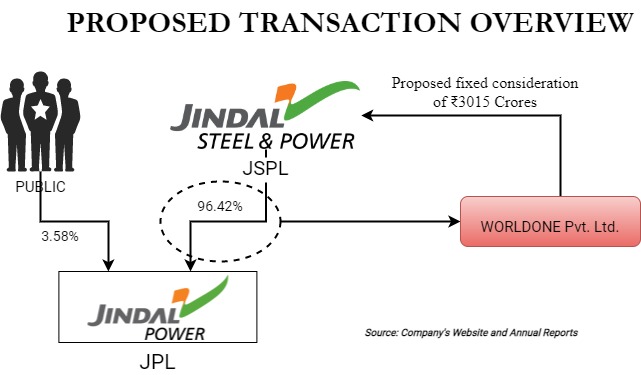

On 26th April 2021, Jindal Steel and Power Limited (“JSPL”), a listed company on BSE and NSE announced that its Board of Directors have approved the divestment of its entire equity interest of 96.42% in Jindal Power Limited (“JPL”) to a promoter’s group company, Worldone Private Limited (“Acquirer”) in an all-cash deal. For this purpose, JSPL called meeting of shareholders (General Meeting) on 24th May 2021 for the approval of proposed divestment, for a total fixed consideration of Rs.3015 Crore through share purchase agreement to be executed between the JSPL, Target Company and Acquirer.

Jindal Steel and Power Limited is one of India’s leading primary steel producers with a significant presence in power generation and mining. Its domestic manufacturing units are situated in Raigarh (Chhattisgarh), Angul (Odisha), Barbil (Odisha) and Patratu (Jharkhand). JSPL’s integrated operations in India encompass production capacities of 8.45 MTPA of iron, 9.0 MTPA of pellets, 8.6 MTPA of liquid steel and 6.55 MTPA of finished steel. JSPL also has a captive thermal power generation capacity of about 1,634 MW at its Raigarh and Angul plants. In addition to steel-manufacturing capacities, JSPL’s international operations include interests in coking coal mining assets in Australia, thermal/coking coal mining assets in Mozambique and anthracite coal mining assets in South Africa.

Incorporated in 1995, Jindal Power Limited is involved in the power generation business with 3,400 MW of thermal power generation capacity at Tamnar in the Raigarh district of Chhattisgarh. JPL is promoted and 96.43% owned by JSPL.

Table 1: Key Financials of JPL (Standalone) & its share in consolidated JSPL FY 2021 (All Figs in ₹ Crores)

| Particulars | Amount |

| JSPL Revenue | 39,989 |

| JSPL EBITDA | 14,444 |

| JPL Revenue | 4604 |

| JPL EBITDA | 1,318 |

| JPL standalone Revenue as % of JSPL | 11.51% |

Table 2: Key Financials of JPL (Consolidated) FY 2020

| Particulars | Amount |

| Revenue | 4390 |

| EBITDA | 1686 |

| Networth | 9838 |

| Property, Plant & Equipment | 9102 |

| Borrowings | 2644 |

On 20th May 2021, JSPL announced the postponement of general meeting stating that few investors have requested the company to examine and simplify certain terms around the proposed sale.

Rationale for the Transaction

JSPL mentioned several reasons for divesting its stake in its material subsidiary:

- Proposed Sale in line with its long-term strategic vision and ESG objectives. The proposed divestment is one such step that will help substantially reduce CO2 emissions by about 50% (on full capacity utilization). The transaction is therefore expected to significantly improve Company’s ESG score and to provide the Company with wider access to capital from ESG focused investors – equity and debt – for both organic and inorganic growth of the Company’s India Steel business.

- Deleverage its balance sheet by achieving its immediate goal of INR 15,000 crores net debt and eventual goal to become a net cash company

- Streamline Company’s operations by becoming a pure play Steel company

- Expansion of capacity using consideration received

Capital Advances & Inter-Company Deposits by JPL to JSPL

JSPL has received capital advances aggregating to INR 2854 Crores from Jindal Power Limited for purchase of undertakings of the captive power plants of the Company located at Angul and Raigarh; and (ii) inter-corporate deposits aggregating to INR 1532 Crores by JPL to JSPL.

