The BK Birla group-controlled Mangalam Cement Ltd and Mangalam Timber Products Ltd have been merged to attain value of scale. The consolidation will help in efficient utilization of their resources, reduction in overheads and other expenses and improvement in other parameters.

Mangalam Timber Products Limited (MTPL), a listed company primarily engaged in the manufacture of Medium Density Fibre Board (MDF) and sells its products under the brand name “DURATUFF”. MDF is used in making furniture, Particle board, Doors and all kind of carpentry all kinds of carpentry work.

Mangalam Cement Limited (MCL), a listed company having registered office in Kota Rajasthan. A well-established cement manufacturing company having two cement manufacturing plants located at Morak, Rajasthan and Aligarh, Uttar Pradesh producing Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC) and marketed under the brand name of “Birla Uttam”. MCL has also set up two Captive Thermal Power Plants of 17.5 MW each. Apart from this, MCL also owns 13 (Thirteen) Wind Mills at Jaisalmer, Rajasthan with an aggregate capacity of 13.65 MW generation per day. Recently, the Company has invested approximately Rs.100 Crores in a Waste Heat Recovery unit (WHR) with a capacity of 11 MW at Morak plant which is scheduled to be commissioned in October 2019.

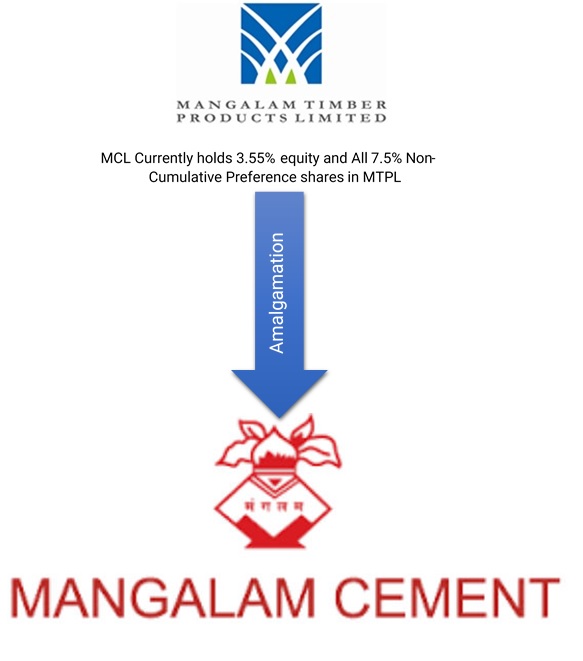

MCL holds 3.55% equity stake & all 7.5% Non-Cumulative preference shares of MTPL worth INR 25.96 crores since February 2012. Both MTPL & MCL are part of BK Birla Group companies and hence are under common management.

The Transaction:

With the appointed date for the same is 1st April 2019, subject to regulatory approvals, MTPL will merge with MCL.

Rationale of the Scheme:

- As both companies are part of same group so integrating, interlinking and combining the business activities undertaken by both the Companies will be beneficial to the growing requirements in the housing sector, amongst other things and in order to utilize the resources available with each other for better functioning and operating in their respective spheres, under a single entity.

- The amalgamation will enable appropriate consolidation and integration of the activities more efficient utilization of their resources, reduction in overheads and other expenses and improvement in other parameters.

- The amalgamation will enable both the companies to pool their financial, managerial, technical and other resources in order to meet the global challenges and competitive market conditions.

It is imperative to note that as mentioned in the Board Resolution passed for approving the scheme, MCL will give loan of INR 5 crores to MTPL. This financial support might be to runs the operations of MTPL till the time scheme becomes operative.

Both the companies operate in different industry not even remotely having any synergies or commonality of customers or suppliers and located and serving in different markets i.e. MCL serving west coast and MTPL serving east coast. So, in effect the merger does not seems to be in any way beneficial to the shareholders of MCL except tax break it can have carried forward losses of MTPL. If one looks at the financial of MTPL for last 5 years, against total revenue of Rs 150 crores, it incurred loss before tax of Rs 87 crores. Deferred tax assets of Rs 28 crores is effectively zero considering it loss making operations in last so many years.

