The government has decided to merger three banks – Bank of Baroda, Dena Bank and Vijaya Bank — to reduce the amount of capital it needs to put into these banks and help clean their balance sheets. The three merged state-owned banks will the third-largest lender after State Bank of India and HDFC Bank. The name of the merged entity and the share-swap ratio will be decided soon. Bank unions, however, were quick to oppose the merger.

While Dena Bank has been placed under the prompt corrective action framework by Reserve Bank of India with restriction on lending, Vijaya Bank is among the only two lenders to have reported a profit in 2017-18. As a percentage of total assets, Dena Bank has the highest net non-performing assets at 11.04% while Vijaya Bank has 4.10% and Bank of Baroda 5.4%. The weaknesses of Dena Bank are being diluted by pooling them with the strengths of the other two.

The merger of the three banks is a signal for further consolidation among the 17 state-owned banks that have seen spiraling non-performing assets. One of the reasons to merger these three banks were that they use the same software – Finacle from Infosys making the task of merging the technology platforms and back-ends easier. In the past, the government merged State Bank of India’s associate banks with the parent and let Life Insurance Corporation take over the debt-ridden IDBI Bank.

The three concerns expressed by investors are about the quality of Dena Bank’s book, distraction from the growth journey for Bank of Baroda and Vijaya Bank and whether the merged entity will be able to raise capital. There are also concerns that whether Bank of Baroda will get distracted to the point that growth will suffer in the long-run. Any merger of such a type will raise these doubts. The answer will be in proper integration process. The merger proposal will first need to be approved by the board of directors of the three banks. The government will then prepare an amalgamation scheme, which will need to be approved by the cabinet and Parliament.

In general, challenges on asset quality and profitability, erosion in networth and high dependence on government for capital support continues to hamper the growth aspirations of state-owned banks, especially under the RBI’s prompt corrective action framework. In fact, state-owned banks account for over 80% of the Rs 10.4 lakh crore of non-performing assets in the banking system as on June 30, 2018, and reported aggregated losses of Rs 1 lakh crore for the past five quarters.

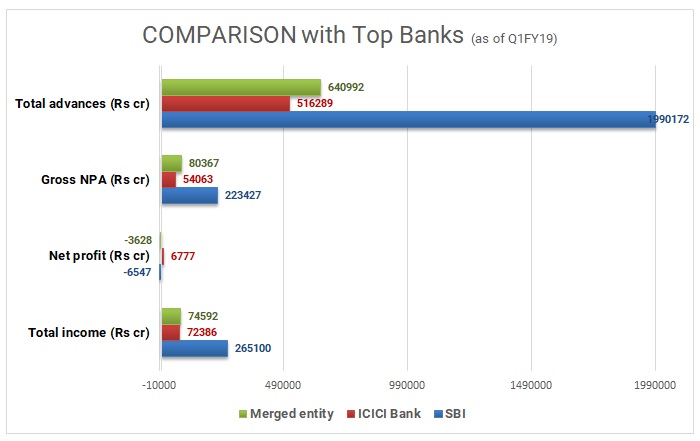

The combined entity: Gaining scale

The government is hoping that Bank of Baroda’s large balance sheet and healthy capital ratios and Vijaya Bank’s robust capital base would fill the losses in Dena Bank’s balance sheet. The merged entity will have a strong presence across the country, especially in South India, with more than 34% of low-cost deposits. The business book will be 14.82 lakh crore. The largest of them — Bank of Baroda has a business book of Rs 10.29 lakh crore, followed by Vijaya Bank at Rs 2.79 lakh crore and Dena Bank at Rs 1.72 lakh crore. The economies of scale and large players and large players are positive for the banking system. It is beneficial for the system to get larger banks but the integration will have to be managed well to gain business benefits.

The merger can bring about material operating efficiencies over time reducing combined operating costs, lower funding cost and strengthened risk management practices on a consolidated basis apart from increasing the scale and reach moderately. The asset-liability mismatch of the smaller banks can be better addressed at the consolidated level.

Table 1: Financials of Merging Banks

| Banks | Net NPAs (%) | Tier -1 Capital (%) | Total business (Rs lakh crore) | Branches | Deposits (Rs lakh crore) | Employees |

| Bank of Baroda | 5.4 | 9.27 | 10.3 | 5502 | 5.8 | 55662 |

| Vijaya Bank | 4.1 | 10.35 | 2.8 | 2129 | 1.6 | 16079 |

| Dena Bank | 11 | 8.25 | 1.7 | 1858 | 3 | 13613 |

| Merged entity | 5.7 | 9.32 | 14.8 | 9489 | 8.4 | 85354 |

Among challenges, the grouping of accounts will be one of the biggest. There could be some accounts which may be standard in one bank and substandard in another. The provision and classification of accounts will have to be aligned in the next two quarters. In fact, State Bank of India had undertaken a similar exercise a few quarters before the five associate banks were merged with it. The associate banks had reported huge losses prior to the merger because some of the accounts needed high provisions to be in line with that of SBI. It is likely that these banks may report high provisions as they align their accounts with each other. Dena Bank has been barred from lending for the past four months by RBI. What the merged entity will have is Dena Bank’s Rs 15,000 crore toxic loan piles for which provisioning cover is just 58%.

