Nine months after Reliance Jio entered into an agreement with Brookfield to sell its mobile network towers, the largest FDI in Indian infrastructure has not yet received all regulatory approvals, said people aware of the matter.

While final approvals from the Department of Telecommunications (DoT) and Ministry of Home Affairs (MHA) are expected shortly, as per the sources cited, Reliance Industries’ (RIL) debt reduction plans have been delayed. RIL has said it plans to become debt-free by March 2021, and this deal is projected to reduce debt by $8 billion.

Government sources tell ET that MHA had referred the matter back to the Securities and Exchange Board of India (Sebi) earlier this year, even as the stock market regulator had blessed the deal late last year. Sebi, in turn, has responded two weeks back.

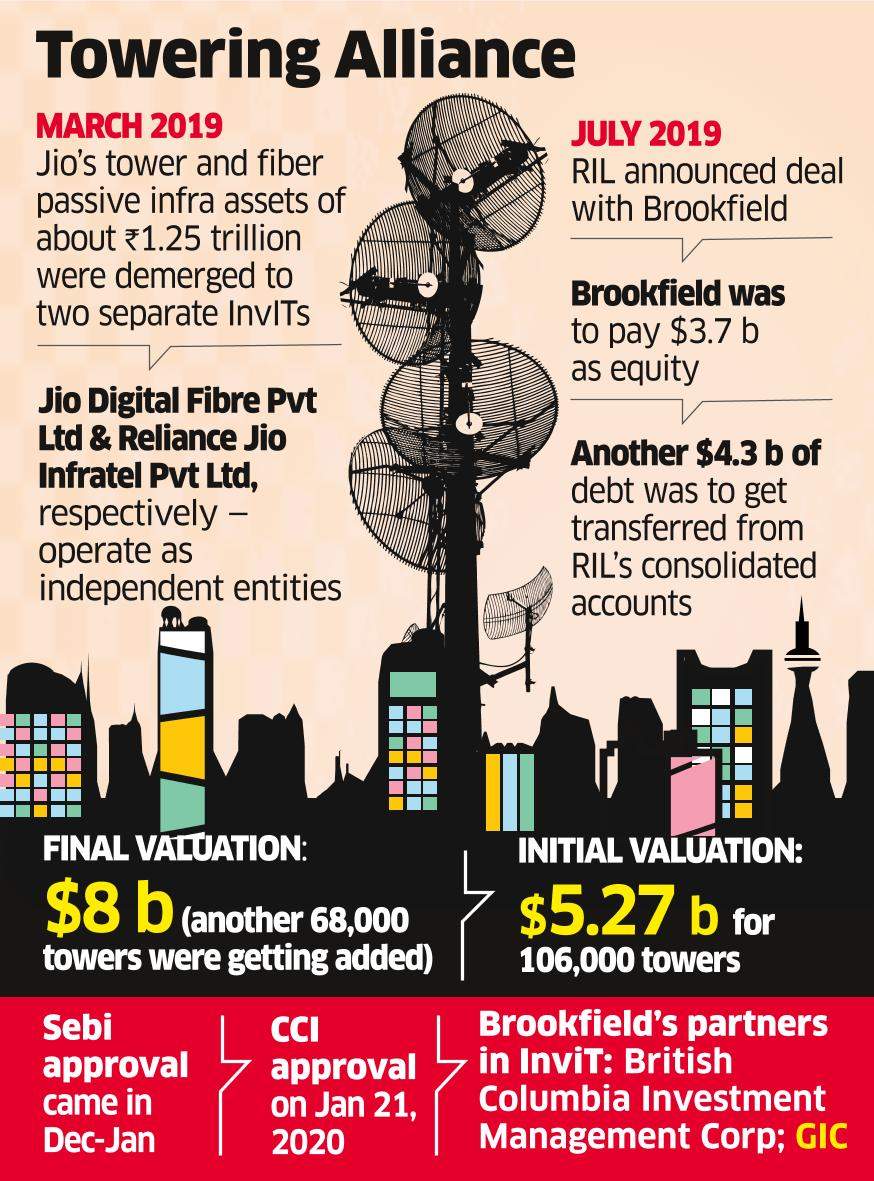

In July 2019, RIL announced it had entered into an agreement with Brookfield for investment of ₹25,215 crore ($3.7 billion) in the Tower Infrastructure Trust. The remaining amount ($4.3 billion) was debt that was to be transferred from RIL’s consolidated books.

At the time of transfer, Jio’s 106,000 towers (ready and in development) were valued at $5.27 billion (₹36,890 crore). However, on completion of the deal, the valuation was $8 billion, as an additional 68,000 towers were to have come up by then.

Subsequently, last December, in a notification to the stock exchanges, RIL noted that Brookfield and its partners would invest ₹25,215 crore in units to be issued by the Tower Infrastructure Trust. The Canadian investor will buy 100% of the units issued by the Trust, which, in turn, owns 100% equity of Reliance Jio Infratel, the operating company for Jio’s tower assets.

The CCI approval came in January 2020.

Mails sent to RIL on Monday did not generate a response till press time Tuesday.

Brookfield declined to comment on ET’s detailed questionnaire, while DoT & MHA didn’t respond to queries.

As per sources close to the deal, had it not been for approvals not coming through so far, the deal would probably have closed by January. To be fair, M&A related approvals often take long. For example, it took DoT over six months to decide on Brookfield’s proposal to buy Reliance Communications towers. That deal eventually got scrapped.

“It is for Reliance to seek approvals. They are creating the InvITs and are just selling Brookfield the units,” explained an analyst who has been following the matter. “$8 billion of (debt resolution) was to take place and the Indian banks were to be paid down. It was the largest FDI in the Indian infrastructure sector. It is odd that it would remain stuck.”

As per regulations, Brookfield was to also bring on board a set of investors after the approvals came in.

Sebi guidelines stipulate at least five non-sponsor investors or unit holders for privately placed InvITs. The instrument will be listed but privately placed to institutions and high net worth individuals, much like listed non-convertible debentures. As per sources, Brookfield had commitments from Canadain pension fund British Columbia Investment Management Corporation (BCIMC), Public Investment Fund of Saudi Arabia and GIC of Singapore to co-invest along with them in the InvIT. One government source said security clearance for each one of the foreign investors was one reason for the delay.

Source: Economic Times