MBL Infrastructure Ltd (MBL Infra) is engaged in the execution of civil engineering projects. The Company provides integrated engineering, procurement and construction (EPC) services for civil construction and infrastructure sector projects. Equity shares of company is listed on BSE & NSE and current market cap of the company is Rs. 58.24 crores.

Insolvency Resolution Process & Resolution plan:

Last year on 30th March 2017 NCLT accepted an application filed by RBL bank for initiation of Corporate Insolvency Resolution Process (CIRP) against MBL Infra. During CIRP, a resolution plan submitted by MBL promoter A.K Lakhotia is accepted by Committee of Creditors (CoC) and approved by NCLT by its order dated 18/04/2018.

Table 1: MBL Infra – Admitted claim (Rs in crores)

| Particulars | Admitted claims | % of total claim |

| Financial Creditors | 1,428.21 | 94.78% |

| Operational Creditors | 78.66 | 5.22% |

| Total | 1,506.87 | 100% |

| Liquidation Value | 269.9 |

Source: IBBI disclosure

Resolution plan

There is no haircut for lenders other than dissenting financial creditors who are paid liquidation value in the resolution plan, existing debt is restructured, and more time is given to pay-off the same with some fresh equity infusion by promoter group in the company.

Table 2: Terms of Resolution Plan

| Category | Amount (Rs in Crores) | Revised Term |

| Operational Creditor, statutory dues and other creditors (except financial creditors) | As per admitted claims | To be paid in three years |

| Cash Credit facility | 37.38 | at the rate of one-year MCLR of SBI plus spread of 0.70% p.a. |

| Working capital term loan | 37.38 | at the rate of one-year MCLR of SBI plus spread of 0.70% p.a. to be paid in 39 unequalled quarterly instalments |

| 0.10% Non-convertible debenture | 878.67 | redeemable over a period of 9.75 years (in 39 unequalled quarterly instalments since issued) (at a premium of 10% at the time of final redemption |

| External Commercial Borrowings | 122.81 | to be paid over a period of 9.75 years @ one-year MCLR of SBI plus spread of 0.70% p.a. in Indian rupees to be paid in 39 unequalled quarterly instalments |

| NBFC-Term Loan | 40.34 | to be paid over a period of 9.75 years @ one-year MCLR of SBI plus spread of 0.70% p.a. to be paid in 39 unequalled quarterly instalments |

| Dissenting financial creditors | 316.22 | to be paid liquidation value amounting to Rs. 49.02 crores |

| Equity Infusion | ||

| Equity Infusion | 128.19 | Equity Infusion by promoter and promoter group over the period of 3 years. |

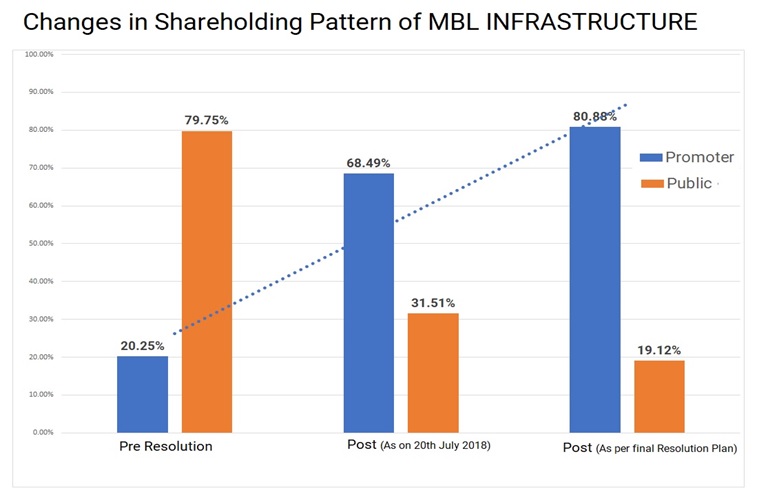

| Promoter Shareholding (in %) | 80.88% | Upon implementation of the Resolution Plan, the equity shareholding of the Promoters would increase from 21.73% to 80.88%. Promoters have already infused Rs. 63.30 crores to raise the stake up to 68.49%. For additional stake of 12.39%, Rs 67.90 crores required (assumed at face value) |

Note: Resolution plan is not available in Public Domain, we have taken information from Investor presentation and from Annual report of MBL Infra.

Pre-& post shareholding

At present promoter group stake has increased from 20.25% to 68.49% (as per disclosure to stock exchanges) further as provided in the resolution plan, promoter will infuse further equity to increase their stake till 80.88%. Due to this increased shareholding, SEBI regulation will trigger and promoter must reduce their shareholding up to or below 75% to company with the regulations.

It is also pertinent to note that in this resolution plan, there are no reduction or consolidation of share capital and existing Public shareholding will not lose any of their existing shares.

