IBN18 Broadcast Ltd (TV18), based in India, is in the business of broadcasting, telecasting, relaying and transmitting general news programmes. It has general news channels in Hindi, English and other regional languages and business news channels in Hindi, English and Gujarati. Network18’s listed subsidiary TV18 owns and operates the largest network of channels – 53 in India spanning news and entertainment. The market cap of the company is Rs 11,015 crore.

Equator Trading Enterprises Pvt Ltd (Equator) is a wholly-owned subsidiary (WoS) of TV18 and a holding company of Panorama Television Pvt Ltd. The principal activities of the company are to carry on the business of trading, financing, investment and trading in shares. TV18 acquired Equator in 2012, as per the letter of offer following were the terms of the deal:

Terms of the Issue

Table 1: IPO Terms

| Figures in Rs million, Except Shares | Network 18 | TV18 |

| Issue Size | 26,996.22 | 26,991.56 |

| Issue Expenses | 746.22 | 741.56 |

| Net Proceeds of Issue | 26,250.00 | 26,250.00 |

| Number of Shares to be Issue | 899,873,930 | 1,349,577,882 |

| Issue Price (Face value + Premium) | Rs. 30 (5 +25) | Rs. 20 (2 + 18) |

| Right Issue ratio (New: Existing) | 307:50 | 41:11 |

Utilization of Issue Proceeds

Table 2: Use of Funds Raised from IPO

| Network 18 | Issue Proceeds (Rs million) | % of total proceeds |

| Repayment of Debt | 11,122.7 | 42.4% |

| Investment in subsidiary TV18 | 13,840.0 | 52.7% |

| General Corporate purposes | 1,287.3 | 4.9% |

| Total | 26,250.0 | 100.0% |

| TV18 | Issue Proceeds (Rs million) | % of total proceeds |

| Repayment of Debt | 4,216.0 | 16.1% |

| Acquisition of ETV channels | 19,250.0 | 73.3% |

| General Corporate purposes | 2,784.0 | 10.6% |

| Total | 26,250.0 | 100.0% |

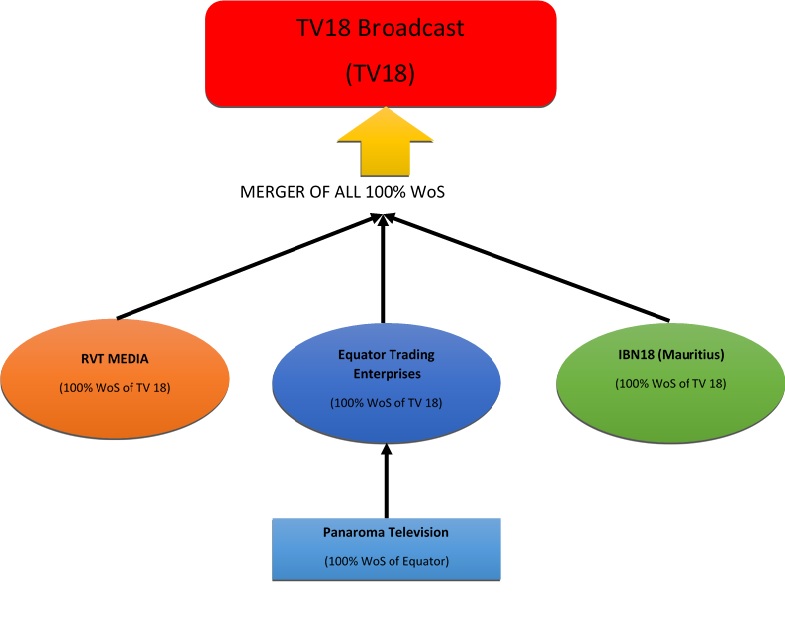

RVT Media Pvt Ltd (RVT Media) is engaged in broadcasting, telecasting, transmitting or distributing in any manner, any audio, video or other programmes or software, trading business and commercial services. In December 2007, TV18 acquired 100% equity stake in RVT Media Pvt Ltd and thus the company became the wholly owned subsidiary with effect from January 1, 2008.

