Merger and acquisition (M&A) funding in India soared three-fold in FY22 to $32.5 billion as international buyout firms, such as Blackstone and Carlyle, raised stakes locally on expectations of the strongest rate of expansion among competing economies. Record low debt costs globally helped.

Blackstone’s $1.1-billion funding from a consortium of 13 banks for the $3-billion Mphasis buyback was among the biggest deals by private equity firms, which dominated acquisition financing either through a structured credit facility in Rupee terms, or Leveraged Buyout (LBO).

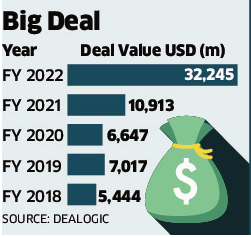

Acquirers raised a record $32.2 billion in 2021-22 to fund their acquisition deals in 321 transactions, show data from Dealogic, a global analytics firm. A year earlier, it was at $10.9 billion. In FY20, the comparative figures were around $6.65 billion.

“The primary motivation for availing debt financing are twofold — cost of debt is significantly lower than the PE fund’s cost of equity, and this helps fund houses to reduce the average cost of capital,” said Utpal Oza, head, investment banking at Nomura, which was involved in eight out of the top ten deals in the last fiscal.

“There is a significant amount of dry powder that is going to be put to work in the medium term,” he said.

This will finally result in generating a significant increase in the Internal Rate of Returns for the funds. Also, with debt, absolute equity deployment in deals is reduced.

Lower interest rates globally also helped PE firms to opt for funding M&As partially through debt.

“With increased liquidity and depth, the leveraged & acquisition financing market is becoming increasingly accessible to mid-market and emerging corporates and sponsors as well,” said Piyush Gupta, head of private credit at Investec Capital.

Leverage is now increasingly becoming an integral part of deal-making considerations. There is an increased interest in sponsor financing whether it is a buyout or even a minority transaction, both in the listed and unlisted space, dealers said.

“The Indian market has evolved considerably in this area,” said Amrish Baliga, managing director Deutsche Bank. “The pie has certainly grown that augurs well for us. Based on our current pipeline, we believe this trend is set to continue. We have both advised on and financed a record number of asset purchases for Indian corporates; buyout funds and financial sponsors.”

The private equity market in India traditionally was dominated by financial sponsors acquiring minority stakes in Indian companies.

However, this has significantly changed over the last 2/3 financial years, increasing the number of buyouts. This has contributed to the significant uptick in the number and size of leverage financing opportunities emanating from global financial sponsors.

Earlier this year, Partners Group, CVC Capital, Blackstone and Barings were in talks to raise more than $1 billion in total in syndicated loans primarily to fund their targeted acquisitions in India, ET reported in February. Last year, Blackstone along with ADIA, UC Investments and GIC agreed to buy control of Mphasis for $2.8 billion. Out of this, $1.1 billion was through syndicated facilities in what was the largest transaction in FY22.