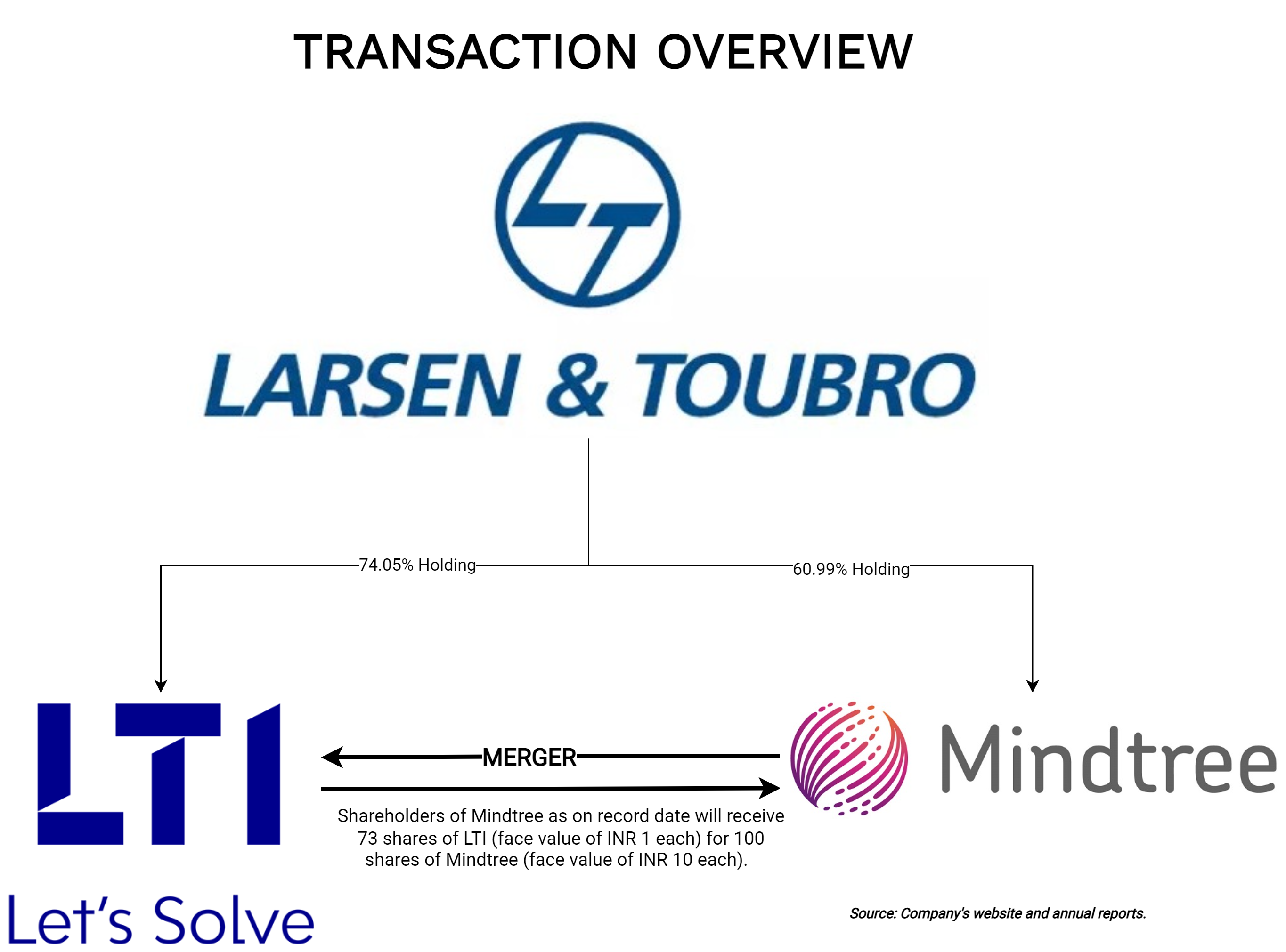

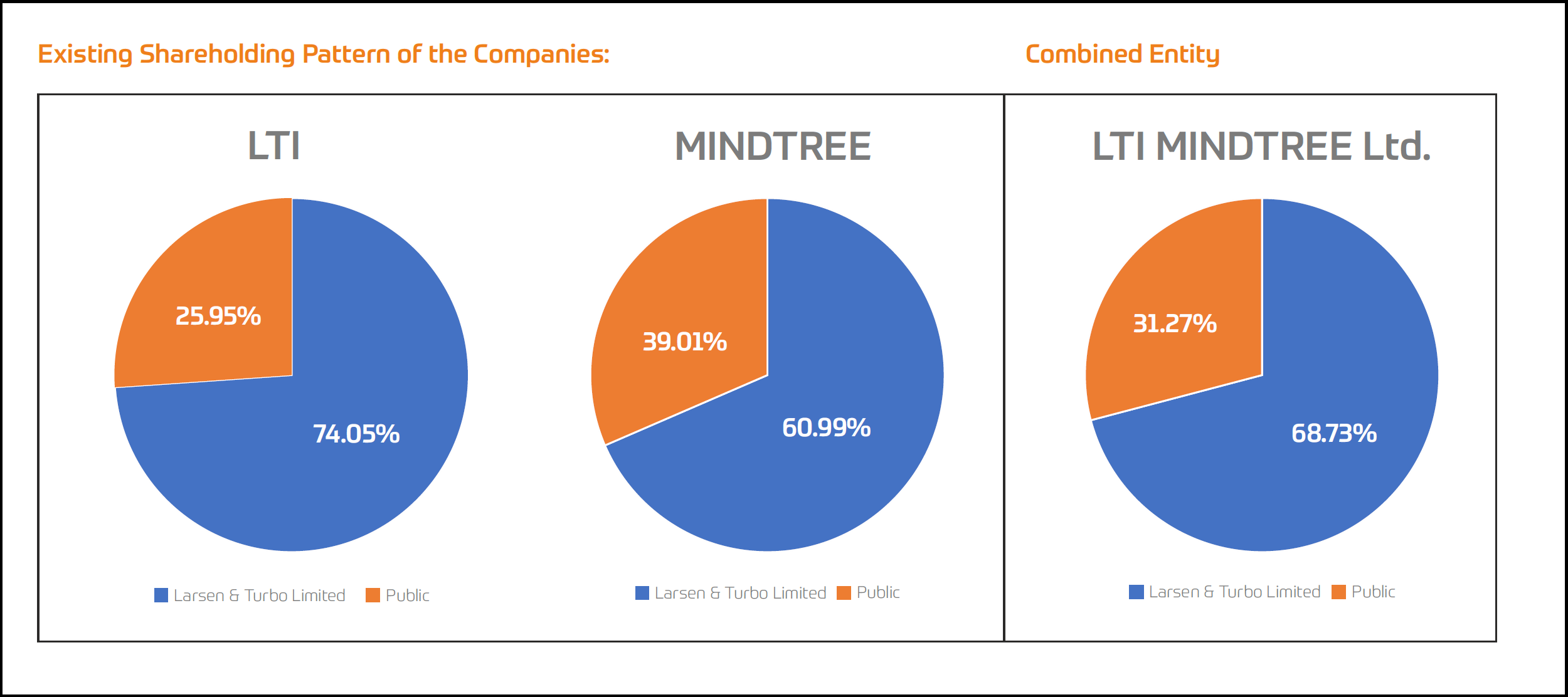

Larsen and Toubro Limited’s hostile acquisition of controlling stake in Mindtree Limited was nothing short of a roller coaster ride. In abide of miniscule promoter stake, Larsen and Toubro Limited successfully acquired a controlling stake (60.99%) in Mindtree Limited. After almost 3 years post-acquisition, Larsen and Toubro Limited announced the merger of Mindtree Limited with Larsen & Toubro Infotech Limited, one of its listed subsidiaries in the information technology business.

Larsen and Tubro Limited (L&T) is an Indian conglomerate engaged in EPC Projects, Hi-Tech Manufacturing and Services. As a part of Services; L&T’s IT & Technology Services being carried through its key listed subsidiaries:

- Larsen & Toubro Infotech Limited

- Larsen & Toubro Technology Services Limited

- Mindtree Limited

Larsen & Toubro Infotech Limited (LTI) is primarily engaged in information technology services. It offers application development, maintenance and outsourcing, enterprise solution, infrastructure management, testing, digital solution, and platform-based solution services. The registered office of the company is in the state of Maharashtra. The equity shares of LTI are listed on BSE Limited and National Stock Exchange of India Limited. Larsen & Toubro Limited holds a 74.05% stake in LTI.

