Insolvency Proceedings Scenario:

In order to tide over the mounting non-performing assets of banks, especially in the power and steel sector, the government legislated Insolvency and Bankruptcy Code (IBC). After one and a half year, lender’s filing cases against defaulting corporate debtor started picking up the pace, but only a few are reaching its desired conclusion and yielding in resolution plan. As per information available (June 2018), 33 cases have successfully resolved the matter by way of resolution plan till date. Amongst them, the bigger names are Bhushan Steel and Electro steel steels Ltd which are part of 12 companies which were initially recommended by RBI for insolvency proceedings. In these two companies, financial creditors have taken a haircut of 36.51% and 59.62% respectively.

Table 1: Top 10 Cases Resolved under the IBC (All figs in INR Crores – As of June 2018)

| Sl. No. |

Name of Corporate Debtor | Total Admitted Claims | Admitted Claims of FCs# | Liquidation Value | Resolution Amount for FCs# | Haircut taken by FC# (%) |

| 1 | Bhushan Steel Ltd. | 57,505.05 | 56,022.06 | 14,541.00 | 35,571.00 | 36.51% |

| 2 | Electrosteel Steels Ltd. | 13,958.36 | 13,175.14 | 2,899.98 | 5,320.00 | 59.62% |

| 3 | Kohinoor CTNL Infrastructure Company Pvt. Ltd. | 2,578.64 | 2,528.40 | 329.90 | 2,246.00 | 11.17% |

| 4 | MBL Infrastructure Ltd. | 1,506.87 | 1,428.21 | 269.90 | 1,597.13 | 0.00% |

| 5 | Sree Metalik Ltd. | 1,289.73 | 1,287.22 | 340.62 | 607.31 | 52.82% |

| 6 | Kamineni Steel & Power India Pvt. Ltd. | 1,523.50 | 1,509.00 | 760.00 | 600.00 | 60.24% |

| 7 | Orissa Manganese & Minerals Ltd. | 5,414.49 | 5,388.54 | 301.02 | 310.00 | 94.25% |

| 8 | Sharon Bio-Medicine Ltd. | 917.92 | 891.38 | 182.69 | 294.03 | 67.01% |

| 9 | West Bengal Essential Commodities Supply Corporation Ltd. | 344.93 | 344.93 | NC | 185.84 | 46.12% |

| 10 | Shirdi Industries Ltd. | 695.74 | 673.88 | 103.05 | 176.36 | 73.83% |

(#Financial Creditors – FC. Source: IBBI, CIRP)

Background

Monnet Ispat & Energy Ltd was amongst one of the 12 companies which were dragged into insolvency proceeding by lenders on recommendation by RBI and admitted by NCLT in July 2017. Total admitted claims for the company during Insolvency proceedings was around Rs 11,478 crores, out of which over 11,014 crores (96%) pertaining to financial creditors and rest are of all other creditors including employees and workmen.

Resolution Plan

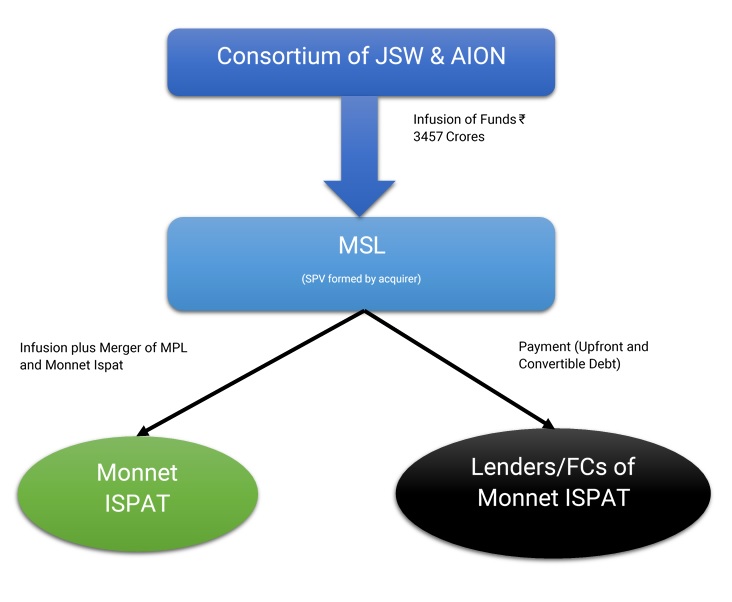

There was only one bidder who put forward resolution plan, a consortium of JSW and AION Investment which showed interest in acquiring steelmaker.

