ACME Cleantech, the largest independent solar power producer in India, is set to sell about 35% stake in the holding company for about ₹3,000 crore, said multiple people aware of the development.

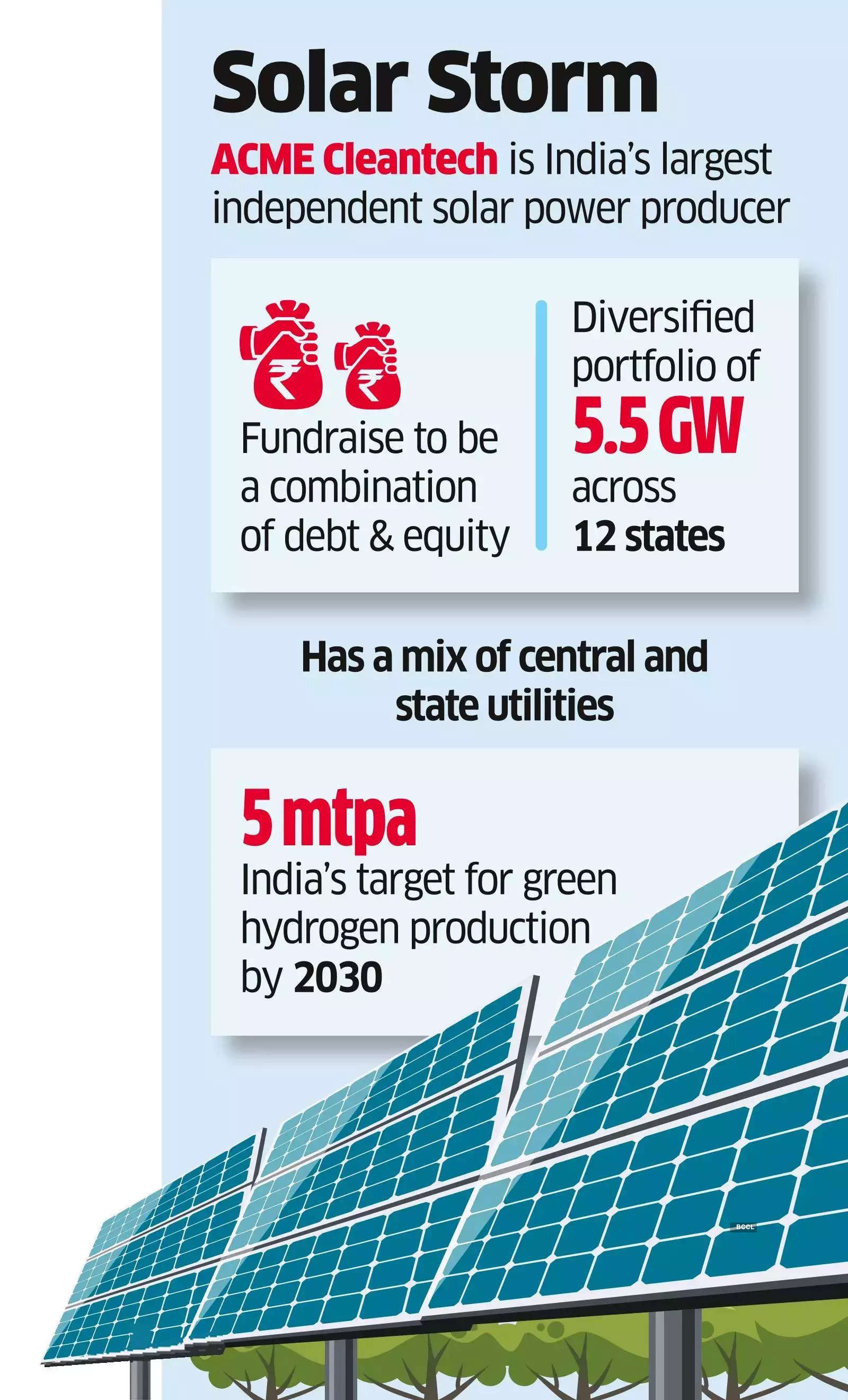

The fundraise, a combination of debt and equity, will be used for completion of its ongoing projects and expansion in green hydrogen and ammonia production, they said.

Investment bank Ambit has been hired and feelers were sent to large investors such as Mubadala, GIP (Blackrock), Actis and NIIF, said the people, who did not wish to be identified.

ACME, established in 2003 by Manoj Kumar Upadhyay, is the largest solar independent power producer in India with a diversified portfolio of 5.5 GW spread across 12 states and with a mix of central and state utilities. Its portfolio of operational solar power projects has grown to 2.9 GW from 15 MW in 2011. The rest of the 2.6 GW is under different phases of development.

In a similar deal, Avaada Group had raised $1.07 billion (about ‘8,200 crore) from Canadian fund Brookfield last year by diluting a significant stake to fund its green hydrogen and green ammonia ventures in India.

When contacted, an ACME spokesperson declined to comment.

Last year, ACME announced plans to expand in the areas of green hydrogen and ammonia production.

ACME Green Hydrogen and Chemicals Company, a joint venture between the UK unit of ACME Group and Norway-based Scatec ASA, aims to become a leading green energy provider in the world by 2030 and produce 10 million tonnes per annum (MTPA) of green ammonia and hydrogen. It started working to develop projects in countries including Oman, India, Egypt, Australia and Chile.

Last year, it also announced plans to invest about ₹27,000 crore to set up the country’s largest single location green hydrogen and derivatives manufacturing facility in Odisha. It plans to set up a nearly 1.3 MTPA green ammonia production facility at Gopalpur.

ACME Group had also tied up a ₹4,000 crore loan from state-owned REC for its green hydrogen and ammonia project in Oman. The amount will be used to start the first phase of the project, to be established at the Special Economic Zone in Duqm, Oman. The first phase of the project is expected to produce 100,000 tonnes of green ammonia annually.

The Indian government has set a target of producing 5 million metric tonnes per annum of green hydrogen by 2030.

As part of diversifying into newer areas, ACME has been selling various operational and under-construction projects in the past couple of years.

In December 2023, ACME sold solar power assets under its 14 special purpose vehicles to BluPine Energy – a unit of London-based private equity firm Actis – for an enterprise value of ₹1,700 crore.

ACME had shelved ₹2,200 crore public listing plans in 2018 due to stock market turbulence.

Source: Economic Times