Mindtree Limited (Mindtree) is also primarily engaged in information technology services. It provides digital transformation and technology services in India and internationally. It offers services in the areas of agile, analytics and information management, application development and maintenance, business process management, business technology consulting, cloud, digital business, independent testing, infrastructure management services, mobility, product engineering, and SAP services. The registered office of the company is in the state of Karnataka. The equity shares of Mindtree are listed on BSE Limited and National Stock Exchange of India Limited. Larsen & Toubro Limited holds a 60.99% stake in Mindtree.

The Transaction

The Board of Directors of Larsen & Toubro Infotech Limited (LTI) & Mindtree Limited has approved a scheme of amalgamation (“Scheme”) for merger of Mindtree Limited into Larsen & Toubro Infotech Limited.

The Appointed Date for the merger is 1st April 2022 or such other date as may be mutually agreed by the Boards of the Companies and conveyed to the NCLT (National Company Law Tribunal).

Post-merger, the name of LTI will be changed to LTIMindtree Limited. Further, the scheme also mentions that both companies have constituted an advisory committee (Steering Committee) to plan the implementation of the proposed merger. The composition of the committee includes Key Managerial Person & directors of both companies. The Role & responsibilities of this committee are mentioned as Annexure to the scheme. The committee shall automatically dissolve upon effective date.

Immediately after the announcement, the Managing Director of LTI, Mr. Sanjay Jalona resigned. Debashis Chatterjee who is currently CEO & MD of Mindtree will be appointed as CEO & MD of the combined entity.

Swap Ratio

As per the swap ratio mentioned in the scheme, Shareholders of Mindtree as on record date will receive 73 shares of LTI (face value of INR 1 each) for 100 shares of Mindtree (face value of INR 10 each).

Paid-Up Capital of the Entities

| Particulars | LTI | Mindtree | Combined |

| No. of Shares | 17,52,70,156 | 164,833,772 | 29,55,98,809 |

| Face Value | 1 | 10 | 1 |

| Paid-Up Capital | 17,52,70,156 | 164,83,37,720 | 29,55,98,809 |

Despite being almost 50% bigger than Mindtree, Paid-up capital of LTI is significantly lower (roughly only 10%) than Mindtree.

Rationale of the Transaction

Consolidation of Information Technology Business & Strengthening Position

The merger will consolidate all the resources and thus, the combined entity will be 5th largest (Valuation-wise) IT company in India. This will place the combined entity is in a better place to compete with other Indian & international giants. Larsen & Toubro Limited systematically did the integrations and finally announced the merger which will streamline the information technology business structure for Larsen & Toubro Limited

Diversification of client base

The proposed merger will give the combined business the opportunity to consolidate its position in the banking, financial services, insurance (BFSI) vertical, enhance scale in high growth verticals like high-tech and consumer packaged goods, retail expand into new verticals like travel, transport, hospitality and at same time combined business will have well balanced sectoral exposure.

Sectoral Exposure:

| Particulars | LTI | Mindtree | Combined |

| BFSI | 47% | 18% | 35% |

| Media & Communications | 12% | 43% | 25% |

| CPG, Retail & Pharma | 10% | 24% | 26% |

| Travel, Transportation & Hospitality | NA | 14% | 5% |

| Others | 31% | 1% | 9% |

Diversified & balance Operations across Geographies

Like most of the IT companies, both LTI & Mindtree derive significant revenues from the Americas region. Both companies have a good exposure to European markets as well.

| Particulars | LTI | Mindtree | Combined |

| Americas | 67% | 74% | 69% |

| Europe | 16% | 18% | 17% |

| Rest of World | 17% | 8% | 14% |

Partner Ecosystems

Both companies have a strong relationship with global giants like Adobe, Amazon Web Services, Google Cloud, Microsoft, Salesforce etc. The merger will further strengthen the relationships and enable status upgrade which will help them in better servicing the clients and margins.

Apart from this, there will be other benefits such as cross-selling & Up-selling opportunities, stronger brand, retention of talent, go-to-market strategy, better financial position, saving in cost etc.

Acquisition of Mindtree by Larsen and Toubro Limited

To grow its Information Technology segment significantly, in 2019, Larsen and Toubro Limited (L&T) announced the acquisition (hostile) of Mindtree Limited.