Panorama Television Pvt Ltd (Panorama) is engaged in the business of programme production and broadcast of satellite television channels in Hindi, Urdu and other regional languages predominantly to Indian viewers. ETV-News Rajasthan, ETV-News Bihar, ETV-News MP, ETV-News UP, ETV-Urdu, ETV-News Bangla, ETV-News Kannada, ETV-News Haryana/HP, ETV-News Gujarathi and ETV – News Odia are the channels owned and broadcast by the company. News18-Assam /North East, News18- Tamil and News18-Kerala launched during this year. The channels are distributed through cable operators, direct to home (DTH) and other service providers. Equator owns Panorama.

IBN18 (Mauritius) Ltd (IBN18) principal activity includes making investments and providing consultancy services.

Structure of the Amalgamation

The appointed date of both the amalgamations is April 1, 2016. In another Scheme of merger by absorption the 13 WoS subsidiaries of the Network18 Media & Investments Limited are amalgamating with the group company.

Consideration

- Upon the Scheme of Amalgamation taking effect, the entire issued, subscribed and paid-up share capital of the transferor companies shall get cancelled and no new shares of the transferee company will be issued in lieu thereof, as all the transferor companies are wholly-owned subsidiaries of the transferee company.

- As stated in clause above, no shares of the listed company (i.e. transferee company) shall be issued and allotted pursuant to the Scheme of Amalgamation and thus there will be no change in the shareholding pattern of the listed company i.e. TV18.

Networth before amalgamation

Table 3: Financials as on March 31, 2017 (all on standalone basis) Rs in Crores

| Particulars | Equator | Panorama | RVT | *IBN18 | TV18 |

| Equity | 200.00 | 24.96 | 0.10 | 376.88 | 342.87 |

| Other Equity: | |||||

| Zero Coupon Optionally Fully Convertible Debentures of Rs.100 each* (held by TV18 Broadcast Ltd) | 1365.90 | 0.00 | 41.89 | 0.00 | 0.00 |

| Zero Coupon Compulsory Convertible Debenture(s) of Rs 1000 each (held by TV18 Broadcast Ltd) | 0.00 | 0.00 | 4.06 | 0.00 | 0.00 |

| Reserves and Surplus | -227.30 | -36.16 | -0.15 | -37.82 | 3354.27 |

| Networth | 1338.60 | -11.20 | 45.90 | 339.05 | 3697.15 |

*Figures for IBN18 are converted into Rs by using exchange rate as 1 USD=67 INR

Recent Updates

- In March 2018 TV18 Broadcast has completed the acquisition of 1% additional stake in the joint venture (JV) Viacom18 for $20 million (Rs 127.1 crore) from JV partner Viacom International.

- On 31 January, TV18 has entered into a definitive agreement with Viacom’s MTV Asia Ventures to purchase the addition 1% stake. The transaction falls under related party transaction and was to be completed within 30 days.

- The additional 1% stake gives TV18 the operational control of Viacom18. TV18 will now own 51% stake in Viacom18, which was an equal JV between TV18 and Viacom. Viacom will continue to own 49% stake in the JV.

- The two companies had also strengthened their 10-year alliance by renewing the brand and content licence agreement for 10 years.

- As a majority partner, TV18 feels it can drive value-addition and synergies across the multi-platform group comprising broadcast, digital, filmed and experiential entertainment and media businesses.

Summary Consolidated Financials

Viacom18 & Indiacast became subsidiaries of TV18 from 28th February 2018 and have now been consolidated into TV18/Network18 financials. HomeShop18 has ceased to be a subsidiary of Network18 from February 15, 2018 as a result of its acquisition of ShopCJ through a share-swap. For a better understanding of group performance and comparability considering these corporate actions, the financials stated below are being restated and represented by consolidating Viacom18 and Indiacast and excluding HomeShop18 throughout.

