Shiny days for the shareholders of ITC Limited seem to be on their way. The Board of ITC Limited has accepted the long-lasting demand from the shareholders for value unlocking through demerger.

ITC Limited announced the demerger of its Hotel Business, however, the demerger comes with a twist. Let’s find out the nitty-gritties of the proposed demerged and the “twist” which can be potentially value accretive for ITC & its shareholders?

ITC Limited (“Demerged Company” or “ITC”) was incorporated in 1910 is one of India’s leading private sector companies and conglomerates engaged in business like Fast-Moving Consumer Goods, Hotels, Paperboard, Paper & Packaging, Agri products and IT industry.

The equity shares of ITC are listed on nationwide bourses while its GDR are listed on the Luxemburg Stock Exchange.

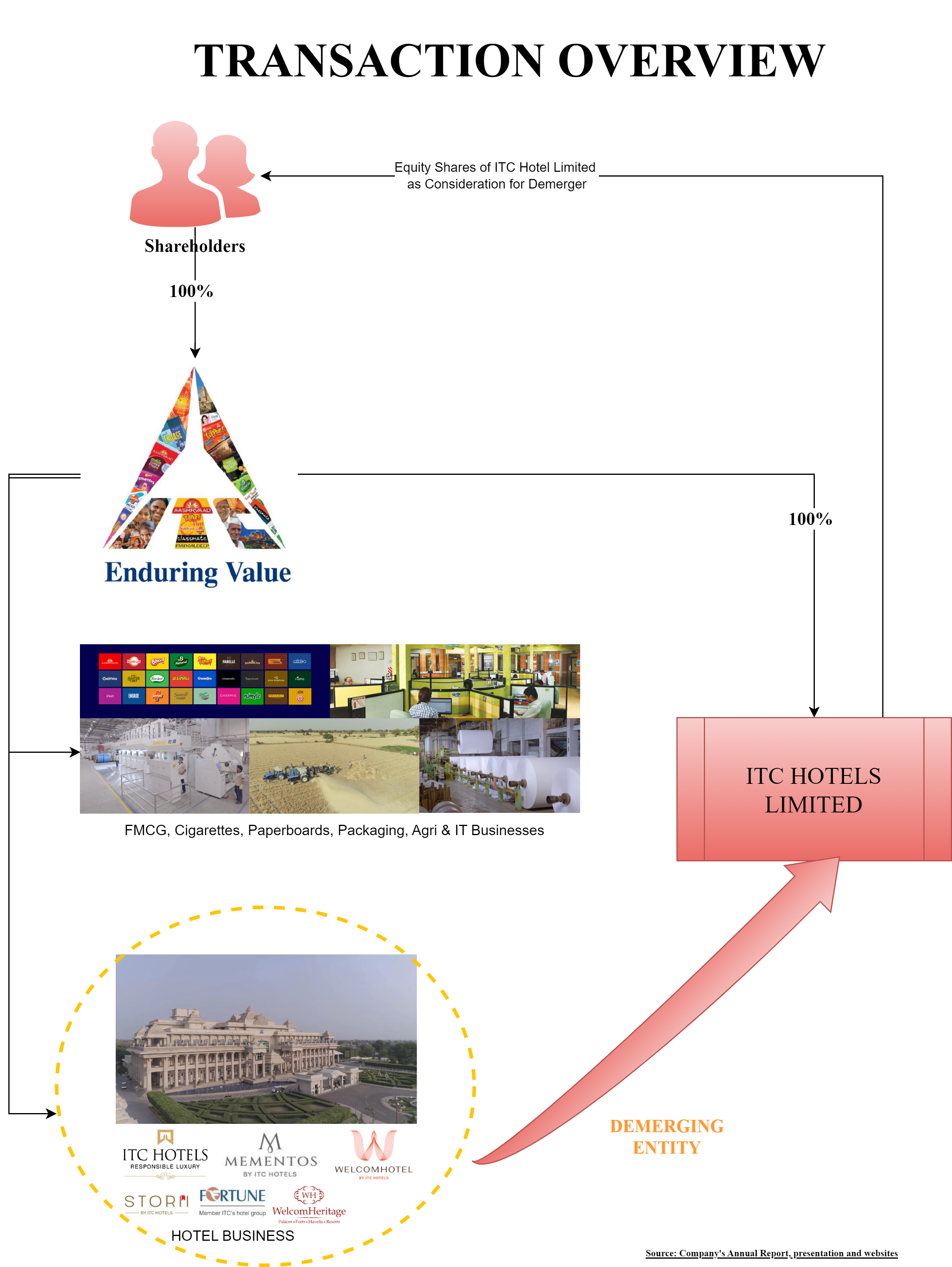

ITC Hotels Limited (“Resulting Company” or “ITC Hotels”) is a wholly-owned subsidiary of ITC incorporated to facilitate the proposed demerger.

