SONA KOYO STEERING SYSTEMS LIMITED (SKSS) is a manufacturer of steering systems in the passenger car and utility vehicle market in India, catering to passenger cars, utility vehicles and light commercial vehicles. SKSS has operations across India through its 7 plants (2 plants in Gurgaon, 3 plants in Dharuhera, 1 plant in Chennai and 1 in Sanand). The customers of the SKSSL include Maruti Suzuki and several global automakers, including Toyota, Tata Motors, Mahindra & Mahindra, Honda, Renault Nissan and Ford. The Equity Shares of the SKSS are listed on the BSE and NSE. Currently, the company is also engaged in business of column type electric power steering through joint venture with JTEKT and business of JKT for column type EPS, Manual Steering through joint Venture with Fuji Kiko.

JTEKT Corporation (JTEKT) is a limited liability listed company under the laws of Japan. The company focuses on four major product technologies: bearings, steering systems, driveline components and machine tools. JTEKT Corporation is holding company of SKSS. JTEKT has a joint venture, JSAI (JTEKT Sona Automotive India Limited) with the SKSS wherein the JTEKT holds 51% stake with a business objective of manufacturing column type electric power steering (C-EPS) systems. JTEKT has several technology license/sharing arrangements with SKSS in the past and the JTEKT continues to have technology license/sharing arrangements with SKSS.

EARLIER TRANSACTION

Japan’s JTEKT corporation acquired 25.12% per cent stake by execution of Share Purchase Agreement dated February 1, 2017 after this through open offer acquired additional 25.23% stake. Post-acquisition from Sona Autocomp Holdings Limited and open offer the JTEKT holding in SKSS becomes 70.45%., the promoters holding is 77.44% including Maruti Suzuki’s stake of 6.99%.

With the Acquisition JTEKT has taken full control from Sona Group (Indian partner). The company is in process of name change from Sona Koyo Steering Systems Limited to JTEKT India Limited and there is also some restriction on Brand usage and non-compete agreement with SONA Group. Sona Group will now focus on forging business for its growth

TRANSACTION

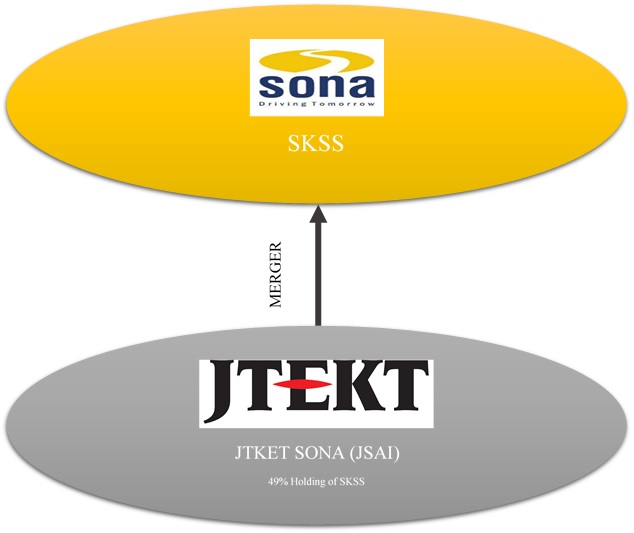

JTEKT Sona Automotive India Limited (hereinafter known as JTEKT Sona) is 49% subsidiary of SKSS and 51% is held by JTEKT, Japan. JTEKT wants to consolidate its joint venture with the company through the scheme of amalgamation from appointed date 1st April 2018 with swap ratio as 1,582 equity shares to be allotted by SKSS for every 1000 Equity shares to shareholders of JTEKT Sona (i.e, other than SKSS).

Please note: JTEKT Technology agreement will continue with SKSS

RATIONALE

- Proposed consolidation will simplify the structure.

- Consolidation will led to forward integration, as SKSS is primarily engaged in making manual steering systems which is in turn an input for electrical steering system manufactured by JTEKT Sona.

- Larger Assets base and facilities access to better financial resources. (Bangalore and Bawal production facilities)

- The cash flow generated by joint venture will now be available to SKSS.

FINANCIAL

The amalgamation of JTEKT Sona with SKSS will have positive impact on the financial of SKSS with improved PAT Margin, EPS, higher book value and Lower Debt Equity Ratio

Table 1: Financials Pre and Post Merger.

| Particulars | Post-Merger | Pre-Merger |

| 2018 (Rs in Lakhs)* | 2018 (Rs in Lakhs)* | |

| Revenue | 1,75,137 | 1,18,907 |

| PAT | 4,865 | 2,186 |

| PAT Margin | 2.78% | 1.84% |

| Number of Shares of Rs 1 each | 2,445 | 1,987 |

| EPS | 1.99 | 1.10 |

| Net worth | 53,235 | 30,310 |

| Debt | 22,235 | 21,544 |

| Debt Equity Ratio | 0.42 | 0.71 |

| Book Value Per share | 21.77 | 15.25 |

* FY 2018 annualized Figures.