Firstly, L&T bought circa 20% stake in Mindtree from Mindtree’s largest investors at that time V.G. Siddhartha and his affiliate Coffee Day group. The erstwhile promoters of Mindtree opposed the acquisition by L&T, however, due to a small equity stake in the company (circa 13.32%), they failed to oppose the acquisition. After open offer & market purchase, L&T acquired a controlling stake in the company and changed the entire management of Mindtree.

In the last 3 years, L&T focused on integrating the Mindtree with its culture and finally announced the merger with its other arm. Open offer by L&T was for INR 980 per equity share while current price of Mindtree is circa INR 2800 which has touched high of INR 5059 per equity share.

Improvement in Mindtree Financials in last the 3 years (Post-Acquisition by L&T)

Over the last three years, L&T took multiple initiatives to improve revenue & profitability. One of the key initiatives was to expand Mindtree business using L&T global network.

| Particulars | FY 2019 | Growth in last 3 years |

| Revenue | 7022 | 49.88% |

| Operating Profit Margins | 15% | 600 basis points |

| Net Profits | 10.73% | 500 basis points |

Thus, under the new management there was all round improvement.

Accounting & Tax Implications

As both LTI & Mindtree are under common control i.e. Larsen & Toubro Limited, the merger will be accounted in the books of LTI in accordance with the pooling of interest method for common control business combinations mentioned in Appendix C of Indian Accounting Standard (Ind As) 103- Business Combinations.

As the merger will be in compliance with section 2(1B) of the Income Tax Act, 1961 there would not be any direct tax implications.

Other Tax Aspects in the Scheme

Mindtree has opted to exercise the beneficial tax provisions as envisaged in section 115BAA of the Income Tax Act, 1961 (reduce taxation) while LTI is following the regular taxation. It is specifically mentioned in the scheme that the provisions of section 115BAA shall not be made applicable to or vested upon the merger to LTI post Appointed Date.

Financial Aspects

Financial of both companies for FY 2022

INR in Crore

| Particulars | LTI | Mindtree | Combined* |

| Revenue | 15,668 | 10,525 | 26,193 |

| EBITDA | 3525 | 2195 | 5720 |

| EBITDA % | 22.49% | 20.85% | 21.83% |

| Profit After Tax | 2298 | 1652 | 3950 |

| Cash & Cash Equivalent | 3910 | 3600 | 7510 |

| Networth | 8814 | 5474 | 14288 |

| Return on Equity | 26.07% | 30.17% | 27.64% |

| Employee Count (In number) | 46,648 | 35,071 | 81,719 |

| Countries Presence | 33 | 24 | – |

| Existing Market Capitalisation | 70,000 | 47,000 | 117,000 |

*: – Please note that combined financials are excluding intercompany transactions (if any) and effects of the merger.

Conclusion

With a vision to exceed Service business contribution above 40% of the total group’s revenue, L&T decided to acquire Mindtree. The journey of L&T from acquisition to finally merger was well planned. When L&T decided to acquire Mindtree, interestingly, instead of acquiring a stake through LTI, L&T directly acquired the controlling stake. Reasons for the same can be i) cultural integration, client integration and maybe even salaries rebalancing was required ii) the acquisition was hostile and considering LTI market cap and cash on the balance sheet, the acquisition was large and probably iii) management thought it will create more value for L&T hence, L&T preferred to keep it separate and independent of each other all these years which incidentally benefited minority shareholders of Mindtree as well.

Further, if the merger were the ultimate goal for L&T, there could be chances that L&T would have ended with a lower stake post-merger in the combined entity as on the merger, the existing stake held by LTI in Mindtree would have got cancelled and no additional shares would have been issued for it. However, in the current scenario, as stake is held by L&T, LTI will issue shares to L&T also.

Tentative working stating if the merger was announced immediately after the acquisition in 2019:

| Particulars | LTI | Mindtree |

| Circa Market Price as on 30th Sept-2019 | 1511.4 | 708.25 |

| L&T Stake | 74.6% | 60.55% |

| L&T Stake in the merged entity | 70.3% | |

*L&T acquired a controlling stake in Sep-2019 quarter.

Finally, with the merger, the combined entity will not only become one of the largest IT companies in India (Valuation-wise) but will be equipped with balanced sectoral exposure and will proactively evaluate more cross-up sell opportunities.

Add comment