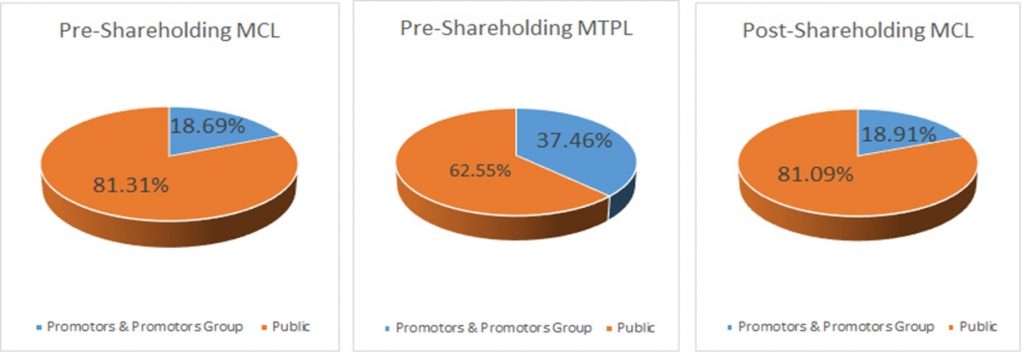

Pre-& Post Shareholding Pattern:

As mentioned earlier, both MTPL & MCL are part of BK Birla Group companies and hence are under common management. MCL also holds 3.55% equity stake of MTPL.

Exchange Ratio:

For every 22 equity shares of Face Value Rs. 10 each fully paid up of MTPL will get 1 equity shares of Face Value 10 each fully paid up of MCL (i.e. 1:22). As a result, MCL will issue around 8 lakh equity shares.

Valuation:

As per the Valuation Report submitted by the companies to exchanges, the valuation has been derived by assigning most of the weightage to the Replacement cost of the business.

| Valuation Approach | Mangalam Cement Limited | Mangalam Timber Products Limited | ||

| Value per Share | Weight | Value per Share | Weight | |

| Net Assets Value based on Replacement Cost | 231.94 | 80% | 9.12 | 80% |

| Market Price Method | 245.88 | 20% | 16.72 | 20% |

Plant and Machinery valuation increases by 12% considering factors and accounting assumptions as the Plant and machinery is a depreciable asset hence increment in valuation may not possible. Therefore, value of Plant and Machinery may not true and fair.

| Particulars | Book Value | Market Value | Increase/(Decrease) | % of Increase/Decrease |

| Plant and Machinery | 65,998 | 73,620 | 7,622 | 12% |

| Investment (Non-Current Assets) | 2,759 | 69 | -2,690 | -97% |

From above, it is clear that the valuer has written-off all investment in preference shares of MTPL and the value assigned belongs to the equity investment in MTPL, though in the event of liquidation preference shareholders are eligible to receive paid up value if any out of remaining assets of the company in preference to the equity shareholders. In fact, MCL will not be required to report the loss through its profit and loss account and as part of the merger it will be adjusted as contra entry as balance sheet item for all the seven years MCL never received any dividend on those preference shares. No doubt post-merger ROCE of cement business will improve as it will not liable to any tax for few years.

Financials

Table: Financial for the year ending 31st March 2019. (INR in Lakhs)

| Particulars | MCL | MTPL |

| Net-Worth | 50,347 | -4,713 |

| Revenue | 1,22,349 | 1,340 |

| Finance Cost | 5,078 | 984 |

| Interest Coverage Ratio | 0.59 | -1.95 |

| EBITDA | 8,098 | -936 |

| EBITDA% | 7% | -70% |

| EBIT | 3,020 | -1,920 |

| PAT | -989 | -1,422 |

| PAT% | -1% | -106% |

It looks that MTPL expenses are more than its turnover and MTPL sales down by around 46% as compare to previous financial year. MTPL’s operating cash flow not sufficient to finance its interest cost. As the company generated Rs. 469 Lakhs and having finance cost Rs.984 Lakhs.

Conclusion:

The MTPL is group company of BK Birla Group and it was not able to generate sufficient cash flow to runs it business. in fact, it carried on its operations on generosity of MCL by way of investments, as equity and preference capital and even loan of Rs 5 crores even after the announcement of merger.

THERE DOES NOT SEEM TO be any commercial rational for this merger except to support timber business eternally. Cement business of MCL will be burden and its capacity to expand and generate reasonable return for its stakeholders will be heavily impacted by losses of timber business. It may be ideal to close the timber business earlier the better.

Add comment