MPS Limited (“MPS”), a listed pure-play publishing services company, provides platforms and services for content creation, full-service production, and distribution to the world’s leading publishers, learning companies, corporate institutions, libraries, and content aggregators. The Group is powered by 2,800 employees based across its five operations and technology centres in India (Noida, Gurugram, Dehradun, Bengaluru, and Chennai), and its five offices in the US (New York, Orlando, Durham, Effingham, and Portland).

The company was established as an Indian subsidiary of Macmillan (Holdings) Limited in 1970. In 2011, the company was acquired by ADI BPO Services Limited from Macmillan (Holdings) Limited, led by Mr. Nishith Arora.

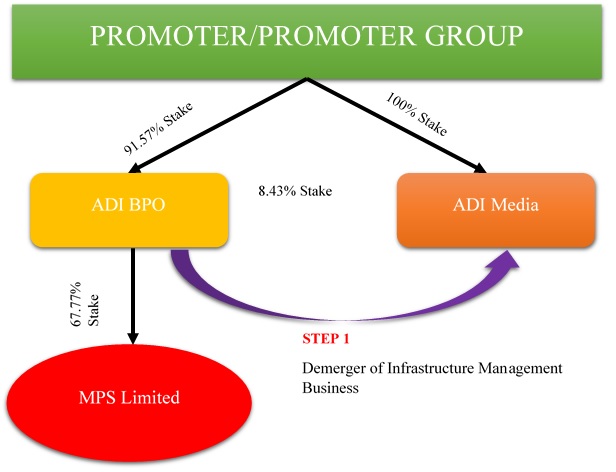

THE TRANSACTION

The Board of Directors of MPS Limited (“Transferee Company”) approved the amalgamation of ADI BPO Services Limited (“Transferor Company” or “ADI BPO”) into the Transferee Company. Before the amalgamation, Transferor Company will de-merge its “Infrastructure Management Business” undertaking (“De-merged Undertaking”) into ADI Media Private Limited (“Resulting Company” or “ADI Media”).

Both ADI BPO & ADI Media are owned by the promoters/ promoter entities. ADI BPO is primarily engaged in the business of providing customer services, Lead Generation, data process, and business process

outsourcing. It also provides facility management services. ADI BPO is the holding company of MPS holding 67.77% stake in MPS.

Resulting Company is primarily a B2B magazine publisher with four niche publications- TV Veopar Journal, Communication Today, Broadcast and Cables at and Medical Buyer. Further, it creates rich business content which reaches a targeted business audience via print, web and exhibitions. It also provides facility management services. ADI Media holds 8.43% stake in ADI BPO.

Demerged Undertaking includes the business activity of leasing and infrastructure management covering all related assets, liabilities, rights and obligations. The Appointed date of the transaction is 1st April 2017.

RATIONALE FOR THE TRANSACTION

According to the scheme filled by the Company, the Transferee Company is actively considering opportunities to acquire Indian entities with a view to expanding its business, operations and revenue. Currently, Transferee Company is the one layer of Indian subsidiary of Transferor Company. Any acquisition by Transferee Company involving more than one layer of the Indian subsidiary would be impermissible having regard to the provisions of section 2(87) of the Companies Act, 2013 read with Companies (Restriction on number of layers) Rules, 2017 as there is a restriction on having more than two layers of subsidiaries.

That being so, the Transferee Company is prevented from acquiring an Indian subsidiary company which has its own Indian subsidiary. This could arise in loss of business opportunities available to the Transferee Company, its growth and future revenues. To provide flexibility to the transferee company, the current structure is proposed to be rationalised by consolidating holding company into the company and thereby removing one layer.

The de-merger of the Infrastructure Management Business undertaking is sought to be undertaken with the intent of realigning the business operations. However, considering the financials of ADI BPO, the asset base (before de-merger) mainly includes land & building which it has given on rent to MPS and investment in the MPS. During FY17, the company classified the said land & building from fixed assets to non-current investment. The management has not provided the assets and liabilities statement pertaining to the de-merged undertaking in the scheme. Further considering the valuation report, it looks the Transferor Company will transfer all its assets (mainly land & building) to the Resulting Company except the equity shares of the MPS.

The Ratio for the De-Merger

1(one) equity share of face value of INR 10 each of the resulting company be issued at par for every 311 equity shares of face value of INR 1 each of the demerged entity.

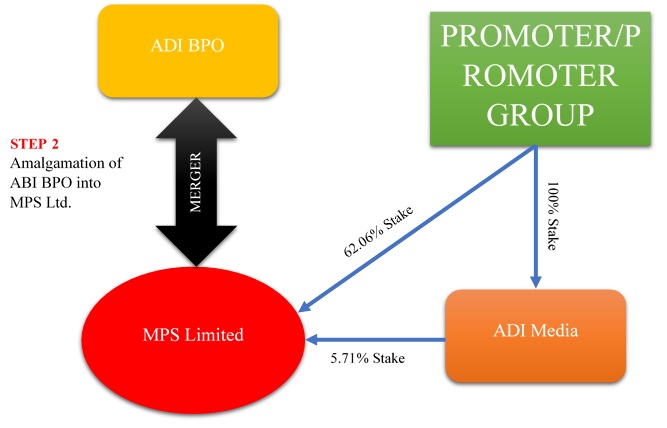

The Ratio of the Amalgamation

1,07,41,183 equity shares of face value of Rs.10 each of the Transferee Company to be issued at par for every 1,00,00,000 equity shares of face value of Rs.1 each of the Transferor Company.

