The government in its zeal to address twin problem of divestments and fiscal deficit and at the same time exiting some loss making PSU which are cash guzzlers and value destroyers; comes out with an innovative idea. Here LIC becoming the core promotor of IDBI Bank is commercial decision or just mean to address above two problems only time will prove. If LIC by putting professional management team can create structure which capture capabilities of both the organization i.e. IDBI branch network and its employees and utilization huge cash generated on daily basis by LIC by grating higher returns than what LIC could make now.

Nudged by the government, the insurance regulator (Insurance Regulatory and Development Authority of India) gave its approval to state-owned behemoth Life Insurance Corporation (LIC) of India to increase stake in the debt-ridden IDBI Bank from the current 10% to up to 51%. The decision has been severely criticised by several sections including employees of the insurance and banking sectors. At the last count, the life insurance company will invest around Rs 20,000 crore to bail out the bank which is in dire straits. The Reserve Bank of India and Securities and Exchange Board of India have also given their in-principal nod to LIC for the deal.

While the exposure may be minuscule as LIC has assets under management (AUM) of Rs 24 lakh crore as on March 2018, the deal even goes against LIC’s own investment mandates, which prevents it from taking over any business. The deal will lead to a concentration of risk is the system and it is still unclear how it will work to improve the performance of the bank. Given the fact LIC has chosen to pick up one of the worst performing banks in the country, it will now depend on the insurance company’s ability to turn the business around or else policyholders will take a hit in terms of bonus payouts. For policyholders, poor investment return will reflect in the form of suppressed bonuses that they get on their participating products portfolio.

As per media reports – the final contours of the deal are still on the drawing board – LIC will reduce its stake in the bank in the next five to six years. While investment is part of LIC’s business, it cannot be that all loss-making government companies are to be bailed out by the insurer at the cost of the interest of policyholders who have invested their money. LIC is already saddled with a large chuck of its portfolio as NPA and the government should take measures to address them instead to forcing it to buy loss making public sector companies.

IDBI Bank in life support system

The Mumbai-based lender has the highest bad loans in the industry at nearly 28% of total advances and posted a loss of Rs 5,663 crore in the quarter ended March 2018 and Rs 8,238 crore in FY18. The total non-performing asset of the bank now stands at Rs 55,600 crore. The bank’s NPA was 1.4 times of the book value as on March this year and 1.2 times its free float market capitalisation. Also, IDBI Bank has put the life insurance subsidiary with Aegis and Federal Bank on block a year ago though no life insurance company has shown any interest in buying the company.

Despite capital infusion of Rs 10,600 crore by the Centre in FY18, the bank’s core equity capital (CET-1) stood at 7.42% in March this year, just above the regulatory norm of 7.37%. The bank’s asset book, which depends heavily on corporate lending, is not showing any signs of recovery. As a result, the bank is in dire need for money and the LIC’s investment would be a much-needed help.

In fact, IDBI Bank has been under the RBI’s prompt corrective action framework since May 2017 due to the high level of bad loans and negative return on assets reported by the bank. The unabated surge in bad loans had prompted the bank to halt corporate lending and shrink its international presence. The bank has now shifted to a capital-light model and focused on retail lending. This has resulted in lower risk weighted assets.

In the past two years, the government had tried to sell stake of IDBI Bank to private players, but no company showed any interest in the state-owned bank. Last year, too, Union Minister Arun Jaitley had informed the Parliament that the process of transformation of IDBI Bank has already started. At present, the government holds 85.96% stake in the bank.

LIC bails out PSUs in trouble

For all reasons, LIC is known as the government’s cash cow. In the past it had bailed out public sector initial public offerings, did acquisitions and even participated in government’s disinvestment programme every year. The company has made incremental investment worth around Rs 70,000 crore in public sector undertakings (PSU) in the last six years. The state-owned life insurer, with a Rs 100 crore capital base and a government guarantee, has Rs 24 lakh crore worth of AUM, or close to 80% of the total life insurance industry’s AUM. The company till date has invested Rs 6 lakh crore in equities. In fact, its PSU holding is around Rs 2 lakh crore, which was just Rs 80,000 crore three years ago.

