Abu Dhabi Investment Authority has joined active discussions for a minority stake in Reliance Industries-owned Jio Platforms as cash-rich sovereign wealth funds from the Gulf proactively seek out deals around the world, people familiar with the matter said.

ADIA follows Mubadala, the sister firm of the UAE’s largest sovereign wealth fund, which has already been in negotiations with Reliance Industries, the parent of Jio Platforms.

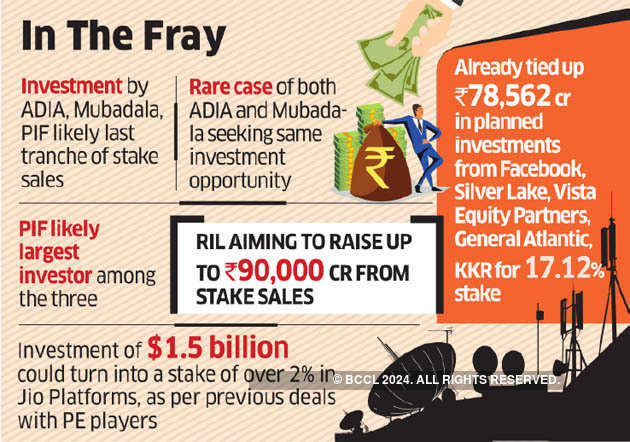

It is not yet clear how much each of the funds will invest. Both entities, along with Saudi Arabia’s sovereign wealth fund Public Investment Fund (PIF), may invest close to $2 billion (Rs 15,000 crore) in Reliance’s digital business unit, the people said. PIF, though, is keen to deploy $1.1-$1.5 billion while the two UAE funds are open to putting in $1-1.25 billion. An announcement is expected shortly, even as early as this week.

“This is probably the last tranche of stake sales in Jio Platforms. It’s likely to be announced shortly,” one person said. “PIF could be the largest investor in this group.”

Even though ADIA invests in technology assets, both publicly listed and private, it is an area where Mubadala plays a far more dominant role. Technology is one of the five sectors being targeted by ADIA’s private equities department, said people familiar with the firm’s plans.

ADIA is part of a consortium that has been engaged with Reliance for months to buy into its pan-India fibre network. It is also a rare case of both UAE funds scoping the same investment opportunity.

Reliance has targeted raising Rs 85,000-Rs 90,000 crore from stake sales in Jio Platforms, another person said. It has so far drawn Rs 78,562 crore in planned investments from Facebook and private equity funds Silver Lake, Vista Equity Partners, General Atlantic and KKR for a combined holding of 17.12%.

An investment of $1.5 billion could get a stake of just over 2%, experts said. KKR paid Rs 11,367 crore for a 2.32% stake in Jio Platforms, pegging its equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore.

ADIA declined to comment on speculation. ET’s emailed queries to Reliance, Mubadala and PIF went unanswered at press time.

Shares of Reliance rose 3.8% to Rs 1,520.45 on the BSE, outperforming the 2.7% gain in the benchmark Sensex.

Investment bankers say SWFs from Gulf countries are on the prowl as global valuations have crashed and they are keen to deploy capital in sectors such as technology, communications, healthcare and retail/logistics, which are expected to bounce back faster than many others. Both the UAE and Saudi Arabia are also key political and economic allies of the Narendra Modi government.

Since inception, ADIA has made about 18 investments in companies, according to data from Crunchbase, ranging from Citigroup to Moderna Therapeutics. It has been a big backer of Indian financial services and renewable companies such as ReNew Power, Greenko, Bandhan Bank and Reliance Nippon Life AMC.

ADIA is a key sponsor or limited partner to several India and Asia-focussed PE firms including National Investment and Infrastructure Fund, India’s SWF with which it has jointly made a play for GVK’s Mumbai International Airport.

Parallels are already being drawn with Masayoshi Son’s SoftBank as two of his biggest backers are now courting Mukesh Ambani, chairman of Reliance. In 2017, SoftBank’s $100 billion technology and innovation focused Vision Fund 1 secured commitments of $15 billion from Mubadala and $45 billion from PIF. Earlier in the year, Son had discussed taking his company private with Mubadala and Elliott Management.

Mubadala, with $229 billion of assets under management, is already an investor in technology firms including AMD and Global Foundries. It opened an office in San Francisco in 2017 and has invested in Silicon Valley entities in partnership with SoftBank as Abu Dhabi, like its oil-rich neighbour, pitches itself as a hub for innovation that is central to the emirate’s economic diversification strategy.

Analysts said Reliance’s stake sales will help it achieve its zero-net debt ahead of the March 2021 target. At the end of last March, Reliance had outstanding debt of Rs 3.36 lakh crore and cash of Rs 1.75 lakh crore, bringing its net debt to Rs 1.61 lakh crore.

ET had reported earlier that PIF and Mubadala were closing in on a stake purchase in Jio Platforms. The Reliance unit comprises mostly its telecom business under Reliance Jio Infocomm, which is the largest in the country with more than 388 million subscribers.

Reliance is also raising Rs 53,125 crore through an ongoing rights issue – India’s biggest and the company’s first in almost three decades.

An IPO for Jio is expected in two years. Reliance has consistently talked about building Jio Platforms into a digital entity on the lines of Alphabet and Tencent.

Reliance is in talks with Saudi Aramco for selling a fifth of its oil-to-chemicals business in a $15 billion deal and has sold half its fuel retail venture to BP Plc for Rs 7,000 crore, apart from its telecommunication tower business to Brookfield for Rs 25,200 crore.

The sharp drop in global oil prices this year and demand compression in most global economies could make an Aramco deal difficult, some analysts said. The Brookfield transaction is yet to receive government clearance.

Source: Economic Times