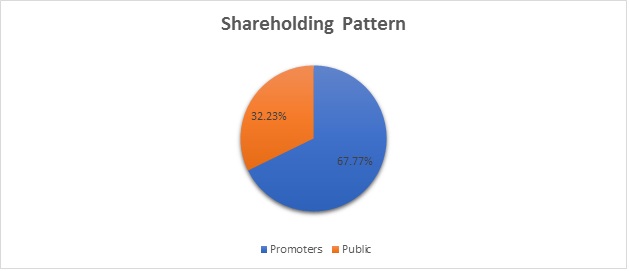

Pre-Post Shareholding Pattern

Source: – Company Website

There will be no change in the total promoters holding in MPS due to restructuring. However, entire promoter’s stake, currently, 67.77% is held through ADI BPO. The Restructuring will result in the direct holding of promoters in MPS (only 8% through ADI Media).

PREVIOUS ACQUISITIONS OF MPS

MPS has completed five acquisitions in the last four years.

- 2013: Element LLC, based in Orlando (USA), specialized in content and media asset development for educational publishers, focusing on science and math.

- 2014: Electronic Publishing Services Inc. (EPS), a leading US-based content services provider to the higher education and STM publishing markets.

- 2015: TSI Evolve (USA), specialized in content development and media asset development for educational publishing, focusing on Reading, Language, Arts, and World Languages.

- 2016: Mag+ provides a complete ecosystem for creating and distributing content to apps on the 1 billion+ mobile devices in the world. Mag+ apps are content hubs that engage and retain users. Mag+ provides tools for creating and delivering designed touchscreen-native documents and issues, news items, real-time notifications, in-app messaging, and web content.

- 2017: THINK Subscription is a subscription management software business that provides publishers with platforms and services to help them manage their subscribers and fulfil their needs. THINK Subscription was a part of Digital River, a global leader in e-commerce outsourcing. It builds and manages online businesses for more than 40,000 software publishers, manufacturers, distributors, and online retailers.

QUALIFIED INSTITUTIONAL PLACEMENT (QIP)

During the year ended 31 March 2015, MPS has made a QIP of equity shares at INR 836 per share mobilizing INR 147.80 crore (net of issue expense) with the objective to acquire large targets. Out of the said proceeds, the company has utilised only a sum of INR 27.56 lakhs for the acquisition of companies and group of assets during the year ended 31 March 2017 and the balance proceeds remain invested in liquid funds.

FINANCIALS

Table 1: Financials ADI Media & ADI BPO (All Figs in Rs. Lacs)

| Particulars | ADI Media | ADI BPO | ||

| 15-16 | 16-17 | 15-16 | 16-17 | |

| EQUITY & LIABILITIES | ||||

| Shareholder’s Fund | 1,443 | 1,442 | 5,725 | 5,823 |

| Non-Current Liabilities | 7 | 8 | 273 | 104 |

| Current Liabilities | 75 | 105 | 11 | 13 |

| Total | 1,525 | 1,555 | 6,009 | 5,940 |

| ASSETS | ||||

| Property, Plant and Equipment | 382 | 418 | 1,043 | 223 |

| Non-Current Investment | 348 | 648 | – | 17 |

| Investment Property | – | – | 4,416 | 4,416 |

| Other Non-Current Assets | 76 | 83 | 3 | 11 |

| Current Assets | 720 | 406 | 548 | 574 |

| Total | 1,525 | 1,555 | 6,009 | 5,940 |

| Particulars | Amount |

| Number of shares (ADI BPO) | 1,17,46,375 |

| Value per share (ADI BPO) | 49.58 |

| Value assigned to the demerged undertaking per share | 14.45 |

| Total value assigned to the demerged undertaking | 16,97,35,119 |

Source: – Company Website, Valuation Report

Financial of MPS

Table 2: Financials MPS (All Figs in INR Crores)

| Particulars | Nine months ended on | |

| 31.12.17 | 31.12.16 | |

| Revenue from operations | 203 | 217 |

| EBIT | 80 | 81 |

| PAT | 55 | 55 |

| Segment Revenue | ||

| Content Solution | 167 | 188 |

| Platform Solution | 36 | 29 |

| Segment Results | ||

| Content Solution | 63 | 69 |

| Platform Solution | 11 | 9 |

CONCLUSION

The management is discussing the acquisitions for a while however they keep shifting the course. In earlier con-calls with Investors/Analyst, the management was quite confident for completing acquisitions during FY18. However, they were not able to do the same. For having a blend of organic/inorganic growth, the company came out with QIP of INR 150 crore (~18% of current MCap) out of which only ~INR 28 has been utilised by the Company and the balance amount is parked in liquid funds which are dragging returns for the shareholders. The company’s previous acquisitions are also giving limited returns. Considering the pressure from the shareholders, it is a need of the hour for the Company to acquire a good business.

Does de-merging infrastructure facility (Land & Building) of ADI BPO into ADI Media makes any sense as the facility is used by MPS only? The scheme also envisages the cost incidental to de-merger shall be borne by the De-Merged Company (which will later de-merged with the MPS on the same day). The key reason behind the re-structuring is for regulatory purpose however, promoters will be benefited from such structure if they sell shares in MPS in future. Further, MPS will ultimately born all the expenses relating to the re-structuring (Fees, stamp duty etc) is not a great idea from the view of corporate governance and a transparency to the public shareholders.