Recently, JK Paper Limited announced an internal restructuring which will enable the group to consolidate its paper products operations along with reorganisation of reserves.

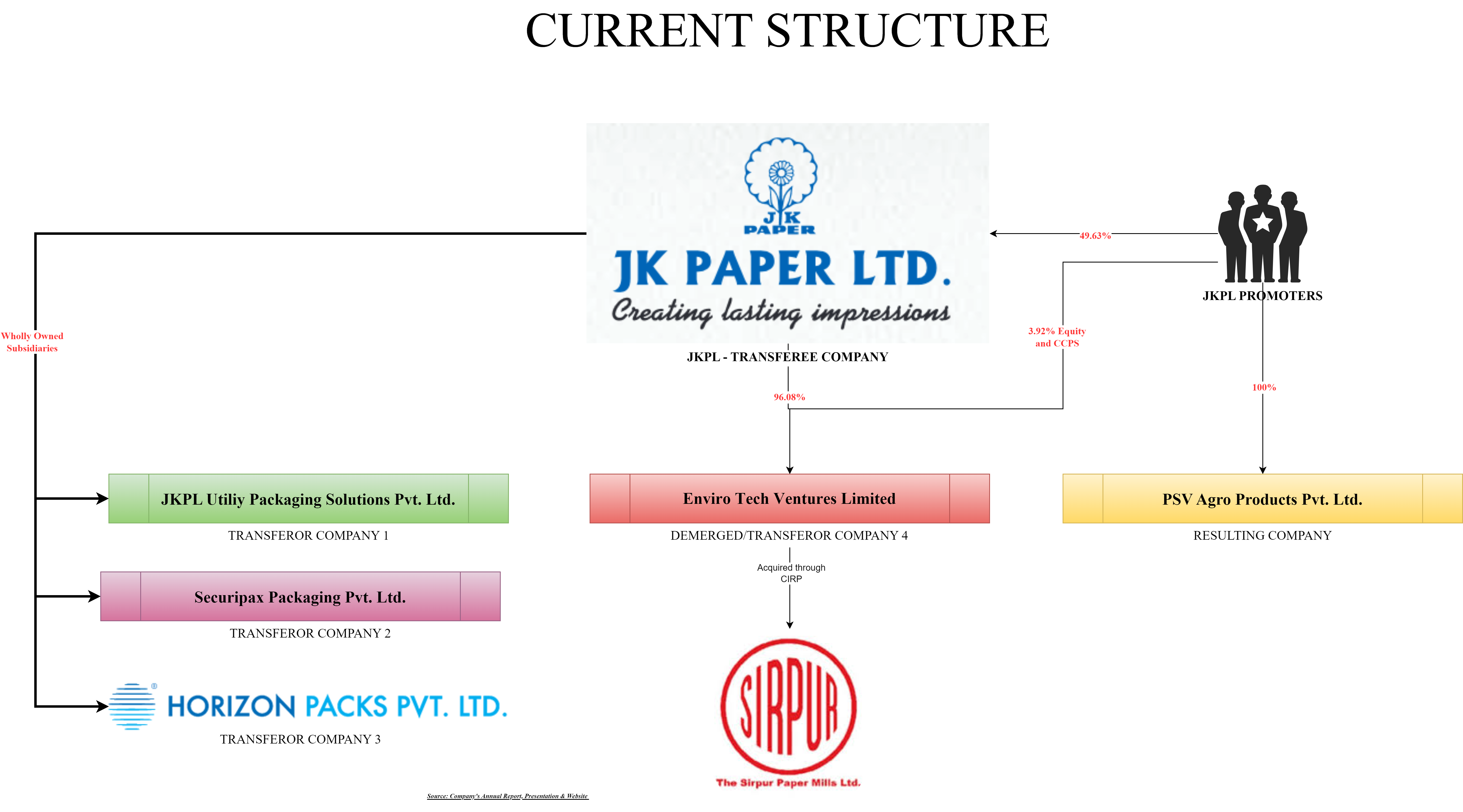

JK Paper Limited (‘Transferee Company”) is engaged in the business of manufacturing and distribution of a wide range of paper products, including office paper, writing & printing, packaging boards, coated paper, specialty paper and other paper related products. The registered office of the Transferee Company is located in the state of Gujarat. The equity shares of the transferee company are listed on nationwide bourses.

