Kaya Limited was formed pursuant to the demerger of Kaya Skin Care business from Marico kaya Enterprises Limited to Kaya Limited. As a result of the demerger, Kaya became an independent company and listed on nationwide bourses. In the near future, Kaya will mark its 10th anniversary of becoming independent entity. In this article, we have tried to analyse the journey of Kaya post its listing.

Kaya Limited (“Kaya”) has a 20-year-old legacy brand and leading innovation in the aesthetic dermatology space with its 600+ service lines; 75+ product mix; 100+ dermatologists and a commanding presence across 70+ clinics in India. Kaya has a comprehensive portfolio of advanced skincare, hair care and body care solutions spanning anti-ageing, Brightening and pigmentation, Acne and Scars, Hair Care, Beauty Facials, Body Contouring and Laser hair reduction amongst others. The equity shares of Kaya are listed on nationwide bourses.

The start after demerger

Kaya Business principally comprises the provision of skin care services and products under the brand name of Kaya in India and Middle East. At time of the demerger (2015) Kaya was having total of 119 clinics (19 in the Middle East) with a presence in 35 cities with 50+ product range. During the demerger, Marico also transferred circa INR 180 crore of surplus cash to Kaya for scaling the operations.

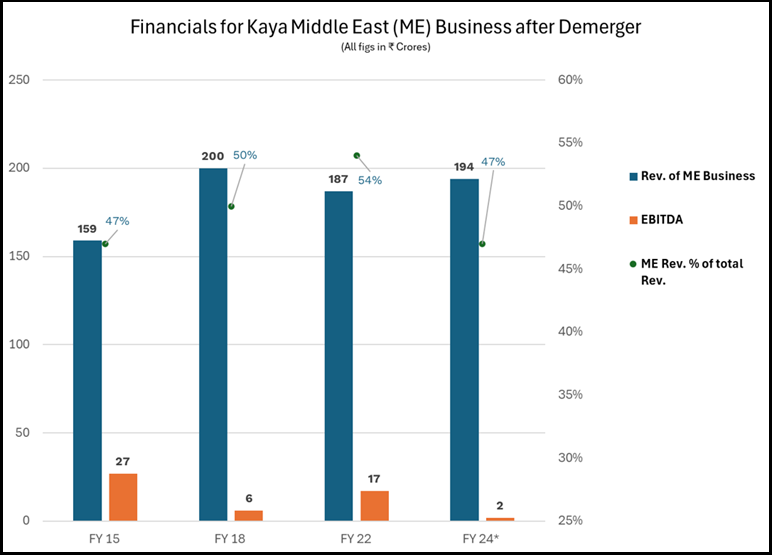

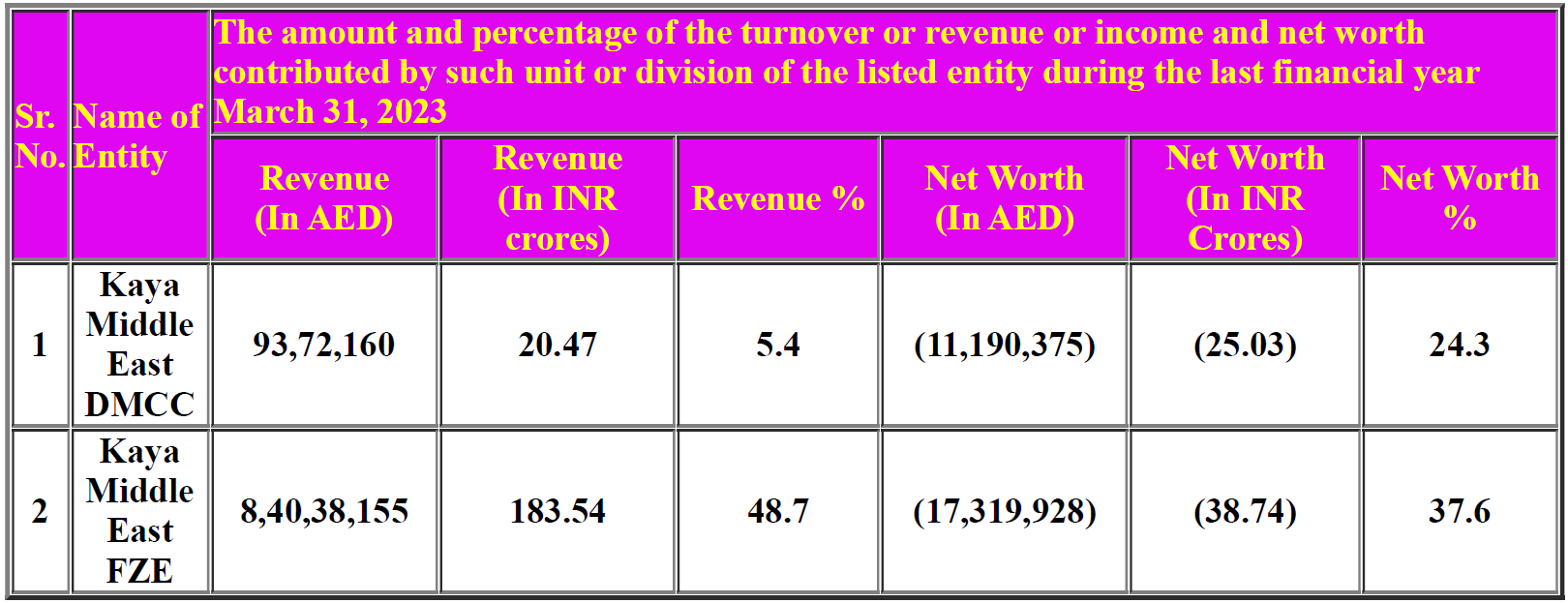

Obviously, Middle East market was cash cow for the company and was generating much better returns than the Indian market. Kaya’s Middle East region presence (United Arab Emirates, Sultanate of Oman and Kingdom of Saudi Arabia) (“Middle East Business”) was through its direct and step-down subsidiaries, viz., Kaya Middle East DMCC (“Kaya DMCC”) and Kaya Middle East FZE (“Kaya FZE”) (Kaya DMCC & Kaya FZE are collectively hereinafter referred to as “Kaya GCC Entities”

Kaya focused on a couple of acquisitions in Middle East. In 2017, it acquired a reputed chain of two clinics in Dubai, and Sharjah: Dr. Minal Clinic and Dr. Minal Medical Centre.

*: after adjusting one time impact of circa 15 crore for cost related to the sale of business.There were continuous efforts from Kaya to increase the revenue & profitability for Middle East market. Post acquisitions it also introduced new technologies, products, branding and revamping. However, due to the high cyclicality of the markets, Kaya was not able to expand its wing in a meaningful and accretive manner. Finally, after trying all things, Kaya decided to exit its Middle East business.

