Adani Group is looking to acquire close to 73% stake in ITD Cementation India for an estimated Rs 5,759 crore ($685 million), a move that will give the Gautam Adani-led conglomerate in-house engineering, procurement and construction (EPC) and civil engineering capabilities.

Renew Exim DMCC, a wholly owned offshore entity of the Adani promoter family, has entered into an agreement with ITD Cementation’s promoter ItalianThai Development Public Co to buy a 46.64% stake, or 80.1 million shares, at Rs 400 per share, totaling Rs 3,204 crore, ITD Cementation said in a stock market filing.

This will be followed by an open offer to buy an additional 26%, or 44.7 million shares, at Rs 571.68 per share from minority shareholders, it said. If the open offer is fully subscribed to, Adani Group will be paying about Rs 5,759 crore for a 73% stake in ITD Cementation, a leader in maritime structures and engineering works. With this, Adani Group will complete a dozen acquisitions this year alone.

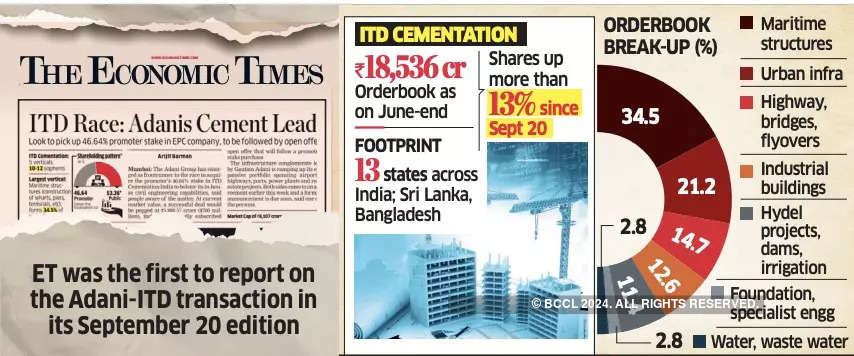

ET was the first to report on the Adani-ITD transaction in its September 20 edition.

ITD Cementation has worked on Jawaharlal Nehru Port Trust and ports in Tuticorin, Haldia, Mundra and Vizhinjam besides the Delhi and Kolkata metro projects. It is seen as a strategic fit for Adani as the latter expands across ports, infrastructure, power, and real estate. It already has a business relationship with Adani in hydel power and marine as well as the 594-km Ganga Expressway toll road project.

Maritime structures — wharfs, piers, container terminals, berths, oil jetties — account for 34.5% of ITD Cementation’s order book, making this its biggest vertical.

Market Value at Rs 9,152.8 crore

Its stock appreciated 86.82% year-to-date in anticipation of a sale. In July, the company had told stock exchanges that its promoters are exploring a potential divestment of their investment, and that the sale process was at a preliminary stage.

On Friday, ITD Cementation’s market value was Rs 9,152.84 crore as its stock closed at Rs 532.80 on the BSE, down 2.65% from the previous close. The massive appreciation in share price was a key trigger that exacerbated the promoter’s decision to monetize its India investment, people aware of the negotiations told ET.

Adani Group is believed to have trumped rival bids from a leading dredging company in Abu Dhabi and RPG Group’s KEC International. With roots in the UK dating back to before India’s independence, ITD Cementation is the outcome of several mergers and acquisitions and has changed hands several times. The company has been operating in India for nine decades. It has a presence in maritime structures, airports, hydro-electric power, tunnels, industrial buildings and structures, highways, bridges and flyovers, and foundation and specialist buildings.

Diversified Portfolio

The company has also diversified into pumped storage and specialized hydro projects, which are now in vogue for renewable players like Adani Green in their pursuit of offering 24×7 green power solutions to utilities and corporate clients.

ITD Cementation is expecting Rs 5,000-6,000-crore worth of tenders to come its way from new hydro and pumped storage projects this fiscal, according to the company management.

The company secured orders worth over Rs 1,053 crore in the June quarter. Its total multi-year order book visibility is at Rs 18,536 crore, of which government contracts account for 48%, with 35% coming from private sector projects and the remaining 17% from public sector units (PSUs).

Beyond a pan-India footprint across 13 states, ITD Cementation has also been seeking out projects in Sri Lanka and Bangladesh.

Earlier this week, Adani Group also announced the buyout of CK Birla-owned Orient Cement at an equity value of Rs 8,100 crore. Ambuja Cements will acquire the promoters’ 37.90% stake in Orient Cement and an additional 8.90% from the company’s public shareholders, at Rs 395.40 a share.