JKPL Utility Packaging Solutions Private Limited (“Transferor Company 1”) is engaged in the business of manufacturing folding cartons’ Corrugated boxes and labels and pre-press activities. The Transferor Company 1 is a wholly owned subsidiary of Transferee Company. Transferor Company 1 is under process to shift its registered office from the State of Karnataka to the State of Gujarat.

Securipax Packaging Private Limited (“Transferor Company 2″) is engaged in the business of manufacturing corrugated boxes, corrugated sheet, and other packaging related work. The Transferor Company 2 is a wholly owned subsidiary of Transferee Company. Transferor Company 2 is under process to shift its registered office from the State of Delhi to the State of Gujarat.

Horizon Packs Private Limited (“Transferor Company 3″) is engaged in the business of manufacturing corrugated boxes, corrugated sheet, and other packaging-related work. The Transferor Company 3 is a wholly owned subsidiary of the Transferee Company. The Transferor Company 3 is under process to shift its registered office from the state of Maharashtra to the state of Gujarat.

Enviro Tech Ventures Limited (“Demerged Company” or “Transferor Company 4”) engaged in the business of trading of all types of goods on wholesale basis in India or elsewhere. Transferor Company 4 is a subsidiary of Transferee Company with 96.08% of the equity shares being owned by Transferee Company and the remaining 3.92% of the equity shares being by Promoter Group of the Transferee Company. However, the Transferor Company 4/ demerged company has also issued compulsorily convertible preference shares to the promoter group of the transferee company. Upon conversion of the same, JK Paper will own 31.12% equity shares of the demerged company.

Enviro Tech Ventures Limited’s key asset includes investment in equity shares (95.05%) of The Shirpur Paper Mills Limited while the remaining stake is held directly by JK Paper Limited. JK Group acquired ownership of The Shirpur Paper Mills Limited in FY 2018-19 through Corporate Insolvency resolution plan. To acquire the requisite stake in The Shirpur Paper Mills Limited, JK Paper Limited infused circa INR 211 crore in Enviro Tech Ventures Limited through compulsorily redeemable preference shares. Some funds were also infused by the promoter group for partly paid-up compulsorily convertible preference shares.

PSV Agro Products Private Limited (“Resulting Company”) is established in 2017 but is currently not engaged in any of the business activity. The resulting company is changing its object clause to engaged in the business of trading all types of goods on a wholesale basis so as to match with the activities which will get demerged into it. Additionally, the Resulting Company is under process to shift its registered office from the State of Delhi to the State of Gujarat. Currently, the entire existing share capital of the resulting company is owned by the promoters of JK Paper Limited.

Effectively, all companies involved are pertains of JK Paper Limited or its promoters. Further, to reduce the approval process, all the companies are transferring their registered office to the state of Gujarat where the registered office of the Transferee Company is located.

The Proposed Transaction:

The board of Directors of various companies as mentioned above approved a composite scheme of arrangement (“Scheme”) which inter alia provides for:

