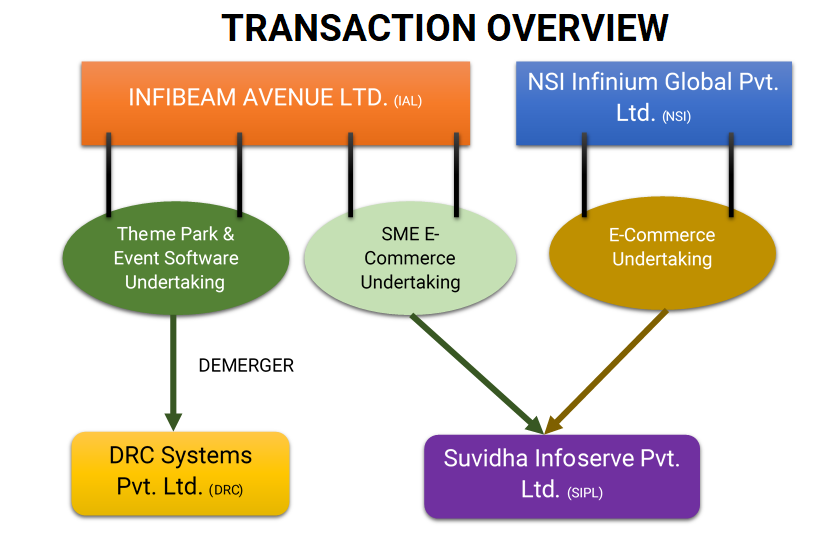

The board of Infibeam Avenues approved demerger of E-commerce business of NSI Infinium and its Theme park & Software business into Suvidhaa and DRC Systems respectively, which will be listed at a later date. The demerger has been done by the board as a part of Infibeam’s broader business restructuring plan. These strategies will pave the way for the management of each firm to chalk out growth strategies.

Infibeam Avenues Limited (IAL) is in the business of digital payments, E-commerce services, software business, e-commerce technology platforms and provides a comprehensive suite of web services spanning digital payments solutions, data centre infrastructure, software platforms, etc. The equity shares of the company are listed on BSE and NSE.

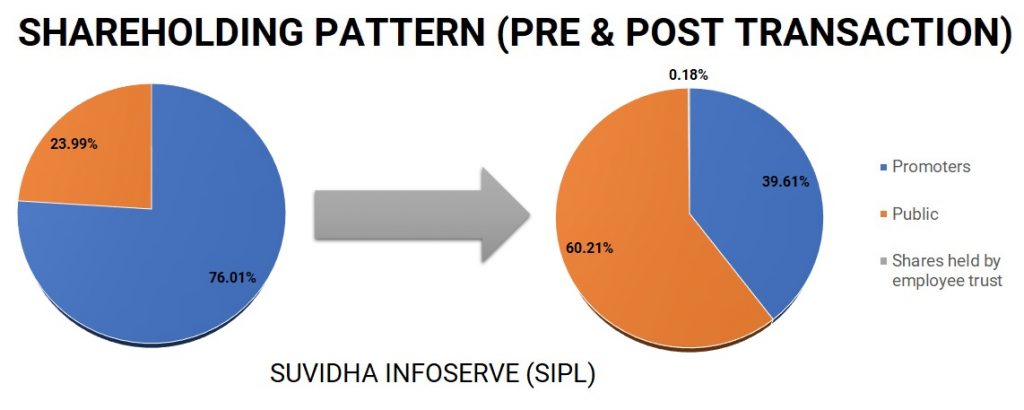

Suvidhaa Infoserve Private Limited (SIPL) is a private limited company. However, for the conversion into public company resolution has been passed on August 27, 2019. SIPL engaged in the business of provide facility to make payments for a host of services like utility bill payment, renewal insurance premium collection, telecom, mobile, DTH recharges besides travel ticketing (rail, air and bus}, domestic remittance services, merchant acquiring services etc. The 76.01% of the equity shares of the company are held by. Paresh Rajde (Not related to IAL) & remaining by FII’s and other individual shareholders.