The Transaction

The proposed Scheme of Arrangement inter-alia provides for the demerger of “Hotel Business” of ITC into ITC Hotels.

“Hotel Business” means owning, licensing, operating, managing, servicing, marketing and supervising the operations of hotels and includes accommodation, dining and banqueting services, and investments in the Hospitality Entities as defined in the scheme carrying on the hotels and hospitality business. Financial (EIH Ltd. & HLV Ltd.) and non-operational Investments (Logix Developers Pvt. Ltd.) are not proposed to be transferred.

Rationale as envisaged in the proposed scheme:

- The hotel business of ITC has matured over the years and is well poised to chart its own growth plan and operate as a separate listed entity.

- The distinctive profile of the hospitality industry, housing the Hotel Business in a separate listed entity would enable crafting of the next horizon of growth and sustained value creation for shareholders.

- ITC Hotels will have the ability to raise capital from equity and debt funding for fueling its growth plans.

- Unlock value for shareholders.

- Long term stability

The Appointed Date for the demerger is Effective Date means the date which will be the first day of the month following the month in which companies mutually acknowledge in writing that all the conditions and matters referred to in Clause 28.1 of the Scheme have occurred or have been fulfilled, obtained or waived, as applicable, in accordance with this Scheme.

Capital Structure

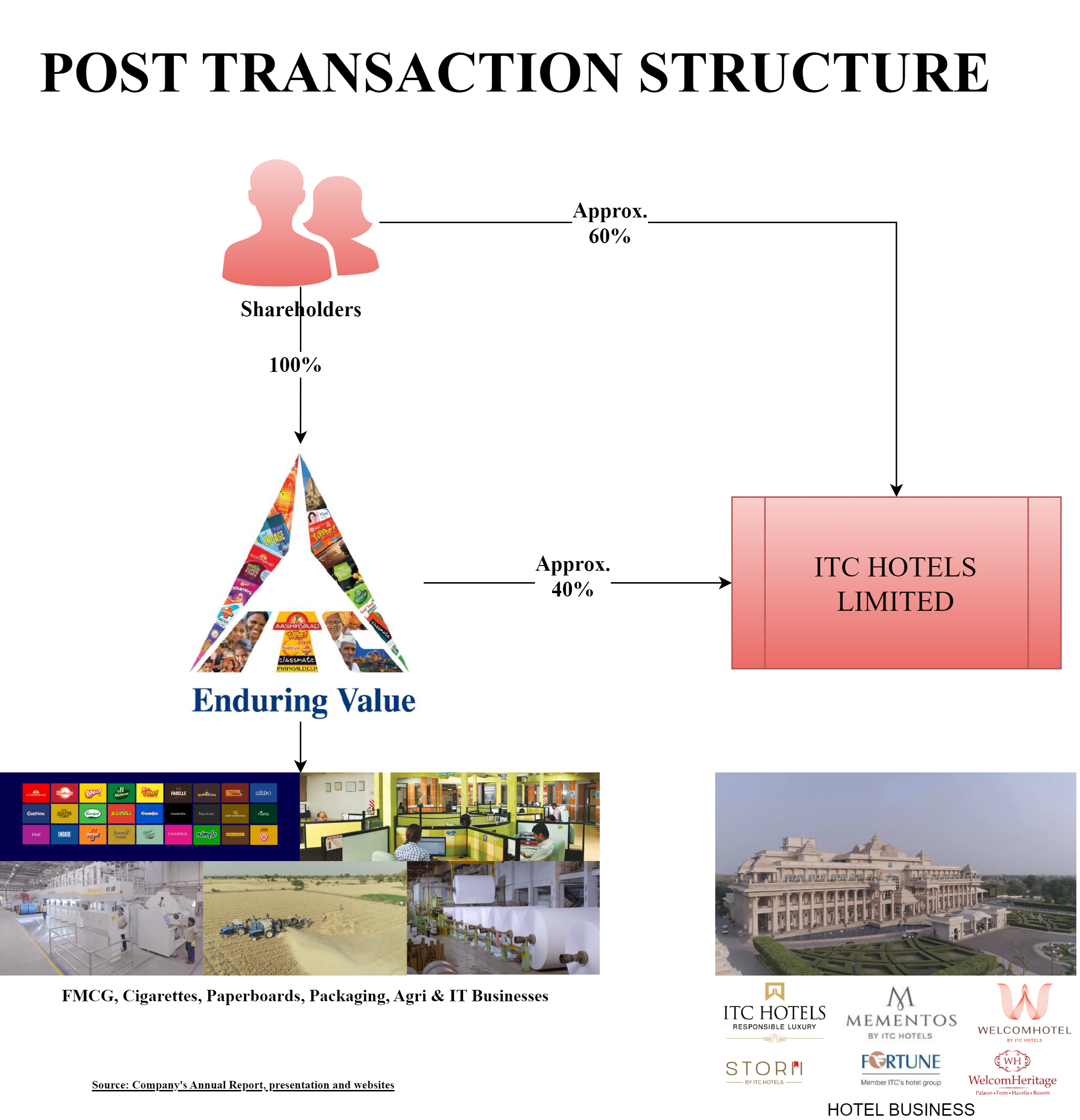

The announced demerger by ITC is not akin to the regular demergers carried out by the listed companies. ITC envisages retaining 40% of the paid-up capital of ITC hotels thus, ITC hotels will issue shares to the extent of 60% of the paid-up capital of ITC hotels to the shareholders of ITC on a proportionate basis.

As the consideration for the proposed demerger, ITC shareholders holding 10 equity shares of INR 1 each of ITC, The Resulting Company will issue 1 equity share of INR 1 each of its own. The current paid-up capital of ITC Hotel is 83,00,00,000. This will be retained by ITC and additional capital of 1,24,57,76.082 will be issued to the shareholders of ITC on a proportionate basis. The beneficial interest of ITC shareholders in ITC Hotels will continue to remain the same. The only difference is 60% they will hold directly & 40% through ITC. Effectively for the business which is circa 3% of total ITC’s revenue & circa 10% of the total capital employed, the equivalent share capital will be circa 17% of that of ITC.

Rationale for retaining 40% stake:

ITC will retain a 40% stake in the hotel business post-demerger. The potential reasons for keeping 40% stake could be:

- Having a promoter for ITC Hotels: Currently the entire share capital of ITC is held by public shareholders. By keeping a 40% stake with ITC, ITC will become the promoter of ITC Hotels though entire ownership is effectively held by public shareholders only.