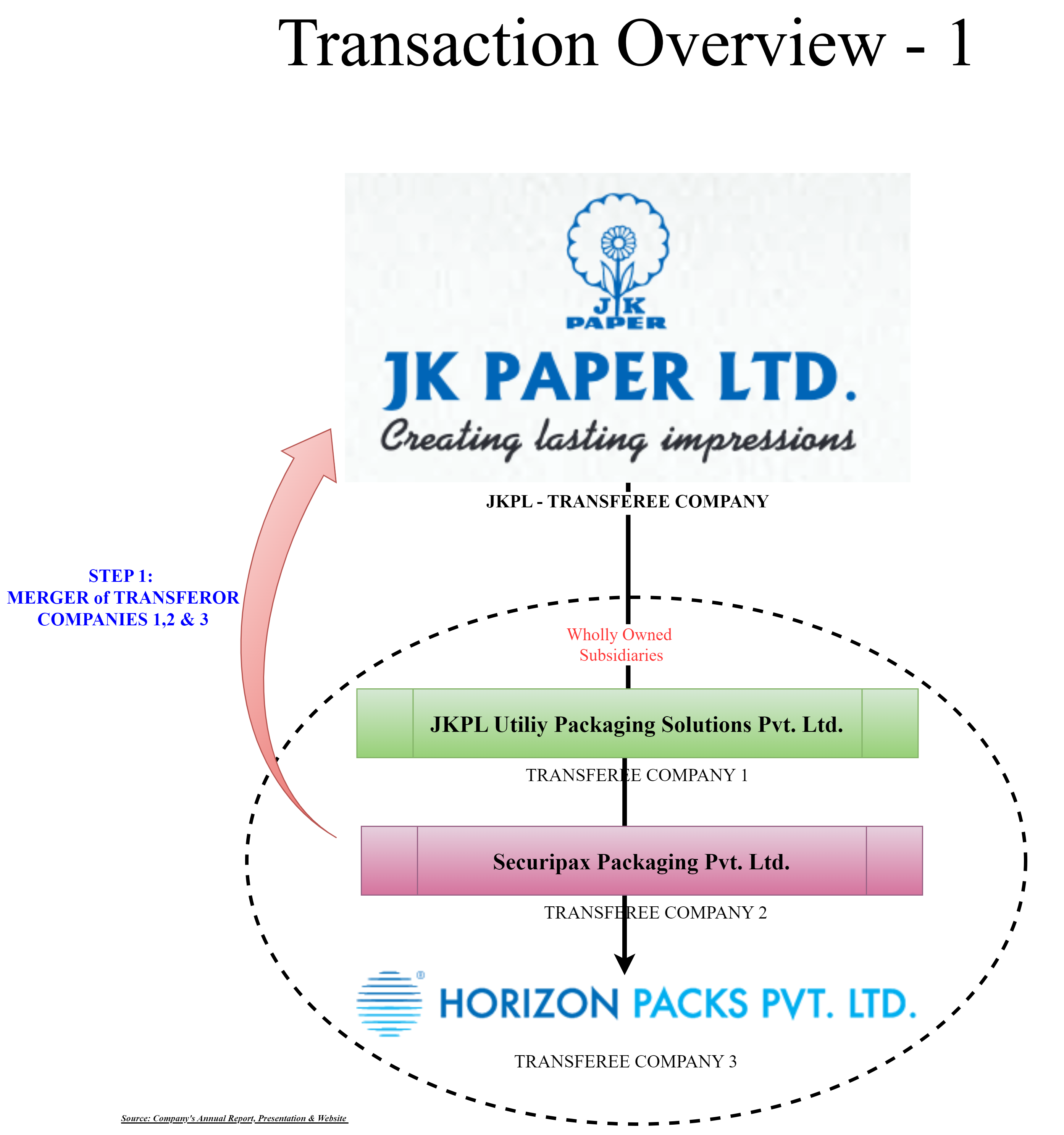

- Merger of JKPL Utility Packaging Solutions Private Limited, Securipax Packaging Private Limited, Horizon Packs Private Limited with and into JK Paper Limited;