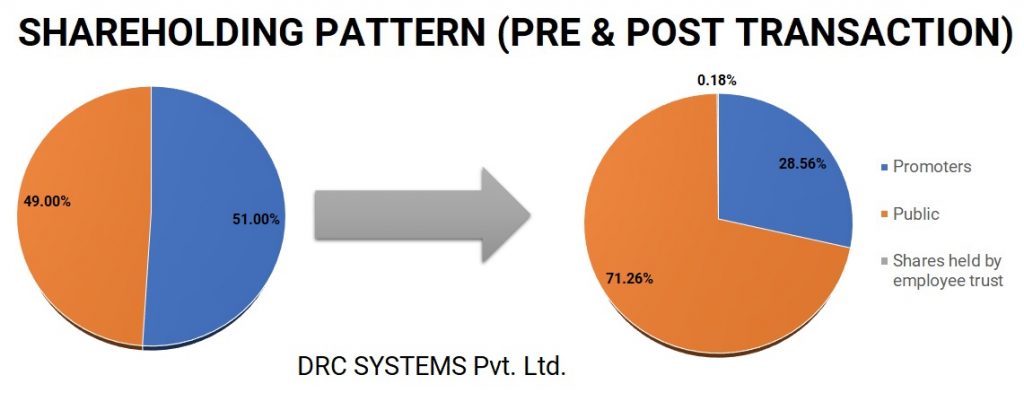

DRC Systems India Private Limited (DRC)is a private limited company however for the conversion into public company resolution has been passed on August 16, 2019. It is engaged in the business to undertake software business, services across e-commerce, content management system, entertainment events management system, payment, processing system, mobile application, learning management system as well as ERP for both front-end user interface as well as back-end. The 51% of the equity shares of DRC are held by IAL & remaining stake is majorly owned by Sutariya Family (Not related to IAL).

NSI Infinium Global Private Limited (NSI) is a private company however for conversion into public limited company, necessary documents filed with ROC. It is engaged in the business of E-commerce. The 6.41% of the equity shares of NSI are held by SIPL & remaining by IAL. All the control of NSI is with SIPL thus making NSI subsidiary of SIPL.

Further the registered office of all the companies are located in the GIFT II Building Gandhinagar, Gujarat.

Proposed Transaction

On September 12, 2019, Board of Directors of the IAL approved the Composite Scheme of Arrangement amongst Infibeam Avenues Limited, SIPL, DRC Systems India Private Limited and NSI Infinium Global Private Limited and their respective shareholders and creditors under Section 230 to 232 read with Section 66 and other applicable provisions of the Companies Act, 2013 and rules made thereunder (‘Scheme’). The Scheme inter-alia provides for:

- Demerger of “SME E-Commerce Services Undertaking” of IAL and transfer of the same to SIPL.

- Demerger of “E-Commerce Business Undertaking” of NSI and transfer of the same to SIPL.

- Demerger of “Theme park & Event Software Undertaking” of IAL and transfer of the same to DRC.

“SME E-Commerce Services Undertaking” means all the businesses, undertakings, activities, properties, investments and liabilities, of whatsoever nature and kind and wheresoever situated, pertaining to SME ECommerce Services Business. However, as per the valuation report, the equity shares of NSI held by IAL forms part of “SME E-Commerce Services Undertaking. However, as per post-restructuring shareholding pattern submitted by the company, IAL will continue to hold same stake in NSI. Hence, it is not clear what exactly constitute “SME E-Commerce Services Undertaking”. In terms of annual turnover of SME E-commerce Services Undertaking for FY 2018-19 was Rs. 23.61 million i.e. Percentage to total turnover on standalone basis of IAL (Rs. 5,446.56 million) is only 0.43%.

The annual turnover of E-Commerce Business Undertaking of NSI for FY 2018-19 is Rs. 2,619.41 million. The same in percentage term to total turnover on standalone basis of NSI (Rs. 2,619.41 million) is 100%. It seems whole of the assets of NSI will get demerged into SIPL.

The annual turnover of Theme park & Event Software Undertaking for FY 2018-19 is Rs. 22.43 million. The same in percentage to total turnover on standalone basis of Infibeam (Rs. 5,446.56 million) is 0.41%

The Appointed date for the transaction is 1stday of April 2020. After approval of this scheme, the equity shares of SIPL & DRC will get listed on bourses.