Redeemable Preference Shares

During the financial year 2020-21, Jindal Power Limited (JPL) has allotted to JSPL fully paid-up Redeemable Preference Shares (RPS) of INR 6,803.01 crores (Redeemable in maximum 20 years) as Bonus Shares by way of capitalization of retained earnings (390,17,25,000 nos. of 5% Cumulative, Non-Convertible RPS of face value of INR 10/- each and 290,12,82,692 nos. of 5% Non-cumulative, Non-convertible RPS).

Process:

JSPL in its notice to shareholder mentioned that in order to maximize the value and run a transparent process, the Company initiated a sale process in the month of December 2020 to invite interested buyers to share offers for the purchase of 96.42% (ninety-six-point four two percent) equity shareholding of JPL held by JSPL. In this regard, JSPL appointed an independent third-party transaction advisor, to run the entire sale process. A total of 33 entities were approached in this regard, including 14 Indian companies, 11 foreign companies and 8 financial investors. Pursuant to completion of the due diligence exercise, JSPL received offers from the interested entities. These offers were analyzed by the Audit Committee and the Board. The Audit Committee and the Board deliberated on the proposals thoroughly and unanimously approved the offer submitted by the Acquirer. No names of the entities were disclosed by JSPL.

Material Terms and conditions of SPA (Share Purchase Agreement)

- Sale of 96.42 % equity capital by JSPL to Acquirer for a consideration of Rs. 3015 Crores

- If JSPL proposes to sell or transfer the RPS or any rights attached thereto to any third party other than its affiliates, then the Acquirer shall have the right to purchase the RPS on the same price and terms and conditions offered by the proposed transferee.

- If JPL misses any two coupon payments of the RPS, then JSPL will automatically take over more than 80% voting rights of JPL. However, there is no clarity on whether and how on payment of accumulated dividend, whether voting rights will go back to the shareholders of JPL.

- A loan agreement dated April 26, 2021 (“Loan Agreement”) with JPL to convert the existing capital advances and intercorporate deposits availed by JSPL from JPL aggregating to Rs. 4386 crores into an unsecured loan. It will have a seven-year term. It will be payable in the fifth, sixth, seventh year in three equal installments. This loan will carry an interest of 9.7%.

Objections raised by the Investors and Proxy Advisory Firms –

Soon after the announcement, many of the investors started opposing the deal on multiple grounds:

Consideration of Rs. 3015 Crore is not appropriate:

According to the proxy advisors, the valuation of JPL would be more than Rs 20,000 crore. It cited several examples as benchmarks. For instance, earlier JPL had proposed to sell a 1,000-MW plant in 2019 to JSW Energy for an enterprise value (EV) of Rs 6500 crore, which comes to Rs 6.5 per MW. Applying this yardstick, 3,400 MW worth of power assets would be around Rs 22,100 crore.

After the objection on the valuation of JPL is raised by the proxy advisors, JSPL has stated that “the thermal power industry has drastically changed over the years and valuations it may have garnered a few years back would be irrelevant in the current time period. Comparison with similar recent transactions of similarly placed assets would depict a valuation range similar to or lesser than the current transaction.”

In FY 2021 just before the proposed transaction, JPL issued Redeemable Preference Shares to equity shareholders as a bonus. Effectively, JPL has converted its Reserves to a fixed liability and thereby reduced its Net-worth significantly and as a result dilution in the equity valuation of the company. This seems to have facilitated the present transaction and made it easier for the acquirer to acquire at lower valuation as the transaction, interesting and surprisingly does not envisages the acquisition of RPS.

Inter-Company Loan/Preference Shares

Inter-Company transaction in the form of Deposit/loan from JPL to JSPL and RPS held by JSPL of JPL really created plethora of confusion amongst investors. Management proposed that RPS will be redeemable by JPL in ~15 years and shall carry interest rate of 5% vis-à-vis the loan/deposits taken by JSPL will be repayable within 7 years and shall carry interest rate of 9.7%. The gross mismatch of period & interest has resulted in questions on corporate governance. Management clarified that both are separate instrument and will continue as it is with fixed timeline for payment doesn’t really absorbed well by the investors. Further, the transaction also results in the blockage of funds in the preference shares.

Timing of the Transaction

JPL had a rather good coal block allocation, 6 million tonnes per annum probably it would have taken six, nine months to ramp up, the profitability for the asset could have been better, it could have fetched a better valuation if divestment would have been delayed. Interestingly, The Gare Palma IV/1 mine, with an annual peak production capacity of 6 MT, earlier belonged to JPL’s parent firm JSPL.

