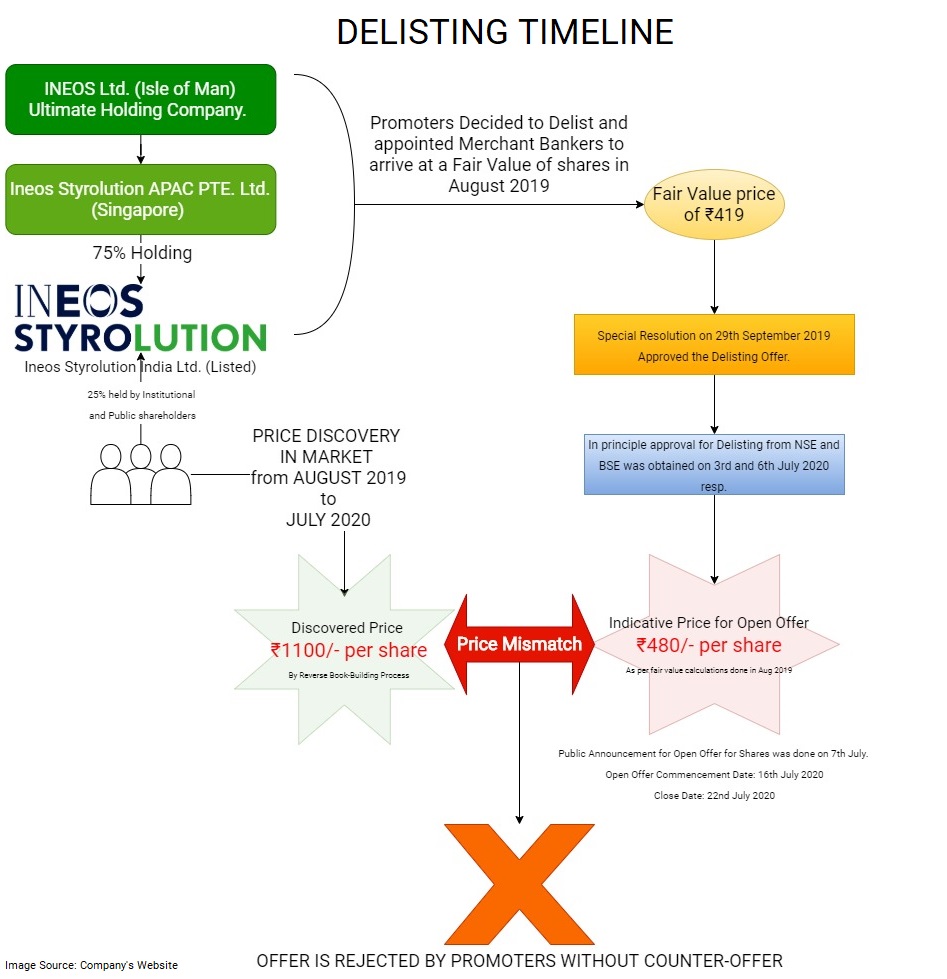

The promoter of the Company namely Ineos Styrolution APAC PTE. Ltd. (Singapore) holding 1,31,89,218 number of fully paid-up equity shares, approximately 75% paid-up equity shares of the Company showed the intention to acquire 43,96,407 fully paid-up equity shares representing approx. 25% of the Shares and as a result delist the company from Indian bourses.

So, considering the proposal, the post-offer promoter holding will be 100% of equity paid-up capital of the Company.

The main objectives as stated by promoter in its proposal are:

- To increase ownership in the Company, which will provide the Acquirer with increased operational flexibility to support the Company’s business and

- Providing exit opportunity to the public shareholders of the Company, given low liquidity of equity shares.

Sequence of events

The board of Directors in its meeting held on August 23, 2019, took on record the offer of delisting of promoters which was communicated to the Company on 16th August 2019. Pursuant to said offer the Board appointed ICICI Securities Limited, a Merchant Banker to carry out due diligence and Registered Valuer arrived at fair value the floor price of Rs. 419 per share in accordance with Delisting Regulations. The shareholders of the company also approved the delisting offer through a special resolution passed in a meeting dated 29th September 2019. BSE and NSE have given their in-principle approval to delisting through their letters dated 3rd July 2020 and 6th July 2020 respectively. A public announcement was made by the company on 7th July 2020 in compliance with Regulation 10.