Swap ratio for the transaction:

| Demerger of SME E-Commerce Services Undertaking from IAL to SIPL | 197 equity shares of SIPL of Rs. 1 each fully paid up for 1500 equity shares of IAL of Rs. 1 each. |

| Demerger of E-Commerce Business Undertaking from NSI to SIPL | 1,10,229 equity shares of SIPL of Rs. 1 each fully paid up for 20 equity shares of NSI of Rs. 10 each fully paid up. |

| Demerger of Theme park and event software undertaking from IAL to DRC. | 1 equity shares of DRC of Rs.10 each fully paid up for 412 equity shares of Rs. 1 each fully paid up. |

As result of demerger of SME E-Commerce Services Undertaking from IAL to SIPL, existing shareholders of IAL will get equity shares of SIPL. As a result of demerger E-Commerce Business Undertaking from NSI to SIPL, IAL will likely to receive equity shares of SIPL. It is not clear whether investment in NSI shares will be part of SME E-Commerce Services Undertaking of IAL. As per Valuation Report, investment in NSI shares will be part of the demerged undertaking then ultimately NSI will become the Wholly-Owned Subsidiary of the SIPL after demerger of SME E-Commerce Services Undertaking of IAL and there will be no question of issuing any shares.

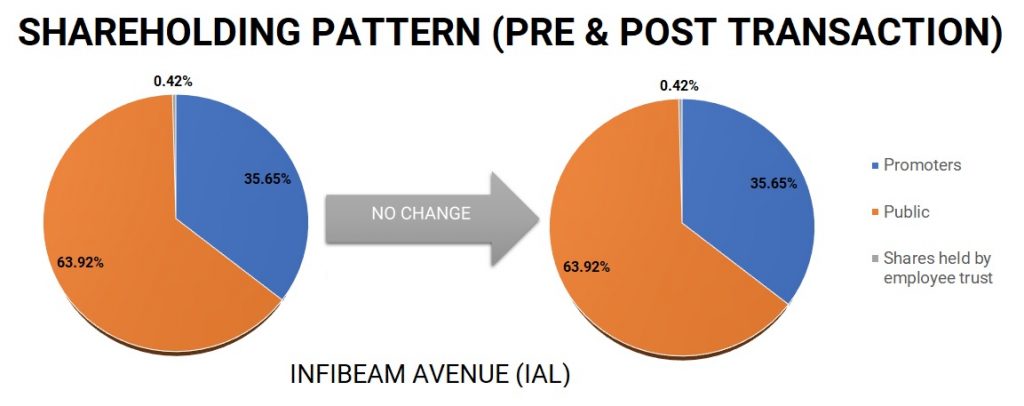

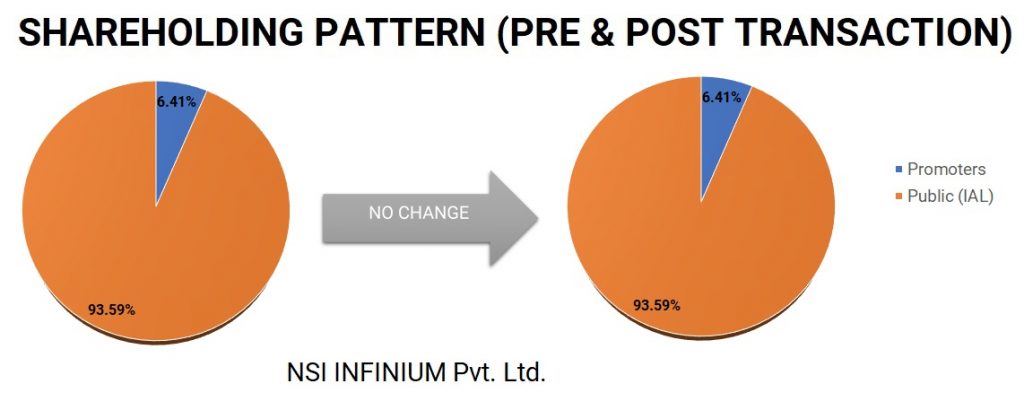

Shareholding pattern

IAL holds 51% shares of DRC, 93.59% of NSI. SIPL holds 6.41% shares of NSI as promotors.

Post-Restructuring, IAL will hold shares of SIPL. Further, current public shareholders (mainly Sutariya Family) will become promoters of DRC.

Further, we are not clear with how the number of shares or stake has been calculated in the shareholding pattern submitted to exchange.

History:

In 2017-2018, NSI acquires 51% stake shares of DRC from Hitesh L. Patel at price of Rs 3 crore. In January 2019 NSI sold entire 51% stake in DRC to IAL at price of 3.06 crore (i.e. transfer at price of Rs. 44.44 per share).