Table 4: Financials of TV18 and Network18

Accounting Treatment

In the books of TV18 i.e. Transferee Company.

| Element | Treatment |

| Accounting Standard | Upon the coming into effect of this Scheme the TV18 shall account for the amalgamation in its books as per the applicable accounting principles prescribed under Indian Accounting Standard (Ind AS) 103 and /or any other applicable Ind AS, as the case may be. |

| Assets and Liabilities of Transferor Companies | The TV18 shall upon the Scheme coming into effect, record the assets and liabilities, if any, of the Transferor Companies vested in it pursuant to this Scheme, at the respective book values thereof and in the same form as appearing in the books of the Transferor Companies. |

| Reserves of the Transferor Companies | The identity of the reserves of the Transferor Companies shall be preserved and TV18 shall record the reserves of the Transferor Companies in the same form and at the same values as they appear in the financial statements of the Transferor Companies. |

| Inter Company Balances | Pursuant to the amalgamation of the Transferor Companies with TV18, the inter-company balances between TV18 and the Transferor Companies, if any appearing in the books of the TV18 shall stand cancelled and there shall be no further obligation in that behalf. |

| Investments held by TV18 in Transferor Companies | The value of investments held by TV18 in the Transferor Companies shall stand cancelled pursuant to amalgamation. |

| Adjustments to Capital Reserve | The difference between the share capital of the Transferor Companies and the book value of the investments cancelled above and adjustment pursuant to inter-company balances as shown above, if any, of the Scheme shall be adjusted in the Capital Reserve in the books of TV18. |

| In case of different accounting policy followed by Transferor Companies and Transferee Company, which treatment will prevail? | In case of any difference in accounting policy between the Transferor Companies and TV18, the accounting policies followed by TV18 will prevail and the difference shall be quantified and adjusted in the books of TV18. |

| General | In addition, TV18 shall pass such accounting entries, as may be necessary, in connection with the Scheme, to comply with any of the applicable accounting standards and generally accepted accounting principles adopted in India. |

Rationale

- All transferor companies are direct or indirect wholly-owned subsidiaries, of the transferee company.

- In order to consolidate and effectively manage the transferor companies and the transferee company in a single entity, which will provide several benefits including synergy, economies of scale, attain efficiencies and cost competitiveness, it is intended that the transferor companies be amalgamated with transferee company.

- Rationalizing the group structure to ensure optimized legal entity structure more aligned with the business by reducing the number of legal entities and reorganizing the legal entities in the group structure so as to obtain significant cost savings and/or simplification benefits;

- Integrating news channels, i.e. Business news channels, English news channels, Hindi news channels and regional news channels, in the amalgamated entity which would result in maximizing overall shareholder value and bring synergies in operations.

- Equator was acquired with sole purpose to gain control over ETV channels

- In the year 2017, Equator raised Zero Coupon Optionally Fully Convertible Debentures of Rs 43.90 crore and repaid the loans of Panorama of Rs 43.65 crore.

- Network18 benefited from acquiring Equator in the sense that as a part of the deal, the Network18 and TV18 have also entered into a Memorandum of Understanding (MoU) with Infotel Broadband Services Limited (Infotel), a subsidiary of Reliance Industries Limited, to distribute media content of all broadcasting channels through 4th Generation Broadband Network of Infotel. Further, Infotel shall have preferential access to this content on a first right basis as a most preferred customer.

Conclusion

The group, after series of restructuring and acquisitions, wants to have simple and efficient corporate structure not only because of commercial needs but also considering changing or to say stringent and transparent legal environment under the new and ever responding laws. Further to capture benefits arising out of digital and cloud and other emerging technologies, it is imperative for the group to have consolidated business entity.

The amalgamation is done to get all the channels under one umbrella. IBN18 (Mauritius) Limited the foreign wholly owned subsidiary of the company, received approval required from RBI for this merger in March 2018. The group is able to untangle various related parties’ transactions including IBN18 (Mauritius) Ltd’s Optionally Convertible Debentures of USD 1 each amounting to $56,249,900, conversion into equity in March 2017, inter-company loans and interest earned there on. Also, the timeline between the appointed date being April 1, 2016 and the scheme being approved in stock exchange in April 2018, indicates substantial delay in procedures in filing the scheme, which casts significant doubt on the scheme being approved into near time come.