The offer for tendering of the shares by public shareholders was commenced on 16th July 2020 and closed on 22nd July 2020. The Promoter required minimum of 26,37,844 shares to complete the delisting. Large Public Shareholders like Nippon India Mutual Fund and Sundaram Mutual Fund having a stake of 3.96% and 1.84% respectively in the company tendered their shares at a price of Rs. 899 per share, while some other investors tendered as high as Rs. 3000 per share. The total number of shares which were tendered up to Rs. 900 per share were 16,56,000 and shares tendered up to Rs. 1200 per share was 26,35,000 which in any case were not enough to make delisting offer successful.

Failure of the Delisting Offer: closure of open offer

Acquirer/Promotor rights under regulation 16 (1A) to make counter offer.

The promoter of the Company based on Floor Price determined on the basis of “Open offer Letter” of registered Valuer in the month of August 2019 proposed a price of Rs. 480 per share as an Indicative Offer Price in a Delisting offer. The Discovered Price was Rs. 1100 per share as per the reverse book building process to have at least 90% stake in the company. To achieve the holding of 90% of the total shareholding as per Regulations 17 of the Delisting Regulations, the Promoter shareholding shall be equal to or in excess of 1,58,27,063 equity shares of the Company.

The Promoter has decided to reject the Discovered Price of Rs. 1,100 (Rupees one thousand one hundred only) per Equity Share and has also decided not to make any counteroffer in terms of Regulation 16(1A) of the Delisting Regulations. Accordingly, the Delisting Offer is deemed to have failed in terms of Regulation 19(1) of the Delisting Regulations. As Promoter have decided to reject the offer the promoter will not acquire any equity shares tendered by the public shareholder in the Delisting Offer.

Other Options available to Promoter instead of Rejection

Earlier if the ‘offer price’, which was determined through reverse book building was not acceptable, the Acquirer could only reject the offer price and, consequently, declined to acquire the equity shares from the public shareholders

But after introduction of Regulations 16 (1A) in November 2018 now it is Right of the promoter to either make a counteroffer or reject the offer.

The Promoter / Acquirer may at its discretion:

- Accept the Offer at the price discovered through reverse book building; or

- Make a counteroffer; or

- Reject the offer

The Current offer:

The primary reason for the rejection of offer would be the huge difference between Indicative Offer Price of Rs. 480 per share offered by Promoter in Delisting offer and the Discovered Price of Rs. 1,100 per share as per Regulation 15 of Delisting Regulations.

Considering the difference of Rs. 620 per share, the Promoter must spend massive amount to purchase shares tendered by the public shareholders and delist the same.

There was continuous hike in the price of shares of the Company after the proposal of delisting from the promoter.

Before the proposal of delisting from Promoter, the share price was below Rs. 400, post the proposal the price gradually increased and doubled expecting delisting premium. As the price kept on increasing so did the expectations of the public shareholders, but the price offered by the Promoter was very less compared to price of the shares in the open market.

The Promoter should have kept in mind the trend of share price from the proposal till the Public Announcement, as the one-year period lapsed since floor price was arrived at.

Here the question arises whether the Promoter were serious to delist? As price as on the date of opening of open offer was almost double that of a floor price, if the Acquirer had no intention to pay such increased price, it should have withdrawn the offer.

The Counter offer:

“The Regulation 16 (1A) states that If the price discovered in terms of regulation 15 is not acceptable to the acquirer or the promoter, the acquirer or the promoter may make a counteroffer to the public shareholders within two working days of the price discovered under regulation 15, in the manner specified by the Board from time to time:

Provided that the counteroffer price shall not be less than the book value of the company as certified by the merchant banker.”

It is at discretion of the Promoter to propose (a) a price higher than the Discovered Price for the purposes of the Delisting Offer; or (b) a price which is lower than the Discovered Price but not less than the book value of the Company as certified by the Merchant Banker, in terms of Regulation 16(1A) of the Delisting Regulations (“Counteroffer Price”).

The Promoter has already provided its Indicative Offer Price which is higher than Book Value of the Company but less than Discovered Price. Further, some of the Large public shareholders of INEOS tendered their shares at a price more than floor price during the Bid Period. It seems the acquirer is not willing to pay higher price, hence allow the delisting offer to lapse and in the process, all cost hassle of going to the offer was wasted.

Conclusion:

To smoothen the process of delisting, the new provisions in terms of Regulation 16(1A) were introduced so that if the acquirer wants to go ahead with the offer at a price higher than floor price. Earlier, if offer receives enough number of shares and just because discovered price through reverse book building is higher, the delisting offer was considered as failed per the old provisions. The acquirer then was required to go through the whole procedure again even though it wants to go ahead with the delisting with the higher price. Though the new provision allows the Acquirer to take another shot at delisting at a price that is acceptable to it, it’s all on the reasonableness of public shareholders while tendering their shares.

Add comment