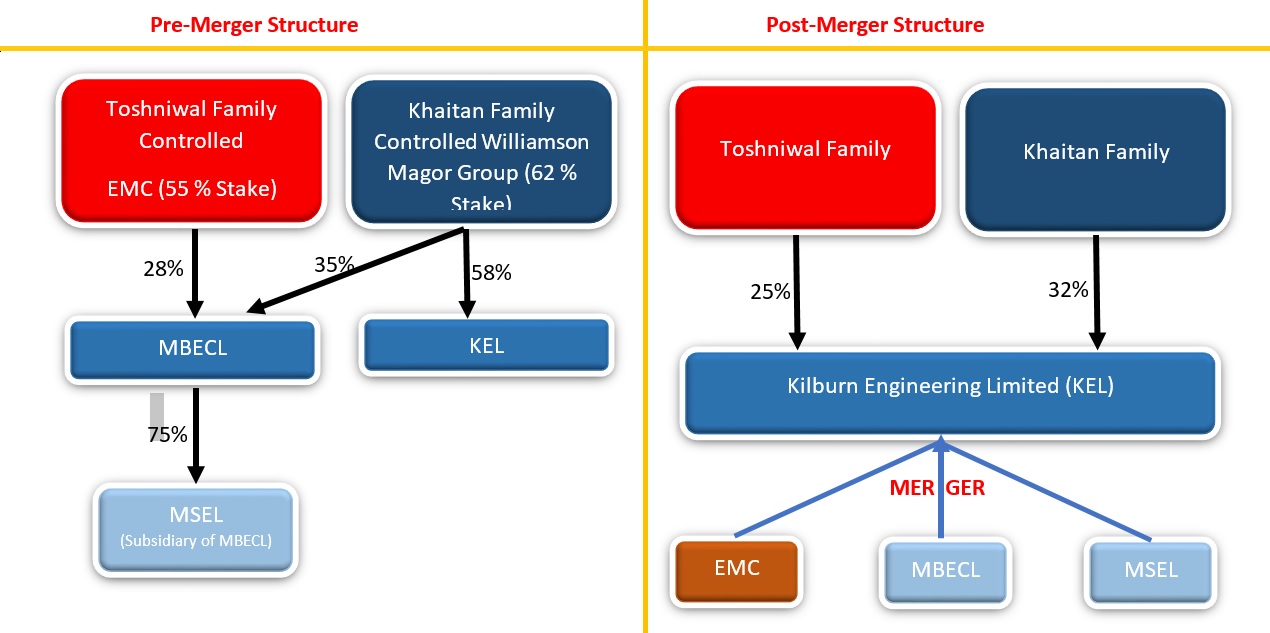

BM Khaitan-controlled Williamson Magor Group’s engineering arms and transmission tower maker EMC Ltd are being merged to create a giant engineering joint venture with a turnover of Rs 6,000-7,000 crore. While EMC is controlled by Manoj Toshniwal, Williamson Magor group owns McNally Bharat Engineering Company Limited (MBECL), McNally Sayaji Engineering Limited (MSEL) and Kilburn Engineering Limited (KEL). The merged entity will be jointly run by the Khaitans and Toshniwals.

The aim of the consolidation is to create a leader in the engineering, procurement, and construction. Both the Groups can collectively capitalise on the huge business opportunity in the engineering field and provide an integral engineering and construction solution to its customers.

Earlier in June 2015, BM Khaitan group has sold its majority control in capital goods maker McNally Bharat Engineering to a fast-growing transmission tower maker EMC Ltd in a bid to turn around the fortunes of the company suffering due to difficult economic environment and high debt burden.

Kilburn Engineering is considered as the holding company primarily because it does not have any cross holdings. Appointment date of Merger is Jan 1st, 2015. Upon the scheme being effective, the name of the transferee company will be changed from Kilburn engineering to McNally Bharat Engineering.

TRANSACTION STRUCTURE AND BACKGROUND

BOARD APPROVAL

The Board of Directors of McNally Bharat Engineering Company Limited (“McNally Bharat“), at its meeting held on March 31, 2016, has considered and approved a scheme of amalgamation amongst EMC Limited (“EMC”), McNally Bharat, McNally Sayaji Engineering Limited (“McNally Sayaji”) and Kilburn Engineering Limited (“Kilburn“) and their respective shareholders in terms of Sections 391-394 of the Companies Act, 1956 and other applicable provisions, if any, of the Companies Act, 1956 and Companies Act, 2013 (“Scheme”).

The merged entity with a consolidated turnover of around Rs 6500 Crores will also become a complete solution provider for power plants as well as power transmission units, material handling, and specialised drying equipment.

Post amalgamation, conversion of ICDs of Kilburn amounting to Rs 400Mn into equity shares of Kilburn at fair value per share.

Transferor Companies:

McNally Bharat (MBECL): Engaged in the business of providing turnkey solutions in the areas of power, steel aluminium, material handling, mineral beneficiation, pyro-processing.

McNally Sayaji (MSEL): Subsidiary of McNally Bharat, is engaged in the business of manufacture of crushing, screening, grinding, material handling and mineral processing equipment.