Structure

The offers to lenders of Rs. 2,892.12 crores out of which Rs 2,676.92 crores are paid upfront (including purchase of OCPPS by consortium) and Rs 215.2 crores settled by way of conversion of debt into equity. Further Rs 25 crores will be paid to Operational creditors in a time of one year. However, to note that Total Infusion by Consortium is Rs. 3,457 Crores out of which Rs. 875 crores will be infused as Equity and CCPS and other as a loan. The details as follows:

| Particular | Loan | Equity/CCPS | Total |

| Settlement with Creditors | |||

| 1. Payment to financial Creditors | 2,457.00 | 2,457.00 | |

| 2. Conversion of debt into Optional convertible preference shares (OCPS) and subsequently purchased by MSL (SPV created by Consortium/acquirer) | 219.92 | 219.92 | |

| 3. Conversion of Debt to equity of assenting Financial Lenders/creditors | 215.20 | 215.20 | |

| Capital Infusion in the company | |||

| 1. Capital Infusion (toward payment of OCPS and working capital & capital expenditure) | 875.00

(including toward purchase of OCPS from Lender as mentioned A2) |

875.00 | |

| Additional infusion in the company as working capital loan | |||

| 1. Working capital advance | 125.00 | 125.00 | |

| Total Amount | 2797.20 | 875.00 | 3672.20 |

Steps

- Conversion of debt into equity to the tune of Rs. 215.2 crores of existing financial creditors

- Extinguishment of equity shares of all the existing protomers which are around 25% of total paid-up capital as on the date of admission.

- Reduction in equity share capital of other public shareholders to 33.06% of its original value.

- Consolidation of face value of shares from Rs 3.3/share to Rs 10 per share without eliminating the shareholders who are holding three or less number of shares.

- All funds by the consortium initially will be funded through Milloret Steel Limited (MSL) a SPV and then merger of MSL with the company and pursuant to the merger 34.92 crores equity shares and 52.59 crores Compulsory Convertible Preference shares (CCPS) are allocated to the shareholders of MSL.

- There was no exemption given by the NCLT for stamp duty liability arise on merger of MSL with Monnet.

- Carry forward of losses benefit will be available to the acquirer.

- Post-merger, JSW & AION equity shareholding is 74.37% and other shareholders holding including lenders is around 25.63% (Source: Monnet Ispat Shareholding Pattern, disclosure to stock exchange).

- JSW & AION will be classified as promoter post-merger and all existing promoters will be declassified from promoter & promoter group.

Settlement of FCs and change in Shareholding

Table 2: Resolution via Settlement for all Financial Creditors of Monnet Ispat (All Figs in INR Crores)

| Financial Creditors (FC) | Admitted claims | Liquidation value | Upfront cash payment | Debt to equity conversion | Haircut | |

| Assenting Secured FC | 9,732.8 | 2,356.3 | 2,637.2 | 192.1 | 70.93% | |

| Dissenting Secured FC | 39.5 | 9.1 | 9.1 | – | 76.96% | |

| Assenting Unsecured FC | 1,169.0 | – | 30.6 | 23.1 | 95.41% | |

| Dissenting Unsecured FC | 73.6 | – | – | – | 100.00% | |

| Total Financial Creditors | 11,014.9 | 2,365.4 | 2,676.9 | 215.2 | 73.74% | |

| Operational creditors (other than workmen and employees) | 444 | – | 25 | – | 94.37% | |

Table 3: Change in Shareholding of Current & New Promoters, Lenders and Others (including Public)

| Particular | Existing Shareholding | After Resolution plan implementation | After Conversion of CCPS into Equity |

| Current Promoters | 25.27% | – | – |

| New Promoters | |||

| Equity | – | 74.37% | 87.91%* |

| CCPS | – | – | |

| Public Shareholding | |||

| Lenders | 15.08% | 7.11% | |

| Other Shareholders | 74.73% | 10.54% | 4.97% |

| Total | 100% | 100% | 100% |

Note:

There is around Rs 875 crores capital infusion by consortium out of which Rs 350 crores (equity) and Rs 525 crores via CCPS. Once the conversion of CCPS takes place holding of consortium will increase to 88% and Public shareholding (including lenders) will come down below 25%.

