Adani Ports and Special Economic Zone, India’s biggest maritime company by market capitalisation, is in advanced talks to acquire Shapoorji Pallonji Group’s (SP) Gopalpur Ports in Odisha for up to Rs 1,100-1,200 crore in equity value as part of a neatly woven string-of-pearls strategy that involves owning considerable facilities along both the eastern and western water margins.

If successful, this will be Adani Port’s sixth acquisition of a multi-purpose facility on the eastern coast, where it already has approximately 247 million tonnes (MT) of capacity. The due diligence process is currently on, people aware of the talks told ET. SP Ports Maintenance holds 56% of Gopalpur Ports.

The remaining stake is held by Orissa Stevedores (OSL). SP Ports in turn is 100% owned by SP Imperial Star, which also acts as its guarantor.

However, people in the know said there is no guarantee the ongoing negotiations will eventually translate into a transaction. On October 26, ET reported that JSW Infrastructure was in talks with the Mistry family for the same asset at a Rs 3,000-crore enterprise valuation. Subsequent reports said private equity groups were also approached as the Mistry family was not happy with the valuations offered.

Covenant Terms

According to a company presentation, reviewed by ET, the SP Group had told investors the enterprise value of the port is $600-650 million (Rs 5,000 crore), with SP Group’s equity value at $240-260 million (Rs 2,000 crore). According to credit rating firm Care Edge, the port has long-term bank facilities of Rs 1,432 crore, as on February 2023.

Spokespersons at both Adani and SP Group did not immediately respond to requests for comment.

Earlier this week, SP Group sold a majority 50% stake in the 5 million tonnes per annum (MTPA) PNP Maritime Services (PNP Port). It operates multi-purpose jetties at Shahbaj, in Raigad district of Maharashtra, about 20 nautical miles from Mumbai Anchorage. JSW Infrastructure paid Rs 270 crore in cash for the Raigad facility that has an enterprise value of around Rs 700 crore.

Proceeds from these asset sales will go toward repaying the non-convertible debenture (NCD) holders of a Rs 14,300-crore, rupee-denominated zero coupon bond the SP Group had raised in July at an effective yield of 18.75%. It was among the most expensive borrowings of this magnitude in recent times by an Indian corporate.

SP Group had raised the money to refinance a debt taken by Cyrus Investment (CIPL) by pledging the 9.185% of Tata Sons shares it owns and to pre-pay Sterling Investment Corp’s (SICPL) debt amounting to Rs 3,327 crore ($406 million). It also sought to use Rs 3,000 crore ($363 million) of the proceeds to fund the other group debt obligations.

These divestments are part of loan commitments, or “covenant terms,” made by SP Group promoters, the Mistry family, to lenders and debenture holders. As per the terms of agreement, the Mistrys are committed to divest these assets by March 31 next year.

According to the NCD structure, the Payment-in-Kind Internal Rate of Return (PIK IRR), or coupon rate, is set to increase by 2% if a minimum amount of Rs 1,500 crore in principal/interest is not repaid by December 31, 2023. This prepayment obligation applies to the amounts generated from the monetisation of SP Imperial Star or other funding sources.

Deutsche Bank AG and Standard Chartered Bank played key roles in this deal. Special situation funds and private credit funds, including Cerberus Capital, Varde Partners, Canyon Capital, and Davidson Kempner, joined in, helping Goswami Infratech — 100% owned by SP Group — to raise the largest private credit deal.