- New structure will get the flexibility to invite investors: In future, if ITC decides to invite a strategic partner or divest the hotel business, investor can get 40% stake in the hotel business directly through ITC and remaining desire stake can be through an open offer or negotiating with some of the large public investors it will have. Effectively, it will be easy for any investors to fetch minimum 51% stake in the hotel business.

- If Hotel Business is sold to strategic/financial partner, ITC will recover substantial amount of capital infused in the said business. No doubt till date it recovered substantial tax breaks as compensation for nurturing the Holel business.

This structure is akin to the structure opted by Larsen & Turbo Limited in 2003 for the demerger of cement business and thereby transfer of ownership in cement business to Aditya Birla Group, through which L&T retained 20% stake in the cement business. L&T transferred the stake for cash consideration to Aditya Birla Group. - Getting the invested capital back to ITC: The capital employed for hotel business in 2005 was circa INR 1200 crore while that at the end of FY 2023 was INR 7000 crore. Over the last 18 years, ITC has incrementally invested INR 5800 crore in the hotel business. A retention of 40% can give them the opportunity to get the capital employed back to ITC, which can be used to return it to its shareholders or infusion into any other business.

- Operational flexibility to infuse money if required: being promoter of ITC Hotels, after demerger if the Hotel business requires any amount, the same can be raised through taking loan from ITC or through equity infusion by ITC till ITC Hotels have strategic or financial promotor.

Other aspects:

- The entire cost for the transaction including stamp duty will be paid by ITC and not by the ITC Hotels. Thus, there will be no burden on ITC Hotels and duty can be paid from the surplus cash available with ITC.

- It is not clear whether as a part of a demerger, hotel business will get any surplus cash available with ITC.

- The hotel business will be given a license to use the ITC name as part of its corporate name and some of its property’s names. The two companies will explore suitable commercial arrangements all on an arm’s length basis, being related party transactions.

Financials

In 2004, ITC merged its hotel business, that time carried through a separate listed company. The topline was circa INR 350 crore with profit of circa INR 50 crore which now stands as revenue of INR 2700 crore to EBITDA of 850 crore. Over the same period, the room inventory galloped from 4500 rooms to 11,600 rooms.

Conclusion

Compared to its other businesses, Hotels business is cyclical and relatively asset heavy & hence lower return on capital employed. Over the period, the expansion of the hotel business was supported by the free cash flows from other businesses. Now with demerger, Hotels will be separate business and must take care of expansion on its own.

In 2017, ITC announced a move towards asset light strategy. Demerger request for hotel business was on the table from investors for a long time. I hope this will be followed by the demerger of other businesses very soon.