Table 1: LIC’s Holding in PSU Banks (% Holding as of June 2018)

| State Bank of India | 9.98 |

| Oriental Bank of Commerce | 7.36 |

| Bank of Baroda | 2.23 |

| Canara Bank | 9.47 |

| UCO Bank | 9.8 |

| Union Bank of India | 9.7 |

| Dena Bank | 6.87 |

| Central Bank of India | 10.04 |

| Bank of Maharashtra | 5.72 |

| Syndicate Bank | 10.2 |

| Corporation Bank | 13.03 |

| Allahabad Bank | 12.37 |

| Punjab & Sind Bank | 7.44 |

| Andhra Bank | 6.58 |

| Vijaya Bank | 8.15 |

| Indian Bank | 1.32 |

| Punjab National Bank | 12.24 |

| IDBI Bank Ltd | 10.82 |

| United Bank of India | 3.13 |

| Bank of India | 8.77 |

| Indian Overseas Bank | 5.36 |

Source: Stock Exchange.

At present, LIC has stake in 21 state-owned banks and in 10 banks the stake is over 9%. In 2015 and 2016, LIC bought preferential share issues of several government run banks to cover for the shortfall of capital. As a result, LIC’s shareholding in these banks has risen. Apart from holding equity in banks, LIC invested in debt securities issued by banks, including additional tier-1 bonds.

The ability of any insurance company’s long-term assets to meet its long term liabilities is known as solvency ratio – ratio of net assets to liabilities. On that parameter, LIC’s solvency ratio is 1.5, which is lowest in the industry and just up to the regulatory threshold level. So, the decision to sell stake cannot be done with the narrow prism of meeting the ambitious Rs 1 lakh crore disinvestment programme of the government this year. Even in the past, LIC has been burdened with picking up stakes in PSU disinvestments when none others were simply interested in them.