The merger process could happen gradually. At first, there will be consolidation of the business followed by the integration of information technology structures. For instance, at the time of merger of ING Vysya with Kotak Mahindra Bank, corporate banking and treasury departments were merged before retail banking was integrated. The merged banks have very different cultures, different operating procedures, different HR processes and managing their integration is going to be a tough job. The proposed amalgamation will require significant bandwidth of management along with deft handling so that operational aspects such as business growth and resolution of large stock of delinquent assets continue receiving adequate attention.

Realigning human resources will be one of the biggest challenges in this merger. The government has assured that there will be no job loss or change in service conditions. The multiple posts that exist in the three banks will surely have to be merged as there cannot be so many posts for single functions. Issues of seniority are important in state-owned setups and the combined management will have to figure out the structure, going forward.

Table 2: Geographic distribution of bank branches (As on June 2018)

| Area | Bank of Baroda | Dena Bank | Vijaya Bank | Merged entity | Industry | Share (%) |

| East | 189 | 41 | 42 | 272 | 5774 | 4.7 |

| North-east | 10 | 1 | 8 | 19 | 737 | 2.5 |

| West | 1433 | 487 | 284 | 2205 | 26894 | 8.2 |

| North | 446 | 101 | 166 | 713 | 16545 | 4.3 |

| South | 347 | 71 | 429 | 846 | 21669 | 3.9 |

| Central | 384 | 48 | 39 | 470 | 6635 | 7.1 |

| Total | 2809 | 749 | 968 | 4525 | 78254 | 5.8 |

For each of the three institutions, there will be added advantages. For instance, Bank of Baroda’s technology platform could be of value to the other banks and the bank’s global presence could be of value to the customers of the other two banks. Merging of three banks will give the new entity benefits of economies of scale and distribution. Moody’s Investors Services has said the plan to merge the three state-owned banks will be credit positive as it would improve their efficiency and governance. The combined entity will have a well-diversified loan book of Rs 6.5 lakh crore and a loan-weighted net interest margin of 2.7%. The merged entity is going to have the second-largest deposit base backed by 34% current account savings account.

SBI, associate banks merger

In February 2017, the government started the process of merger of five associate banks of SBI with SBI and in August last year the Lok Sabha passed the State Banks (Repeal and Amendment) Bill to amend the State Bank of India Act of 1955 to remove references related to subsidiary banks. The merger of five associates and Bharatiya Mahila Bank with State Bank of India was relatively easier because of common branding and technology, and SBI’s strong balance sheet, which could cover asset-side risks of subsidiaries. However, the merger of five associate banks of State Bank of India has resulted in a sharp jump in the combined entity’s bad loans portfolio, crimping its profits. The associate banks made a loss of Rs 5,792 crore for the March quarter of 2016-17 and Rs 10,243 crore for the entire year 2016-17. This resulted in the consolidated net profit of SBI going down to Rs 241 crore when the standalone profit was Rs 10,484 crore in the year (2016-17).

The biggest merger benefit is the reduction in competition for lending and deposit business within the group. There has been rationalization of branches which has led to higher efficiency. Merger of group entities of SBI led to the restructuring of the balance sheet of the entities and some of the liabilities were set off with realization of assets. Cost savings on account of treasury operations, audit, and technology helped lower the cost-to-income ratio.

Conclusion

The government’s move to merge two better performing banks – Bank of Baroda and Vijaya Bank – with a weak one – Dena Bank – is a good strategy to ensure stability of both, operations and the credit profile of the consolidated entity. The success of the three-way merger will be crucial as it will pave the revival path for other weak state-owned banks through mergers. Moreover, the merger will reduce the capital burden for the government over the long term, and enable better management of a smaller set of large nationalized banks. The ability to manage potential challenges in terms of balance sheet, people and processes and their impact on growth and operating metrics over the medium term will determine the success of future mergers.

Merging state-owned banks is lot more challenging given the integration-related issues, especially regarding human resources and operations. If this merger is executed well it can set the path for future mergers among PSU banks which will strengthen the banking sector in the country.