Marking an entry into India, Sanjeev Gupta-led Gupta Family Group (GFG) Alliance, which owns Liberty House, has acquired bankrupt Adhunik Metaliks and Zion Steel for Rs 425 crore, which was under the Insolvency and Bankruptcy Code. It was an all-cash deal. In fact, Liberty House had failed to complete Adhunik’s acquisition in its first attempt. It was given a second chance by the National Company Law Appellate Tribunal to take over the bankrupt steel mill.

Adhunik Metaliks Ltd. (AML) was incorporated in 2001 and is primarily engaged in manufacture and sale of integrated special alloys and stainless steel with linkages across the entire value chain from critical raw materials such as iron ore and coke. The integrated steel plant of the company consists of coke ovens, sintering plants, mini blast furnace (MBF), steel melting shop (SMS), continuous casting machine (CCM) and rolling mill along with all auxiliaries and supporting facilities. AML also has Ferroalloys division, DRI division, Power Plant and associated facilities. The Company has its manufacturing units located at Chadri Hariharpur, P.O. Kuarmunda, Sundargarh, and Odisha.

NCLAT gave a second chance to Liberty House to acquire Adhunik Metaliks and Zion Steel which was under Insolvency.

Zion Steel Limited (ZSL) was incorporated in 2006 and is primarily engaged in the business of rolling alloy billets to produce rounds of size 20mm to 50mm and MS billets to produce TMT of 8mm to 24mm ZSL has a 120,000 MTPA rolling mill which is situated adjacent to the steel production facility of AML in Odisha. It also consists of reheating furnace and inspection and dispatch area. ZSL’s rolling mill was being utilized solely for the conversion of AML’s products.

Liberty House is the GFG Alliance’s global steel manufacturing arm with a total rolling capacity exceeding 18 million tonnes is one of the top 10 producers globally, excluding China. Its comprehensive product range includes semis, long and flat products, including coated steels. These are manufactured in a variety of grades and finishes to comply with national and international quality certified standards and meet stringent customer specifications. Located across the UK, Australia, Europe, India, China, South Africa, Latin America and the USA, the division’s furnaces, mills, service centres and distribution sites serve demanding sectors such as automotive, aerospace, oil and gas, ship building, construction, agriculture, on and off-shore power generation, yellow goods, mining, machinery, highways and materials handling.

Insolvency Process

In 2017 application for IBC filed by lender-bank SBI against AML and ZSL. On 04th September 2017, Mr. Sumit Binanai was appointed as IRP and the same approved by the Committee of Creditors. CIRP submitted the plan to Liberty group and COC NCLT gave their approval on 17th July 2018. However, Liberty house failed to implement the resolution plan and Adjudicating Authority on 08th July 2019 ordered for the liquidation process. During the liquidation process, the resolution plan earlier accepted by the COC was again approved and Liberty House has been given another chance to execute the same within a year.

Entry of Liberty in India:

Liberty Group enters into India through the acquisition of Bankrupt companies AML and ZSL to expand its wings in one of the fastest-growing and most vibrant steel markets in the world.

Deal Value and Future Plan

Liberty Group Completed the strategic acquisition of ADL and ZSL in a Rs 425 crores cash deal, the company said in a statement.

The immediate focus will be on reviving and restoring the facilities and operations, and once stabilised the business will begin its integration into the LIBERTY Steel Group. In October 2019 GFG Alliance announced the consolidation of its steel businesses into one global entity – the Liberty Steel Group – the eighth-largest steel producer in the world outside China, with operations in 200 locations in 10 countries. Liberty Steel Group has a target to become carbon neutral by 2030.

Liberty shall pay Rs. 60 lakhs to the public shareholders (excluding any shareholders who are the promoters or members of the promoter group) as consideration for delisting, acquisition, reduction and extinguishment of shares from the Public Shareholders.

Capacity of Plants

ADL’s plant is located in Odisha with a coal-fired blast furnace and an electric arc furnace with an annual capacity of 500,000 tonnes a year of crude steel. Zion Steel is a rolling mill with a capacity of 4,00,00 tonnes a year.

Resolution Plan:

Table 1: Claims Submitted & Accepted (All Figs in INR Crores)

| Particulars | Claims Submitted | Accepted |

| Claims of Financial Creditors (FCs) | 5371 | 410 |

| Claims of Financial Creditors (FCs) | 5371 | 410 |

| Claims of of Workmen/Employees | 4 | 44 |

| Claims of Other Operational Creditors (OCs) (including Statutory Dues) | 273 | 300 |

| Payments to Shareholders | 0 | 0.60 |

| Claims of Financial Creditors (FCs) | 5371 | 410 |

| Total | 5648 | 444 |

| Haricut | 92% | |

Some past acquisition of steel companies through IBC

Table 2:Comparative Analysis of Steel Companies Acquisitions through IBC Route.

| Company | Amount Paid (INR in Crores) | Plant Capacity (MTA) | Value / MTA (INR Crores) |

| Vedanta’s acquisition of Electro-steel steels | 5320 | 1.5 | 3,547 |

| Arcelor Mittal acquisition of Essar Steel | 42,000 | 10 | 4,200 |

| Tata Steel acquisition of Bhushan Steel | 35,300 | 5.6 | 6,304 |

| Liberty House acquisition of Adhunik Metaliks & Zion Steel | 425 | 0.45 | 944 |

As compared to other acquisitions in the steel segment in last two years it looks a good deal for Liberty in terms of value per million tonnes.