Table 3: Promoters – Gain/loss on additional equity infusion

| Promoters shares | No’s | Value (in crores) |

| Shareholding before resolution plan | 83,93,909 | 8.39 |

| Additional subscription as per plan (so far)* | 6,33,48,000 | 63.35 |

| Shareholding as on 10th July | 7,17,41,909 | 71.74 |

| Current Mkt value | 13.85 | 99.36 |

Note: Assumption is Promoters have subscribed additional shares at face value only

Financial Impact on restructuring

Table 4: Financials Pre & Post Resolution (All Figs in INR Crores)

| Particular | Mar-18 | Mar-17 | % change |

| Assets | |||

| Non-current Assets | 2,017.96 | 1,723.60 | 17.08% |

| Current Assets | 296.03 | 515.69 | -42.60% |

| Total | 2,313.99 | 2,239.30 | 3.34% |

| Equity | |||

| Share Capital | 41.45 | 41.45 | – |

| Reserve & Surplus | 856.58 | 619.96 | 36.39% |

| Liabilities | |||

| Non-Current Liabilities | 1,156.39 | 99.56 | 1061.50% |

| Current Liabilities | 259.57 | 1,481.32 | -82.48% |

| Total | 2,313.99 | 2,239.30 | 3.34% |

Note:

- Mar-18 equity does not include the additional shares subscribed by promoter group as mentioned in the plan and further increase in reserve & surplus due to adjustments arising out of Resolution Plan.

- Due to restructuring of debt and change in tenure, current debts are reclassified to Non-current liabilities.

Share Price Movement:

Current Position

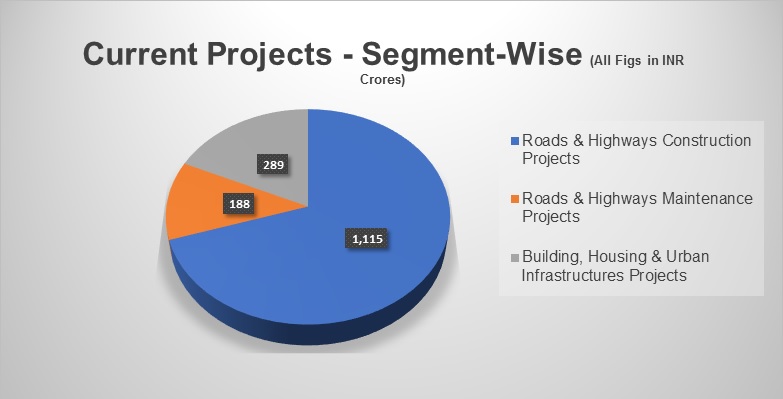

Current MBL is having around Rs. 1,591.32 crores (approx.) ongoing project in roads & highways construction & maintenance and in building, housing & urban infra projects of various state and central government.

Win-win situation

From looking at the contents of resolution plan, there is win-win for everyone:

- Public shareholder does not lose their shares as there were no reduction in value, though market value of shares are eroded but still trading above its face value

- For operational creditors, liquidation value available was Nil considering the provisions of Insolvency Code, but in resolution plan promoter buy time of three years for making their payment in full which they shouldn’t have any problem.

- Lenders rather than taking a haircut restructured their debt and shown confidence in promoter’s ability to run the company in near future.

- Promoters now have an uphill task to revive the company post restructuring of debts, they need to have sound orders book to fulfil its repayment commitments.

Cash flow Requirement

Post restructuring, MBL infra has to repay its creditors as per resolution plan over a period of 9.75 years and also require working capital to run its business. Assuming payment in initial years will be less and will gradually increase in coming years, MBL will require minimum revenue of around Rs. 1600 crores with an 10% p.a. annual CAGR in upcoming years until Rs 4,000 crores (approx.) considering a margin of 6-8% to fulfil its repayment commitment and working capital requirement.

Considering the economic growth and opportunity available in the infrastructure and construction sector, MBL needs to keep on taping new orders else these restructuring efforts will be of no use.

Other Points

- As on Mar-18 MBL is having total trade receivables (current & Non-current including deferred) of around 1,761 crores (approx.) out of which around Rs. 1,695 crores (approx.) are non-current in nature & ageing more than 180 days, which is almost 96% of total receivables. Probability of recoverability of these receivables is to be ascertained.

- Company has Rs. 731 crores in deferred credit-deposit in non-current asset as against 279 crores in previous year Mar17.

Conclusion

MBL infra resolution plan was one of its kind which was put forwarded by promoter and approved by CoC without hitting Sec 29A ineligibility criteria as plan was already discussed before the amendment. Essar promotors also trying to gain control of Essar Steel in the similarly manner but as of now it looks like they will not be so lucky. Without giving the haircut to lenders (except dissenting financial creditors) debts were restructured in timely manner which otherwise would have been done through Debt Restructuring Tribunal and time consuming activity. Now promoters need to focus their efforts on generating cash flow and improving margins to repay the debt on time.