Regulator’s rule for stake sale

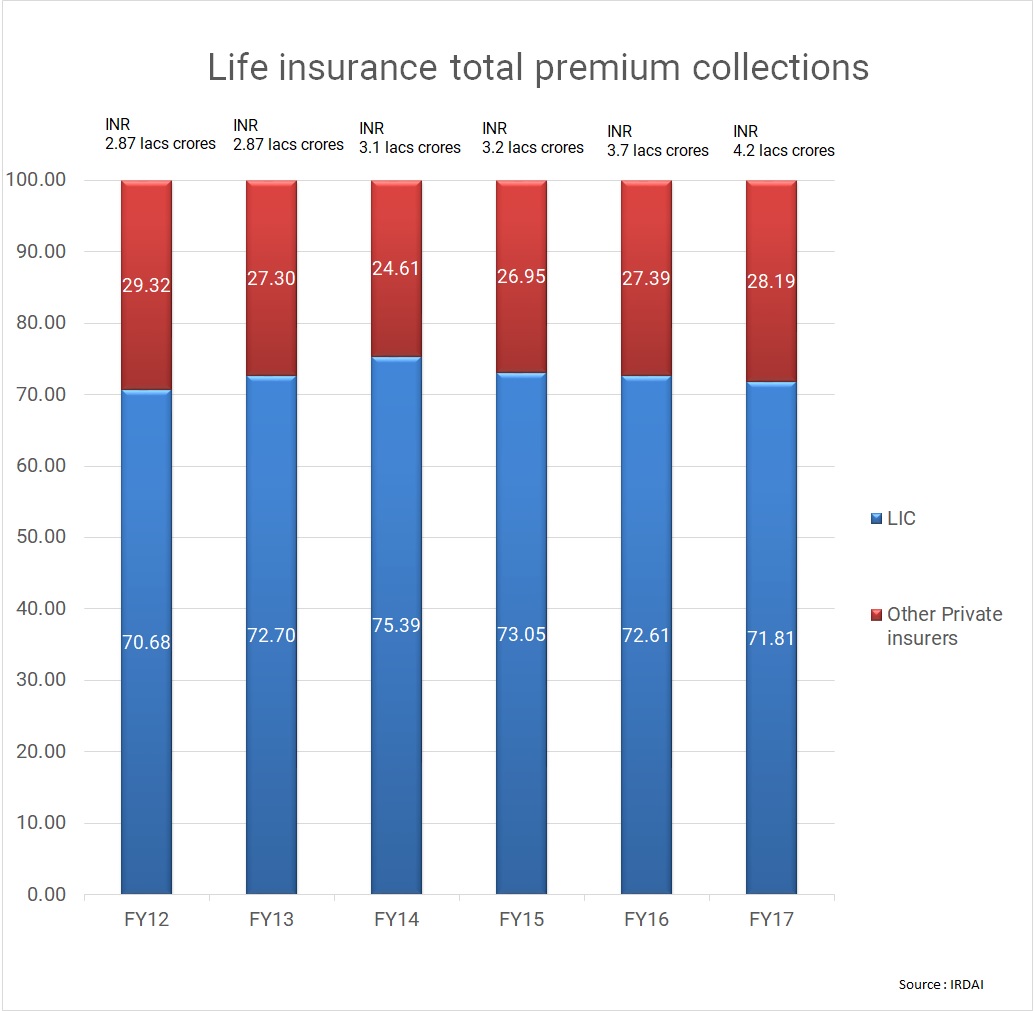

LIC is a mammoth organisation. While the private sector insurance companies were allowed to operate since 2000, LIC still commands over 70% of the new business premium, which is the lifeline for any insurance company. The company issues nearly 20 million policies every year. Overall, it manages insurance contracts for 300 million policyholders and the total insurance premium collection is over Rs 3 lakh.

The company comes under the Life Insurance Corporation Act, 1956 and sets its own investment guidelines. It invests around Rs 2 to 2.5 lakh crore every year in the capital markets, and in FY17 gave out over Rs 1 lakh crore in loans, according to its annual report. Over the years, it has given loan to railways, highways and subscribed to the power sector’s Ujwal Discom Assurance Yojana (UDAY) bonds and invested in the National Investment and Infrastructure Fund. LIC’s annual report also shows that in 2016-17, it earned Rs 1.8 lakh crore in investment income alone.

Regarding the investment limit of insurance companies in equity, the Insurance Regulatory and Development Authority (Investment) (Fifth Amendment) Regulations, 2013 allows insurance companies with assets of over Rs 2.5 lakh crore to buy up to 15% equity in a company. However, under special provisions, LIC can hold up to 30% with the approval of the government, investment committee and the regulator. As the LIC Act precedes the IRDA Act, that is the kind of edge and leeway LIC has over other life insurers as far as investments are concerned.

Impact on policyholders

The money that LIC collects from policyholders gets invested across a variety of instruments governed by rules laid down by the insurance regulator – Insurance Regulatory and Development Authority of India (IRDAI). Policyholders of LIC have a sovereign guarantee, which means the government will bail out the company in case the company goes bankrupt. So, policyholders do not have to worry much and will remain immune. Holders of non-participating policies are guaranteed their returns. However, those who have taken participating policies may be impacted as the bonus declared by LIC depends on the returns or profits it makes in the full year.

LIC’s long-term holding periods have ensured that it seldom makes a loss. The company reported a 33% rise in profit from the sale of investments a Rs 28,527 crore in 2017-18, much higher than the profit of Rs 21, 503 crore during 2016-17. It paid interim bonuses to policyholders to the tune of Rs 1,555 crore in FY18 as compared with Rs 929 crore in FY17, which is growth of 67% year-on-year.

Table 2: Assest under management of life insurers (INR Crores)

| LIC | Private insurers (23) | Total | LIC’s share (%) | |

| As on March 2016 | 2009118.93 | 492949.36 | 2502068.29 | 80.3 |

| As on March 2017 | 2275276.59 | 578016.52 | 2853293.11 | 79.7 |

Source: IRDAI

Some Recent News of LIC – IDBI Bank

-

LIC’s acquisition of 51% in IDBI Bank a ‘win-win’ situation for both

-

LIC views IDBI acquisition as a sound business deal, says Piyush Goyal

Conclusion

The deal will help IDBI Bank to come out of the stressed assets scenario and start lending to individuals and companies. For LIC, the deal will help to tap the bank’s 2000 branches for selling its products through the bancassurance channel. But all these depend on how LIC proactively uses the opportunity to turnaround the bank and makes the investments profitable.

Given the precarious situation of non-performing assets in IDBI Bank, there is contagion risk on the policyholders’ precious savings, which will grossly impact the capability of LIC to serve its policyholders. In the past, even RBI has raised concerns about the inter-linkages between the country’s largest insurer and the banking sector. The high degree of linkage between LIC and the banking sector through this deal can lead to financial stability risks and the stress in the banking sector can hurt LIC’s portfolio.