Strategic Facilities

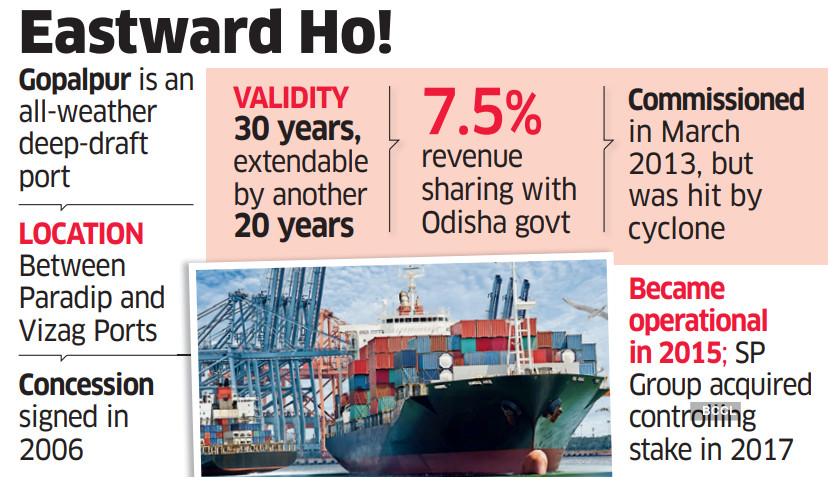

Operational since 2015 to cater primarily to the steel industry, the all-weather deep-draft Gopalpur Port is located along the Bay of Bengal between the two busiest ports on the East Coast — south of Paradip Port and north of Vizag Port. The facility is connected to the Golden Quadrilateral (NH-5) through NH-516, which is 6 km from the port.

It also has two railway sidings accessible to both the east and south of India. GPL has been handling capesize and mini-capesize vessels at its port.

“Gopalpur Port is not a major port and hence does not have tariffs regularised by TAMP (Tariff Authority for Major Ports) and is free to charge competitive market rates,” said Saikat Roy, credit rating analyst, Care Edge. “Further, tariff flexibility allows the port to provide additional value-added services.”

The SP Group acquired major shareholding in the port in 2017 and undertook development and expansion of the infrastructure to increase the cargo handling capacity to 25 MTPA with storage space of about 2.5 MT of cargo.

The project included construction of 3 berths with mobile cranes facility and material handling systems, breakwaters, roads, railway sidings, power sub-station and other EPC works. Limestone and overseas cargo for iron ore and coal are the principal volume drivers as the ports key clients include Jindal Steel & Power Ltd, JSW Minerals Ltd, JSW Steel Ltd, Dalmia Cement (Bharat) Ltd among others.

String of divestments

In the past two years, in an effort to deleverage its balance sheet, the SP Group sold Eureka Forbes to PE group Advent, Sterling and Wilson Renewable Energy to Reliance Industries, and SP Jammu Udhampur Highway to National Investment and Infrastructure Fund (NIIF). After these divestments, the consolidated debt of the group came down Rs 20,600 crore as of June this year, from Rs 37,170 crore as of August 2020. But lenders had sought more asset sales to have promoter-level debt reduced.

Adani Ports and Special Economic Zone is India’s largest commercial ports operator. The company witnessed a 17% YoY rise in cargo volumes to 101.2 MT in the second quarter. Container volumes increased 24%. The East handled 40.2 MT of cargo, and the West coast handled 57.9 MT. Mundra Port handled 44.4 MT, with non-Mundra ports managing 53.7 MT.

As per the company’s management, volume growth guidance was maintained for FY24 and FY25 at 390-400 MT (higher end of the range is likely) and 500 MT, respectively. The management highlighted that FY25 volume growth will be led by existing assets (including Colombo and Vizhinjam at 25-30 MT).

“While the company refrained from providing specific guidance on capital expenditure, it did indicate that net debt/ebitda will be maintained around 2.5x by end-FY24, as compared with 3.5x in FY23,” said Achal Lohade, analyst, JM Financial.

The company’s shares jumped 7% to hit a record high of Rs 1,082 apiece on the BSE Wednesday after global brokerage firm Citi raised the target price on the counter to Rs 1,213 apiece from Rs 972, implying an upside of more than 12%. It closed Wednesday at Rs 1,018.65/share. In the past one week, the stock of Adani Ports & SEZ has soared over 23% as against 4% rise in the benchmark Sensex.

Source: Economic Times