Global emerging market fund Actis has acquired solar energy assets of 600 megawatt capacity from Acme Cleantech Solutions in a deal worth Rs 3,000 crore, said two people aware of the development. Actis outbid Canadian fund Brookfield to strike a deal with one of the largest solar power producers in India, they said.

ET had reported last month that global investors including Brookfield and UK-based Actis were in discussions with Acme Cleantech.

The deal, signed on Wednesday, is subject to regulatory approvals, said one of the persons. The equity value of the deal is pegged at Rs 900 crore, he added. Offloading part of its assets will help Acme fund additional capacity and pay off debt. It’s due shortly to repay Piramal Finance, having borrowed Rs 700 crore in 2017.

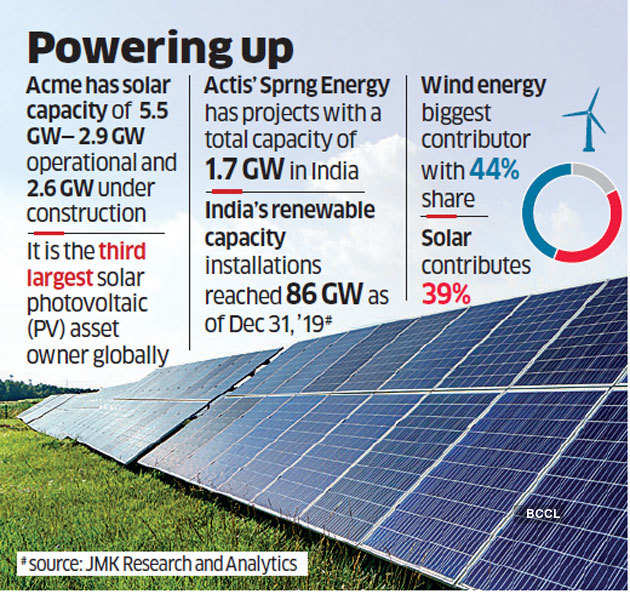

Acme has a total solar capacity of 5.5 GW, of which 2.9 GW is operational and 2.6 GW is under construction.

Actis will acquire the Acme assets through its global infrastructure vertical, said one of the persons cited above. The fund has been investing in the Indian renewable energy space and has its own platform — Sprng Energy — which has projects with a total capacity of 1.7 GW in India. That comprises 750 MW of solar and 797 MW of wind energy projects under execution besides 194 MW of solar power under operation. Sprng Energy had acquired the operating 194 MW solar energy portfolio of the Shapoorji Pallonji Group last year. Earlier, Actis had been in talks to acquire the solar assets of debt-ridden Essel Infraprojects. The talks didn’t succeed and the assets were sold to Adani Green Energy.

Since 2014, Actis has been investing in the Indian energy space through its platform Ostro Energy, which was sold to Renew Power in 2018. Ostro, with a capacity of 1.1 GW, was sold for $1.6 billion in one of the largest M&A deals in the energy sector. Acme declined to comment. Actis didn’t respond to queries. Tapping the potential in the clean energy sector, global and domestic investors have been active with multiple acquisitions. The Indian government has targeted the addition of 175 GW of renewable energy to the country’s grid by 2022 by increasing solar power generation to 100 GW and wind to 60 GW.

However, the sector has been witnessing headwinds due to regulatory uncertainty and a tight financial environment. Overall, the industry has been affected by a mix of factors such as continuing delays in payments from utilities in a few states and regulatory uncertainty on tariff matters for independent power producers (IPPs) in Andhra Pradesh, a recent ICRA report said. It also cited delays in land acquisition and transmission connectivity approvals apart from a tight financing environment in the past 8-10 months.

Source: Economic Times