ESG

JSPL mentioned that the divestment moves to improve ESG score and thereby inviting more investors in future. However, there are other assets including overseas coal mines which are also dragging JSPL ESG score. Further, interesting those ESG dragger Assets/Business has been acquired by the promoter group company itself which raises huge question mark on promoter’s consciousness towards ESG.

Proposed transaction of sale of shares of JPL by JSPL can be analyzed as following:

- Sale of undertaking

- Related Party Transactions

Audit Committee is required to ensure the valuation of the undertaking and approve related party transaction. There is no provision under the Companies Act, 2013 regarding disclosure of some minimum or mandatory information before the “Audit Committee” for approving certain transactions. The benchmark to decide whether deal value is correct or not is only the “Valuation Report” obtained from the registered valuer. Further, along with the approval of Audit Committee, related Party Transactions are also required to be approved by the Board of Directors in their meeting. Since the majority of directors attending the “Board Meeting” and “Audit Committee” are common, the passing of resolution is not a big hurdle. Further, at the Audit Committee and Board Meeting “Unanimous Approval” is not required. Even if the Audit Committee or Board Approves transaction which is not so in the interest of stakeholders, there is no penal provision under the Companies Act, 2013. Further as of now, apart from the approval of the Board and Shareholders, no approval of any other authority is required like Central Government or National Company Law Tribunal.

In the explanatory statement of notice, JSPL has not mentioned anything about obtaining of valuation report but has provided the terms and conditions of share purchase agreement. In the reply to the objection raised by the proxy advisors, JSPL has mentioned valuation report is not required to be obtained as per the provisions of the Companies Act, 2013. Though under the Companies Act, 2013 it is not mandatory to obtain valuation report from the registered valuer under section 180, as a matter of good corporate governance, Company must obtain valuation report from the registered valuer and statement regarding obtaining the same shall be disclosed in the notice. Many listed companies are following practice of obtaining valuation report from registered valuer.

JSPL has complied with the provisions of Companies Act, 2013 by providing required details, but it has “Adequately” complied with the provisions of the Act i.e complying with the law without following spirit of the laws.

JSPL has stated that after starting of sale process in December 2020, JSPL has appointed independent third-party transaction advisor and bids were invited from the entities involved in the power sector. Total 33 entities (14 Indian Companies, 11 Foreign Companies and 8 Financial Investors) approached the JSPL for the purchase of JPL undertaking with non-binding deals and Audit Committee and Board of Directors thoroughly evaluated the proposal given by the bidders.

One can opine that, terms and conditions attached to the sale of JPL undertaking may be of such nature that no bidder is ready to go ahead in the transaction. If the terms and conditions are bit different, then definitely JSPL could get the much better price than Rs. 3015 Crore given by its promoter. Terms and conditions of the sale might be framed in a such way that only the Acquirer could comply with the same and can avail the maximum benefits from such transaction.

Conclusion

Buying & selling of business by a listed company to group’s unlisted company is not a new thing. Multiple corporates follow this practice. What is important is the transaction should have strong commercial reasoning and should be done at arm’s length price. If JSPL is stating that Rs. 3015 Crores is the fair value, it should also disclose how the value has been computed. Further, since except acquirer, no buyer has accepted the terms and conditions of the sale, JSPL should also prove to the satisfaction of the other investors that such terns are fair enough and not prepared with the intention to provide benefit only to the acquirer.

Earlier (June 2020), JSPL also proposed divestment of up to the entire interest in M/s Jindal Shadeed Iron & Steel LLC, a step-down material subsidiary, by Jindal Steel & Power (Mauritius) Limited, a wholly-owned subsidiary of JSPL to promoter group entity. Proxy Advisory firms also raised couple of questions to this deal however, the deal sail through. This time, investors forced the company and as a result, current deal of divestment of JPL has been put on hold by JSPL.

There are multiple large value transactions open between the Target company and JSPL since 2015. The recent transaction of issuing RPS as Bonus Shares really creates a question. The proposed divestment fixes the price for acquisition today without getting any major net cash inflow as on date (RPS will be redeemed after ~15 years). If desired, the pending transactions (mainly RPS) can happen only between the Company and the Acquirer which is controlled by the promoters. . The explanatory statement did not disclose what were other biding deals in terms of value.

Though the Companies Act, 2013 and Securities Exchange Board of India (LODR) allows the companies to sale their undertaking and even to the related parties, considering the interest of various stakeholders involved, a bit stringent provisions should be incorporated like approval of any other authority apart from shareholders.

Add comment