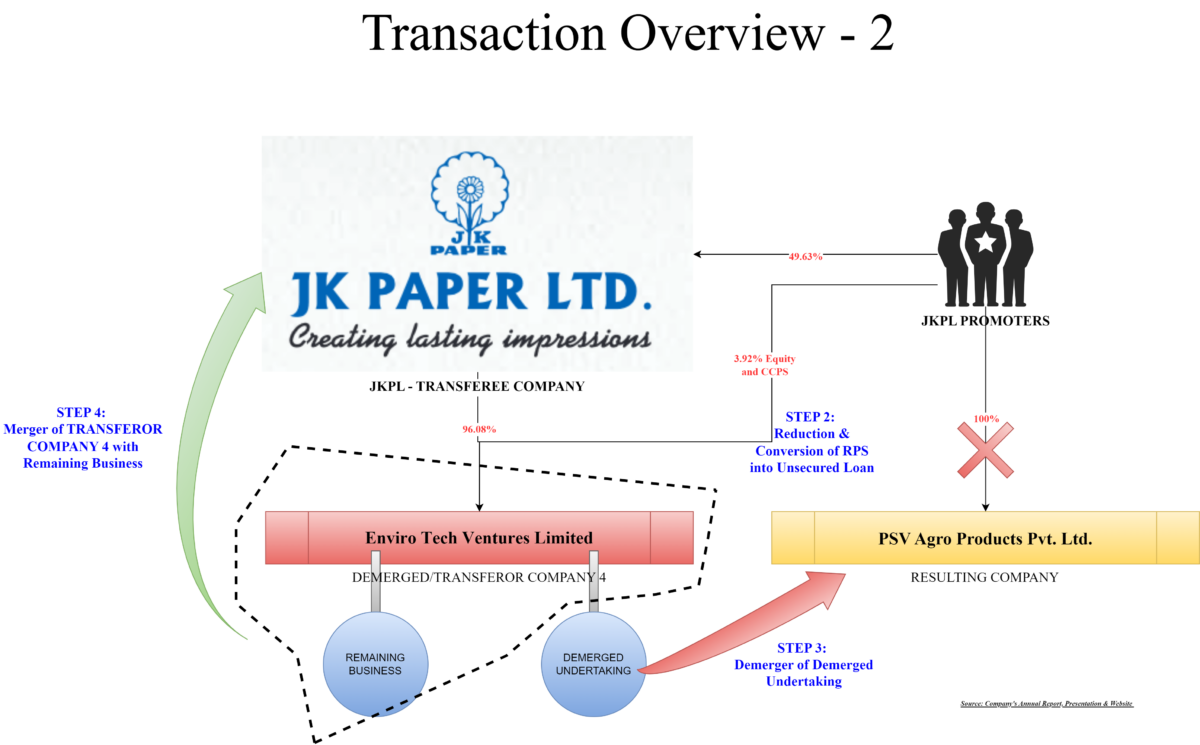

- Reduction and conversion of Redeemable Preference Shares of Enviro Tech Ventures Limited into unsecured loan;

- Demerger of Demerged Undertaking of Enviro Tech Ventures Limited into PSV Agro Products Private Limited

- Merger of Enviro Tech Ventures Limited with and into JK Paper Limited

- Re-organization of reserves of the Transferee Company post effectiveness of scheme.

As mentioned in the scheme, the proposed scheme will be given effect in chronological order as mentioned above. The proposed scheme shall have two appointed dates, one being 1st April 2024 for the merger of Transferor Company 1,2 and 3 & other being 1st April 2025 for all remaining transactions.

Rationale for the proposed scheme:

- Transferor Company 1, Transferor Company 2, Transferor Company 3', and the Transferee Company are engaged in similar line of business and the Board of the respective companies has decided to consolidate all packaging business manufacturing and trading entities under the Transferee Company.

- The reduction and conversion of Redeemable Preference Shares (RPS) in the manner proposed in the Scheme would enable the Transferee Company to reflect the true nature of investment in the Transferor Company 4 i.e., as a liability, and thereby, facilitate the demerger from the Transferor Company 4.

- The RPS issued by Transferor Company 4 (or the Demerged Company) shall be converted into an unsecured loan. Furthermore, as Transferor Company 4 is merging with the Transferee Company, such unsecured loan, previously arising from the conversion of the RPS, shall stand cancelled without any further act, deed, or instrument;

- Demerger shall allow the Demerged Company to merge the residual business (related to paper and packaging business) with the Transferee Company.

- The scheme proposes to set off the debit balance of the credit reserve arising out of the effectiveness of the scheme as on the Appointed Date against the existing credit balance lying under the Transferee Company, in order to right-size the balance sheet.

Reduction of the Redeemable Preference Shares by way of conversion into Loan

The scheme provides for reduction of 2,11,00,000 Redeemable preference Shares which comprises of RPS of 1,00,00,000 having a face value of Rs 100 each and RPS of 1,11,00,000 having a face value of Rs. 100, held by the Transferee Company in the Transferor Company 4 shall get cancelled and be converted into:

- RPS of 1,11,00,000 having face value of Rs. 100 shall be recorded as an outstanding unsecured loan amounting to Rs. 1,11,00,00,000

- RPS of 1,00,00,000 having a face value of Rs.100 shall be recorded as an outstanding unsecured loan at an equivalent net present value of the redemption amount

As mentioned in the scheme, the same shall amount to the reduction of the share capital. Further, the demerged company has miniscule “accumulated profits” thus, there will not be any “Deemed dividend” in the hands of preference shareholders on grounds of reduction of preference shares. One may ponder whether the same will be taxable as “Deemed dividend” or “Capital gains.”

As entire RPS are held by the Transferee Company & Transferor Company 4 is anyways getting merged with the Transferee Company, the key question arises is what is the need to convert the preference shares into loans? One of the reasons could be the demerger of business undertaking of the Transferor Company 4 into the Resulting Company prior to its merger. Considering the provisions of Section 2(19AA), it becomes paramount for the resulting company to issue RPS to the Transferee Company if to have tax neutral demerger which will be just book entry not backed by any assets and in fact Transferor Company 4 is going to be merged and dissolved after conversion/demerger. Due to conversion into loan, no shares are required to be issued, and the entire investment will get cancelled after the merger.

Demerger

Considering the financial statements of the demerged company for the financial year 2023-24, the significant asset of the demerged company is its investment in subsidiary “The Sirpur Paper Mills Limited” which is engaged in the paper products business. As mentioned in the valuation report, the same will not be part of the demerged undertaking and effectively will become direct subsidiary of JK Paper Limited post-merger of the demerged company/the transferor company 4.