Company had a negative net worth of Rs. 2177.96 crores as on 30th September 2018. Note: After 30th September 2018 there is no financial statements filed by the company with SEBI.

Financial and Operational Creditors had to take 92% haircut on their outstanding debts in the process of acquisition by Liberty House.

Competitive edge

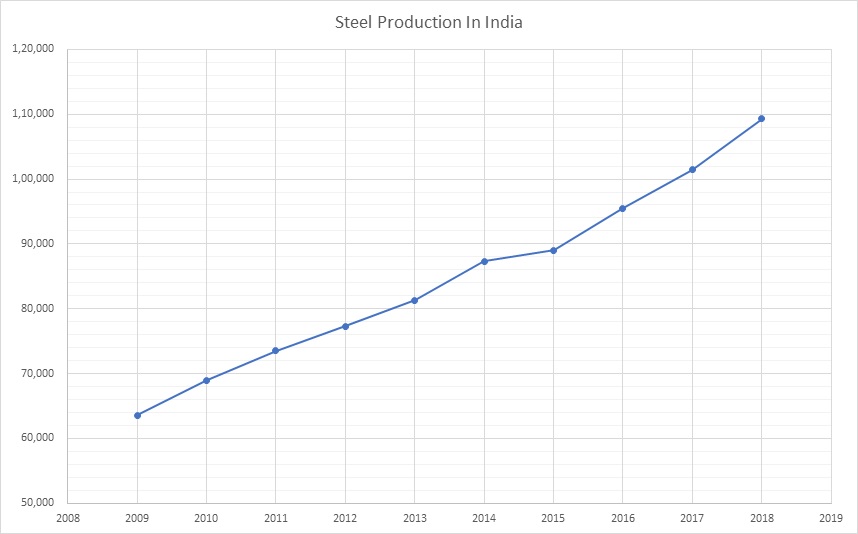

As we can see from the below graph that the production of steel in India in FY 2018 continuously increases and as per the Indian Stainless-Steel Development Association (ISSDA) per capita consumption of stainless-steel touched a new peak of 2.5 kg in 2019, against 1.2 kg per capita in 2010.

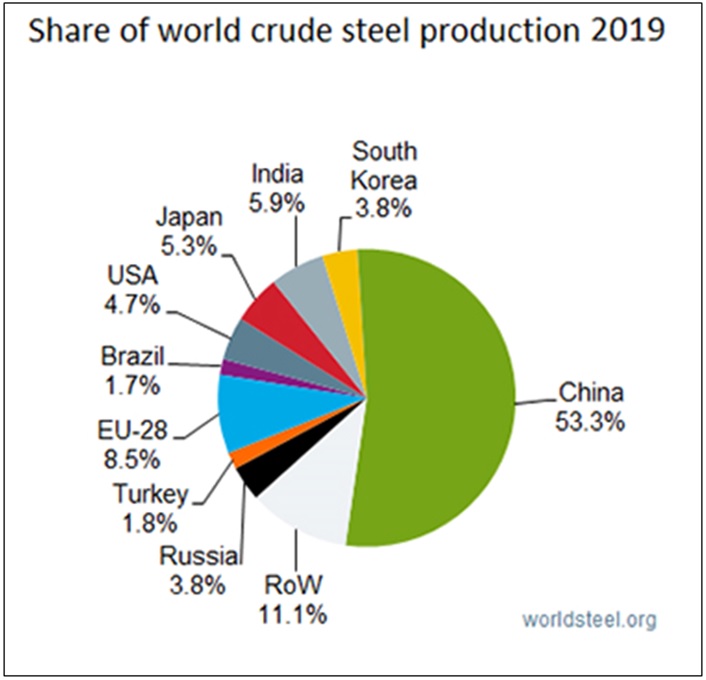

Thus, even global companies want to enter and expand their wings in India. The companies trying to enter India have some tough competition from big players like SAIL, TATA, JSW and Vizag steel and should have some competitive edge in terms of technology to win in this market.

Installed capacity: 138 Million Tonnes (Source: PIB GOI Ministry of Steel)

Conclusion

Insolvency and Bankruptcy Law has no doubt revived large plants which became non-operational under the burden of financial debts. The result of the resolution is that as assets goes into the strong hands of the acquirer, they will be able to squeeze those assets and generate value for all the stakeholders. The country will benefit as those assets will be fruitfully utilised which were lying idle and non-operational for various reasons. This acquisition by Liberty group also shows that assets of Adhunik steel are valuable and commercially viable to generate positive cash flow immediately. If the government is able to further rationalise and remove hurdles in smoothly transferring ownership from present owners who have failed to run the business profitably to new owners who have depth in terms of funds, technology and marketing, lot of idle assets can be fruitfully utilised almost immediately.

Add comment