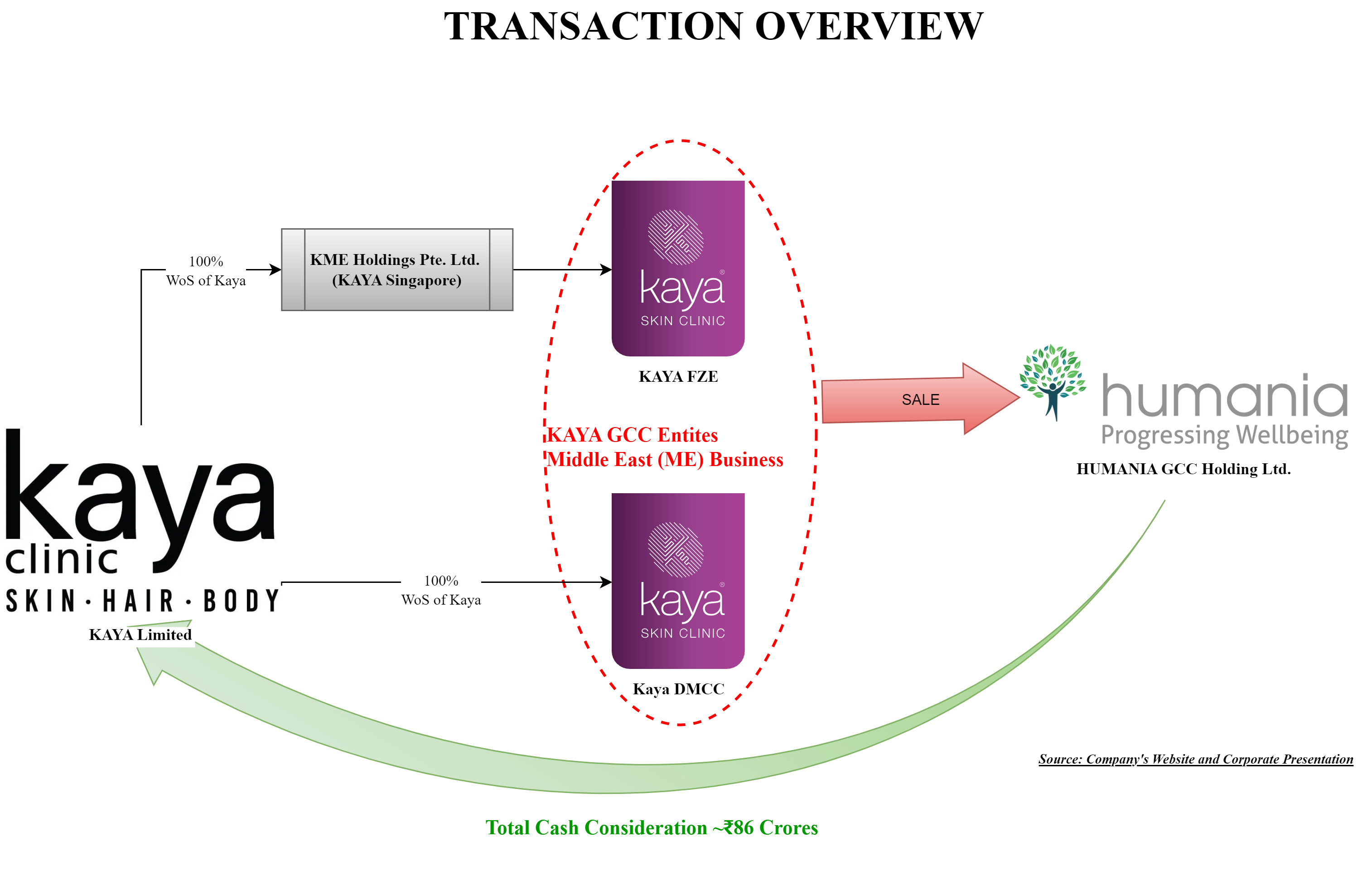

The Board of Directors of Kaya at its meeting held on March 27, 2024, decided to retain its focus on the Indian market where the Company has seen continuous and strong growth in its revenues. In pursuant to this the board decided to divest the Kaya DMCC & Kaya FZE collectively referred to as “Kaya GCC Entities” and the Middle East Business carried through its direct and step-down subsidiaries.,).

Accordingly:

The Company has entered into definitive agreements to:

- sell its entire shareholding in Kaya DMCC to Humania GCC Holding Limited (“Buyer”); and

- assign and transfer to the Buyer in perpetuity its rights to trademarks bearing Kaya name in the United Arab Emirates, Kingdom of Saudi Arabia, Bahrain, Kuwait, Sultanate of Oman, Qatar, Egypt, Morocco, and Iraq.

- KME Holdings Pte. Ltd. (“Kaya Singapore”), a wholly owned material subsidiary of Company Kaya has also entered into definitive agreements to sell its entire shareholding in Kaya FZE to the Buyer.

Consideration:

In relation to Kaya FZE: AED 30.7 million (~INR 68.6 Crores) subject to customary adjustments for actual debt, actual working capital, gratuity payments to employees of the businesses being transferred and transaction-related expenses and payables. In relation to Kaya DMCC: AED 2.3 million (~INR 5.1 Crores) subject to customary adjustments for actual debt, actual working capital, gratuity payments to employees of the businesses being transferred and transaction-related expenses and payables. The Company shall receive AED 5.5 million (~INR 12.5 Crores) from the Buyer in respect of the sale of its trademarks in the Middle East region.

In all the total consideration was circa INR 86 crore for divesting almost 50% of the revenues.

Collaboration with Marico

