India’s container ports handled 11.58 Million TEUs with a growth rate of 6.1 % for FY 16, with a modest growth rate during past few years. Western Coast of India plays a major role in container growth rate as it contributes almost 73% of the overall Indian container market. There are around 200 ports in India including 12 major ports which handles almost 95% of trade volumes in India.

During the last 2-3 years, Central Government is giving lots of emphasis on developing infrastructure which also include proposal to develop inland waterways and coastline shipping. Major ports are expected to increase their capacity, infrastructure and better connectivity with rails and roads which will, in turn, benefits the container market and related services.

Transaction

The board approved the scheme of amalgamation of Navkar Terminal Limited (NTL) into Navkar Corporation Limited (NCL), with appointed date 1st March 2016, former being wholly owned subsidiary of NCL. Since all equity share are held by NCL and it nominees no shares are allotted to equity shareholders.

Redeemable preference shareholders of NTL are allotted Redeemable Preference Shares of NCL in 1:1 ratio, all preference shares are held by promoter group which are redeemable at par in March 2025.

About the company

Navkar is amongst India’s leading Container Freight Station (CFS) operator with a capacity of 3,10,000 TEUs (Twenty-foot equivalent units) per annum as on Mar-16. Company also owns Private freight terminal (PFT) which allows them loading – unloading of train cargo container and transport domestic cargo to and from inland destination on the Rail network.

NCL is headed by Mr. Shantilal J Mehta Chairman and Managing Director and company is listed on BSE and on NSE.

NCL was established in the year 2008, and as of Mar 16 company has 573 Trailers for transporting cargo between their CFSs and JNPT, 92 Refer plug points for storing cargo at a controlled temperature, 5 lakh sq. ft. aggregate area of warehouse which include 60,872 sq. ft. of bonded warehouse and 1,18,000 sq. ft. for the consolidation of “Less Than Container Load” (“LCL”) containers.

With increasing global scenario and EXIM trade along with the port expansion, India’s containerisation volume is expected to be double up by 2020, by keeping that in mind company is planning to triple its capacity to 10,52,000 TEUs over the next couple of years. Increasing capacity at Somathane CFS which will take care of increased container traffic demand at JNPT. Setting up ICD and logistic part at Vapi to Carter needs of volume generated from South Gujrat industrial belt, being only ICD in that region will give them a competitive edge and value to its customer.

Financials

Navkar Corporation Limited is currently having a market cap of over Rs 3,100 crores, total revenue stood at Rs 378.8 Cr with a good operating profit margin of 44.84% & Net Profit Margin of around 27% for FY 16-17.

During the year 2015 company raised Rs 478.14 Cr (net of issue expense) through Initial public offer object of the issue being capacity enhancement of the Somathane CFS, development of its non-notified areas of CFS and establishment of a logistics park at Valsad (Vapi), out of the total receipts Rs 121.57 crores is not yet utilized and lying in current account and fixed deposits (after excluding issue expense of Rs 31.86 crores).

Table 1: Details utilisation proceeds of IPO as on March 31, 2017

Amount utilised up to March 31, 2017,

| Particulars | Proposed amount as per IPO | Revised proposed amount | Amount un-utilised as on March 2017,17 | |

| Capacity enhancement of Somathane CFS | 114.53 | 79.89 | 74.19 | 5.70 |

| Development of non-specified areas of CFSs | 54.25 | 46.93 | 29.77 | 17.16 |

| Establishment of a logistic park at Valsad (near Vapi) | 314.57 | 269.26 | 170.66 | 98.59 |

| Repayment of loan | – | 87.27 | 87.16 | 0.11 |

| Total | 483.34* | 483.34 | 361.78 | 121.57 |

*Including issues expense (including service tax) Rs 31.86 crores.

Company is currently availing Tax benefit under Sec 80-IA (4)(i) of Income Tax Act, 1961 for its CFS operation for 10 years from the date of operation till date of exemption, these benefits will be expired in Year 2017 for 2 CFS and in Year 2019 for remaining one CFS, post that tax liability will increase which will have an impact on the margins of the company.