EMC: EMC is controlled by the Toshniwal family and is engaged in the business of manufacture of towers, hardware, and conductor suitable for EPC projects. It also provides transmission, distribution, solutions for Power Transmission EPC projects.

Transferee Company:

Kilburn Engineering (KEL): Engaged in the business of manufacturing of different types of dryers and focuses on designing, manufacturing, and commissioning customized equipment/systems for critical application in several industrial sectors.

RATIONALE FOR MERGER

- To have focused business approach

- Capitalise on the large business opportunity in the engineering field

- Provide an integral engineering and construction solution to customers.

- Financial resources being efficiently merged and pooled leading to more effective and centralised management of funds

- Greater economies of scale & stronger base for future growth

- Reduction of administrative overheads (i.e. cost rationalization)

- Operational Synergies across businesses shall lead to enhancement of net worth of the combined business and reflection of true net worth in the financial statements

- Improved alignment of debt and enhancement in earnings and cash flow.

- Facilitate debt consolidation which will improve the debt servicing abilities through improved cash flows.

FINANCIAL DETAILS – As on March 2015 (INR in Crores)

| Size | Turnover | ||

| Particulars | As on 31st March 2015 | As on 31st March 2015 | |

| Total Assets | Net worth | ||

| Transferee Company | |||

| Kilburn | 208.91 | 98.11 | 120.69 |

| Transferor Companies | |||

| EMC | 3,121.50 | 652.08 | 3,582.67 |

| McNally Bharat | 3,709.49 | 314.98* | 2,170.11 |

| McNally Sayaji | 503.97 | 165.83 | 206.42 |

*Including money received against share warrants.

CONSIDERATION AND SHARE EXCHANGE RATIO

The Share Exchange Ratio for the consideration to be paid under the Scheme has arrived at based on the valuation report prepared by M/s Sharp & Tannan, an Independent Chartered Accountant, submitted to the Audit Committee and presented to the Board at its meeting.

In consideration of the amalgamation of Transferor Companies into the Transferee Company, the Transferee Company shall issue and allot equity shares to the shareholders of the Transferor Companies in the following ratio (“Share Exchange Ratio“):

- 235 fully paid up equity shares of Rs. 10 each of Kilburn issued for every 100 fully paid up equity shares of Rs. 10 of EMC – (235:100)

- 293 fully paid up equity shares of Rs. 10 each of Kilburn issued for every 100 fully paid up equity shares of Rs. 10 to each member of McNally Sayaji (293: 100)

- 120 fully paid up equity shares of Rs. 10 each of Kilburn issued for every 100 fully paid up equity shares of Rs. 10 to each of McNally Bharat(120: 100)

- fully paid up 11.50% non-convertible redeemable preference shares of Rs. 100 each of Kilburn each issued for every 1 fully paid up 11.50% non-convertible redeemable preference shares of McNally Bharat(1:1)

- Post-Amalgamation, Inter Corporate Deposits of INR 40 crore given by present promoters of Kilburn will get converted into equity shares of Kilburn at fair value per share.

VALUATION

The share exchange ratio has been arrived on the basis of valuation report of Sharp & Tannan, an independent chartered accountant firm. Microsec Capital Limited has provided the fairness opinion.

| Company | Method Applied |

| MSEL | DCF Method |

| EMC | DCF Method |

| MBECL | DCF method and Market Price method |

| Kilburn | DCF method and Market Price method |

ACCOUNTING TREATMENT

- Transferee Company shall record all the assets (including intangible assets) and liabilities of the Transferor Company vested in it pursuant to the scheme at their respective fair values as per the Purchase method of accounting in accordance with AS 14.

- Intercompany loans, advances, deposits, investments as amongst the transferor and transferee companies will come to an end and the corresponding effect will be given to the books of accounts and records of the Transferee company as well as transferor companies for reduction of any asset or liability as the case may be and there would be no accrual of interest or any other charged in respect of intercompany loans, deposits from the appointment date.

- Excess of consideration i.e. fair value of New equity shares and New Preference shares issued over the fair value of Net Assets taken over and recorded will be recognized as Goodwill as per Accounting standard 14. In the event the result is negative, it shall be credited as Capital Reserve in the books of Account of Transferee Company.

CONCLUSION

The move to amalgamate EMC with the engineering arms of Williamson Magor group controlled by Khaitan Family will help the merged entity emerge as a total engineering solution provider to undertake projects of much larger size. Further synergies arising out of Consolidation will lead to enhancement of net worth, improved alignment of debt & enhancement in earnings and cash flow.

Khaitan family struggled to turn around the engineering business of MBECL and eventually had to rope in EMC as a strategic partner last year to manage the engineering business. Upon establishing a relation with Toshniwal’s (Through EMC), Khaitan’s decided to make Toshniwal’s their strategic partner in the entire engineering business. We believe that the restructuring is done in a way that post-merger, Khaitan Family will continue to be the largest shareholder of Kilburn and Toshniwal family will have stake just below 25% and likely to participate in the management and get some board seats.