In FY 2019, IAL decided to transfer its holding in NSI at a valuation of Rs.500 crores with SIPL. In Q3 FY 18-19, SIPL bought 5% stake in NSI at Rs 25 crore from IAL. Further, it bought 1.41% stake in NSI at around Rs. 13.5 crores in Q4 of the FY2019. It is not clear why there was a significant increase in valuation in one quarter. Further, it was agreed that the transfer of remaining stake of NSI held by IAL shall be by way of merger, wherein proportionate equity shares of SIPL shall be issued to IAL. Further, it also states that in the event the merger is not approved, SIPL will acquire balance 93.59% stake in NSI at agreed valuation of Rs. 4,61.21 crores. Further, as per the terms of MOU, SIPL has acquired operational, business and financial control over NSI on February 28, 2019.

Recent issue of shares by SIPL on Private Placement basis:

On March 26, 2019 SIPL issued 5,00,000 shares to Mr. Ashok Kumar Gupta (Classified as public shareholder) at a price of Rs. 20 per shares while on March 30, 2019 SIPL issued 33,75,000 shares to Vespera Fund Limited at Rs. 60. thereafter company has also issued 5,00,000 shares to Anish J Shah HUF (Classified as public shareholder) at Rs. 20 on two different dates, April 12, 2019 and July 17, 2019.

Financials

Table 1: IAL Consolidated Financials as on 31st March 2019 (INR in Million)

| Particulars | E-Commerce | ||

| Sale of Product | Sale of Software and related ancillary services | ||

| Revenue | 2,026.08 | 9,564.61 | |

| Results | -136.94 | 1,793.79 | |

| Segment Assets | – | 21,967.03 | |

| Segment Liabilities | – | 3,399.42 | |

| Segment Capex | 0.25 | 1,307.16 | |

| Depreciation | 35.38 | 587.33 | |

| Non-Cash other than Dep. | 20.91 | 127.19 | |

Table 2: Financials of SISPL, DRC and NSI for FY 17,18 & 19 (All Figs in INR Crores)

| Particulars | 2019 | 2018 | 2017 | ||||||

| SISPL | DRC | NSI | SISPL | DRC | NSI | SISPL | DRC | NSI | |

| Net Worth | 58.00 | 2.33 | 98.34 | -5.08 | 2.24 | -29.41 | -9.34 | 2.01 | -46.17 |

| Revenue | 82.85 | 13.27 | 263.86 | 26.90* | 12.26 | 284.71 | 69.42 | 9.68 | 296.37 |

| Profit after tax | 5.79 | – | 0.93 | 4.13 | 0.31 | 16.57 | -11.26 | 0.09 | -19.47 |

*includes exceptional income of Rs. 5.43 crores.

Valuation

Table 3: Valuation of Different Undertakings & Companies

| Particulars | Per Share Value (INR) | No. of shares | Valuation (INR Crores) |

| SME E-Commerce Business – IAL | 7.88 | 66,67,21,490 | 525.37 |

| E-Commerce Business- NSI | 3,30,687 | 18,293 | 604.92 |

| Theme Park Business- IAL | 0.29 | 66,67,21,490 | 19.33 |

| SIPL | 60 | 10,58,01,885 | 634.81 |

| DRC | 119.43 | 22,50,000 | 26.87 |

As per Valuation Report, the valuation of SIPL & E-Commerce Business of NSI has been arrived using the price of recent transaction in the respective equity shares. It is interesting to note that SIPL issued one tranche of equity shares at INR 60 and thereafter at INR 20 per shares. However, while arriving at the share exchange ratio, its value is taken at INR 60 per equity share. We are not clear why there is a huge difference between valuation of equity shares issued to different person not having much time gap between two issues, on March 26, 2019 equity shares were issued at Rs 20 per shares while on March 30, 2019, they were issued at Rs. 60 and interesting later it again issued at INR 20 per share.

In January 2019, NSI sold entire 51% stake in DRC to IAL at price of 3.06 crores i.e. transfer at price of Rs. 44.44 per equity share. However, for the purpose of demerger, value given to the share DRC is Rs. 119.43 per equity share.

Conclusion

The proposed demerger will pave the way for separate listing of E-Commerce & Theme Park Software business. The scheme is structured in such a way that SIPL will get listed and there will be change of management for Theme Park Software business without trigging takeover code and listing related SEBI Compliances. Last year, the share prices of IAL fallen by over 75% in a single day over corporate governance concerns. Some clarity on some of the steps of the proposed re-structuring from the company will be helpful. As per the company, the proposed demerger is a move to focus on its core business. However, this contradicts with the present structure as SIPL will issue shares to IAL as result of demerger of E-Commerce business of NSI hence SIPL will continue to hold interest in E-Commerce Business. Further, how listing of miniscule Theme Park Business will benefit stakeholders more specifically minority shareholders should be evaluated.

Add comment