Table 2: Financials of NCL on Standalone basis(All Figures in Rs. Crores)

| Particulars | 2016-17 | 2015-16 |

| Revenue from Operations | 355.16 | 347.26 |

| Other Income | 23.64 | 32.34 |

| Total Revenue | 378.8 | 379.6 |

| Less: Expense | 219.55 | 213.34 |

| Profit before Interest, tax and depreciation | 159.25 | 166.26 |

| Depreciation | 18.86 | 19.32 |

| Interest | 31.04 | 34.32 |

| Profit Before Tax | 109.35 | 112.62 |

| Less: Tax Expense | 13.14 | 17.71 |

| Profit after Tax | 96.21 | 94.91 |

| Add: Other comprehensive income | -0.33 | -0.09 |

| Total comprehensive income | 95.88 | 94.82 |

| EPS | 6.75 | 7.38 |

| OPM % | 44.84% | 47.88% |

| NPM % | 27.09% | 27.33% |

| Debt to Equity | 0.16 | 0.24 |

| Interest Coverage Ratio | 4.52 | 4.28 |

| Return on Capital Employed | 9.77% | 10.38% |

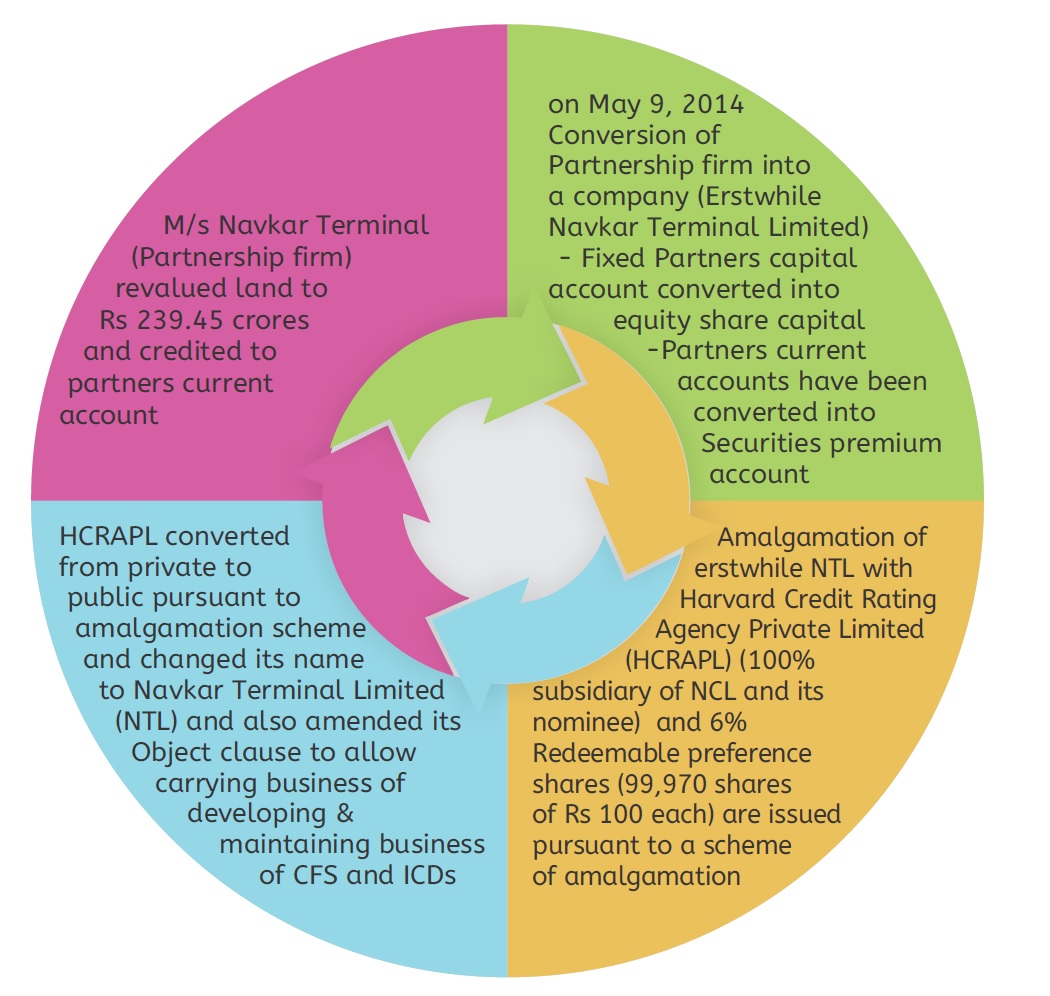

Navkar Terminal Limited (NTL) is 100% subsidiary of NCL was established in Sept 2010 with a name of Harvard Credit Rating Agency Limited with a primary business of analysis, rating, evaluations on any kind of loan or equity, appraisal of the obligation, dues, debts and commitments.