Immediately after exit of the GCC business, Kaya announced that it would collaborate, with Marico exclusively to handle sales and marketing of Kaya’s range of 75+ efficacious science-based personal care products outside of Kaya’s clinics. This collaboration will leverage the established expertise and capabilities of both companies and unlock the untapped growth potential of the brand by enhancing its presence and accessibility across markets and channels.

Financials

INR in Crore

| Particulars | 2015 | 2018 | 2022 | 2024 |

| Revenue | 332 | 400 | 323 | 404 |

| Core EBITDA | 33 | -3.32 | -2 | -42 |

| % | 9.9% | -0.8% | -0.6% | -10.4% |

| Core EBIT | 22 | -27.32 | -64 | -105 |

| Profit After Tax | 32 | -19.8 | -68 | -130 |

| Cash Profit After tax | 43.5 | 4.2 | -6 | -67 |

| Networth | 235 | 212 | -1.1 | -226 |

| Investments | 182 | 40 | 30 | 45 |

| Borrowings | 0 | 0 | 85 | 178 |

| Core Capital Employed | 53 | 172 | 54 | NA |

| Fixed Assets& | 56 | 96 | 40 | 59 |

| Return on Capital Employed | 40.6% | -15.9% | NA | NA |

| Products | 50 | 70 | 60 | 70 |

| Clinics | 119 | 100 | 94 | 74 |

Market price since listing

Conclusion

Kaya was demerged from Marico to facilitate the creation of a listed entity focused on customized personal care. Marico also gave surplus cash to Kaya during the demerger to take care of future growth. After almost 10 years of independence, Kaya is still struggling to create any mark.

Kaya tried many things to grow its business including acquisitions in the Middle East. It has not been able to generate free cash flow nor substantial revenue growth. It seems to being run with the blessings of its promoters.

This exit from the Middle East region, even though coming after almost a decade of its independence, could become a welcome move. Kaya also announced a strategic tie-up with Marico for marketing & networking for its products. It has also started revamping its clinics in a big way. Well, it seems better to be late than never. and hope that in the changed Avtar, the management will be able to turn around and scale up the business.