As per recent SEBI guidelines if a company’s public shareholding fall below 10 % due to resolution plan same need to be increased to 10 % or more within 1 year and further to 25% or more within of 3 years from approval of resolution plan, so the acquirer has three years window to bring down the stake below 75%

Post-acquisition

Capacity utilisation and operational turnaround

Monnet Ispat has an integrated steel plant with a capacity of 1.5 MTPA to produce HR plates, rebars and structure profiles to cater to the rapidly growing infrastructure & construction industry. JSW currently has around 18MTPA capacity with capacity utilisation of around 93% targeted for FY 19 and on an expansion mode to increase its capacity further in coming years.

JSW looking for Monnet turnaround within one year, and if they able to do that and utilise the current capacity of Monnet will certainly lead to valuation creation for all stakeholders involved.

Comparison with other companies in CIRP

There is more interest shown by the buyers in defaulted steel companies as compared to other sectors which yielded in resolution plan. As compared to other steel industries companies in the Insolvency process, Monnet’s lender has the largest haircut for their debts around 74% whereas Bhushan steel’s lenders get just 36% haircut and recovered around Rs 35,571 Crs of debt.

Table 4: Resolution in Steel Sector (All Figs in INR Crores)

| Sl. | Name of Corporate Debtor | Admitted Claims of FCs | Liquidation Value | Resolution Amount for FCs | Haircut taken by FC (%) |

| 1 | Bhushan Steel | 56,022.06 | 14,541 | 35,571 | 36.51% |

| 2 | Sree Metalik | 1,287.22 | 340.62 | 607.31 | 52.82% |

| 3 | Electrosteel Steels | 13,175.14 | 2,899.98 | 5,320 | 59.62% |

| 4 | Kamineni Steel & Power India | 1,509.00 | 760 | 600 | 60.24% |

| 5 | Monnet Ispat | 11,014.90 | 2365.4 | 2892.1 | 73.74% |

Valuation analysis

| Gains for New Promoters | |||||||

| Particular | Infusion by Promoters | Stake | Market cap | Promoters Value (Market cap.) | |||

| Equity (in cr.) | 349.02 | 74.37% | 1,612.90 | 1,199.51 | |||

| Equity + Preference* (in cr.) | 850.00 | 87.91%* | 3419.64 | 3,006.20 | |||

Please Note: From the current market cap., it is clearly visible that capital infused is already recovered by the JSW & AION

Table 5: Valuation based on holding company JSW Steel comparison

| Particulars | Amount in Cr |

| Market Value (Mar-18) | 69,628 |

| Loan (Mar-18) | 33,900 |

| Enterprise Value (EV) | 1,03,528 |

| MT Sale | 15.55 |

| Enterprise Value per MT (EV/MT) | 6,658 |

| Monnet Capacity | 1.50 |

| Expected EV for Monnet ISPAT | 9,987 |

| Expected EV for Monnet ISPAT based Replacement Value | 9,355 |

| Scenario | Enterprise value | Loan Book* | Equity Value (fully diluted basis) | Difference between present market cap and likely valuation assuming debt remaining same |

| Current Scenario (Market Price) | 6,001.64 | 2582 | 3,419.64 | |

| Valuation on Replacement value | 9,355.00 | 2582 | 6,773.00 | 1.98 |

| Valuation on JSW Comparison (EV) | 9,987.00 | 2582 | 7,405.00 | 2.17 |

*We have assumed Rs. 2,457 Crs & Rs. 125 Crs working capital advance as a loan

Minority shareholders

The IBC restricts rights of small equity holders of listed entities viz.

- No Financial updating but still Stock continue to trade during the bankruptcy process, this usually has a significant impact on the stock price.

- No revert to the queries of the small shareholders by the new management

- Generally, extension of Annual General Meeting

- No say in major corporate actions by NCLT such as

- capital reduction in what proportion?

- delisting of shares?

However, ordinarily it needs shareholder approval, but not required if proposed resolution plan is approved by the Committee of Creditors (CoC) and National Company Law Tribunal

Therefore, the small shareholders are confused that where they stand in the insolvency process and what should they do with their shares. So, IBC should include some provisions where representative of small shareholders has at least right to put their words before the CoC/authorities.

Conclusion

This present case can be the first case of resolution where it creates value for all the stakeholders and also put idle assets to profitable use. It seems small shareholders were short charged as they are being categorised along with the promoters’ shareholders even though they had no role in the mess created by the promotor’s’ shareholders and secured lenders. In same way in case of such resolution small shareholders are compensated in similar manner as secured lenders it will be fair to them. Though present provisions do not accommodate but COC can while accepting the resolution plan can consider the same based on informal guidelines to be issued by the insolvency agency.