In year 2015, company changed its name to NTL from Harvard Credit Rating Agency Limited and it also altered its MOA to allow company to develop and maintain Container Freight Station (CFS) and Inland Container Depot (ICD).

As of March 2016, no business activity was carried out by the company, focus is on developing CFS and ICDs and logistics park at its Vapi location. For the year 2016-17 company has started business operation and generated around Rs 15.75 crores (arrived from consolidated financial statement of NCL) till March 2017.

Table 3: Financial of NTL (All Figures in Rs. Crores)

| Particulars | 1st April. 2016 to 31st Dec, 2016 | 2015-16 | 2014-15 |

| Equity Paid-up capital | 0.05 | 0.05 | 0.05 |

| Reserves and Surplus | 215.55 | 215.55 | 215.55 |

| Carry forward Losses | -0.56 | -0.84 | -0.67 |

| Net worth | 215.04 | 214.76 | 214.93 |

| Secured Loans | 204.45 | 139.77 | 25.87 |

| Unsecured Loans | 96.76 | 90.03 | 75.41 |

| Fixed Assets | 514.97 | 485.11 | 312.2 |

| Income from Operation | 7.94 | NIL | NIL |

| Total Income | 8.26 | NIL | NIL |

| Total Expenditure | 8.45 | 0.23 | 0.17 |

| Profit before tax | -0.18 | -0.23 | -0.17 |

| Profit after tax | 0.19 | -0.17 | -0.12 |

| EPS | 37.42 | -34.63 | -80.23 |

Pre-merger saga of NTL

Accounting Treatment of Merger

- Transferee company (NCL) shall account for amalgamation in accordance with the “Pooling of Interest Method of Accounting” prescribed under Accounting Standard 14 – ‘Accounting for Amalgamation’.

- All assets and liabilities including reserves of transferor company shall be the recorded in the books of the transferee company at their existing carrying value and in same form.

- The difference between the share capital of the NCL, investment in the NTL recorded in the books of the NCL and the face value of preference shares of the NCL issued and allotted by it to the members of the NCL pursuant to the scheme shall be adjusted in the Capital Reserve Account.

- In case of difference in accounting policies of NCL and NTL, accounting policies of NCL will prevail and the difference till the appointed date will be quantified and adjusted in the capital reserve account.

Table 4: Capital Structure and Shareholding Pattern pre-and post-amalgamation of NCL:

| Particulars | Pre | Post |

| Authorised Capital | ||

| 15,50,00,000 /20,50,000 Equity Shares of Rs 10/- each | 1,55,00,00,000 | 2,05,00,00,000 |

| 50,00,000 0% Cumulative Redeemable Preference Shares of Rs 10 each | 5,00,00,000 | 5,00,00,000 |

| 6,00,000 6% Cumulative Redeemable Preference Shares of Rs 100 each | – | 6,00,00,000 |

| Total | 1,60,00,00,000 | 2,16,00,00,000 |

| Issued, Subscribed and Paid up Capital | ||

| 14,26,08,023 (March 31, 2015: 10,97,04,798) Equity Shares of Rs.10 each fully paid up | 1,42,60,80,230 | 1,42,60,80,230 |

| 23,00,000 0% Cumulative Redeemable Preference Shares of Rs 10 each fully paid up | 2,30,00,000 | 2,30,00,000 |

| 99,790 6% Cumulative Redeemable Preference Shares of Rs 100 each fully paid up | – | 99,79,000 |

| Total | 1,44,90,80,230 | 1,45,90,59,230 |

| By Promoter Group: | ||

| In Equity | 72.86% | 72.86% |

| In Preference shares | 100% | 100% |

| By Public: | ||

| In Equity | 27.14% | 27.14% |

| In Preference shares | NIL | NIL |

Benefit from the merger

- Consolidation of business – It will enable NCL to consolidate similar line of business into a single company.

- Enable focus strategies, management, investment and leadership.

Impact of Merger

Post-merger- amalgamated company will have enough bandwidth to expand and consolidate. There is enough surplus land available for expansion. It needs to go for strategic tie up and leverage its knowledge to quickly ramp up and creates capacity to expand its customer base and reach for its services by having ICD in the area where its customers need. As mentioned, it has still surplus cash lying out of IPO. This will give a boost to the expansion plan of NCL and will enhance its capacity.