Abu Dhabi’s sovereign wealth fund is in talks to invest $200 million, or about Rs 1,290 crore, in toll roads platform Cube Highways and Infrastructure Pte Ltd for a significant minority stake, three people aware of the development told ET.

This would be the first direct equity investment of Abu Dhabi Investment Authority (ADIA) in India’s ambitious toll road programme, further diversifying deployment of its petrodollars. So far, ADIA has backed the country’s two largest homegrown renewable energy companies Renew and Greenko.

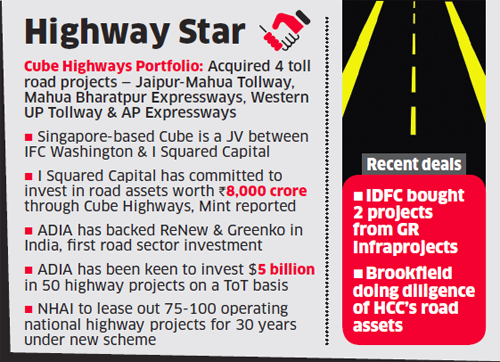

Set up by private equity investor I Squared Capital and World Bank’s private investment International Finance Corp (IFC), Cube Highways owns, manages and operates four toll road projects in India stretching over 1,000 lane kilometres. This is through Jaipur-Mahua Tollway Private Ltd, Mahua Bharatpur Expressways Ltd, Western UP Tollway Ltd and Andhra Pradesh Expressways Ltd.

“Cube has been in discussions with investors for months,” said an official aware of the developments. “ADIA pipped Allianz, the global insurer, for the stake. Canada’s CDPQ was also in the fray but opted out before,” the person said. Spokesperson of ADIA declined to comment.

Mails sent to I Squared Capital and IFC Washington did not get any response as of press time on Thursday.

A decision on the proposed investment is expected in 2-3 weeks, sources cited earlier said.

Under the TOT model, National Highways Authority of India (NHAI) plans to lease 75-100 national highway projects that are operational and have been generating toll revenues for at least two years.

As per the guidelines, the right to collect user fee, or toll, for 30 years on selected operational national highway stretches constructed through public funding is proposed to be assigned to developers and investors for a lump sum payment upfront to the government.

During the tenure of the contract, operation and maintenance responsibility would be with the assigned developer.

At a diplomatic level, Abu Dhabi has become a close strategic ally of Prime Minister Narendra Modi and it has been proactively scouting for opportunities to back most of his flagship ventures in sectors of mutual interests such as energy, telecommunications, and infrastructure.

It had in the past expressed its keenness to make a $5-billion bet on India’s national highways by taking up 50 projects on a toll-operate-transfer basis.

Foreign policy experts said ADIA’s proposed investments will be part of a long-term strategic engagement.

ADIA representatives had spent significant time with power minister Piyush Goyal, trying understanding the renewable sector business dynamics before investing in the space.

I Squared Capital plans to invest $1 billion, or about Rs 6,467 crore, in India’s infrastructure sector. It has already invested around Rs 1,000 crore through Cube Highways and Infrastructure Pte Ltd and has committed to investing in assets worth Rs 2,000 crore through its rooftop solar platform Amplus Energy Solutions Pvt Ltd.

According to information available on IFC’s website, its $100 million equity investment in Cube Highways was its first investment in the Indian road sector.

The existing shareholders of Cube, especially I Squared Capital, will also deploy funds in Cube as per their previous commitments. The development is expected to boost overall investment sentiment.

“Over the past 12-18 months, we have seen a strong interest from sovereign and long-term asset managers to acquire operational assets,” said Rajesh Narain Gupta, managing partner at Mumbai-based law firm SNG & Partner. “We may see more operational assets on the block. An entry of a large fund like ADIA will definitely boost investment sentiment,” he said.

HIGHWAY OF PROGRESS

Union road transport minister Nitin Gadkari had last month told ET that the government can raise more than Rs 1lakh crore by leasing out more than 100 highway projects under the TOT policy “which will be reinvested in the country’s highway development”.

“The kind of return global investors can get here is unmatchable,” he had said in an interview. “Just to make investment in such projects risk-free, foreign funds investing in the government-owned operational national highways need not worry about loss of traffic and other unforeseen risks, such as engineering faults associated with projects, because NHAI may provide a risk cover to such investors. We’ll start bidding these projects out next month.”

The minister said with highway traffic growing 10%, the corresponding rise in toll income is making the sector attractive for global investors.

Finance Minister Arun Jaitley has allocated Rs 64,900 crore for the construction of national highways this fiscal year, up from about Rs 58,000 crore in 2016-17.