Thus, the key trading business is likely to include other assets such as investments in preference shares and mutual funds along with the trading business. Please note that a significant portion of its trading revenue comes from trading of goods with “JK Paper Limited.”

Reduction of existing paid-up shares of the Resulting Company

The scheme further provides that with effect from the Appointed Date 2 and immediately prior to issuance of shares to the shareholders of the Demerged Company, the existing share capital of the Resulting Company shall stand cancelled for a consideration equal to the net asset value as on the Appointed Date 2 to the existing shareholders subject to availability of cash and bank balance. Effectively, entire share capital of the Resulting Company as held by JK Paper Limited promoters shall stand cancelled.

Consideration for the demerger:

To Equity Shareholders:

"1 fully paid equity share of Rs. 10 each of Resulting Company, for every 1 equity share of Rs. 10 each held in the Demerged Company"

To Compulsorily Convertible Preference Shareholders:

- "2,50,00,000 fully paid equity shares of Rs. 10 each of Resulting Company, for every 30,00,000 fully paid Series 1 Compulsorily Convertible Preference share of Rs. 100 each held in the Demerged Company.

- 83,33,333 fully paid equity shares of Rs. 10 each of Resulting Company, for every 10,00,000 fully paid Series 2 Compulsorily Convertible Preference Share of Rs. 100 each held in the Demerged Company

- 1,70,57,692 fully paid equity shares of Rs. 10 each of Resulting Company, for every 23,00,0O0 fully paid Series 3 Compulsorily Convertible Preference Share of Rs. 100 each held in the Demerged Company

Effectively, JK Paper will own circa 31.12% of the diluted equity stake after demerger.

Consideration for Merger:

To Equity Shares:

"2,635 fully paid equity shares of Rs. 10 each of Transferee Company, for every 10,000 equities share of Rs. 10 each held in the Transferor Company 4"

To Compulsorily Convertible Preference Shareholders:

- 21,958 fully paid equity shares of Rs. 10 each of Transferee Company, for every 10,000 Series l Compulsorily Convertible Preference Share of Rs. 100 each held in the Transferor Company 4

- 21,958 fully paid equity shares of Rs. 10 each of Transferee Company, for every 10,000 Series 2 Compulsorily Convertible Preference Share of Rs. 100 each held in the Transferor Company 4.

- 12,568 fully paid equity shares of Rs. 10 each of Transferee Company, for every 10,000 Series 3 Compulsorily Convertible Preference Share of Rs. 100 each held in the Transferor Company 4

Pursuant to the scheme, the shareholding pattern of JK Paper Limited will be:

| Particulars% | Pre-Transaction% | Post Transaction% |

| Total equity shares including compulsorily convertible preference shares | 16,94,02,344 | 18,13,18,771 |

| Promoter stake | 49.63% | 52.94% |

Reorganisation of reserves

Scheme also provides that any capital reserve recorded by the Transferee Company pursuant to this Scheme as of the Appointed Date 1 and Appointed Date 2 shall be adjusted in the following sequence: first, against the existing credit balance (if any) of Capital Reserve; any remaining surplus shall then be adjusted against the Capital Redemption Reserve; any further surplus shall be adjusted against Debenture Redemption Reserve; any further surplus shall be adjusted against any reserve other than the Free Reserve; any further surplus shall be adjusted against Securities Premium Account and any balance left thereafter shall finally be adjusted against the Free Reserves of the Transferee Company as of the Appointed Date 2.

As in most of the companies mentioned above, the investment in the books of JK Paper Limited is higher than the net worth of these companies, there is a likelihood for negative capital reserve arising pursuant to the transaction which shall get set off in above mentioned sequence.

Scheme Cost

The scheme provides that all costs, charges, taxes including duties, levies, stamp duty, transfer premium for leasehold lands, and all other expenses if any (save as expressly otherwise agreed) in relation to the Scheme shall be borne by the Transferee Company. Thus, even for the demerger, the entire charges will be borne by the Transferee Company.

Conclusion

The proposed scheme provides for consolidation of related businesses carried by JK Paper Limited through its subsidiaries. However, what makes the proposed restructuring interesting is some of its parts like conversion of redeemable preference shares prior to its consolidation and demerger. The key reason for conversion before demerger & merger could be regulatory/accounting. Further, the demerger is likely to be executed mainly to carve out the surplus assets (investment) which management does not wish to consolidate with JK Paper Limited.