Debt-laden ABG Shipyard would soon get a new owner as promoters of the company are in advance talks with a Russian shipbuilder for sale of controlling stake.

“Talks are in advance stage and the Russian firm is said to have got all internal approvals for this deal,” a lender close to the development told Business Standard.

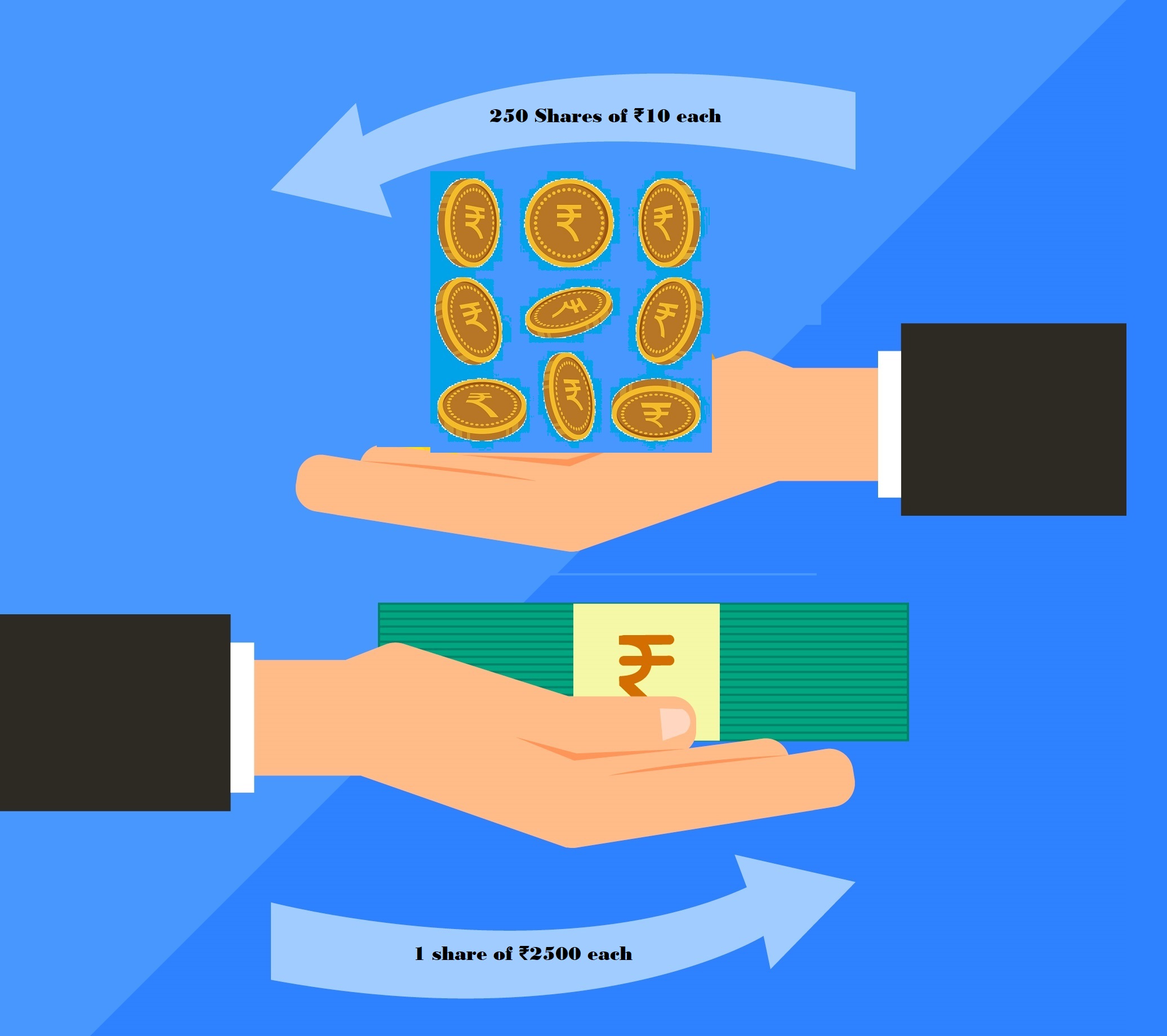

Recently, lenders to ABG Shipyard commenced conversion of compulsorily convertible preference shares (CCPS) into equity. This was part of the company’s corporate debt restructuring (CDR) package, approved by the lenders in March 2014. “The conversion of CCPS into equity is now complete and the lender consortium, led by ICICI Bank, has invited bidders to pick controlling stake in the company,” said a senior executive of ABG Shipyard. “Not just the Russian firm, even domestic shipbuilding companies have bid for controlling stake in ABG.”

According to industry sources, Shapoorji Pallonji is among domestic companies that might have bid for controlling stake in the company. “The process is on. To get a new owner in place, it will take at least another three months,” said the ABG Shipyard executive.

This is not the first time ABG Shipyard is talking to an overseas player for stake sale. In December last year, ABG’s talks with Germany-based Privinvest Holding for financial collaboration had failed after the latter felt the balance sheet of ABG was much bigger than the size of the facilities. ABG Shipyard is the flagship company of ABG Group with two shipbuilding facilities in Gujarat, at Dahej and Surat. As on March 31, the company’s debt stood at about Rs 16,000 crore.

ABG, like many other shipbuilding companies across the globe, is going through a rough patch due to a long grim business cycle. If the company is able to get an investor this time, like its peer Reliance Defence Engineering (erstwhile Pipavav Defence & Offshore), ABG Shipyard will be able to look at shipbuilding with renewed interest in segments like defense. Currently, ABG Shipyard is largely into commercial shipbuilding.

As on June 2016, promoters of ABG Shipyard held 18.23 percent stake in the company with nearly 99 per cent of its shares already pledged.

In terms of earnings, the company’s operating profits have consistently been in the negative with debt-equity ratio moving only in the northward direction and toplines drying up.

Recent Articles on M&A

Source: Business-Standard