VALUATION

Since SKSS being listed company market approach method is followed and whereas value for JTEKT Sona has been arrived based on simple average of market approach and Income Approach method. SKSS and JTEKT Sona has been valued at Rs. 2187 crores (Rs. 110.1 per share) and 987 crores (Rs.174.1 per share). We have worked approx. value created for JTEKT from the date of incorporation (i.e. 2007) investment in JTEKT Sona by Promoters vis a vis valuation on merger.

Table 2: Valuation of SKSS and JTEKT

| Particulars | No. of Share | Investment Amt (Rs in Lakhs) | As per Valuation report for merger (Rs. In Lakhs) |

| By SKSS for 49% Stake | 2,77,78,094 | 2,778 | 48,363 |

| by JTEKT for 51% Stake | 2,89,11,906 | 2,891 | 50,337 |

| Total | 5,66,90,000 | 5,669 | 98,700 |

Please note: Other than above JTEKT has been benefited for Technical fees and in form of dividend.

PRE- AMALGAMATION SHAREHOLDING

Table 3: Shareholding Pattern Pre-Transaction

| Particulars | SKSS | JTEKT Sona | |||

| No, of shares | %age | No, of shares | %age | ||

| Promoters holding | 15,38,12,741 | 77.39% | 2,89,11,896 | 51.00% | |

| SKSS | 0.00% | 2,77,78,096 | 49.00% | ||

| Public | 4,49,29,091 | 22.61% | – | 0.00% | |

| Total | 19,87,41,832 | 100.00% | 5,66,89,992 | 100.00% | |

Please Note: Post open offer there is some sale by Maruti Suzkui will has led to decreased in promoter’s shareholding from 77.44% to 77.39%

POST AMALGAMATION SHAREHOLDING

Table 4: Shareholding Pattern Post Transaction

| Particulars | SKSS | Allotment on Merger | Post Merger | ||

| No. of shares | %age | JTEKT Sona | No. of shares | %age | |

| Promoters Holding | 15,38,12,741 | 77.39% | 4,57,38,619 | 19,95,51,360 | 81.62% |

| Public | 4,49,29,091 | 22.61% | – | 4,49,29,091 | 18.38% |

| Total | 19,87,41,832 | 100.0% | 4,57,38,619 | 24,44,80,451 | 100.00% |

Please Note: To comply with minimum public shareholding Promoters has to reduced shareholding below 75%.

RECENT INVESTMENT BY JTEKT AND SALE IN SKSS

| Sr. No | Particulars | Figure | Stake |

| Before Control from Sona group | |||

| 1 | Investment in No. of Share of SKSS before Acquisition from Sona Group | 3,99,47,108 | |

| 2 | Investment by JTEKT (Approx.) | 18,06,29,473 | 20.10% |

| Recent Investment for Control from Sona Group | |||

| 1 | Acquired from Sona Autocomp Holding ltd. (No. of Share) | 4,99,14,664 | 25.12% |

| 2 | Acquired from Public through Open Offer (No. of Share) | 5,01,50,969 | 25.23% |

| 3 | No. of Share acquired recently | 10,00,65,633 | |

| 4 | Price for Acquisition | 84 | |

| 5 | Recent Investment | 8,40,55,13,172 | 50.35% |

| Grand total (2+5) | 8,58,61,42,645 | 70.45% | |

Recent industry trend being Japanese companies are actively participating in India Growth story of Make in India. JTEKT recently acquired majority control with total cash outflow of Rs. 840 crores. However, to comply with legal compliance (i.e. open offer post majority acquisition) and positive response for the same led to promoter’s stake increased above 75%. Again, to comply with regulation i.e. minimum 25% public shareholding and no intention of delisting, JTEKT corporation has offered 47,56,367 equity shares constituting 2.39% of the pre-amalgamation total paid-up share capital to the public shareholders i.e. retail and non-retail category on 19th March and 20th March respectively at an offer price of Rs. 102 per share. So, the Cash inflow from shares offered for sale is approx. Rs.49 crores. The additional stake of promoter’s due to merger above 75% will be 4.68% will be liquidated going forward by the promoters approx. value Rs. 115 crores. So, the promoter is liquidating stake above minimum requirement to offset its recent investment.

CONCLUSION

The restructuring phase for the company continues, first control shifts to JTEKT with exit given to Indian joint venture partner. With this structuring, JTEKT is consolidating business related to steering into one listed entity except for joint venture with Fuji Koki. The management does not have delisting strategy as promoters offloaded shares through open offer in the secondary market and more to come to achieve minimum public shareholding and offset their recent investment. As an integrated plant and facilities, it will have positive impact on financial of SKSS with improved margin, more cash flow available to company, improvement in debt-equity ratio and no dilution for expansion will create value for the minority shareholders.